Simple interest calculates earnings only on the initial principal, providing a fixed return over time, making it straightforward but often less profitable. Compound interest generates earnings on both the initial principal and accumulated interest, leading to exponential growth and higher returns for savers. Choosing compound interest for savings maximizes long-term earnings by leveraging interest on interest effects.

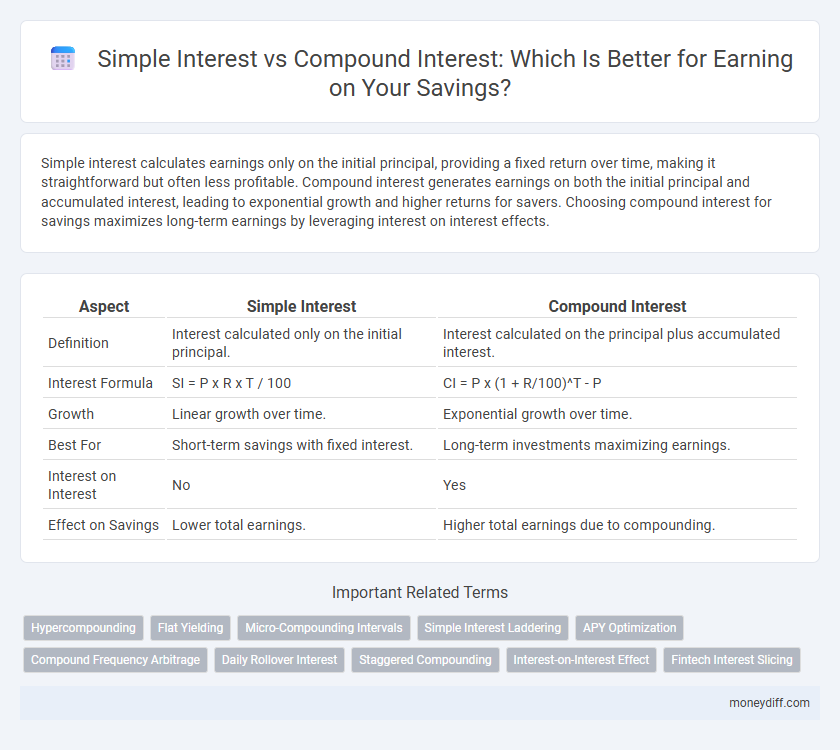

Table of Comparison

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Interest calculated only on the initial principal. | Interest calculated on the principal plus accumulated interest. |

| Interest Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)^T - P |

| Growth | Linear growth over time. | Exponential growth over time. |

| Best For | Short-term savings with fixed interest. | Long-term investments maximizing earnings. |

| Interest on Interest | No | Yes |

| Effect on Savings | Lower total earnings. | Higher total earnings due to compounding. |

Understanding Simple Interest: A Basic Overview

Simple interest calculates earnings on the original principal only, using a fixed percentage rate over a specific time period, making it easy to understand and predict. Unlike compound interest, simple interest does not reinvest earned interest, resulting in lower total returns on savings over long durations. This straightforward approach is ideal for short-term investments or loans where clarity and consistency matter more than maximizing interest growth.

What is Compound Interest? Key Concepts Explained

Compound interest is the process where interest earned on savings is reinvested, generating earnings on both the initial principal and the accumulated interest from previous periods. This exponential growth effect significantly increases the total returns over time compared to simple interest, which calculates interest solely on the original principal. Key concepts include the compounding frequency, which affects how often interest is added to the principal, and the time period, both of which influence the overall growth of the investment.

Simple Interest vs Compound Interest: Core Differences

Simple interest is calculated only on the original principal amount throughout the investment period, resulting in a linear growth of savings. Compound interest, in contrast, is computed on the initial principal plus the accumulated interest from previous periods, enabling exponential growth of the investment. Understanding these core differences helps savers maximize earnings based on their time horizon and risk tolerance.

How Simple Interest Works in Savings Accounts

Simple interest is calculated only on the initial principal amount, making it straightforward and predictable for savings accounts. The interest earned remains constant over time because it does not compound, which means savings grow linearly. This method benefits those who prefer steady, easy-to-understand returns without fluctuations or reinvestment complexities.

The Power of Compound Interest in Growing Wealth

Compound interest exponentially increases savings by earning interest on both the initial principal and the accumulated interest, leading to significantly higher returns over time compared to simple interest, which calculates interest only on the principal. This amplification effect accelerates wealth growth, especially with longer investment periods and frequent compounding intervals. Savers can maximize their earnings by choosing compound interest accounts, reinvesting returns, and allowing time to harness the full potential of compounding.

Real-Life Examples: Simple vs Compound Interest Calculations

Simple interest calculates earnings on the principal amount only, resulting in linear growth over time, such as earning $100 annually on a $1,000 deposit at 10% interest. Compound interest calculates earnings on both the principal and accumulated interest, leading to exponential growth, evident when a $1,000 investment at 10% compounded annually grows to $1,610 over five years. Real-life savings accounts using compound interest can significantly increase returns compared to simple interest, especially over longer periods.

Pros and Cons of Simple Interest for Savers

Simple interest offers straightforward and predictable earnings, making it easier for savers to calculate returns without complex formulas. Its main advantage is the stability of interest income, as it is calculated solely on the principal amount, ensuring no surprises in total growth. However, simple interest yields lower returns compared to compound interest since it does not take into account the interest-on-interest effect, limiting wealth accumulation over time.

Advantages of Compound Interest for Long-Term Savings

Compound interest significantly accelerates the growth of long-term savings by earning interest on both the initial principal and accumulated interest, resulting in exponential growth over time. This mechanism maximizes returns compared to simple interest, which only calculates interest on the principal amount. The advantage of compound interest is especially evident in retirement accounts and other long-term investments, where reinvested earnings amplify overall wealth accumulation.

Choosing the Best Interest Method for Your Savings Goals

Simple interest calculates earnings solely on the principal amount, providing predictable returns ideal for short-term savings goals. Compound interest reinvests accrued interest, generating exponential growth and maximizing long-term savings potential. Selecting the best interest method depends on your financial timeline and desired growth, with compound interest favored for maximizing returns over extended periods.

Maximizing Earnings: Tips for Leveraging Compound Interest

Maximizing earnings through compound interest involves reinvesting your interest to generate returns on both the principal and accumulated interest, creating exponential growth over time. Choosing accounts with higher compounding frequencies, such as daily or monthly, significantly increases your total returns compared to simple interest, which only pays based on the initial principal. Starting early and consistently contributing to your savings amplify the power of compound interest, accelerating wealth accumulation and maximizing your long-term financial growth.

Related Important Terms

Hypercompounding

Simple interest calculates earnings solely on the principal amount, resulting in linear growth, while compound interest generates returns on both the principal and accumulated interest, leading to exponential growth. Hypercompounding accelerates this process by reinvesting earnings continuously at high frequencies, maximizing savings growth over time.

Flat Yielding

Simple interest calculates earnings based on the original principal, providing a flat yielding rate over time without reinvesting the interest earned. Compound interest, by reinvesting accrued interest, results in exponential growth and higher returns on savings compared to the flat yield of simple interest.

Micro-Compounding Intervals

Micro-compounding intervals, such as daily or hourly compounding, significantly increase returns on savings by calculating interest on previously earned interest more frequently than traditional compound interest periods. Simple interest lacks this benefit, as it computes interest solely on the principal, leading to lower overall earnings compared to micro-compounded savings accounts over time.

Simple Interest Laddering

Simple Interest Laddering involves dividing savings into multiple fixed-term deposits earning simple interest, allowing investors to access funds at different maturity dates while steadily earning returns. This strategy reduces reinvestment risk compared to compound interest, providing predictable earnings and liquidity through staggered maturities.

APY Optimization

Simple interest calculates earnings solely on the principal amount, resulting in linear growth, while compound interest generates earnings on both the principal and accumulated interest, leading to exponential growth and a higher Annual Percentage Yield (APY). Optimizing APY requires prioritizing compound interest accounts, which maximize return on savings by reinvesting interest, significantly outperforming simple interest over time.

Compound Frequency Arbitrage

Compound frequency arbitrage leverages differences in compounding intervals to maximize returns by repeatedly shifting funds between accounts with varying compounding frequencies. This strategy exploits the exponential growth effect of compound interest, often outperforming simple interest by reinvesting accrued interest more frequently.

Daily Rollover Interest

Daily rollover interest in compound interest calculations significantly increases earnings by reinvesting interest every day, unlike simple interest which accrues only on the initial principal. Over time, this daily compounding mechanism maximizes savings growth through exponential accumulation, outperforming simple interest's linear return.

Staggered Compounding

Simple interest calculates earnings on the original principal only, resulting in linear growth over time, while compound interest involves reinvesting interest to generate earnings on both the principal and accumulated interest, leading to exponential growth. Staggered compounding, which applies interest at varying intervals, can enhance returns by optimizing the frequency and timing of interest accrual compared to standard fixed-period compounding.

Interest-on-Interest Effect

Simple interest calculates earnings solely on the principal amount, while compound interest generates returns on both the principal and accumulated interest, amplifying growth through the interest-on-interest effect. This effect significantly increases total savings over time, making compound interest a more powerful tool for wealth accumulation in long-term savings plans.

Fintech Interest Slicing

Simple interest calculates earnings only on the original principal, while compound interest generates returns on both the principal and accumulated interest, leading to exponential growth over time. Fintech platforms leverage interest slicing to break down complex compound interest calculations into user-friendly segments, enabling savers to optimize earnings and make informed financial decisions.

Simple Interest vs Compound Interest for earning on savings. Infographic

moneydiff.com

moneydiff.com