Simple interest provides a straightforward way to grow savings by earning a fixed percentage on the initial principal over time, ensuring predictable returns. Negative interest, on the other hand, can erode savings as banks charge fees or reduce balances, discouraging traditional saving methods. Understanding the impact of both helps individuals make informed decisions to protect and optimize their financial growth.

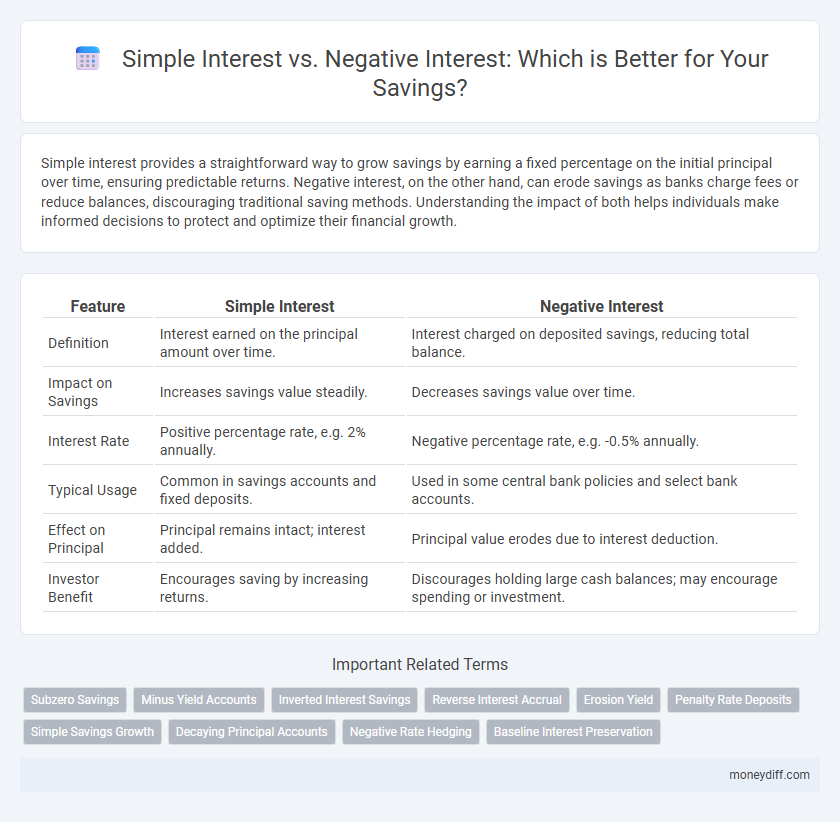

Table of Comparison

| Feature | Simple Interest | Negative Interest |

|---|---|---|

| Definition | Interest earned on the principal amount over time. | Interest charged on deposited savings, reducing total balance. |

| Impact on Savings | Increases savings value steadily. | Decreases savings value over time. |

| Interest Rate | Positive percentage rate, e.g. 2% annually. | Negative percentage rate, e.g. -0.5% annually. |

| Typical Usage | Common in savings accounts and fixed deposits. | Used in some central bank policies and select bank accounts. |

| Effect on Principal | Principal remains intact; interest added. | Principal value erodes due to interest deduction. |

| Investor Benefit | Encourages saving by increasing returns. | Discourages holding large cash balances; may encourage spending or investment. |

Understanding Simple Interest in Savings

Simple interest in savings calculates earnings based solely on the original principal over a fixed period, offering clear and predictable growth. Unlike negative interest rates, which can reduce the principal value, simple interest ensures savers gain a positive return without complex compounding effects. Understanding this concept helps individuals make informed decisions about where to place their funds for steady financial growth.

What is Negative Interest and How Does It Work?

Negative interest occurs when banks charge depositors for holding their money, effectively reducing savings over time instead of earning returns. This counterintuitive concept means savers pay a fee, lowering principal balances, unlike simple interest where savings grow at a fixed percentage rate. Financial institutions implement negative interest to encourage spending and investment during periods of low economic growth or deflation.

Comparing Returns: Simple Interest vs Negative Interest

Simple interest generates positive returns on savings by calculating interest solely on the principal amount, ensuring predictable growth over time. Negative interest, commonly seen in certain economic environments, results in depositor costs where savers must pay to hold funds, effectively reducing savings value. Comparing returns reveals that simple interest preserves and increases capital, whereas negative interest diminishes savings, impacting financial planning and wealth accumulation strategies.

Why Banks Offer Negative Interest Rates

Banks offer negative interest rates during economic downturns to encourage spending and investment by making it costly to hold excess savings. Unlike simple interest, which provides savers with predictable returns, negative interest rates effectively charge depositors, reducing their incentive to keep money idle in savings accounts. This strategy aims to stimulate economic activity by shifting funds from savings into lending and consumption.

Pros and Cons of Simple Interest for Savers

Simple interest offers savers predictable and straightforward returns, calculated solely on the principal amount, which simplifies financial planning and risk assessment. However, it may yield lower growth over time compared to compound interest, limiting wealth accumulation in long-term savings. Unlike negative interest rates that erode savings value, simple interest preserves the principal, but savers should consider inflation impact that can diminish real returns.

Risks of Saving Under Negative Interest Rates

Saving under negative interest rates poses significant risks, including the erosion of principal as account balances decline over time instead of growing. Unlike simple interest, which guarantees predictable growth by applying a fixed percentage to the initial principal, negative interest charges reduce the savings value, potentially leading to losses even without withdrawals. This scenario can discourage traditional saving behavior, prompting investors to seek alternative assets with better protection against negative yield environments.

Strategies to Maximize Savings with Simple Interest

Maximizing savings with simple interest involves consistently depositing funds in accounts that offer higher fixed rates, as the interest is calculated solely on the principal amount. Choosing longer terms with stable simple interest rates ensures predictable growth, avoiding the complexities of fluctuating negative interest scenarios. Prioritizing accounts with transparent fee structures and minimal penalties helps preserve capital and optimize overall returns.

Protecting Your Savings from Negative Interest

Simple interest helps protect your savings by providing a predictable and positive return, calculated solely on the initial principal amount over time. Negative interest rates, often imposed by banks in certain economies, erode your savings by charging you for holding money, effectively shrinking your capital. Opting for accounts or investments with simple interest safeguards your funds against loss, ensuring steady growth despite economic downturns or unconventional monetary policies.

Current Trends: Where Are Interest Rates Headed?

Current trends indicate that simple interest rates on savings accounts remain low but positive, providing modest growth opportunities. Negative interest rates, increasingly observed in some economies, effectively charge savers for holding funds, discouraging deposits and incentivizing spending or investment. Central banks' policies and inflation rates are pivotal in shaping these trajectories, with many analysts predicting continued low or near-zero simple interest rates in the near term.

Choosing the Best Savings Option in Varying Interest Environments

Simple interest offers predictable growth on savings by applying a fixed percentage to the principal amount, making it ideal for stable, positive interest rate environments. Negative interest rates, where banks charge depositors for holding savings, reduce the value of saved funds over time and may require seeking alternative investment options to preserve capital. Choosing the best savings option depends on comparing simple interest returns against potential losses in negative rate scenarios, emphasizing the importance of understanding current monetary policies and inflation impacts.

Related Important Terms

Subzero Savings

Simple interest provides a predictable, fixed return calculated only on the initial principal, making it straightforward for traditional savings growth. Negative interest, often seen in subzero savings accounts, essentially charges depositors for holding their money, eroding savings instead of growing them.

Minus Yield Accounts

Simple interest provides a fixed, predictable return on savings by calculating earnings solely on the principal amount, contrasting sharply with negative interest rates where depositors experience a minus yield, effectively paying banks to hold their money. Minus yield accounts erode the saved capital over time, incentivizing borrowers while discouraging traditional saving behaviors and redefining financial strategies in low-rate environments.

Inverted Interest Savings

Inverted interest savings occur when negative interest rates lead banks to charge depositors for holding their money, effectively reducing the principal over time instead of earning simple interest. This scenario contrasts with traditional simple interest savings, where the principal consistently grows at a fixed rate, making inverted interest a costly risk for savers seeking capital preservation.

Reverse Interest Accrual

Simple interest calculates earnings solely on the initial principal, providing predictable growth for savings, whereas negative interest, or reverse interest accrual, reduces the principal over time, essentially charging savers a fee for holding money in deposits. Reverse interest accrual diminishes savings value, incentivizing spending or investment over traditional holding strategies.

Erosion Yield

Simple interest provides a predictable, fixed return on savings, whereas negative interest results in an erosion of yield, effectively reducing the principal over time. This erosion yield diminishes the real value of saved funds, impacting long-term wealth accumulation and financial stability.

Penalty Rate Deposits

Simple interest on savings offers predictable returns calculated on the principal amount, whereas negative interest in penalty rate deposits means savers effectively pay to keep their funds, reducing overall earnings. Penalty rate deposits impose charges when withdrawals occur before maturity, magnifying losses beyond the negative interest rates by applying additional fees.

Simple Savings Growth

Simple interest provides a straightforward method for savings growth by applying a fixed percentage rate to the initial principal, ensuring predictable and steady earnings over time. In contrast, negative interest rates reduce the principal balance, effectively decreasing savings and discouraging accumulation, which can impact long-term financial stability.

Decaying Principal Accounts

Simple interest on savings steadily increases earnings by calculating interest only on the original principal, while negative interest in decaying principal accounts reduces the balance over time by charging fees or negative rates that erode the initial deposit. Understanding the impact of decaying principal accounts is crucial for savers to avoid loss of capital and select better growth options in negative interest rate environments.

Negative Rate Hedging

Negative interest rates erode savings by charging depositors to hold money, prompting investors to seek negative rate hedging strategies such as purchasing inflation-protected securities or diversifying into real assets. Simple interest on savings provides predictable growth, but negative interest environments require proactive financial planning to preserve capital value against diminishing returns.

Baseline Interest Preservation

Simple interest preserves the baseline interest by calculating returns solely on the initial principal, ensuring predictable and stable growth over time. Negative interest, in contrast, erodes baseline capital by charging a fee on the principal or deposits, effectively reducing savings despite nominal interest rates.

Simple Interest vs Negative Interest for saving. Infographic

moneydiff.com

moneydiff.com