Flat interest charges a fixed percentage on the original loan amount throughout the loan tenure, making repayments predictable but often resulting in higher total interest. Reducing balance interest calculates interest on the outstanding loan principal after each repayment, which can lower overall interest costs as the loan balance decreases. Borrowers seeking cost efficiency generally prefer reducing balance interest due to its decreasing interest burden over time.

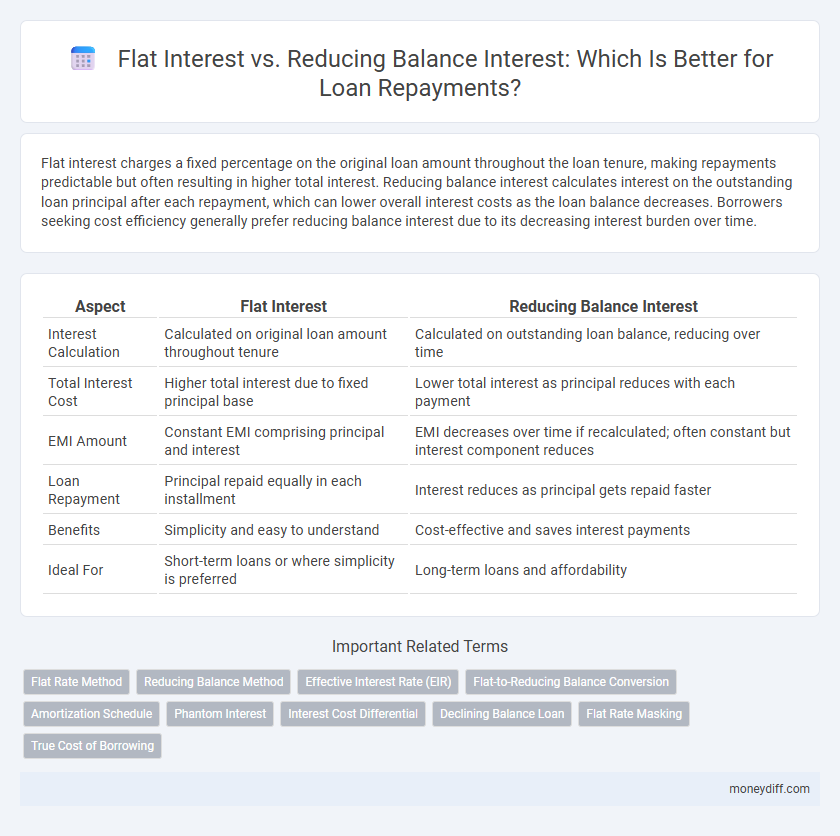

Table of Comparison

| Aspect | Flat Interest | Reducing Balance Interest |

|---|---|---|

| Interest Calculation | Calculated on original loan amount throughout tenure | Calculated on outstanding loan balance, reducing over time |

| Total Interest Cost | Higher total interest due to fixed principal base | Lower total interest as principal reduces with each payment |

| EMI Amount | Constant EMI comprising principal and interest | EMI decreases over time if recalculated; often constant but interest component reduces |

| Loan Repayment | Principal repaid equally in each installment | Interest reduces as principal gets repaid faster |

| Benefits | Simplicity and easy to understand | Cost-effective and saves interest payments |

| Ideal For | Short-term loans or where simplicity is preferred | Long-term loans and affordability |

Flat Interest vs Reducing Balance Interest: An Overview

Flat interest charges a fixed percentage on the entire principal loan amount throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance interest. Reducing balance interest calculates interest on the outstanding loan balance after each repayment, which decreases over time and lowers the total interest paid. For borrowers, reducing balance interest is generally more cost-effective, especially for long-term loans, as interest burden diminishes with each installment.

How Flat Interest Works in Loan Repayments

Flat interest in loan repayments calculates interest on the entire principal amount throughout the loan tenure, resulting in fixed monthly payments. This method does not reduce the principal balance over time when computing interest, causing higher total interest costs compared to reducing balance interest. Lenders often apply flat interest rates in personal loans and vehicle loans for simplicity and predictable repayment schedules.

The Mechanics of Reducing Balance Interest

Reducing balance interest calculates interest on the outstanding loan principal after each repayment, leading to lower interest charges over time compared to flat interest. Each installment reduces the principal amount, thereby decreasing the base on which interest is calculated in subsequent periods. This method ensures borrowers pay interest only on the remaining balance, making it a more cost-effective option for loan repayments.

Key Differences Between Flat and Reducing Balance Interest

Flat interest calculates loan interest on the entire principal amount throughout the loan tenure, resulting in higher total interest payments. Reducing balance interest is computed on the outstanding loan balance after each repayment, leading to lower interest costs over time. The key difference lies in how interest accrues, with flat interest remaining constant and reducing balance interest decreasing as the principal reduces.

Impact on Total Loan Repayment Amounts

Flat interest loans calculate interest on the entire principal throughout the loan tenure, resulting in higher total repayment amounts compared to reducing balance interest, which charges interest only on the outstanding principal after each repayment. Reducing balance interest lowers the effective interest burden over time, significantly decreasing the total cost of the loan. Borrowers opting for reducing balance interest often benefit from substantial savings on interest payments, making it a more cost-effective repayment method.

Pros and Cons of Flat Interest Calculation

Flat interest calculation offers predictable and straightforward repayment amounts, making budgeting easier for borrowers. However, it often results in higher total interest costs compared to reducing balance interest since interest is charged on the entire principal throughout the loan tenure. This method lacks flexibility and does not reflect the decreasing loan balance, potentially leading to less cost-effective repayments over time.

Advantages and Disadvantages of Reducing Balance Interest

Reducing Balance Interest calculates interest on the outstanding loan principal, resulting in lower overall interest payments compared to flat interest. It provides borrowers with faster equity buildup and decreased interest cost over time, making it a cost-effective option for long-term loans. However, its complexity in calculation and higher initial installment amounts can pose challenges for some borrowers.

Which Interest Method Is More Cost-Effective?

Reducing balance interest is generally more cost-effective for loan repayments because interest is calculated on the outstanding principal, decreasing with each payment, unlike flat interest which is fixed on the entire loan amount. Borrowers pay less total interest over the loan tenure with the reducing balance method, especially for longer terms or larger loans. This method aligns repayments closer to actual loan usage, providing significant savings compared to the flat interest approach.

Choosing the Right Interest Structure for Your Loan

Choosing the right interest structure for your loan significantly affects the total repayment amount and monthly installments. Flat interest charges are calculated on the original principal throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance interest, which is computed on the outstanding loan balance and decreases as you repay. Evaluating your financial goals and cash flow helps determine whether the predictability of flat interest or the cost efficiency of reducing balance interest best suits your loan repayment strategy.

Tips for Borrowers: Comparing Loan Offers Based on Interest Calculation

When comparing loan offers, borrowers should focus on the total repayment amount by analyzing flat interest and reducing balance interest methods. Flat interest calculates interest on the entire principal throughout the loan tenure, often resulting in higher overall costs, while reducing balance interest charges interest only on the outstanding principal, leading to lower payments over time. Evaluating the effective interest rate and total cost of the loan helps borrowers select offers that minimize financial burden.

Related Important Terms

Flat Rate Method

Flat interest method calculates loan interest based on the original principal amount throughout the loan tenure, resulting in fixed monthly interest payments; this often leads to higher overall interest costs compared to the reducing balance method, where interest is calculated on the outstanding loan balance after each repayment. The flat rate method is simpler and easier to compute but lacks accuracy in reflecting the actual interest burden as the loan principal decreases over time.

Reducing Balance Method

Reducing balance interest calculates interest on the outstanding loan principal after each repayment, resulting in lower interest costs over the loan tenure compared to flat interest, which charges interest on the entire principal throughout the loan period. This method enables borrowers to save money and reduce the total repayment amount as the interest decreases proportionally with the reducing principal balance.

Effective Interest Rate (EIR)

Flat interest calculates interest on the entire principal amount throughout the loan tenure, resulting in a higher Effective Interest Rate (EIR) compared to reducing balance interest, which charges interest on the outstanding loan amount after each repayment. Reducing balance interest offers a lower EIR due to decreasing principal, making it more cost-effective for borrowers over time.

Flat-to-Reducing Balance Conversion

Flat interest calculates loan interest on the original principal throughout the tenure, resulting in higher total interest, while reducing balance interest charges interest on the outstanding principal amount, decreasing over time and lowering overall cost. Converting from flat to reducing balance interest significantly reduces total repayment amounts by aligning interest calculations with the diminishing loan balance, offering substantial savings for borrowers.

Amortization Schedule

Flat interest calculates interest on the entire principal amount throughout the loan tenure, resulting in equal interest charges each period, while reducing balance interest applies interest on the outstanding loan balance, decreasing over time as payments are made. An amortization schedule under flat interest shows fixed interest amounts and principal repayments, whereas under reducing balance interest, the schedule reflects gradually declining interest expenses and increasing principal repayments, leading to lower total interest paid.

Phantom Interest

Flat interest calculates interest on the entire original loan amount throughout the tenure, often leading to higher phantom interest, which is the unseen extra interest paid due to lack of principal reduction. Reducing balance interest charges interest on the outstanding loan balance, minimizing phantom interest and resulting in more accurate repayment costs over time.

Interest Cost Differential

Flat interest calculates interest on the entire principal amount throughout the loan tenure, resulting in higher total interest payments compared to reducing balance interest, which charges interest only on the outstanding loan balance, decreasing over time. This differential causes flat interest loans to incur significantly greater interest costs, making reducing balance interest more cost-efficient for borrowers seeking lower overall repayment expenses.

Declining Balance Loan

Declining balance loans calculate interest on the outstanding principal, resulting in lower interest payments over time compared to flat interest rates that apply a fixed percentage on the original loan amount. This method offers borrowers cost savings and faster principal reduction, making it a preferred choice for amortized loan repayments.

Flat Rate Masking

Flat interest loans calculate interest on the entire principal throughout the tenure, resulting in higher total interest payments despite lower monthly EMIs, masking the true cost compared to reducing balance interest that charges interest on the outstanding principal, reducing over time. Borrowers often underestimate total repayment amounts with flat rates, making reducing balance interest more cost-effective and transparent for loan repayments.

True Cost of Borrowing

Flat interest calculates interest on the entire principal throughout the loan tenure, often resulting in higher total repayment compared to reducing balance interest, which charges interest only on the outstanding loan amount that decreases over time. Understanding the true cost of borrowing requires comparing both methods, as reducing balance interest typically offers lower overall interest payments and more accurate reflection of loan affordability.

Flat Interest vs Reducing Balance Interest for loan repayments. Infographic

moneydiff.com

moneydiff.com