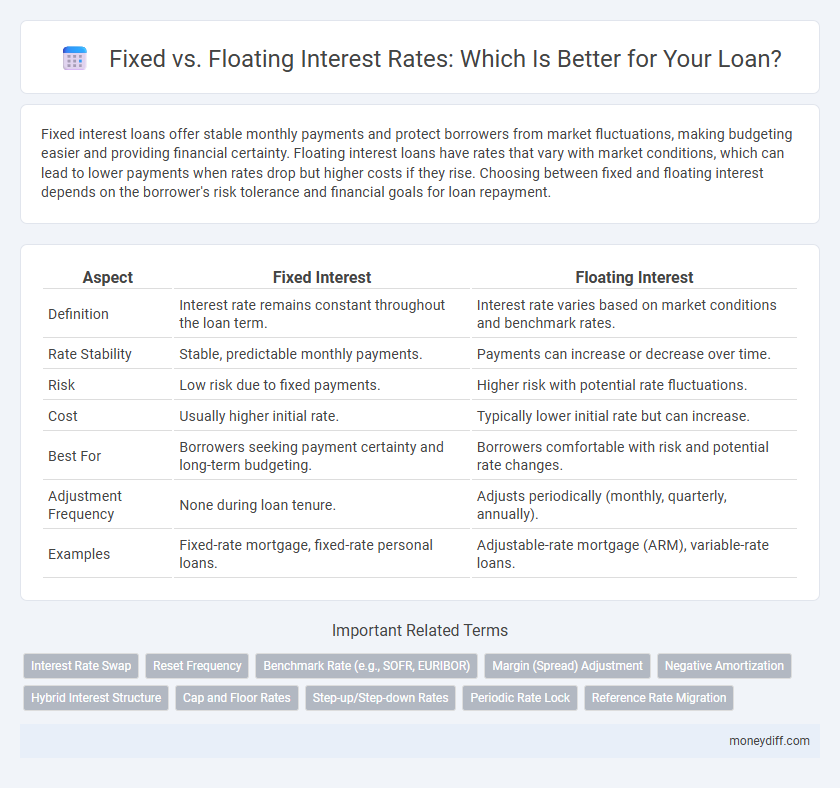

Fixed interest loans offer stable monthly payments and protect borrowers from market fluctuations, making budgeting easier and providing financial certainty. Floating interest loans have rates that vary with market conditions, which can lead to lower payments when rates drop but higher costs if they rise. Choosing between fixed and floating interest depends on the borrower's risk tolerance and financial goals for loan repayment.

Table of Comparison

| Aspect | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant throughout the loan term. | Interest rate varies based on market conditions and benchmark rates. |

| Rate Stability | Stable, predictable monthly payments. | Payments can increase or decrease over time. |

| Risk | Low risk due to fixed payments. | Higher risk with potential rate fluctuations. |

| Cost | Usually higher initial rate. | Typically lower initial rate but can increase. |

| Best For | Borrowers seeking payment certainty and long-term budgeting. | Borrowers comfortable with risk and potential rate changes. |

| Adjustment Frequency | None during loan tenure. | Adjusts periodically (monthly, quarterly, annually). |

| Examples | Fixed-rate mortgage, fixed-rate personal loans. | Adjustable-rate mortgage (ARM), variable-rate loans. |

Understanding Fixed Interest vs Floating Interest Loans

Fixed interest loans maintain a constant interest rate throughout the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Floating interest loans feature rates that adjust periodically based on benchmark rates like LIBOR or the prime rate, potentially lowering initial costs but increasing payment variability. Borrowers should assess their risk tolerance and financial stability when choosing between fixed and floating interest options to optimize loan affordability.

Key Differences Between Fixed and Floating Rate Loans

Fixed interest loans maintain a constant rate throughout the loan tenure, providing predictable monthly payments and shielding borrowers from market fluctuations. Floating interest loans, however, have rates that adjust periodically based on benchmark indices like the LIBOR or prime rate, potentially lowering initial costs but increasing payment variability. The key differences lie in payment stability, risk exposure, and sensitivity to market interest rate changes.

Pros and Cons of Fixed Interest Loans

Fixed interest loans offer predictable monthly payments, making budgeting easier by locking in the interest rate for the loan's duration. They provide protection against rising interest rates but may result in higher initial rates compared to floating interest loans. Borrowers might miss out on potential savings if market rates decrease, limiting flexibility in changing economic conditions.

Pros and Cons of Floating Interest Loans

Floating interest loans offer lower initial rates compared to fixed interest loans, enabling borrowers to benefit from market rate decreases. The main risk involves rate fluctuations that can increase monthly payments, creating budgeting uncertainties. Flexibility in loan repayment and potential savings during low-interest periods make floating rates attractive, but they demand careful financial planning to manage possible cost rises.

How Fixed and Floating Rates Impact Loan Payments

Fixed interest rates offer predictability in loan payments by maintaining a constant rate throughout the loan term, enabling consistent budgeting without exposure to market fluctuations. Floating interest rates fluctuate with market conditions, which can lead to lower initial payments but introduce variability and potential increases in monthly loan obligations. Understanding the trade-off between payment stability with fixed rates and possible savings with floating rates is crucial for managing loan affordability and financial planning.

Factors Influencing Interest Rate Choices

Borrowers often choose between fixed interest, which offers a stable rate over the loan term, and floating interest, which fluctuates based on market benchmarks like the prime rate or LIBOR. Key factors influencing this choice include risk tolerance, economic forecasts, inflation expectations, and loan duration, with fixed rates favored in volatile markets and floating rates preferred when interest rates are expected to decline. Lenders also assess creditworthiness and liquidity, affecting the offered interest rates and terms.

Suitability of Fixed vs Floating Rates for Borrowers

Fixed interest rates provide borrowers with predictable monthly payments, making them suitable for those seeking stability and budgeting certainty in their loan repayments. Floating interest rates fluctuate with market conditions, offering potential savings when rates decline, ideal for borrowers with flexible financial situations and tolerance for risk. Choosing between fixed and floating rates depends on a borrower's risk appetite, income stability, and expectations of future interest rate movements.

Interest Rate Trends: Fixed and Floating Rates

Fixed interest rates on loans remain stable throughout the term, providing predictability amid fluctuating market conditions. Floating interest rates adjust periodically based on benchmark indices like LIBOR or the federal funds rate, often reflecting current economic trends. Historical data shows floating rates tend to be lower initially but carry uncertainty, whereas fixed rates may be higher but protect borrowers from future increases.

Risk Management in Choosing Loan Interest Types

Fixed interest rates provide predictable loan payments, enabling borrowers to manage financial risk by avoiding market fluctuations. Floating interest rates, linked to benchmark indices, can offer lower initial costs but expose borrowers to potential rate increases and higher repayment volatility. Effective risk management involves assessing cash flow stability, market interest rate trends, and personal risk tolerance before choosing between fixed and floating interest loan options.

Making an Informed Decision: Fixed or Floating Interest

Choosing between fixed and floating interest rates for loans hinges on evaluating financial stability versus market risk tolerance. Fixed interest rates offer predictable monthly payments and shield borrowers from market fluctuations, providing budget certainty. Floating interest rates, while initially lower, expose borrowers to variable payments tied to benchmark rates like LIBOR or SOFR, necessitating careful assessment of potential rate hikes and overall loan affordability.

Related Important Terms

Interest Rate Swap

Interest rate swaps enable borrowers to switch from floating interest rates, which fluctuate with market benchmarks like LIBOR or SOFR, to fixed interest rates, providing predictable loan repayments and mitigating exposure to interest rate volatility. This financial derivative is crucial for managing interest costs and aligning loan strategies with risk tolerance in variable rate environments.

Reset Frequency

Fixed interest loans maintain a constant interest rate throughout the loan term, providing payment stability and predictability, while floating interest loans adjust periodically based on a reference rate, exposing borrowers to potential rate fluctuations. The reset frequency in floating interest loans, such as monthly, quarterly, or annually, determines how often the interest rate is recalibrated, directly impacting repayment amounts and overall loan cost.

Benchmark Rate (e.g., SOFR, EURIBOR)

Fixed interest loans offer stability by locking in a constant rate over the loan term, while floating interest loans fluctuate based on benchmark rates such as SOFR (Secured Overnight Financing Rate) or EURIBOR (Euro Interbank Offered Rate), which reflect current market conditions. Borrowers with floating interest benefit from potentially lower rates when benchmark rates decrease but face higher payments if SOFR or EURIBOR rise during the loan period.

Margin (Spread) Adjustment

Margin adjustment in fixed interest loans remains constant throughout the loan term, providing predictable repayment amounts, whereas floating interest loans feature margins that can fluctuate based on benchmark rate changes, impacting overall borrowing costs. Lenders adjust the spread within floating interest loans to reflect market risk and credit conditions, influencing the effective interest rate paid by borrowers.

Negative Amortization

Fixed interest loans offer predictable payments but can lead to negative amortization if payments do not cover accrued interest, causing the loan balance to increase over time. Floating interest rates fluctuate with market conditions, potentially reducing the risk of negative amortization but introducing payment uncertainty and variable loan costs.

Hybrid Interest Structure

Hybrid interest structures combine fixed and floating interest rates to optimize loan repayment flexibility and cost-efficiency, offering stability on a portion of the principal while allowing borrowers to benefit from market fluctuations on the remaining balance. This approach mitigates risk by balancing predictable fixed-rate payments with the potential savings of lower floating rates during market dips.

Cap and Floor Rates

Fixed interest loans maintain a constant rate throughout the loan term, providing predictable payments without exposure to market fluctuations. Floating interest loans fluctuate with benchmark rates but often include cap and floor rates to limit the maximum and minimum interest charged, balancing risk and cost for borrowers.

Step-up/Step-down Rates

Step-up and step-down rates in fixed interest loans provide predictable payment adjustments over time, enhancing financial planning by gradually increasing or decreasing interest rates at specified intervals. Floating interest loans with step-up or step-down features adjust rates based on benchmark indices, offering potential cost savings when rates decline but exposing borrowers to higher payments if rates rise.

Periodic Rate Lock

Periodic rate lock in fixed interest loans guarantees a stable interest rate for the loan term, protecting borrowers from market fluctuations. In contrast, floating interest loans adjust rates periodically based on benchmark indices, exposing borrowers to potential rate increases or decreases over time.

Reference Rate Migration

Fixed interest loans maintain a constant rate throughout the loan term, providing payment stability, whereas floating interest rates fluctuate based on reference rate migration, such as shifts in LIBOR or SOFR benchmarks. Reference rate migration impacts floating loans by aligning interest adjustments with market conditions, which can increase or decrease borrowing costs over time.

Fixed Interest vs Floating Interest for loans Infographic

moneydiff.com

moneydiff.com