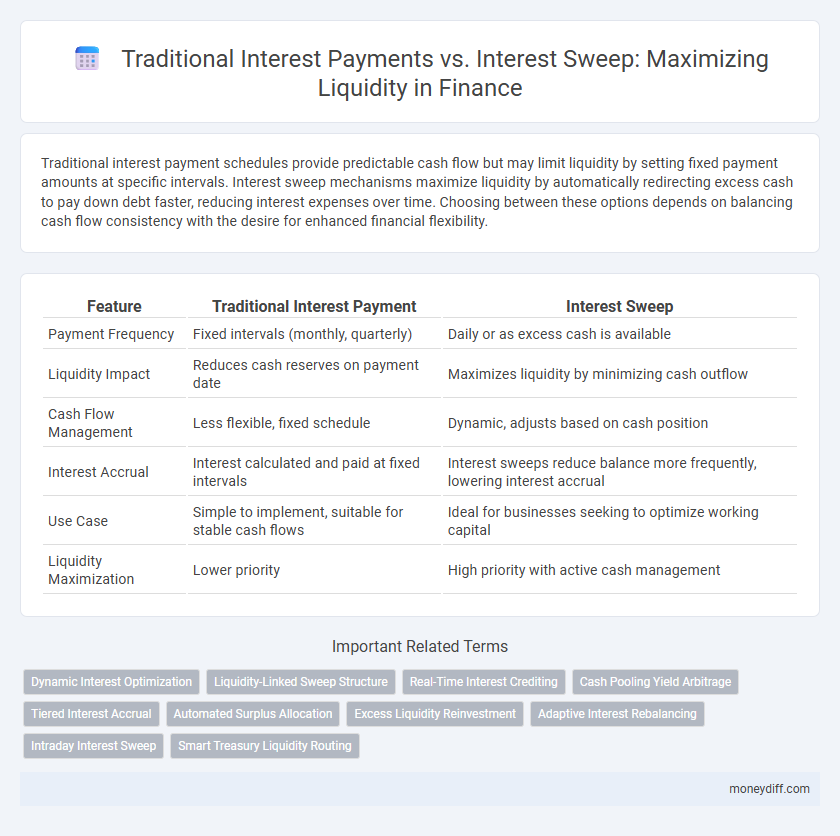

Traditional interest payment schedules provide predictable cash flow but may limit liquidity by setting fixed payment amounts at specific intervals. Interest sweep mechanisms maximize liquidity by automatically redirecting excess cash to pay down debt faster, reducing interest expenses over time. Choosing between these options depends on balancing cash flow consistency with the desire for enhanced financial flexibility.

Table of Comparison

| Feature | Traditional Interest Payment | Interest Sweep |

|---|---|---|

| Payment Frequency | Fixed intervals (monthly, quarterly) | Daily or as excess cash is available |

| Liquidity Impact | Reduces cash reserves on payment date | Maximizes liquidity by minimizing cash outflow |

| Cash Flow Management | Less flexible, fixed schedule | Dynamic, adjusts based on cash position |

| Interest Accrual | Interest calculated and paid at fixed intervals | Interest sweeps reduce balance more frequently, lowering interest accrual |

| Use Case | Simple to implement, suitable for stable cash flows | Ideal for businesses seeking to optimize working capital |

| Liquidity Maximization | Lower priority | High priority with active cash management |

Understanding Traditional Interest Payment Methods

Traditional interest payment methods typically involve fixed periodic payments based on a predetermined principal amount and interest rate, providing predictable cash outflows for borrowers. These payments do not adjust for fluctuating cash balances, potentially limiting liquidity optimization for businesses with variable cash flow. Understanding these methods highlights the contrast with interest sweep strategies, which dynamically allocate excess funds to reduce interest expenses and enhance overall liquidity management.

What Is an Interest Sweep?

An interest sweep automatically transfers excess cash from a business's operating account to pay down outstanding loan balances, minimizing idle funds and reducing interest expense. Unlike traditional interest payments made periodically on a fixed schedule, an interest sweep dynamically adjusts based on available liquidity, optimizing cash flow and maximizing interest savings. This strategy enhances liquidity management by ensuring funds are effectively utilized to lower debt costs while maintaining sufficient operational cash.

Key Differences Between Traditional Interest and Interest Sweep

Traditional interest payments involve fixed or scheduled interest disbursements based on the principal balance, providing predictable cash outflows. Interest sweep mechanisms automatically transfer excess funds from an operating account to reduce interest-bearing debt, optimizing liquidity by minimizing interest expenses. The key difference lies in the control and timing of payments--traditional interest is predetermined, while interest sweeps dynamically adjust based on real-time cash balances.

How Interest Sweep Improves Liquidity

Interest sweep enhances liquidity by automatically redirecting excess cash from operating accounts to pay down debt, reducing interest expenses and freeing up available funds. This proactive cash management strategy minimizes idle balances, ensuring optimal utilization of working capital. Compared to traditional interest payments, interest sweeps increase cash flow efficiency, supporting better financial flexibility and operational stability.

Pros and Cons of Traditional Interest Payment

Traditional interest payment provides predictable cash outflows with fixed due dates, simplifying financial planning and budgeting for businesses. However, its rigid schedule can limit liquidity by requiring payments regardless of cash availability, potentially constraining working capital during downturns. This method lacks flexibility compared to interest sweep, which dynamically manages excess cash to optimize interest expenses and liquidity.

Advantages of Using Interest Sweep Accounts

Interest sweep accounts automatically transfer excess funds from a checking to an interest-bearing account, optimizing liquidity by maximizing interest earnings while maintaining operational cash. This method reduces idle cash without manual intervention, ensuring that surplus balances earn higher returns compared to fixed traditional interest payments. Companies benefit from enhanced cash flow management and improved investment efficiency by leveraging real-time fund allocation.

Liquidity Optimization: Traditional vs. Sweep Approaches

Traditional interest payments provide predictable cash outflows at fixed intervals, but can limit immediate liquidity access. Interest sweep mechanisms automatically transfer surplus funds to pay down debt or invest, enhancing real-time liquidity optimization. Businesses leveraging interest sweeps benefit from reduced interest expenses and improved cash flow management compared to static traditional interest schedules.

Cost Efficiency: Comparing Interest Payment Structures

Traditional interest payments involve fixed periodic payments that can strain liquidity by locking funds, whereas interest sweep mechanisms dynamically allocate surplus cash to reduce debt principal and minimize interest costs. By automatically redirecting excess funds to pay down outstanding balances, an interest sweep enhances cost efficiency through lower overall interest expenses and improved cash flow management. This strategy aligns debt repayment with real-time liquidity, maximizing capital availability and reducing financial charges compared to static interest payments.

Choosing the Right Interest Strategy for Your Business

Choosing the right interest strategy for your business involves evaluating Traditional Interest Payment and Interest Sweep methods based on cash flow needs and liquidity goals. Traditional Interest Payment provides predictable, scheduled income but may limit immediate liquidity, whereas an Interest Sweep dynamically reallocates excess funds to optimize cash availability and reduce idle balances. Businesses prioritizing maximum liquidity benefit from Interest Sweep strategies that enhance working capital efficiency without compromising interest earnings.

Future Trends in Interest Management for Liquidity Maximization

Traditional interest payment methods often involve fixed periodic payments that may limit immediate cash flow availability, whereas interest sweep mechanisms automatically redirect excess cash to repay debt, enhancing liquidity optimization. Future trends in interest management emphasize integrating real-time data analytics and AI-driven algorithms to dynamically adjust interest sweeps, maximizing liquidity while minimizing financing costs. Advanced cash management platforms will increasingly enable seamless synchronization between interest payments and sweeping strategies, driving improved financial agility for businesses.

Related Important Terms

Dynamic Interest Optimization

Dynamic interest optimization leverages real-time analysis to choose between traditional interest payments and interest sweep mechanisms, maximizing liquidity by minimizing idle cash and enhancing investment returns. This approach adjusts interest flows based on cash flow variability, ensuring optimal fund utilization without sacrificing debt service obligations.

Liquidity-Linked Sweep Structure

Liquidity-linked sweep structure enhances cash flow efficiency by automatically transferring excess funds from transaction accounts to higher-yield interest-earning accounts, maximizing liquidity without manual intervention. Traditional interest payments, fixed and periodic, often miss opportunities to optimize idle cash, whereas interest sweeps dynamically adjust balances to ensure continuous liquidity optimization.

Real-Time Interest Crediting

Real-time interest crediting enhances liquidity management by immediately applying earnings to the principal, contrasting with traditional interest payment methods that delay capitalization until the end of the period. This instant accumulation through an interest sweep mechanism maximizes available funds, reduces idle balances, and optimizes cash flow efficiency for businesses.

Cash Pooling Yield Arbitrage

Traditional interest payments offer fixed returns on cash balances, while interest sweeps dynamically transfer excess funds into higher-yield accounts, enabling better cash pooling yield arbitrage. This strategy maximizes liquidity by optimizing interest income through automated balance sweeps and strategic allocation across multiple accounts.

Tiered Interest Accrual

Traditional interest payment involves fixed periodic interest disbursements based on loan balances, limiting liquidity flexibility, whereas interest sweep automatically applies excess cash flow to principal reduction, optimizing available funds. Tiered interest accrual enhances this by adjusting rates according to outstanding balances, maximizing returns and liquidity management in dynamic cash environments.

Automated Surplus Allocation

Traditional interest payments provide fixed periodic returns on outstanding balances, often resulting in underutilized funds during non-payment periods. Interest sweep automates surplus allocation by redirecting excess liquidity into interest-bearing accounts daily, maximizing cash flow efficiency and optimizing overall returns.

Excess Liquidity Reinvestment

Traditional interest payment methods distribute earned interest periodically, which can result in idle funds between payments and missed opportunities for maximizing liquidity. Interest sweep mechanisms automatically reinvest excess liquidity by transferring surplus balances into higher-yield accounts, enhancing cash flow efficiency and optimizing returns through continuous reinvestment.

Adaptive Interest Rebalancing

Adaptive Interest Rebalancing leverages dynamic allocation between Traditional Interest Payment and Interest Sweep methods to optimize liquidity by reinvesting earned interest back into the principal, enhancing compounding effects. This approach minimizes idle cash by automatically sweeping interest into high-yield instruments, thereby maximizing overall returns and improving cash flow management efficiency.

Intraday Interest Sweep

Intraday interest sweep maximizes liquidity by automatically transferring surplus funds from operating accounts to interest-bearing accounts throughout the day, reducing idle cash and enhancing returns compared to traditional interest payments made periodically. This real-time optimization leverages intraday cash flows to boost effective interest income while preserving operational flexibility.

Smart Treasury Liquidity Routing

Traditional interest payment methods involve fixed, scheduled disbursements that may limit immediate cash flow optimization, whereas interest sweep strategies dynamically redirect excess funds into higher-yield accounts, maximizing liquidity through real-time Smart Treasury Liquidity Routing. Employing Smart Treasury Liquidity Routing ensures automated, data-driven allocation of assets, enhancing return on idle cash while maintaining operational flexibility and optimizing interest income streams.

Traditional Interest Payment vs Interest Sweep for maximizing liquidity. Infographic

moneydiff.com

moneydiff.com