Daily interest accrual calculates and adds interest to your savings once every day, allowing your balance to grow steadily with each passing day. Continuous interest accrual, on the other hand, compounds interest constantly, resulting in faster savings growth as interest is calculated at every moment. Choosing continuous compounding maximizes returns by leveraging the power of exponential growth on your investment.

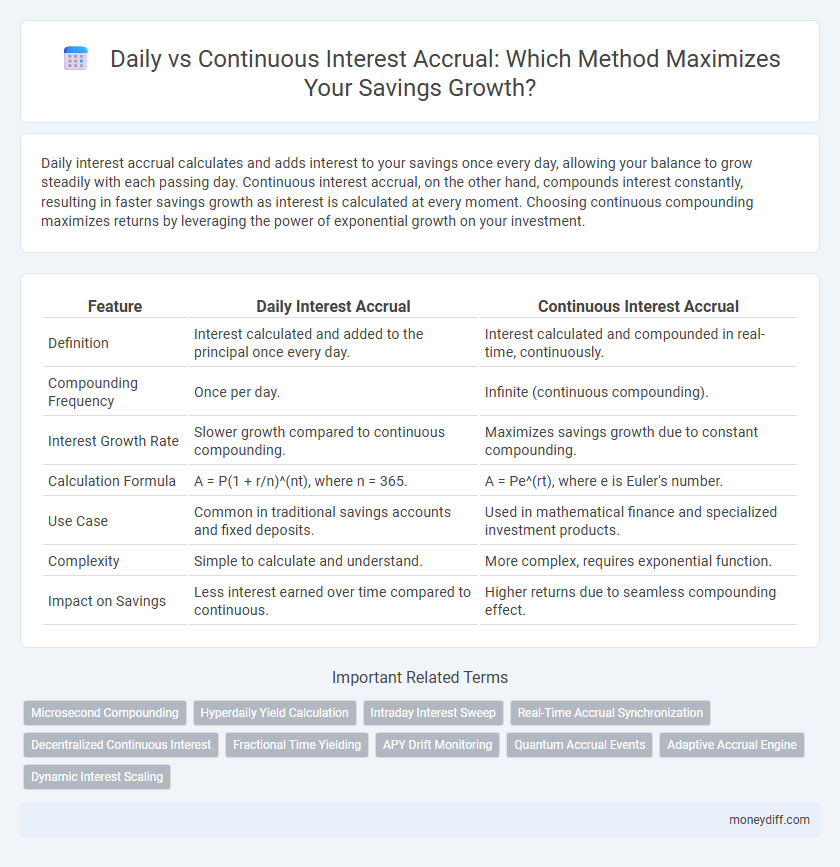

Table of Comparison

| Feature | Daily Interest Accrual | Continuous Interest Accrual |

|---|---|---|

| Definition | Interest calculated and added to the principal once every day. | Interest calculated and compounded in real-time, continuously. |

| Compounding Frequency | Once per day. | Infinite (continuous compounding). |

| Interest Growth Rate | Slower growth compared to continuous compounding. | Maximizes savings growth due to constant compounding. |

| Calculation Formula | A = P(1 + r/n)^(nt), where n = 365. | A = Pe^(rt), where e is Euler's number. |

| Use Case | Common in traditional savings accounts and fixed deposits. | Used in mathematical finance and specialized investment products. |

| Complexity | Simple to calculate and understand. | More complex, requires exponential function. |

| Impact on Savings | Less interest earned over time compared to continuous. | Higher returns due to seamless compounding effect. |

Understanding Daily Interest Accrual

Daily interest accrual calculates interest based on the account balance at the end of each day, allowing for regular compounding that enhances savings growth over time. This method provides clear visibility into how interest accumulates and compounds daily, making it easier for savers to track and project their earnings. Understanding this concept is crucial for maximizing returns in savings accounts that compound interest every day rather than on less frequent intervals.

How Continuous Interest Accrual Works

Continuous interest accrual calculates interest on a savings balance at every possible moment, using exponential growth based on the formula A = P * e^(rt). This method compounds interest infinitely many times per year, resulting in faster growth compared to daily accrual, which compounds once per day. Continuous compounding is particularly advantageous for long-term savings, maximizing returns through constant accumulation of interest.

Key Differences Between Daily and Continuous Interest

Daily interest accrual calculates interest based on the principal plus any accumulated interest at the end of each day, resulting in discrete compounding periods. Continuous interest accrual compounds interest instantaneously at every moment, using the mathematical limit of compounding frequency for maximum growth potential. The key difference lies in the frequency and formula used: daily uses \( A = P \left(1 + \frac{r}{365}\right)^{365t} \), while continuous uses \( A = Pe^{rt} \), where \( P \) is principal, \( r \) is annual interest rate, \( t \) is time in years, and \( e \) is Euler's number.

Impact on Savings Growth Over Time

Daily interest accrual calculates and adds interest to the savings balance once every day, allowing for consistent but discrete growth increments. Continuous interest accrual compounds interest at every moment, resulting in a slightly higher effective yield due to constant reinvestment of earnings. Over time, continuous compounding maximizes the growth potential of savings by leveraging the exponential effect of interest-on-interest more effectively than daily compounding.

Which Accrual Method Yields Higher Returns?

Continuous interest accrual typically yields higher returns than daily interest accrual due to the effect of constant compounding, which calculates interest on an ever-increasing principal balance every moment. Daily interest accrual compounds interest only once per day, leading to slightly lower overall growth over the same period. Savers seeking maximum growth should consider accounts offering continuous compounding rates to leverage faster accumulation of earnings.

Real-World Examples: Daily vs Continuous Interest

Daily interest accrual calculates and adds interest to the account balance once every day, which is common in traditional savings accounts offered by banks like Chase or Wells Fargo. Continuous interest accrual, employed in certain high-yield savings accounts and investment platforms, compounds interest constantly, as seen in products like cryptocurrency staking or blockchain-based savings protocols. For example, an account with a 5% annual interest rate will grow faster with continuous compounding than daily compounding, resulting in slightly higher returns over time when invested regularly.

Compound Frequency and Its Effect on Earnings

Daily interest accrual compounds savings by adding earned interest to the principal each day, allowing subsequent interest calculations to grow faster compared to less frequent compounding intervals. Continuous interest accrual represents the mathematical limit of compounding frequency, calculating interest at every possible instant, which maximizes earnings over time. The higher the compounding frequency, including daily and continuous, the greater the total interest accrued due to exponential growth effects on principal accumulation.

Pros and Cons of Daily and Continuous Accrual

Daily interest accrual calculates and adds interest to the principal balance once every day, allowing for visible daily growth and easier tracking of earnings, but it may miss potential gains from intra-day compounding. Continuous interest accrual compounds interest an infinite number of times per second, maximizing growth potential through seamless compounding, though it can be harder to conceptualize and may require more sophisticated systems for accurate calculation and tracking. Choosing between daily and continuous accrual depends on the saver's preference for simplicity versus maximizing compound interest efficiency.

Choosing the Right Interest Accrual for Your Savings

Daily interest accrual calculates interest based on the account balance at the end of each day, resulting in consistent growth that compounds regularly. Continuous interest accrual compounds interest instantaneously and theoretically at every moment, leading to slightly higher returns over time, especially for larger balances or longer periods. Selecting the right method depends on your savings goals and account terms, with continuous compounding offering maximum growth potential while daily compounding provides predictable, tangible increments.

Maximizing Savings Growth with Optimal Interest Accrual

Daily interest accrual calculates interest based on the balance at the end of each day, resulting in regular compounding that steadily increases savings growth. Continuous interest accrual compounds interest at every moment, mathematically utilizing the formula A = Pe^(rt) for maximized returns over time. Choosing continuous interest accrual often leads to higher yields compared to daily accrual, optimizing savings growth through more frequent compounding intervals.

Related Important Terms

Microsecond Compounding

Daily interest accrual applies a fixed interest rate compounded once per day, resulting in moderate growth on savings accounts, while continuous interest accrual calculates interest at every microsecond, maximizing returns through microsecond compounding. Microsecond compounding leverages high-frequency calculations to exponentially increase savings growth compared to traditional daily compounding methods.

Hyperdaily Yield Calculation

Hyperdaily yield calculation enhances savings growth by compounding interest multiple times within each day, surpassing traditional daily interest accrual rates. Continuous interest accrual, based on the exponential function e^(rt), maximizes returns by crediting interest in real-time, providing a more precise and higher effective yield over time.

Intraday Interest Sweep

Daily interest accrual calculates interest on the principal at the end of each day, while continuous interest accrual compounds interest every moment, maximizing returns through intraday interest sweep mechanisms. Intraday interest sweep automatically transfers excess funds into interest-bearing accounts multiple times within the day, enhancing overall savings growth by capturing more frequent interest compounding opportunities.

Real-Time Accrual Synchronization

Daily interest accrual calculates and adds interest once every day, while continuous interest accrual compounds in real time, providing seamless synchronization of earnings with account balance fluctuations. Real-time accrual synchronization ensures that every deposit, withdrawal, or balance change immediately affects the interest earned, maximizing savings growth efficiency.

Decentralized Continuous Interest

Decentralized continuous interest accrual enables savings growth by compounding every moment on blockchain platforms, providing higher yields compared to traditional daily interest accrual methods that compound once per day. This real-time interest calculation maximizes earnings through seamless integration with decentralized finance (DeFi) protocols, eliminating delays and increasing capital efficiency.

Fractional Time Yielding

Daily interest accrual calculates earnings based on the principal plus interest added each day, enabling profits to compound at discrete intervals; continuous interest accrual, using exponential growth formulas, assumes interest is compounded infinitely often, resulting in higher fractional time yielding. This fractional time yielding effect means continuous compounding captures even the smallest time increments, maximizing savings growth compared to the chunked compounding periods of daily interest.

APY Drift Monitoring

Daily interest accrual calculates interest at the end of each day, causing a slight delay in compounding compared to continuous interest accrual, which compounds interest instantaneously and maximizes growth potential. Monitoring APY drift is essential for savers to identify discrepancies between expected and actual returns, ensuring optimal savings growth strategies and better maximizing compound interest benefits.

Quantum Accrual Events

Daily interest accrual calculates savings growth by adding interest once per day, while continuous interest accrual compounds interest at every possible moment, maximizing returns through exponential growth. Quantum accrual events represent discrete points where interest is added, causing stepwise increases in balance that differ fundamentally from the smooth, uninterrupted growth seen in continuous compounding models.

Adaptive Accrual Engine

Adaptive Accrual Engine enhances savings growth by dynamically switching between daily interest accrual, which calculates interest at the end of each day, and continuous interest accrual, which compounds interest in real-time for maximum efficiency. This technology optimizes returns by adjusting accrual methods based on account behavior and market conditions, ensuring precise and accelerated wealth accumulation.

Dynamic Interest Scaling

Daily interest accrual calculates and adds interest to the savings balance at the end of each day, allowing for compound growth based on the principal plus any interest earned. Continuous interest accrual uses a dynamic interest scaling model that compounds interest instantaneously, resulting in faster and more efficient savings growth over time.

Daily Interest Accrual vs Continuous Interest Accrual for savings growth. Infographic

moneydiff.com

moneydiff.com