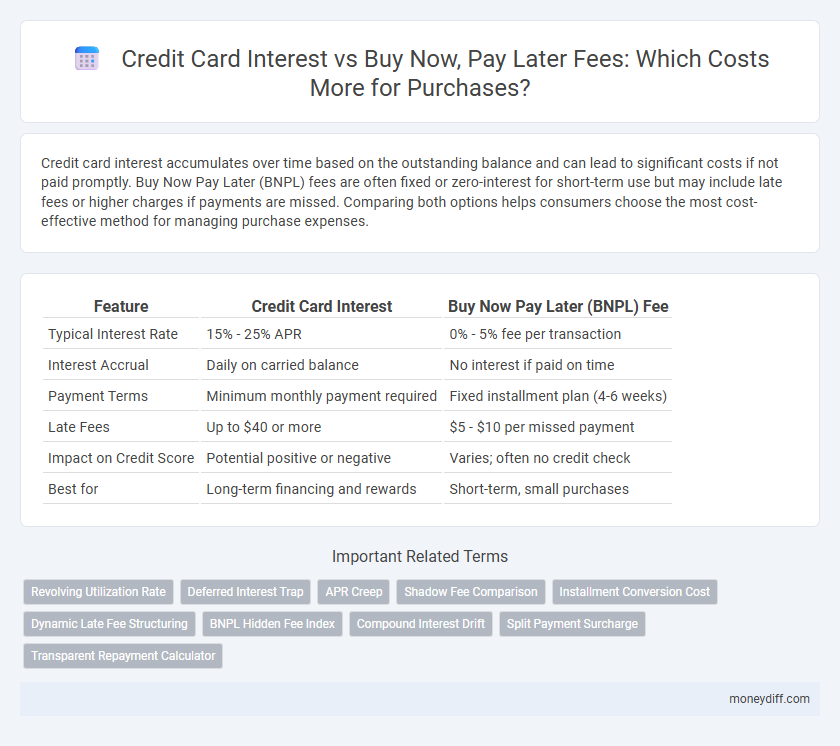

Credit card interest accumulates over time based on the outstanding balance and can lead to significant costs if not paid promptly. Buy Now Pay Later (BNPL) fees are often fixed or zero-interest for short-term use but may include late fees or higher charges if payments are missed. Comparing both options helps consumers choose the most cost-effective method for managing purchase expenses.

Table of Comparison

| Feature | Credit Card Interest | Buy Now Pay Later (BNPL) Fee |

|---|---|---|

| Typical Interest Rate | 15% - 25% APR | 0% - 5% fee per transaction |

| Interest Accrual | Daily on carried balance | No interest if paid on time |

| Payment Terms | Minimum monthly payment required | Fixed installment plan (4-6 weeks) |

| Late Fees | Up to $40 or more | $5 - $10 per missed payment |

| Impact on Credit Score | Potential positive or negative | Varies; often no credit check |

| Best for | Long-term financing and rewards | Short-term, small purchases |

Understanding Credit Card Interest Rates

Credit card interest rates typically range from 15% to 25% APR, impacting the total cost if balances are not paid in full each month. Buy Now Pay Later fees often involve fixed charges or late fees rather than interest, making them potentially cheaper for short-term financing but costly if payments are missed. Understanding the compounding nature of credit card interest helps consumers evaluate the true expense compared to the transparent fees of Buy Now Pay Later options.

How Buy Now Pay Later Fees Work

Buy Now Pay Later (BNPL) fees typically work by charging a fixed late payment fee or a percentage of the outstanding amount if the installment is missed, rather than accruing interest like credit cards. Unlike credit card interest rates that compound monthly on revolving balances, BNPL services often impose transparent and upfront fees tied directly to missed or delayed payments. This fee structure can make BNPL appealing for short-term purchases but potentially costly if payments are not managed on time.

Comparing Credit Card Interest vs BNPL Fees

Credit card interest rates typically range from 15% to 25% APR, accruing daily on outstanding balances and compounding over time, which can lead to higher overall costs if not paid promptly. Buy Now Pay Later (BNPL) services often offer interest-free periods but may charge fixed fees or late payment penalties, making them potentially more cost-effective for short-term, small purchases. Evaluating the total cost of credit card interest versus BNPL fees depends on repayment speed, purchase amount, and the specific terms of each financing option.

Which Is More Cost-Effective: Cards or BNPL?

Credit card interest typically accrues at rates ranging from 15% to 25% APR, leading to higher costs for prolonged balances, whereas Buy Now Pay Later (BNPL) services often offer interest-free periods but charge late fees or short-term fees if payments are missed. BNPL can be more cost-effective for consumers who pay off purchases within the interest-free window, but credit cards may provide better rewards and flexibility for managing longer-term debt. Evaluating the total cost, including interest rates, fees, and repayment terms, is essential to determining which option saves more money on purchases.

Hidden Costs in Credit Card and BNPL Services

Credit card interest often comes with hidden costs such as compounding interest and late payment penalties, which can significantly increase the total repayment amount. Buy Now Pay Later (BNPL) services may appear interest-free but frequently include fees like late payment charges and higher costs for extended payment plans. Understanding these concealed fees is crucial for accurately comparing the true expense of credit cards versus BNPL options.

Impact of Missed Payments: Interest vs Fees

Missed payments on credit cards result in high-interest charges that compound daily, significantly increasing the total debt owed over time. Buy Now Pay Later (BNPL) services often impose fixed late fees rather than interest, which can lead to lower immediate financial penalties but potentially harm credit scores. Understanding the long-term impact of interest accumulation versus fixed fees is crucial for managing debt effectively.

Long-Term Debt Implications: Credit Cards vs BNPL

Credit card interest rates typically range between 15% and 25% APR, leading to significant long-term debt accumulation if balances are not paid off monthly. Buy Now Pay Later (BNPL) schemes often advertise interest-free short-term plans but can impose high late fees and penalties that increase total repayment costs. Over extended periods, credit cards may result in more predictable interest costs, while BNPL's deferred payment models risk escalating debt and financial strain if payments are missed.

How Interest and Fees Affect Your Credit Score

Credit card interest accrues based on the outstanding balance and payment history, directly impacting your credit utilization ratio and payment timeliness, which are critical factors in credit scoring models like FICO. Buy Now Pay Later (BNPL) fees, often incurred as late or service charges, may not always be reported to credit bureaus but can lead to increased debt and potential missed payments, indirectly affecting your credit score. Consistently managing credit card interest and BNPL fees by making timely payments helps maintain a healthy credit utilization rate and positive payment history, essential for preserving or improving your credit score.

Tips to Minimize Costs on Purchases

To minimize costs on purchases, carefully compare the interest rates of credit cards and the fees associated with Buy Now Pay Later (BNPL) plans. Paying off credit card balances in full each month avoids high-interest charges, while selecting BNPL options with zero or low fees and understanding their repayment schedules can prevent unexpected costs. Monitoring spending and choosing the payment method with the lowest total cost over time ensures smarter financial decisions.

Choosing the Best Payment Option for You

Credit card interest typically accrues daily based on the outstanding balance and can become costly if not paid within the grace period, while Buy Now Pay Later (BNPL) fees are often fixed or linked to late payments without ongoing interest. Evaluating your spending habits, payment timeline, and the specific fee structures of each option helps determine the most cost-effective choice. Opting for BNPL may benefit short-term budget management, whereas credit cards can offer rewards and simplified payments if balances are cleared promptly.

Related Important Terms

Revolving Utilization Rate

Credit card interest accrues based on the revolving utilization rate, which measures the percentage of available credit currently used and directly impacts your credit score. Buy Now Pay Later fees typically involve fixed service charges rather than interest, making them less influenced by utilization rates but potentially more costly over time for larger purchases.

Deferred Interest Trap

Credit card interest typically accrues daily on unpaid balances, leading to higher costs over time compared to Buy Now Pay Later (BNPL) fees, which often appear as flat charges or delayed payments but may include hidden deferred interest traps that activate if the balance is not paid in full within the promotional period. Consumers must carefully review BNPL terms to avoid deferred interest accumulation, which can result in retroactive interest charges, often at high APRs, negating the perceived short-term savings.

APR Creep

Credit card interest rates typically feature an APR creep, where the annual percentage rate gradually increases due to late payments or variable rates, potentially raising the cost of borrowing over time. Buy Now Pay Later fees often present a fixed fee structure without APR creep, making the total cost more predictable but sometimes resulting in higher upfront fees compared to credit cards.

Shadow Fee Comparison

Credit card interest typically accrues daily with rates averaging 15%-25% APR, while Buy Now Pay Later (BNPL) services often advertise no upfront interest but include hidden fees or late payment charges that can effectively increase the cost, creating a shadow fee comparable to or exceeding traditional credit card interest. Understanding the total cost of ownership requires analyzing late fees, deferred interest policies, and processing charges within BNPL agreements to reveal their true financial impact against transparent credit card interest rates.

Installment Conversion Cost

Credit card interest rates typically range from 15% to 25% APR, significantly impacting the total repayment amount for purchases. Buy Now Pay Later (BNPL) services often charge a fixed installment conversion fee, usually between 2% and 8%, which can be more cost-effective than credit card interest for short-term financing.

Dynamic Late Fee Structuring

Dynamic late fee structuring in Buy Now Pay Later (BNPL) services offers flexible penalties based on payment behavior, often resulting in lower overall costs compared to traditional credit card interest rates that compound daily on outstanding balances. This adaptive fee model can reduce financial strain for consumers by aligning charges with actual payment delays rather than fixed, cumulative interest charges typical of credit cards.

BNPL Hidden Fee Index

Credit card interest rates typically range from 15% to 25% APR, potentially increasing the total purchase cost significantly over time, while Buy Now Pay Later (BNPL) services may charge a BNPL Hidden Fee Index averaging 5% to 10%, often concealed in late fees or service charges that are not immediately apparent to consumers. Understanding the BNPL Hidden Fee Index is crucial, as these additional costs can outweigh upfront savings by accumulating through missed payments or extended repayment periods.

Compound Interest Drift

Credit card interest compounds daily, causing balances to grow exponentially if unpaid, while Buy Now Pay Later (BNPL) fees are typically fixed or flat, avoiding the cumulative effect of compound interest drift but potentially leading to high late fees. Understanding the impact of compound interest drift on credit cards reveals how small unpaid amounts can escalate significantly over time compared to the straightforward fees of BNPL plans.

Split Payment Surcharge

Credit card interest typically accrues daily on the outstanding balance, often ranging from 15% to 25% APR, leading to higher overall costs if not paid in full each month. In contrast, Buy Now Pay Later (BNPL) options with split payment surcharges impose fixed fees for dividing payments, which can increase the total purchase cost without the compounding interest associated with credit cards.

Transparent Repayment Calculator

Comparing credit card interest and Buy Now Pay Later (BNPL) fees highlights the importance of using a transparent repayment calculator to accurately estimate total costs over time, including variable interest rates and hidden processing fees. A clear calculator offers detailed breakdowns of payment schedules, interest accrual, and fee structures, enabling consumers to make informed decisions between high APR credit cards and often lower, but sometimes compounding, BNPL charges.

Credit Card Interest vs Buy Now Pay Later Fee for purchases. Infographic

moneydiff.com

moneydiff.com