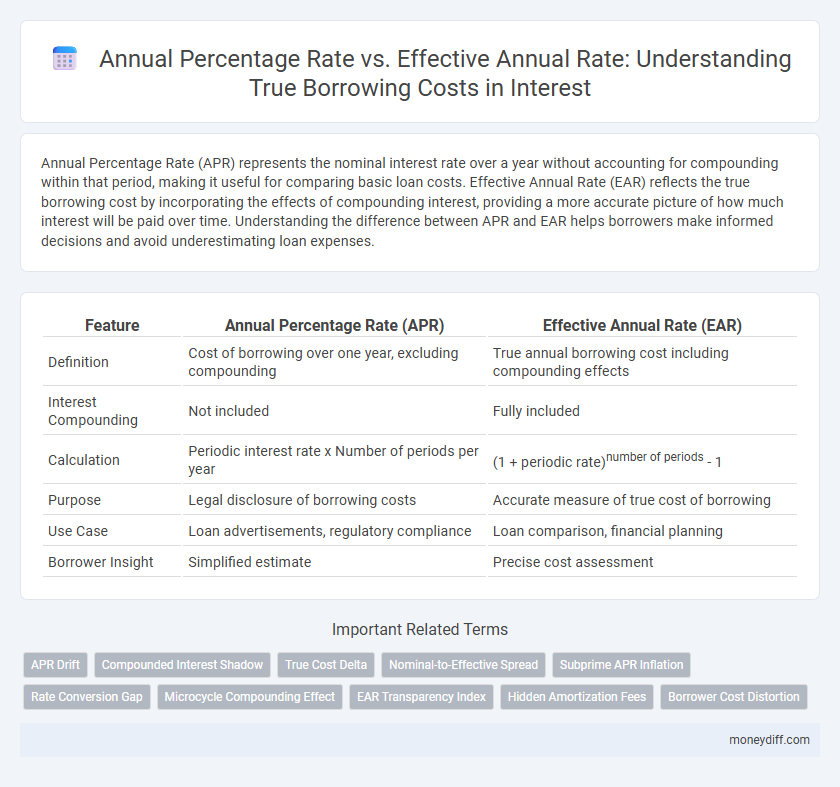

Annual Percentage Rate (APR) represents the nominal interest rate over a year without accounting for compounding within that period, making it useful for comparing basic loan costs. Effective Annual Rate (EAR) reflects the true borrowing cost by incorporating the effects of compounding interest, providing a more accurate picture of how much interest will be paid over time. Understanding the difference between APR and EAR helps borrowers make informed decisions and avoid underestimating loan expenses.

Table of Comparison

| Feature | Annual Percentage Rate (APR) | Effective Annual Rate (EAR) |

|---|---|---|

| Definition | Cost of borrowing over one year, excluding compounding | True annual borrowing cost including compounding effects |

| Interest Compounding | Not included | Fully included |

| Calculation | Periodic interest rate x Number of periods per year | (1 + periodic rate)number of periods - 1 |

| Purpose | Legal disclosure of borrowing costs | Accurate measure of true cost of borrowing |

| Use Case | Loan advertisements, regulatory compliance | Loan comparison, financial planning |

| Borrower Insight | Simplified estimate | Precise cost assessment |

Understanding Annual Percentage Rate (APR)

Annual Percentage Rate (APR) represents the yearly cost of borrowing expressed as a percentage, including interest and some fees, but it often excludes compounding effects. Unlike APR, Effective Annual Rate (EAR) accounts for compounding within the year, providing a more accurate measure of true borrowing costs. Understanding APR helps borrowers compare loan offers while recognizing that EAR reveals the actual interest incurred over time.

What Is the Effective Annual Rate (EAR)?

The Effective Annual Rate (EAR) measures the true annual cost of borrowing by accounting for compounding periods within a year, providing a more accurate reflection of interest expenses compared to the Annual Percentage Rate (APR). EAR incorporates the effect of compounding frequency, making it crucial for comparing loans or investment rates with different compounding intervals. Understanding EAR helps borrowers and investors assess the actual financial impact and make informed decisions about loan terms or investment yields.

APR vs EAR: Key Differences Explained

Annual Percentage Rate (APR) represents the nominal interest rate without compounding, primarily reflecting the yearly cost of borrowing including fees. Effective Annual Rate (EAR) accounts for the effects of compounding interest within the year, providing a more accurate measure of the true borrowing cost. Borrowers should compare EAR instead of APR to understand the actual amount they will pay over time when interest compounds multiple times per year.

How Lenders Calculate APR and EAR

Lenders calculate the Annual Percentage Rate (APR) by combining the nominal interest rate with certain fees and costs to reflect the total yearly borrowing expense but often exclude compounding effects. The Effective Annual Rate (EAR), however, accounts for compounding within the year, providing a more accurate measure of true borrowing costs by converting nominal rates into an annualized rate that incorporates interest-on-interest. Comparing APR and EAR helps borrowers understand the full impact of loan terms, especially when compounding periods vary between lenders.

Compounding Frequency: Its Impact on True Costs

Compounding frequency significantly influences the true borrowing costs by determining how often interest is calculated and added to the principal balance within a year. While the Annual Percentage Rate (APR) shows the nominal interest rate without accounting for compounding, the Effective Annual Rate (EAR) reflects the actual cost by incorporating the effects of compounding frequency. Higher compounding frequencies increase the EAR, leading to higher true borrowing costs compared to APR, making EAR a more accurate measure for borrowers assessing loan affordability.

When APR Understates Borrowing Expenses

The Annual Percentage Rate (APR) often understates true borrowing expenses by excluding the effects of compounding within the year, leading borrowers to underestimate total costs. In contrast, the Effective Annual Rate (EAR) accounts for compounding periods, providing a more accurate measure of the actual interest paid over a year. This discrepancy is critical for loans with frequent compounding intervals, where relying solely on APR can mislead borrowers about the true financial burden.

Why EAR Gives a More Accurate Cost Picture

Effective Annual Rate (EAR) provides a more accurate picture of true borrowing costs because it accounts for the effects of compounding within the year, unlike the Annual Percentage Rate (APR) which only represents the nominal interest rate without compounding. EAR reflects the actual interest paid on a loan or investment by incorporating the frequency of compounding periods, offering borrowers a realistic cost comparison across different financial products. Understanding EAR is crucial for borrowers to avoid underestimating expenses, as it reveals the total cost more precisely than APR.

Real-World Examples: APR vs EAR Calculations

APR and EAR both measure borrowing costs, but APR represents the nominal interest rate without compounding effects, while EAR accounts for compounding periods, reflecting the true cost of borrowing. For example, a loan with a 12% APR compounded monthly has an EAR of approximately 12.68%, highlighting the impact of compounding on the final interest paid. Real-world comparisons using EAR reveal that seemingly similar APR loans can result in significantly different total interest expenses, emphasizing the importance of understanding effective rates for accurate loan cost assessment.

Choosing Financial Products: APR or EAR Focus?

When choosing financial products, the Effective Annual Rate (EAR) provides a more accurate reflection of true borrowing costs compared to the Annual Percentage Rate (APR), as EAR accounts for compounding periods within the year. APR often underestimates costs by ignoring intra-year compounding effects, making EAR a better metric for comparing loans or credit offers with different compounding frequencies. Consumers should prioritize EAR estimates to understand total interest expenses and make informed financial decisions.

Making Informed Borrowing Decisions Using EAR

Effective Annual Rate (EAR) provides a more accurate measure of true borrowing costs compared to Annual Percentage Rate (APR) by accounting for compounding interest within the year. Borrowers relying on EAR can better compare loan offers and understand the actual financial impact, especially when interest compounds multiple times annually. Using EAR enables informed decisions by revealing the full cost of credit, avoiding underestimation inherent in APR calculations.

Related Important Terms

APR Drift

Annual Percentage Rate (APR) underestimates true borrowing costs due to APR drift, which ignores compounding within the year. Effective Annual Rate (EAR) captures interest-on-interest effects, providing a more accurate metric for comparing loan expenses and avoiding surprises in debt repayment.

Compounded Interest Shadow

The Annual Percentage Rate (APR) often understates true borrowing costs by excluding the impact of compounded interest, whereas the Effective Annual Rate (EAR) fully incorporates compounding effects, revealing the actual expense over a year. Understanding the compounded interest shadow within EAR helps borrowers grasp the real financial burden beyond the nominal APR figure.

True Cost Delta

The True Cost Delta between Annual Percentage Rate (APR) and Effective Annual Rate (EAR) reflects the real difference in borrowing expenses, where EAR accounts for compounding within the year, highlighting the actual interest paid beyond the nominal APR. Borrowers should prioritize EAR to understand the full financial impact of loans, as APR often understates true borrowing costs by ignoring intra-year compounding effects.

Nominal-to-Effective Spread

The Nominal-to-Effective Spread highlights the difference between the Annual Percentage Rate (APR) and the Effective Annual Rate (EAR), revealing the actual borrowing costs after accounting for compounding periods. While APR reflects the nominal interest without compounding, EAR provides a true measure of cost by including the effects of interest compounding over a year.

Subprime APR Inflation

Subprime APR inflation significantly distorts the true borrowing cost by inflating the Annual Percentage Rate (APR), masking the actual cost borrowers face when fees and compounding interest are considered. Effective Annual Rate (EAR) provides a more accurate measure of true borrowing costs by incorporating the effects of compounding, revealing higher real expenses in subprime loans compared to the understated APR.

Rate Conversion Gap

The Annual Percentage Rate (APR) often understates true borrowing costs by excluding compounding effects, whereas the Effective Annual Rate (EAR) accurately reflects the total interest accrued over a year, including compounding periods. This rate conversion gap between APR and EAR is crucial for borrowers to understand the real cost of loans and make informed financial decisions.

Microcycle Compounding Effect

Annual Percentage Rate (APR) often understates the true borrowing cost by ignoring the microcycle compounding effect, which occurs when interest is compounded more frequently than annually, leading to an Effective Annual Rate (EAR) that reflects the actual financial impact. EAR incorporates these microcycle compounding intervals, providing a more accurate measure of the borrower's total cost over a year.

EAR Transparency Index

The Effective Annual Rate (EAR) provides a more accurate measure of true borrowing costs than the Annual Percentage Rate (APR) by accounting for compounding interest within a year. The EAR Transparency Index evaluates lenders based on how clearly they disclose EAR information, promoting transparency and enabling borrowers to make more informed financial decisions.

Hidden Amortization Fees

The Annual Percentage Rate (APR) often understates true borrowing costs by excluding hidden amortization fees embedded within loan payments, whereas the Effective Annual Rate (EAR) provides a more accurate measure by capturing the full impact of compounding and these additional charges. Borrowers should scrutinize the EAR to fully understand the financial burden and avoid surprises from amortization fees not reflected in the APR.

Borrower Cost Distortion

Annual Percentage Rate (APR) often underestimates true borrowing costs by excluding the effects of compounding within the year, causing Borrower Cost Distortion that can mislead individuals comparing loan offers. Effective Annual Rate (EAR) accounts for compounding periods, providing a more accurate reflection of the real expense borrowers incur over the life of a loan.

Annual Percentage Rate vs Effective Annual Rate for true borrowing costs. Infographic

moneydiff.com

moneydiff.com