The nominal interest rate represents the stated percentage return on an investment without adjusting for inflation, while the real interest rate accounts for inflation, providing a clearer picture of the true purchasing power gained. Investors use the real interest rate to evaluate the actual profitability of an investment, ensuring that returns exceed the inflation rate. Comparing nominal and real interest rates is essential for making informed investment decisions and protecting long-term wealth.

Table of Comparison

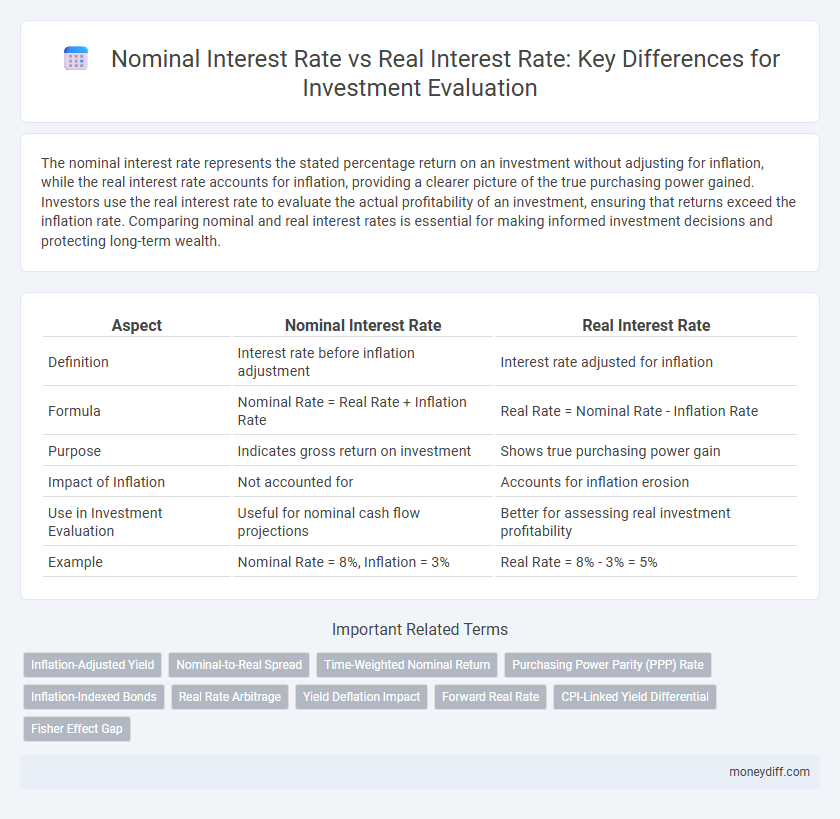

| Aspect | Nominal Interest Rate | Real Interest Rate |

|---|---|---|

| Definition | Interest rate before inflation adjustment | Interest rate adjusted for inflation |

| Formula | Nominal Rate = Real Rate + Inflation Rate | Real Rate = Nominal Rate - Inflation Rate |

| Purpose | Indicates gross return on investment | Shows true purchasing power gain |

| Impact of Inflation | Not accounted for | Accounts for inflation erosion |

| Use in Investment Evaluation | Useful for nominal cash flow projections | Better for assessing real investment profitability |

| Example | Nominal Rate = 8%, Inflation = 3% | Real Rate = 8% - 3% = 5% |

Understanding Nominal vs Real Interest Rates

Nominal interest rate reflects the percentage return on investment without adjusting for inflation, representing the raw rate quoted by financial institutions. Real interest rate accounts for inflation, providing a more accurate measure of an investor's purchasing power and true profitability. Evaluating investments using real interest rates is crucial for making informed decisions that consider the impact of inflation on returns.

Why Distinguish Between Nominal and Real Rates?

Distinguishing between nominal and real interest rates is crucial for accurate investment evaluation because nominal rates reflect the stated return without adjusting for inflation, whereas real rates represent the true purchasing power of returns after inflation. Investors relying solely on nominal rates may overestimate profitability and make misguided decisions, especially in high-inflation environments. Evaluating real interest rates ensures that investment growth exceeds inflation, preserving or increasing real wealth over time.

Calculating the Nominal Interest Rate

Calculating the nominal interest rate involves adding the real interest rate to the expected inflation rate, reflecting the total return an investor anticipates before adjusting for inflation. This rate is crucial for evaluating investments because it shows the apparent growth of money over time without considering purchasing power changes. Accurate calculation of the nominal interest rate ensures better comparison of investment options by incorporating inflation expectations into the decision-making process.

The Formula for Real Interest Rate

The formula for the real interest rate is given by subtracting the inflation rate from the nominal interest rate, expressed as Real Interest Rate = Nominal Interest Rate - Inflation Rate. This calculation adjusts the nominal rate to reflect the true purchasing power of investment returns, providing a more accurate measure for evaluating investment profitability. Understanding the real interest rate is essential for investors to assess the actual growth of their capital in the presence of inflation.

Inflation’s Impact on Investment Returns

Nominal interest rates reflect the stated return on investment without adjusting for inflation, while real interest rates account for inflation's erosion of purchasing power, providing a more accurate measure of true investment returns. Inflation reduces the real value of nominal returns, meaning investors may experience lower actual gains despite high nominal rates. Understanding the differential between nominal and real interest rates is crucial for evaluating the effective profitability of investments in inflationary environments.

Evaluating Investment Performance Accurately

Nominal interest rate represents the stated percentage return on investment without adjusting for inflation, while the real interest rate accounts for inflation, providing a more accurate measure of purchasing power gains. Evaluating investment performance using the real interest rate ensures investors understand the true growth of their wealth after inflation erodes value. Accurate assessment of investment returns requires emphasizing real interest rates to make informed financial decisions and compare investment alternatives effectively.

Risks of Ignoring Real Interest Rates

Ignoring real interest rates in investment evaluation risks understating the true cost of borrowing and overestimating returns, as nominal rates exclude inflation effects. This can lead to misguided investment decisions and erode purchasing power over time, impacting long-term financial goals. Incorporating real interest rates provides a more accurate assessment of investment profitability and economic viability.

Nominal vs Real Interest: Practical Examples

Nominal interest rate represents the stated percentage without adjusting for inflation, affecting the apparent growth of an investment. Real interest rate accounts for inflation, providing a more accurate measure of purchasing power and true return on investment. For instance, a 7% nominal interest rate with a 3% inflation rate yields a 4% real interest rate, highlighting the importance of considering inflation in investment evaluation.

Adjusting Investment Strategies for Inflation

Nominal interest rate represents the stated return on investment without accounting for inflation, while the real interest rate adjusts for inflation, reflecting the true purchasing power of returns. Investors must prioritize the real interest rate to accurately assess investment performance and maintain capital value over time. Adjusting investment strategies by considering expected inflation rates helps preserve real returns and optimize portfolio growth.

Key Takeaways for Smart Investment Decisions

Nominal interest rate reflects the stated return on an investment without adjusting for inflation, while real interest rate accounts for inflation's impact, providing a clearer measure of purchasing power growth. Evaluating investments using the real interest rate enables smarter decisions by accurately comparing returns against the cost of living and inflation expectations. Prioritizing real interest rates ensures long-term investment value preservation and more reliable financial planning.

Related Important Terms

Inflation-Adjusted Yield

The real interest rate represents the nominal interest rate adjusted for inflation, providing a more accurate measure of an investment's purchasing power growth. Evaluating investments using the inflation-adjusted yield ensures that returns reflect true profitability after accounting for the eroding effect of inflation on nominal gains.

Nominal-to-Real Spread

The nominal-to-real interest rate spread measures the difference between the nominal interest rate, which includes inflation expectations, and the real interest rate, reflecting true purchasing power after adjusting for inflation. Investors use this spread to assess the inflation premium embedded in nominal rates, crucial for evaluating the real returns and risks of investment opportunities.

Time-Weighted Nominal Return

Time-weighted nominal return reflects the growth of an investment without adjusting for inflation, showing the compound rate of return over multiple periods. Real interest rate accounts for inflation, providing a clearer measure of purchasing power growth, but for evaluating timing and actual performance, the time-weighted nominal return offers a precise metric of investment efficiency.

Purchasing Power Parity (PPP) Rate

The nominal interest rate reflects the stated return on investment without adjusting for inflation, while the real interest rate accounts for inflation effects, providing a truer measure of purchasing power. Purchasing Power Parity (PPP) rate is crucial in comparing real interest rates internationally, as it adjusts for differences in price levels and inflation between countries, ensuring accurate investment evaluation across borders.

Inflation-Indexed Bonds

Nominal interest rates represent the stated return on investment without adjusting for inflation, while real interest rates reflect the inflation-adjusted purchasing power of returns, crucial for evaluating the true profitability of investments. Inflation-indexed bonds offer protection by linking principal and interest payments to inflation rates, ensuring investors maintain real returns despite rising price levels.

Real Rate Arbitrage

Real interest rate, adjusted for inflation, provides a more accurate assessment of investment returns compared to the nominal interest rate, which excludes inflation effects. Real rate arbitrage exploits differences between real interest rates across markets, enabling investors to achieve higher inflation-adjusted returns by reallocating capital efficiently.

Yield Deflation Impact

Nominal interest rates reflect the stated return on investment without adjusting for inflation, while real interest rates account for inflation's impact, providing a clearer measure of actual purchasing power and investment yield. During periods of deflation, real interest rates increase as the general price level falls, enhancing the effective yield on investments despite nominal rates remaining unchanged or low.

Forward Real Rate

The forward real interest rate represents the expected inflation-adjusted return on an investment over a future period, derived from nominal interest rates and inflation forecasts. Investors use the forward real rate to evaluate the true profitability of long-term investments by isolating the impact of anticipated inflation on nominal returns.

CPI-Linked Yield Differential

Nominal interest rate reflects the stated return on investment without adjusting for inflation, while real interest rate accounts for inflation by subtracting the Consumer Price Index (CPI) from the nominal rate, providing a more accurate measure of purchasing power growth. The CPI-linked yield differential is critical in investment evaluation as it indicates the premium investors demand to offset inflation risk, influencing real returns and investment decisions in inflation-sensitive environments.

Fisher Effect Gap

The Fisher Effect illustrates the gap between nominal interest rates, which include expected inflation, and real interest rates, reflecting true investment profitability after accounting for inflation. Understanding this difference is crucial for accurate investment evaluation, as nominal rates can overstate returns when inflation expectations rise.

Nominal Interest Rate vs Real Interest Rate for investment evaluation. Infographic

moneydiff.com

moneydiff.com