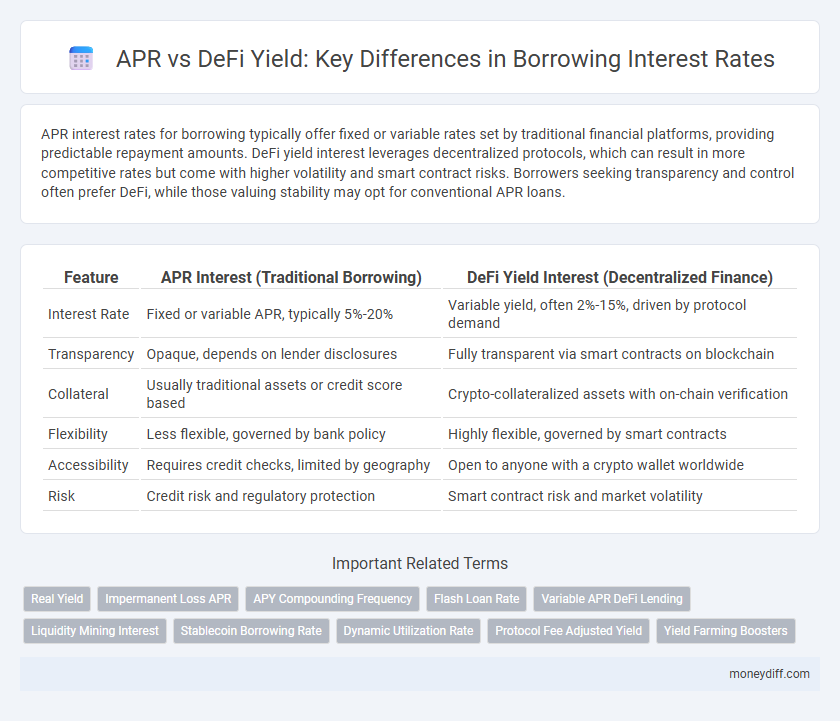

APR interest rates for borrowing typically offer fixed or variable rates set by traditional financial platforms, providing predictable repayment amounts. DeFi yield interest leverages decentralized protocols, which can result in more competitive rates but come with higher volatility and smart contract risks. Borrowers seeking transparency and control often prefer DeFi, while those valuing stability may opt for conventional APR loans.

Table of Comparison

| Feature | APR Interest (Traditional Borrowing) | DeFi Yield Interest (Decentralized Finance) |

|---|---|---|

| Interest Rate | Fixed or variable APR, typically 5%-20% | Variable yield, often 2%-15%, driven by protocol demand |

| Transparency | Opaque, depends on lender disclosures | Fully transparent via smart contracts on blockchain |

| Collateral | Usually traditional assets or credit score based | Crypto-collateralized assets with on-chain verification |

| Flexibility | Less flexible, governed by bank policy | Highly flexible, governed by smart contracts |

| Accessibility | Requires credit checks, limited by geography | Open to anyone with a crypto wallet worldwide |

| Risk | Credit risk and regulatory protection | Smart contract risk and market volatility |

Understanding APR Interest in Traditional Borrowing

APR interest in traditional borrowing represents the annual percentage rate charged by lenders, encompassing both the nominal interest rate and any associated fees, providing borrowers a clear understanding of the total cost of loans. It establishes a fixed or variable rate over a set term, offering predictability in repayment schedules compared to the fluctuating yields found in DeFi borrowing platforms. Understanding APR is crucial for comparing traditional loans, as it reflects the comprehensive financial commitment without the volatility inherent in decentralized finance yield mechanisms.

What Is DeFi Yield Interest?

DeFi yield interest refers to the returns generated from decentralized finance protocols where users lend or stake crypto assets in smart contracts, earning interest through automated, trustless processes. Unlike traditional APR interest rates that are fixed or set by centralized institutions, DeFi yield interest fluctuates based on market demand, liquidity, and protocol incentives. This dynamic system enables borrowers and lenders to access variable interest rates often higher than conventional APR, with transparency and without intermediaries.

Key Differences: APR vs. DeFi Yield

APR interest for borrowing represents a fixed annual percentage rate that includes fees and interest, providing clear cost predictability for borrowers in traditional finance. DeFi yield interest fluctuates based on decentralized liquidity pool dynamics, smart contract incentives, and market conditions, resulting in varying borrowing costs. The key difference lies in APR's fixed, transparent rate versus DeFi's variable, protocol-driven yield impacting borrower expenses.

Calculation Methods: APR versus DeFi Yields

APR interest for borrowing is calculated as a simple annual percentage rate based on the principal loan amount, excluding compounding effects and often fixed or variable depending on the lender's terms. DeFi yield interest is generated through decentralized finance protocols, employing complex calculation methods that factor in variable interest rates, liquidity pool rewards, and compounding returns over time. While APR provides a straightforward cost metric for borrowers, DeFi yields can fluctuate significantly due to market demand, token incentives, and additional yield farming strategies.

Risk Factors in Traditional vs. DeFi Borrowing

APR interest rates in traditional borrowing are typically fixed or variable but regulated, offering predictable costs and legal protections, whereas DeFi yield interest depends on smart contract protocols, exposing borrowers to risks like contract vulnerabilities and market volatility. Traditional loans involve credit checks and collateral requirements, minimizing default risk, while DeFi borrowing often requires over-collateralization, increasing liquidation risk amid rapidly changing crypto asset prices. The lack of centralized oversight in DeFi amplifies counterparty and systemic risks, contrasting with the more stable, institution-backed frameworks of traditional financial lending.

Transparency and Accessibility in Both Systems

APR interest rates in traditional borrowing offer standardized transparency through regulated disclosures, ensuring borrowers clearly understand cost components such as principal, interest, and fees. DeFi yield interest operates on blockchain technology, providing real-time, immutable transaction data that enhances transparency beyond conventional methods. Accessibility in traditional APR frameworks depends on credit scores and financial institutions, whereas DeFi platforms allow global participation without intermediaries, broadening financial inclusion for borrowers.

Impact of Market Volatility on DeFi Yields

DeFi yield interest rates for borrowing are highly sensitive to market volatility, causing fluctuations that can significantly alter the cost compared to fixed APR interest rates in traditional finance. Sudden shifts in asset prices and liquidity in DeFi protocols lead to unpredictable yield changes, increasing risk for borrowers who rely on stable borrowing costs. In contrast, APR interest rates offer predictable repayments unaffected by rapid market swings, making them more suitable for those seeking stability amidst volatile crypto markets.

Borrower Experience: Centralized vs. Decentralized Platforms

Borrowers on centralized platforms typically face a fixed APR interest rate with transparent repayment schedules, enhancing predictability and budget management. In contrast, DeFi yield interest offers variable rates influenced by market liquidity and protocol incentives, creating opportunities for lower costs but higher volatility. The decentralized model provides greater access and permissionless borrowing, yet requires borrowers to navigate smart contract risks and fluctuating yields.

Regulatory Considerations: APR and DeFi Interest

APR interest rates on traditional loans are subject to strict regulatory oversight from entities like the Consumer Financial Protection Bureau (CFPB) and the Federal Reserve, ensuring transparency and consumer protection. DeFi yield interest for borrowing operates in a largely unregulated environment, increasing risks related to smart contract vulnerabilities and the absence of recourse for borrowers. Regulatory considerations emphasize the need for clearer guidelines around DeFi platforms to enhance borrower protection and financial stability.

Choosing the Right Borrowing Strategy for Your Needs

APR interest rates on traditional loans offer predictable monthly payments but often come with higher fees and stricter credit requirements. DeFi yield interest for borrowing provides flexible, often lower-cost options with variable rates, leveraging blockchain technology and smart contracts for transparency and speed. Evaluating your risk tolerance, loan duration, and need for collateral is crucial in selecting between stable traditional APR loans and dynamic DeFi lending platforms.

Related Important Terms

Real Yield

APR interest on traditional loans represents the annual cost of borrowing including fees, offering predictable repayments but often lacks real yield after inflation and fees, whereas DeFi yield interest leverages decentralized finance protocols providing variable returns that can include real yield by capturing underlying asset appreciation and protocol-generated rewards. Real yield in DeFi borrowing is driven by factors like liquidity mining incentives, staking rewards, and protocol revenue sharing, offering borrowers a potential to offset interest costs through earned yields unlike fixed APR borrowing rates.

Impermanent Loss APR

APR interest on traditional loans offers fixed rates with predictable costs, while DeFi yield interest leverages liquidity pools where impermanent loss impacts APR by reducing returns during token price volatility. Impermanent loss causes a divergence between pooled token values, making APR in DeFi borrowing variable and potentially lower compared to stable APR interest in centralized finance.

APY Compounding Frequency

APR interest rates on traditional loans reflect simple interest without compounding, resulting in fixed borrowing costs over time. DeFi yield interest leverages high-frequency APY compounding, enhancing returns or costs by reinvesting interest multiple times per year, significantly affecting total borrowing expenses.

Flash Loan Rate

APR interest rates for traditional borrowing typically range between 3% to 15%, representing the annual percentage cost of borrowing including fees, while DeFi yield interest on flash loans can vary significantly, often exceeding 100% APY due to the instantaneous nature and high risk of the loans. Flash loan rates in DeFi protocols adjust dynamically based on liquidity demand, often relying on smart contract execution, which contrasts with fixed or tiered APR structures in centralized finance.

Variable APR DeFi Lending

Variable APR in DeFi lending offers dynamic interest rates that adjust based on supply and demand, often resulting in lower borrowing costs compared to traditional fixed APR loans. This flexibility allows borrowers to optimize expenses by capitalizing on real-time market fluctuations, enhancing cost-efficiency over the static rates commonly found in conventional APR interest models.

Liquidity Mining Interest

APR interest on traditional loans provides a fixed percentage cost of borrowing annually, while DeFi yield interest through liquidity mining offers dynamic rewards based on protocol token incentives and liquidity pool participation. Liquidity mining interest capitalizes on decentralized finance mechanisms, allowing borrowers to earn native tokens as an additional yield, potentially offsetting borrowing costs beyond standard APR calculations.

Stablecoin Borrowing Rate

Stablecoin borrowing rates in traditional APR interest models typically feature fixed or variable rates set by centralized lenders, often resulting in predictable repayment amounts. In contrast, DeFi yield interest rates for stablecoin borrowing fluctuate dynamically based on decentralized liquidity pools, supply-demand mechanisms, and protocol algorithms, offering potentially lower costs but higher market risk.

Dynamic Utilization Rate

APR interest rates in traditional lending typically remain fixed or adjust slowly, often failing to reflect real-time market conditions, whereas DeFi yield interest dynamically fluctuates based on protocol-specific utilization rates, offering more responsive borrowing costs. The dynamic utilization rate in DeFi mechanisms directly influences APR, increasing borrowing costs during high utilization periods and lowering them when liquidity is abundant, promoting efficient capital allocation and risk management.

Protocol Fee Adjusted Yield

APR interest on traditional loans typically accounts for fixed rates and fees, while DeFi yield interest incorporates dynamic protocol fee adjustments that optimize returns based on liquidity pool performance and governance token incentives. Protocol fee adjusted yield in DeFi reduces borrowing costs by redistributing fees to liquidity providers, enhancing net interest rates compared to conventional APR models.

Yield Farming Boosters

APR interest rates for borrowing typically reflect fixed annualized costs set by centralized lenders, whereas DeFi yield interest leverages yield farming boosters that optimize returns through dynamic incentive mechanisms and liquidity mining rewards. Yield farming boosters enhance DeFi borrowing by increasing effective interest returns via protocols' token incentives, compounding deposits, and strategic liquidity provision, thereby offering potentially higher, variable yields compared to traditional APR.

APR Interest vs DeFi Yield Interest for borrowing. Infographic

moneydiff.com

moneydiff.com