Manual interest calculation requires frequent monitoring and precise input to ensure accuracy, often leading to human errors and time-consuming processes. Automated interest optimizers leverage sophisticated algorithms to analyze account data, maximizing returns by continuously adjusting for the best interest rates without user intervention. This technology streamlines account management by providing real-time updates and optimized interest earnings that manual methods cannot consistently achieve.

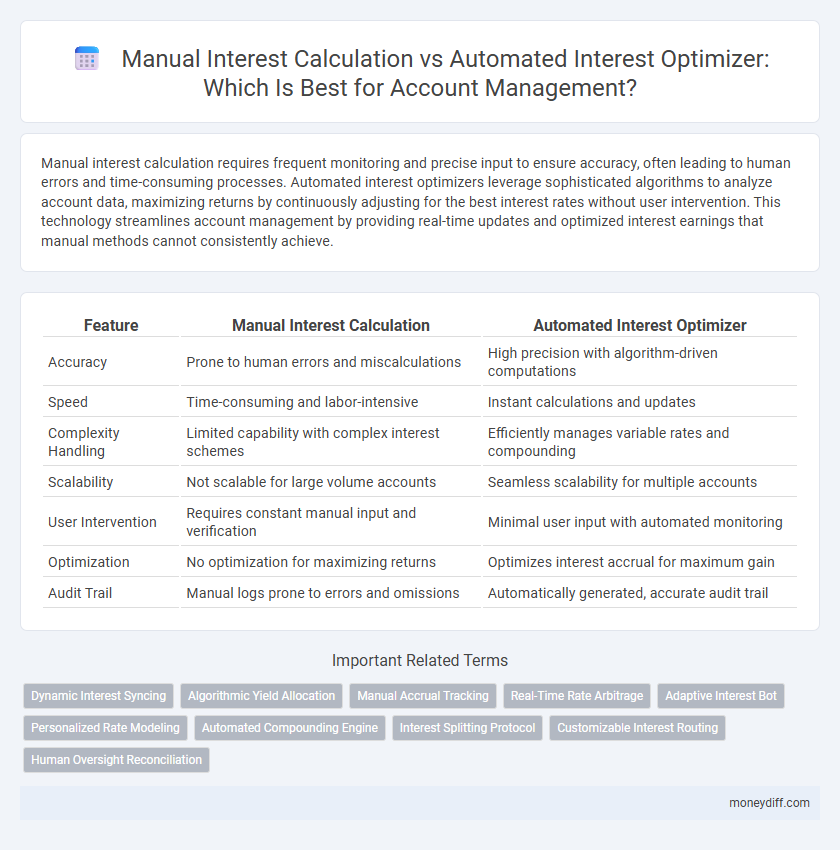

Table of Comparison

| Feature | Manual Interest Calculation | Automated Interest Optimizer |

|---|---|---|

| Accuracy | Prone to human errors and miscalculations | High precision with algorithm-driven computations |

| Speed | Time-consuming and labor-intensive | Instant calculations and updates |

| Complexity Handling | Limited capability with complex interest schemes | Efficiently manages variable rates and compounding |

| Scalability | Not scalable for large volume accounts | Seamless scalability for multiple accounts |

| User Intervention | Requires constant manual input and verification | Minimal user input with automated monitoring |

| Optimization | No optimization for maximizing returns | Optimizes interest accrual for maximum gain |

| Audit Trail | Manual logs prone to errors and omissions | Automatically generated, accurate audit trail |

Manual vs Automated: A New Era in Interest Calculation

Manual interest calculation relies on human input and standard formulas, often leading to errors and inefficiencies in account management. Automated interest optimizers use advanced algorithms and real-time data analysis to maximize returns and ensure precise calculations. This shift from manual processes to automation enhances accuracy, saves time, and adapts dynamically to fluctuating interest rates.

Understanding Manual Interest Calculation Methods

Manual interest calculation methods involve applying standard formulas such as simple interest or compound interest based on principal, rate, and time parameters, requiring precise data entry and computation. These approaches depend heavily on user accuracy and can be time-consuming, often leading to errors in account management when interest rates vary or compounding periods differ. Understanding these traditional techniques is essential for comparing their efficiency and accuracy against automated interest optimizers that streamline calculations through advanced algorithms and real-time data integration.

What is an Automated Interest Optimizer?

An Automated Interest Optimizer is a technology-driven tool designed to maximize interest earnings on accounts by dynamically reallocating funds based on current interest rates and account terms. It uses algorithms to continuously monitor and compare various financial products, ensuring funds are placed in options with the highest returns in real time. This automation reduces manual errors, saves time, and enhances overall account profitability by leveraging data-driven decision-making.

Key Differences Between Manual and Automated Interest Approaches

Manual interest calculation relies on basic formulas and periodic reviews, often prone to human error and time-consuming processes. Automated interest optimizers employ algorithms and real-time data analysis to ensure precise, dynamic adjustments that maximize account earnings. Key differences include accuracy, efficiency, and scalability, with automation providing faster updates and optimized returns compared to manual methods.

Pros and Cons of Manual Interest Calculation

Manual interest calculation allows for precise control over individual account variables and custom adjustments based on unique contract terms. However, it is time-consuming, prone to human error, and lacks scalability for managing large volumes of accounts. This method often results in slower processing times and increased operational costs compared to automated interest optimizers.

Advantages of Automated Interest Optimization Tools

Automated interest optimization tools enhance account management by accurately calculating interest in real-time, minimizing human errors and ensuring compliance with current rates. These systems use advanced algorithms to maximize returns by dynamically adjusting interest computations based on account activity and market fluctuations. Integration with account management platforms streamlines processes, reduces administrative workload, and provides users with precise, timely interest earnings projections.

Impact on Account Accuracy: Manual vs Automated Interest

Manual interest calculation often leads to errors and inconsistencies due to human miscalculations and data entry mistakes, impacting overall account accuracy negatively. Automated interest optimizers use precise algorithms to ensure consistent, real-time calculations, significantly reducing discrepancies and improving reliability in account management. This enhanced accuracy supports better financial decision-making and compliance with regulatory standards.

Time Efficiency: Traditional Methods vs Cutting-edge Automation

Manual interest calculation often consumes significant time due to repetitive data entry and error-prone computations, limiting account management efficiency. Automated interest optimizers leverage algorithms and real-time data integration to accelerate calculations, reducing processing time from hours to minutes. This cutting-edge automation enhances time efficiency, enabling faster decision-making and improved account accuracy.

Common Account Management Errors in Manual Calculations

Manual interest calculations often lead to frequent errors such as misapplication of interest rates, incorrect compounding periods, and overlooked transaction dates, resulting in inaccurate account balances. These mistakes can cause customer dissatisfaction and regulatory non-compliance issues, which impact overall financial management. Automated interest optimizers reduce these errors by using precise algorithms and real-time data integration to ensure accurate and consistent interest calculations across all accounts.

Choosing the Best Interest Calculation Strategy for Your Needs

Manual interest calculation offers precise control over customized account scenarios but can be time-consuming and prone to errors, especially with complex compounding rules. Automated interest optimizer tools leverage advanced algorithms and real-time data to maximize returns while minimizing miscalculations and administrative overhead. Selecting the best interest calculation strategy depends on your account complexity, desired accuracy, and resource availability, with automation generally benefiting high-volume or intricate portfolios.

Related Important Terms

Dynamic Interest Syncing

Manual interest calculation often leads to errors and delays, impacting accurate account management and interest accrual. Automated interest optimizers leverage dynamic interest syncing to continuously update rates in real-time, ensuring precise and timely interest computations for optimized financial outcomes.

Algorithmic Yield Allocation

Manual interest calculation relies on fixed formulas and human input, often leading to inefficiencies and errors in yield assessment. Automated interest optimizers employ algorithmic yield allocation to dynamically distribute earnings across accounts, maximizing returns by continuously analyzing market conditions and interest rate fluctuations.

Manual Accrual Tracking

Manual interest calculation relies on accountants or finance professionals to track accruals and apply rates consistently, which increases the risk of errors and time consumption during account management. Automated interest optimizers utilize algorithms and real-time data to accurately compute interest accruals, improving precision and efficiency while minimizing manual oversight.

Real-Time Rate Arbitrage

Manual interest calculation relies on static rates and periodic updates, often missing opportunities for real-time rate arbitrage that can maximize returns. Automated interest optimizers continuously analyze market fluctuations and dynamically allocate funds across accounts to exploit the best available rates instantly, enhancing overall yield and account performance.

Adaptive Interest Bot

Manual interest calculation often leads to errors and inefficiencies due to complex compounding rules and varying rates, while an Adaptive Interest Bot streamlines account management by dynamically adjusting calculations based on real-time data and personalized financial behavior. This automated interest optimizer enhances accuracy, improves decision-making, and maximizes returns through continuous learning algorithms that adapt to market fluctuations and user preferences.

Personalized Rate Modeling

Manual interest calculation relies on fixed formulas and static rates, often lacking the flexibility to adjust for individual account behaviors and market fluctuations. Automated interest optimizers employ personalized rate modeling using advanced algorithms and real-time data analytics to tailor interest rates dynamically, maximizing returns and enhancing account management efficiency.

Automated Compounding Engine

Automated Compounding Engine revolutionizes account management by accurately calculating interest through real-time compounding algorithms, maximizing returns more efficiently than manual interest calculation methods. This technology minimizes human error and ensures optimized growth by continuously reinvesting earned interest, enhancing financial performance for users.

Interest Splitting Protocol

Manual interest calculation requires extensive time and is prone to errors, impacting accuracy in interest splitting protocols for account management. Automated Interest Optimizers enhance precision by instantly calculating and distributing interest according to predefined splitting rules, improving efficiency and compliance.

Customizable Interest Routing

Manual interest calculation requires precise input and consistent updates to ensure accurate interest accrual, often leading to time-consuming errors and inefficiencies. Automated interest optimizers leverage customizable interest routing to dynamically allocate earnings based on predefined criteria, maximizing returns while reducing the risk of miscalculations and enhancing overall account performance.

Human Oversight Reconciliation

Manual interest calculation relies on human oversight to identify discrepancies and ensure accuracy through periodic reconciliation, which can be time-consuming and prone to errors. Automated interest optimizers employ advanced algorithms and real-time data processing to minimize errors and streamline reconciliation, improving efficiency and accuracy in account management.

Manual Interest Calculation vs Automated Interest Optimizer for account management. Infographic

moneydiff.com

moneydiff.com