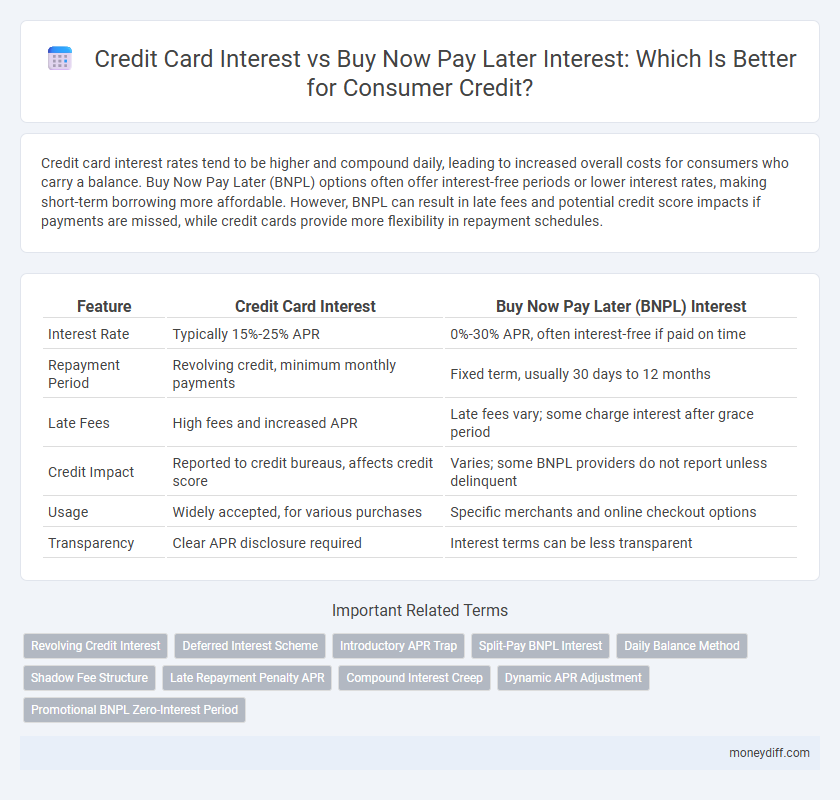

Credit card interest rates tend to be higher and compound daily, leading to increased overall costs for consumers who carry a balance. Buy Now Pay Later (BNPL) options often offer interest-free periods or lower interest rates, making short-term borrowing more affordable. However, BNPL can result in late fees and potential credit score impacts if payments are missed, while credit cards provide more flexibility in repayment schedules.

Table of Comparison

| Feature | Credit Card Interest | Buy Now Pay Later (BNPL) Interest |

|---|---|---|

| Interest Rate | Typically 15%-25% APR | 0%-30% APR, often interest-free if paid on time |

| Repayment Period | Revolving credit, minimum monthly payments | Fixed term, usually 30 days to 12 months |

| Late Fees | High fees and increased APR | Late fees vary; some charge interest after grace period |

| Credit Impact | Reported to credit bureaus, affects credit score | Varies; some BNPL providers do not report unless delinquent |

| Usage | Widely accepted, for various purchases | Specific merchants and online checkout options |

| Transparency | Clear APR disclosure required | Interest terms can be less transparent |

Understanding Credit Card Interest: How It Works

Credit card interest is calculated based on the average daily balance and is typically expressed as an annual percentage rate (APR), which can range from 15% to 25% or higher depending on the cardholder's creditworthiness. Interest accrues daily and compounds, meaning unpaid balances can grow quickly if payments are missed or only minimum payments are made. Unlike Buy Now Pay Later (BNPL) plans that often offer interest-free periods, credit card interest applies immediately after the billing cycle, making it crucial for consumers to understand how balance carrying costs affect overall debt.

Buy Now, Pay Later: The Interest Structure Explained

Buy Now Pay Later (BNPL) interest structures often feature zero or low upfront interest rates, but late fees or high interest can apply if payments are missed, differing significantly from traditional credit card interest, which accrues daily based on the outstanding balance. BNPL programs typically split purchases into fixed installments without compounding interest, making costs predictable if payments are timely. Understanding the precise terms and conditions, including potential penalties, is crucial for consumers to avoid unexpected charges compared to revolving credit card debt.

Key Differences Between Credit Card and BNPL Interest Rates

Credit card interest rates typically range from 15% to 25% APR, compounding daily and accruing on outstanding balances immediately after the grace period, leading to higher long-term costs for consumers. Buy Now Pay Later (BNPL) services often offer interest-free periods, but impose steep fees or interest rates if payments are missed or extended, usually calculated on a fixed schedule. The key difference lies in credit cards applying continuous compound interest on revolving credit, while BNPL structures focus on installment payments with potential penalties rather than ongoing interest accrual.

How Credit Card Interest Accumulates Over Time

Credit card interest accumulates daily based on the average daily balance and the card's annual percentage rate (APR), compounding monthly if not paid in full. This compounding effect can significantly increase the total amount owed over time, especially when only minimum payments are made. Consumers often face higher long-term costs compared to Buy Now Pay Later (BNPL) options, which typically offer interest-free periods before charging fees or interest.

When Does BNPL Charge Interest? Key Triggers to Know

Buy Now Pay Later (BNPL) services typically charge interest when consumers miss scheduled payments or extend their repayment period beyond the interest-free grace period, which usually ranges from 14 to 30 days. Unlike traditional credit cards that accrue interest daily from the purchase date, BNPL interest triggers are often linked to late fees or deferred payment options converting into interest-bearing loans. Understanding these key triggers helps consumers avoid unexpected interest charges and manage credit costs effectively.

Comparing the Total Cost: Credit Card vs. BNPL Interest

Credit card interest rates typically average between 15% and 25% APR, which can compound daily, significantly increasing the total repayment amount over time. Buy Now Pay Later (BNPL) services often offer interest-free periods but may charge late fees or higher rates after promotional periods end, potentially leading to higher costs if payments are missed or extended. Comparing the total cost requires evaluating the APR, fee structures, and repayment timelines to determine which option minimizes overall interest charges for consumer credit.

Impact of Missed Payments: Credit Card vs. BNPL Penalties

Missed credit card payments typically result in immediate interest accrual at high annual percentage rates (APRs), often ranging from 15% to 25%, significantly increasing overall debt. Buy Now Pay Later (BNPL) services may impose late fees but generally do not charge ongoing interest, potentially offering a less costly penalty for missed payments. Consumers benefit from understanding that credit cards increase debt through compounding interest, whereas BNPL penalties are usually fixed fees, impacting long-term financial planning differently.

Which Option Has Higher Interest for Consumers?

Credit card interest rates typically range from 15% to 25% APR, often exceeding the interest charged by Buy Now Pay Later (BNPL) plans, which frequently offer 0% interest for short-term installments but may impose late fees or higher rates if payments are missed. BNPL services usually attract consumers with interest-free periods up to six months, whereas credit cards continuously accrue interest on outstanding balances after the grace period. Consumers face higher overall interest costs from credit cards when carrying balances long-term, while BNPL interest can escalate quickly if payments are not made within the interest-free period.

Choosing Wisely: Factors to Consider Before Using Credit or BNPL

Credit card interest rates typically range from 15% to 25% APR, accruing daily on outstanding balances, while Buy Now Pay Later (BNPL) services often offer interest-free periods but may charge high fees or penalties after. Consumers should evaluate the total cost, repayment flexibility, and potential impact on credit scores when choosing between credit cards and BNPL options. Understanding the terms and assessing personal financial discipline is essential to avoid accumulating unmanageable debt.

Strategies to Minimize Interest on Credit Cards and BNPL

Consumers can minimize credit card interest by paying balances in full each month and utilizing cards with low or introductory 0% APR offers. For Buy Now Pay Later (BNPL) services, selecting plans without fees or interest charges and making timely payments avoids additional costs. Comparing interest rates and payment terms before committing to either credit option ensures more cost-effective borrowing strategies.

Related Important Terms

Revolving Credit Interest

Revolving credit interest on credit cards typically accrues daily on outstanding balances, often with rates ranging from 15% to 25% APR, which can lead to significant costs if balances are not paid in full each month. Buy Now Pay Later interest often comes with lower or zero interest during the promotional period but can include late fees or higher rates if payments are missed, making revolving credit interest more predictable but potentially more expensive over time.

Deferred Interest Scheme

Credit card interest typically accrues immediately on outstanding balances, whereas Buy Now Pay Later (BNPL) plans often utilize deferred interest schemes that apply interest retroactively if the full payment is not made within the promotional period. Consumers should carefully evaluate the terms of deferred interest BNPL offers, as failing to pay on time can result in substantial accrued interest charges similar to or exceeding traditional credit card rates.

Introductory APR Trap

Credit card introductory APR offers often lure consumers with 0% interest for a limited period, but high rates can apply once the promo ends, leading to substantial debt. Buy Now Pay Later plans may seem interest-free initially, yet missed payments can trigger fees and high-interest charges, making the financial impact comparable to or worse than credit card interest.

Split-Pay BNPL Interest

Split-Pay Buy Now Pay Later (BNPL) interest rates often appear lower or interest-free during the short-term installment period but can result in higher effective annual interest rates compared to traditional credit card interest, especially if payments are missed or extended. Consumers using Split-Pay BNPL should carefully compare the total repayment costs against credit card APRs to avoid unexpected financial charges and maintain healthy credit profiles.

Daily Balance Method

Credit card interest calculated using the Daily Balance Method accrues based on the outstanding balance each day, resulting in potentially higher interest costs for consumers carrying varying balances. Buy Now Pay Later plans often offer fixed or zero interest if paid within the promotional period, making them more cost-effective than credit cards where interest compounds daily on fluctuating balances.

Shadow Fee Structure

Credit card interest often carries higher apparent APRs but includes transparent terms, while Buy Now Pay Later (BNPL) services use a shadow fee structure with hidden costs embedded in late fees or inflated prices, making true consumer cost less obvious. This obscured interest framework in BNPL can lead to underestimated debt accumulation compared to the upfront clarity of credit card interest rates.

Late Repayment Penalty APR

Credit card interest rates typically include higher Late Repayment Penalty APRs, often exceeding 25%, which significantly increase the cost of missed payments compared to Buy Now Pay Later (BNPL) services that usually impose fixed late fees or lower penalty APRs under 20%. Consumers opting for BNPL plans benefit from clearer, often less punitive late repayment terms, reducing the risk of escalating debt from penalty interest charges common in credit cards.

Compound Interest Creep

Credit card interest typically compounds daily, causing the balance to grow exponentially if unpaid, leading to what is known as compound interest creep that significantly increases the total repayment amount over time. Buy Now Pay Later (BNPL) plans often advertise interest-free periods but may impose high compound interest rates or fees after this period, potentially resulting in unexpected compound interest creep that outweighs the initial benefits.

Dynamic APR Adjustment

Credit card interest rates often feature dynamic APR adjustment based on creditworthiness, payment history, and market conditions, leading to variable monthly costs for consumers. Buy Now Pay Later (BNPL) services typically offer fixed interest rates or no interest within promotional periods, but may impose significantly higher fees or interest after the grace period, affecting overall consumer credit expenses.

Promotional BNPL Zero-Interest Period

Promotional Buy Now Pay Later (BNPL) plans offer zero-interest periods that can significantly reduce consumer credit costs compared to traditional credit card interest rates, which typically range from 15% to 25% APR. Consumers leveraging BNPL zero-interest promotions should ensure timely payments to avoid deferred interest charges or late fees that can negate the initial savings.

Credit Card Interest vs Buy Now Pay Later Interest for consumer credit. Infographic

moneydiff.com

moneydiff.com