Bullet interest payments require borrowers to pay the entire interest amount at the end of the loan term, simplifying cash flow management but increasing final payment risk. Step-up interest payments start with lower initial interest rates that gradually increase over time, allowing borrowers to ease into higher payments as their financial capacity improves. Choosing between these structures depends on cash flow predictability and risk tolerance in loan servicing.

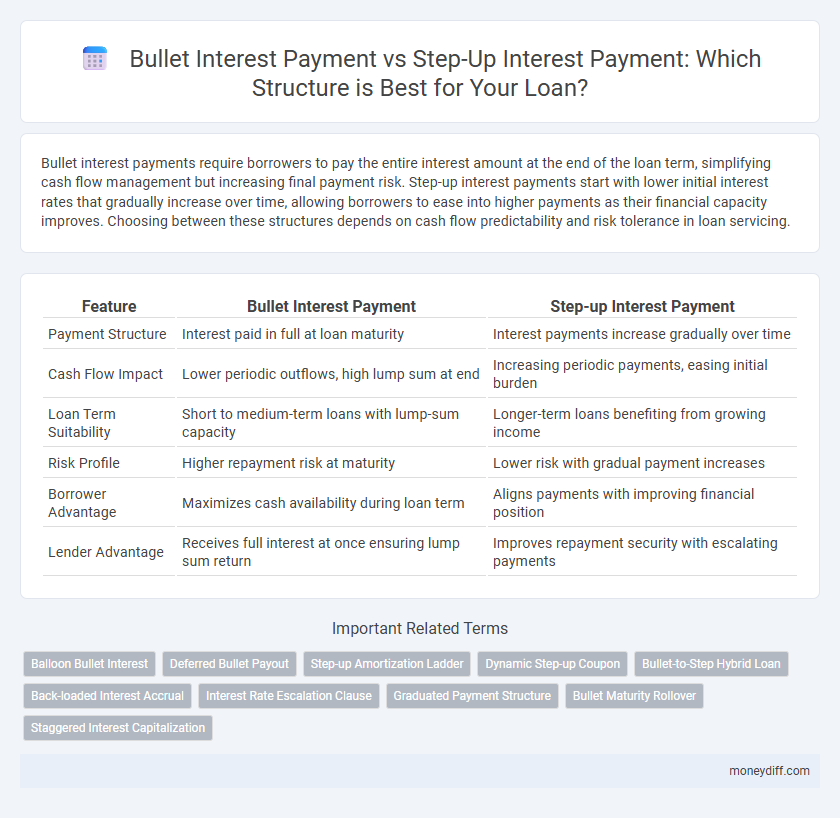

Table of Comparison

| Feature | Bullet Interest Payment | Step-up Interest Payment |

|---|---|---|

| Payment Structure | Interest paid in full at loan maturity | Interest payments increase gradually over time |

| Cash Flow Impact | Lower periodic outflows, high lump sum at end | Increasing periodic payments, easing initial burden |

| Loan Term Suitability | Short to medium-term loans with lump-sum capacity | Longer-term loans benefiting from growing income |

| Risk Profile | Higher repayment risk at maturity | Lower risk with gradual payment increases |

| Borrower Advantage | Maximizes cash availability during loan term | Aligns payments with improving financial position |

| Lender Advantage | Receives full interest at once ensuring lump sum return | Improves repayment security with escalating payments |

Understanding Bullet Interest Payment Structures

Bullet interest payment structures involve paying the entire principal amount at the end of the loan term while making periodic interest payments throughout the term, which helps in managing cash flow by reducing regular payment amounts. This structure is particularly advantageous for projects or businesses expecting substantial cash inflows at loan maturity, enabling them to defer principal repayment without increasing monthly financial burden. Compared to step-up interest payment structures, bullet payments maintain consistent interest outflows without escalating costs over time, making them predictable and favorable for borrowers with uneven revenue streams.

What is Step-up Interest Payment in Loans?

Step-up interest payment in loans refers to a structured repayment method where the interest amount increases progressively over the loan tenure, allowing borrowers to pay lower interest in the initial periods and higher interest in later stages. This payment plan is commonly used in long-term financing to match improving cash flows or expected revenue growth. Step-up interest schemes help manage early cash outflows while ensuring total interest cost aligns with lender risk and return expectations.

Key Differences: Bullet vs Step-up Interest Payments

Bullet interest payments require the borrower to pay the entire interest amount at the end of the loan term, resulting in lower periodic payments but a larger final payment. Step-up interest payments start with lower interest amounts that gradually increase over the loan period, helping borrowers manage cash flow early on and anticipate higher costs later. Choosing between bullet and step-up structures depends on the borrower's cash flow stability, risk tolerance, and long-term financial planning.

Pros and Cons of Bullet Interest Payment

Bullet interest payment requires a borrower to pay only the interest periodically and repay the principal amount in a lump sum at the end of the loan term, reducing initial cash flow burden and simplifying accounting. This structure may lead to higher overall cost due to accumulated interest and increased risk of default if the borrower lacks a clear repayment plan. Bullet payments are advantageous for projects expecting significant future cash inflows but pose refinancing risks and potential liquidity challenges at maturity.

Advantages and Limitations of Step-up Interest Payment

Step-up interest payment in loan structuring offers the advantage of lower initial payments that gradually increase over time, which can improve early cash flow management for borrowers with anticipated revenue growth. This structure reduces financial strain during the initial loan period but may lead to higher total interest costs as payments increase. A limitation includes potential difficulty in budgeting future expenses due to escalating payment amounts and the risk of borrower default if income growth projections are not met.

Impact on Cash Flow: Bullet vs Step-up Payments

Bullet interest payments require borrowers to make periodic interest payments and repay the principal in a lump sum at maturity, resulting in lower initial cash outflows but a significant payment obligation at the end of the loan term. Step-up interest payments start with lower interest costs that increase gradually over time, smoothing cash flow impact and enhancing short-term affordability while increasing total interest expense as the loan progresses. Choosing between bullet and step-up structures affects liquidity management and financial planning, with bullet payments favoring borrowers expecting higher future cash inflows and step-up payments supporting stability in early payment phases.

Loan Suitability: When to Choose Bullet or Step-up

Bullet interest payment suits borrowers seeking short-term financing with a lump-sum principal repayment, ideal for projects with delayed cash flows or refinancing at maturity. Step-up interest payment benefits borrowers expecting growing revenues over time, aligning increasing interest obligations with improving cash flow capacity. Selecting between bullet and step-up structures depends on the borrower's cash flow pattern, financial stability, and repayment strategy for optimal loan suitability.

Risk Factors in Bullet and Step-up Interest Payment Loans

Bullet interest payment loans concentrate principal repayment at maturity, increasing default risk due to a large lump-sum obligation, while cash flow volatility can strain borrower liquidity during the loan term. Step-up interest payment loans begin with lower initial payments that escalate over time, potentially causing payment shock and heightened default risk in later periods if the borrower's cash flow does not grow as projected. Both structures require careful risk assessment of borrower cash flow stability, interest rate fluctuations, and refinancing capabilities to mitigate credit and liquidity risks effectively.

Real-world Examples: Bullet vs Step-up Interest Payment

Bullet interest payments are commonly used in commercial real estate loans where a borrower pays interest periodically and repays the entire principal at maturity, exemplified by office tower financing in major cities. Step-up interest payments, often utilized in leveraged buyouts, start with lower interest rates that increase over time, aligning with the borrower's growing cash flow, as seen in private equity acquisitions. Real-world cases like a retail chain refinancing with step-up payments demonstrate how gradual interest increments help balance initial debt servicing with future profitability.

Choosing the Right Interest Payment Structure for Your Loan

Selecting the optimal interest payment structure depends on cash flow stability and financial goals; bullet interest payments require a lump sum of interest at maturity, ideal for borrowers expecting higher future income or refinancing options. Step-up interest payments gradually increase interest amounts over time, benefiting those anticipating rising revenues or needing lower initial payments to maintain liquidity. Careful analysis of repayment capacity and market conditions ensures the chosen structure aligns with long-term financial strategy and risk tolerance.

Related Important Terms

Balloon Bullet Interest

Balloon bullet interest payment schedules involve a lump sum interest payment at the end of the loan term, reducing periodic cash flow burdens but increasing final payment risk for borrowers. Step-up interest payments gradually increase over time, offering smoother payment escalation but less flexibility compared to balloon bullet structures that optimize cash flow management and refinancing strategies.

Deferred Bullet Payout

Deferred bullet interest payment defers the principal and interest until the loan maturity, minimizing cash outflows during the loan term and optimizing liquidity management for borrowers. Step-up interest payment gradually increases interest obligations over time, whereas deferred bullet structures concentrate payments at the end, enhancing flexibility in financing high-growth or seasonal businesses.

Step-up Amortization Ladder

Step-up interest payment structures feature gradually increasing payments over the loan term, aligning cash flow with borrowers' projected income growth and facilitating easier debt service in early stages. The step-up amortization ladder optimizes loan repayment schedules by incrementally raising principal and interest installments, improving lender security while reducing borrower strain during initial periods compared to fixed bullet payments.

Dynamic Step-up Coupon

Dynamic Step-up coupon structures in loan agreements allow interest payments to incrementally increase at predetermined intervals, optimizing cash flow management compared to fixed bullet interest payments that require lump-sum coupon payments at maturity. This flexible interest schedule supports borrowers in aligning debt service obligations with anticipated revenue growth, enhancing loan affordability and credit risk profile.

Bullet-to-Step Hybrid Loan

A Bullet-to-Step Hybrid Loan combines a lump-sum bullet interest payment at the initial phase with progressively increasing step-up interest payments over time, optimizing cash flow management and aligning repayment schedules with projected revenue growth. This structure balances upfront interest saving with gradual payment escalation, making it ideal for borrowers anticipating improving financial stability.

Back-loaded Interest Accrual

Back-loaded interest accrual in bullet interest payments concentrates the interest repayment at the end of the loan term, minimizing early cash outflows and improving short-term liquidity. Step-up interest payment structures gradually increase interest expenses over time, aligning with projected cash flow growth but resulting in higher total interest costs in later periods.

Interest Rate Escalation Clause

Bullet interest payment structures involve a single lump-sum interest payment at loan maturity, resulting in steady interest expense without escalation clauses, while step-up interest payments incorporate a predetermined interest rate escalation clause that gradually increases the interest rate over the loan term to align with risk profile and cash flow projections. Incorporating an interest rate escalation clause in step-up payments enhances lender security by adjusting interest revenue in response to borrower performance and market conditions, optimizing loan structuring flexibility.

Graduated Payment Structure

Bullet interest payment requires full interest to be paid at loan maturity, optimizing cash flow early but potentially increasing payment risk, while step-up interest payment incorporates a graduated payment structure with increasing interest installments over time, aligning payments with anticipated income growth and reducing initial financial burden. Graduated payment structures in step-up plans enhance borrower affordability by gradually escalating payments, making them suitable for projects or businesses expecting rising cash flows.

Bullet Maturity Rollover

Bullet interest payments require a lump-sum principal repayment at maturity, often leading to the necessity of a bullet maturity rollover to refinance the outstanding loan amount. Step-up interest payments gradually increase over time, reducing refinancing pressure at maturity but potentially resulting in higher overall interest costs compared to the bullet structure.

Staggered Interest Capitalization

Bullet interest payments require full interest settlement at maturity, simplifying cash flow but potentially increasing end-of-term financial pressure, whereas step-up interest payments involve gradually increasing interest rates structured to align with improving borrower cash flows and staggered interest capitalization schedules. Staggered interest capitalization enables partial interest accrual during earlier periods, reducing immediate cash outflows and facilitating more manageable loan servicing aligned with projected revenue growth.

Bullet Interest Payment vs Step-up Interest Payment for loan structuring. Infographic

moneydiff.com

moneydiff.com