Nominal interest refers to the stated interest rate on a loan or investment without accounting for inflation, while real interest adjusts this rate to reflect the true purchasing power of money over time. Real interest is calculated by subtracting the inflation rate from the nominal interest rate, providing a clearer understanding of the actual return or cost. This adjustment is crucial for investors and borrowers to make informed financial decisions that consider the eroding effects of inflation on earnings or payments.

Table of Comparison

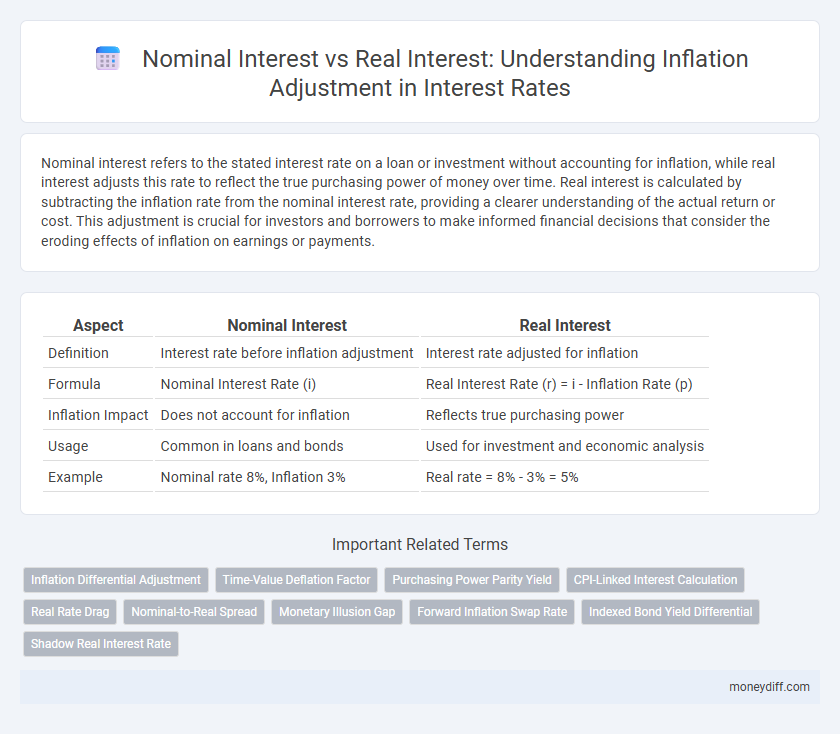

| Aspect | Nominal Interest | Real Interest |

|---|---|---|

| Definition | Interest rate before inflation adjustment | Interest rate adjusted for inflation |

| Formula | Nominal Interest Rate (i) | Real Interest Rate (r) = i - Inflation Rate (p) |

| Inflation Impact | Does not account for inflation | Reflects true purchasing power |

| Usage | Common in loans and bonds | Used for investment and economic analysis |

| Example | Nominal rate 8%, Inflation 3% | Real rate = 8% - 3% = 5% |

Understanding Nominal Interest: The Basics

Nominal interest represents the stated or advertised interest rate on loans and investments without adjusting for inflation, reflecting the actual amount of money earned or paid over a period. It is crucial to distinguish nominal interest from real interest, which accounts for inflation by subtracting the inflation rate from the nominal rate, thereby revealing the true purchasing power of the returns. Understanding nominal interest helps investors and borrowers assess the face value of financial products before evaluating their real profitability or cost after inflation effects are considered.

What Is Real Interest? Key Differences Explained

Real interest represents the nominal interest rate adjusted for inflation, reflecting the true purchasing power of the return on an investment. Unlike nominal interest, which simply shows the stated rate without considering rising prices, real interest accounts for inflation's impact on money value over time. Understanding real interest is crucial for accurately assessing investment gains and the cost of borrowing in an inflationary economy.

How Inflation Impacts Your Interest Rate

Inflation erodes the purchasing power of nominal interest rates, meaning the real interest rate reflects the true earning after adjusting for inflation. When inflation rises, the real interest rate decreases if nominal rates remain unchanged, reducing the actual return on savings or investments. Understanding the difference between nominal and real interest rates is crucial for making informed financial decisions in an inflationary environment.

Calculating Real Interest: The Role of Inflation

Calculating real interest involves adjusting the nominal interest rate to account for inflation's impact on purchasing power, using the formula: Real Interest Rate Nominal Interest Rate - Inflation Rate. This adjustment ensures the true cost of borrowing or return on investment reflects changes in consumer prices, providing a more accurate financial assessment. Investors and borrowers rely on real interest rates to make informed decisions that consider inflation's effect on economic value.

Nominal vs Real Interest: Why the Distinction Matters

Nominal interest represents the stated rate without adjusting for inflation, while real interest accounts for inflation's impact, reflecting the true purchasing power of returns. Distinguishing nominal versus real interest is crucial for investors, as high inflation can erode nominal gains, leaving real returns negative or negligible. Understanding this difference enables more accurate financial planning and investment decisions by measuring actual growth and preserving wealth against inflation risks.

Protecting Investments Against Inflation

Nominal interest represents the stated rate without accounting for inflation, while real interest adjusts nominal returns by subtracting the inflation rate, providing a clearer measure of purchasing power protection. Investors aiming to safeguard their portfolios against inflation should prioritize real interest rates to ensure their returns exceed rising prices. Understanding the distinction between nominal and real interest is crucial for making informed investment decisions that preserve wealth over time.

Real World Examples: Nominal vs Real Interest

Nominal interest rates represent the stated percentage without adjusting for inflation, often misleading investors about true borrowing costs. Real interest rates account for inflation, providing a more accurate measure of purchasing power, as seen in the 1970s U.S. inflation crisis where high nominal rates eroded real returns. For instance, a 10% nominal interest rate with 7% inflation results in a 3% real interest rate, highlighting the importance of inflation-adjusted calculations in financial decision-making.

Inflation Adjustment Strategies in Money Management

Nominal interest rates represent the stated return on investment without accounting for inflation, while real interest rates are adjusted to reflect the true purchasing power by subtracting the inflation rate. Effective inflation adjustment strategies in money management prioritize real interest rates to preserve capital value and optimize investment returns. Incorporating inflation-indexed securities or diversifying into assets with historical protection against inflation enhances portfolio resilience against inflationary erosion.

How Central Banks Use Nominal and Real Interest Rates

Central banks use nominal interest rates as a primary tool to influence economic activity and control inflation by adjusting policy rates that affect borrowing costs. Real interest rates, which account for inflation, provide a more accurate measure of the true cost of borrowing and the real yield on savings, guiding central banks in setting appropriate monetary policies. By analyzing both nominal and real interest rates, central banks ensure inflation targets are met while supporting sustainable economic growth.

Making Better Financial Decisions with Real Interest Awareness

Nominal interest rates represent the stated rate without adjusting for inflation, while real interest rates reflect the true purchasing power by subtracting inflation from the nominal rate. Understanding real interest rates enables investors and borrowers to make more informed financial decisions by accurately assessing the actual cost of borrowing and the real return on investments. Prioritizing real interest awareness helps protect against inflation erosion and ensures better long-term financial planning and wealth preservation.

Related Important Terms

Inflation Differential Adjustment

Nominal interest rates represent the stated return without adjusting for inflation, while real interest rates account for inflation by subtracting the inflation rate, providing a true measure of purchasing power. Inflation differential adjustment becomes crucial when comparing interest rates across countries, as it adjusts nominal rates by the inflation rate differences to reflect real returns accurately.

Time-Value Deflation Factor

The Time-Value Deflation Factor adjusts nominal interest rates by accounting for inflation, revealing the real interest rate that reflects true purchasing power over time. This factor is essential for investors and economists to understand how inflation erodes returns and impacts investment decisions.

Purchasing Power Parity Yield

Nominal interest rates represent the stated interest without accounting for inflation, while real interest rates adjust for inflation to reflect the true increase in purchasing power. Purchasing Power Parity (PPP) yield incorporates inflation differentials between countries, aligning real interest rates with expected changes in currency value and maintaining equilibrium in international investment returns.

CPI-Linked Interest Calculation

Nominal interest represents the stated rate without adjusting for inflation, while real interest accounts for changes in purchasing power by incorporating CPI-linked adjustments to reflect true economic value. Calculating CPI-linked interest involves indexing the nominal rate to inflation data from the Consumer Price Index, ensuring returns maintain their real value over time.

Real Rate Drag

Real interest rates adjust nominal interest rates by subtracting inflation, revealing the true cost of borrowing or return on investment, while nominal rates do not account for rising prices. Real rate drag occurs when inflation erodes purchasing power, reducing the effective yield on investments despite stable or increasing nominal rates.

Nominal-to-Real Spread

Nominal interest rates represent the stated returns without adjusting for inflation, while real interest rates reflect purchasing power by subtracting expected or actual inflation. The nominal-to-real spread indicates inflation expectations and impacts investment decisions, showing how much inflation erodes nominal returns in financial markets.

Monetary Illusion Gap

Nominal interest rates represent the stated percentage return without adjusting for inflation, while real interest rates account for inflation's impact, reflecting the true purchasing power of returns. The monetary illusion gap arises when investors focus on nominal interest, ignoring inflation adjustments, leading to misperceptions about the real value of their earnings.

Forward Inflation Swap Rate

Nominal interest rates reflect the total return without adjusting for inflation, while real interest rates incorporate inflation expectations, providing a clearer measure of purchasing power. The Forward Inflation Swap Rate is a critical instrument used to extract market-implied inflation expectations, enabling investors to accurately distinguish between nominal and real interest rates for effective inflation adjustment.

Indexed Bond Yield Differential

Indexed bond yield differential reflects the gap between nominal interest rates and real interest rates adjusted for inflation, providing investors clarity on inflation expectations embedded in bond prices. Real interest rates, derived from nominal rates minus expected inflation, represent the true cost of borrowing and return on investment, highlighting the inflation-adjusted value in financial markets.

Shadow Real Interest Rate

The Shadow Real Interest Rate adjusts nominal interest rates by incorporating expected inflation and economic slack, providing a more accurate measure of the true cost of borrowing and real returns on investments. This rate is crucial for monetary policy decisions as it reveals the underlying stance of interest rates beyond traditional real interest calculations that only subtract expected inflation from nominal rates.

Nominal Interest vs Real Interest for inflation adjustment Infographic

moneydiff.com

moneydiff.com