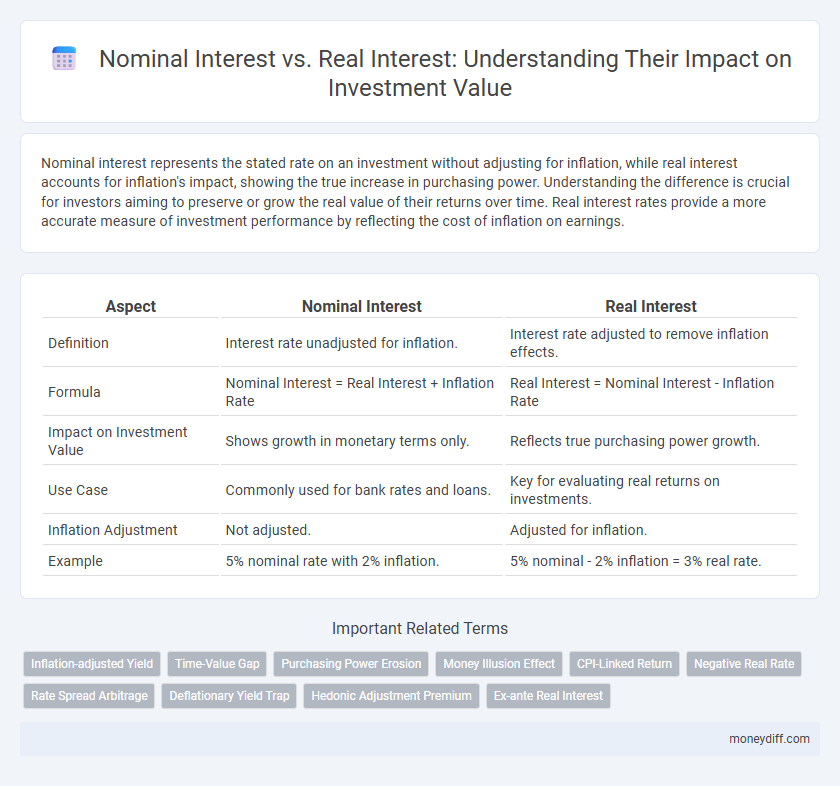

Nominal interest represents the stated rate on an investment without adjusting for inflation, while real interest accounts for inflation's impact, showing the true increase in purchasing power. Understanding the difference is crucial for investors aiming to preserve or grow the real value of their returns over time. Real interest rates provide a more accurate measure of investment performance by reflecting the cost of inflation on earnings.

Table of Comparison

| Aspect | Nominal Interest | Real Interest |

|---|---|---|

| Definition | Interest rate unadjusted for inflation. | Interest rate adjusted to remove inflation effects. |

| Formula | Nominal Interest = Real Interest + Inflation Rate | Real Interest = Nominal Interest - Inflation Rate |

| Impact on Investment Value | Shows growth in monetary terms only. | Reflects true purchasing power growth. |

| Use Case | Commonly used for bank rates and loans. | Key for evaluating real returns on investments. |

| Inflation Adjustment | Not adjusted. | Adjusted for inflation. |

| Example | 5% nominal rate with 2% inflation. | 5% nominal - 2% inflation = 3% real rate. |

Understanding Nominal and Real Interest Rates

Nominal interest rates represent the stated percentage return on an investment without adjusting for inflation, reflecting the raw gain over time. Real interest rates account for inflation, providing a more accurate measure of purchasing power growth by subtracting inflation from the nominal rate. Understanding the distinction between nominal and real interest rates is essential for evaluating true investment value and making informed financial decisions.

The Core Differences Between Nominal and Real Interest

Nominal interest represents the stated rate on an investment without adjusting for inflation, directly impacting the face value of returns. Real interest accounts for inflation, reflecting the true purchasing power and actual value of investment gains over time. Understanding these core differences is crucial for investors aiming to assess the real growth of their capital and maintain the value of their investments.

How Inflation Impacts Investment Returns

Nominal interest rates represent the stated return on an investment without adjusting for inflation, while real interest rates account for inflation's effect by reflecting the true purchasing power of returns. Inflation erodes investment value by decreasing the real interest rate, meaning that even if nominal returns appear high, the actual growth in wealth is diminished when inflation is high. Understanding the difference between nominal and real interest is crucial for investors aiming to preserve and grow their investment value in an inflationary environment.

Calculating Real Interest Rate: The Formula Explained

Calculating the real interest rate involves subtracting the inflation rate from the nominal interest rate, providing a more accurate measure of investment returns after adjusting for purchasing power changes. The formula is Real Interest Rate = Nominal Interest Rate - Inflation Rate, which helps investors evaluate the true gain on investments. Understanding this calculation is crucial for making informed financial decisions in environments where inflation impacts the value of nominal returns.

Why Nominal Interest Can Be Misleading for Investors

Nominal interest rates do not account for inflation, which can erode the actual purchasing power of investment returns and mislead investors about their true gains. Real interest rates, adjusted for inflation, provide a more accurate measure of the investment's growth in value over time. Understanding the difference between nominal and real interest is critical for making informed investment decisions and preserving wealth.

The Importance of Real Interest Rate in Investment Decisions

Real interest rate reflects the true cost of borrowing and the actual return on investment by adjusting nominal interest for inflation, providing a clearer picture of purchasing power changes. Investors rely on real interest rates to assess the genuine profitability of investments, ensuring returns exceed inflation and preserve wealth. Ignoring inflation leads to overestimating returns, which can result in poor investment decisions and diminished portfolio growth over time.

Nominal vs Real Interest: Effects on Portfolio Growth

Nominal interest reflects the stated rate earned on investments without adjusting for inflation, while real interest accounts for inflation's impact, revealing the true growth in purchasing power of a portfolio. High nominal interest rates can be misleading if inflation is equally high, eroding the real returns investors receive, thus impacting long-term wealth accumulation. Understanding the difference between nominal and real interest is crucial for portfolio growth, as real interest rates provide a clearer picture of actual investment value over time.

Inflation-Protected Investments: Mitigating Real Rate Erosion

Nominal interest rates reflect the stated return on investments without adjusting for inflation, often overstating actual purchasing power gains. Real interest rates account for inflation, providing a clearer measure of investment value by showing the true growth in investor wealth. Inflation-protected investments, such as Treasury Inflation-Protected Securities (TIPS), are designed to mitigate real rate erosion by adjusting principal and interest payments based on changes in the Consumer Price Index (CPI).

How Central Banks Influence Nominal and Real Interest Rates

Central banks influence nominal interest rates primarily through monetary policy tools like setting benchmark rates and open market operations, directly affecting borrowing costs and liquidity. Real interest rates, adjusted for inflation expectations, respond indirectly as central banks manage inflation targets to stabilize purchasing power over time. Investors assess these rates to determine investment value, balancing nominal returns with anticipated inflation impacts shaped by central bank decisions.

Practical Tips for Investors: Focusing on Real Returns

Investors should prioritize real interest rates over nominal rates when evaluating investment opportunities, as real rates account for inflation and reflect the true purchasing power of returns. Calculating real interest involves subtracting the inflation rate from the nominal interest rate, providing a clearer picture of investment profitability. Focusing on real returns ensures better financial planning and more accurate comparisons across different investment options.

Related Important Terms

Inflation-adjusted Yield

Nominal interest represents the stated return on an investment without factoring in inflation, while real interest adjusts this yield to reflect the true purchasing power of returns by accounting for inflation rates. Understanding the inflation-adjusted yield is crucial for investors to evaluate the actual growth of their investment value over time.

Time-Value Gap

Nominal interest reflects the stated percentage return on investment without adjusting for inflation, while real interest accounts for inflation's impact, revealing the true purchasing power gained over time. The time-value gap between nominal and real interest rates highlights how inflation erodes investment value, making it critical to focus on real interest for accurate wealth growth assessment.

Purchasing Power Erosion

Nominal interest rates represent the stated return on investment without adjusting for inflation, while real interest rates account for inflation, reflecting the true increase in purchasing power. Ignoring real interest rates when evaluating investments can lead to an overestimation of gains, as inflation erodes the actual value of nominal returns.

Money Illusion Effect

Nominal interest rates reflect the percentage return on investment without adjusting for inflation, often leading investors to overestimate real gains due to the money illusion effect. Real interest rates, adjusted for inflation, provide a more accurate measure of an investment's purchasing power and true value growth.

CPI-Linked Return

Nominal interest represents the stated return on investment without adjustment for inflation, while real interest accounts for changes in purchasing power by subtracting the Consumer Price Index (CPI) inflation rate. CPI-linked returns offer investors a more accurate measure of investment value by reflecting true gains in real terms, protecting against inflation erosion.

Negative Real Rate

Negative real interest rates occur when nominal interest rates fall below inflation, eroding the purchasing power of investment returns and diminishing the real growth of capital. Investors face challenges in preserving wealth as the nominal gains fail to outpace rising prices, leading to a decrease in the actual value of their investments over time.

Rate Spread Arbitrage

Nominal interest represents the stated return on investment without adjusting for inflation, while real interest accounts for the purchasing power by subtracting inflation rates, providing a clearer measure of true investment value. Rate spread arbitrage exploits differences between nominal and real interest rates across markets, allowing investors to profit from the inflation risk premium embedded in nominal rates.

Deflationary Yield Trap

Nominal interest rates represent the stated return on investment without adjusting for inflation, while real interest rates reflect the true purchasing power by subtracting inflation from nominal rates. In a deflationary yield trap, falling prices cause real interest rates to appear high despite low or negative nominal yields, reducing incentives for investment and potentially stalling economic growth.

Hedonic Adjustment Premium

Nominal interest rates reflect the percentage increase in money without accounting for inflation, while real interest rates adjust for inflation to show the true increase in purchasing power. The Hedonic Adjustment Premium captures the added value investors assign to improvements in product quality or technology, affecting the real interest rate by accounting for changes in consumption utility beyond price inflation.

Ex-ante Real Interest

Ex-ante real interest rate measures the expected inflation-adjusted return on investment, reflecting investors' anticipated purchasing power gains before inflation materializes, unlike nominal interest rates which include inflation effects but not adjusted for it. Evaluating ex-ante real interest enables more accurate investment decisions by isolating true growth potential from inflation distortions.

Nominal Interest vs Real Interest for investment value Infographic

moneydiff.com

moneydiff.com