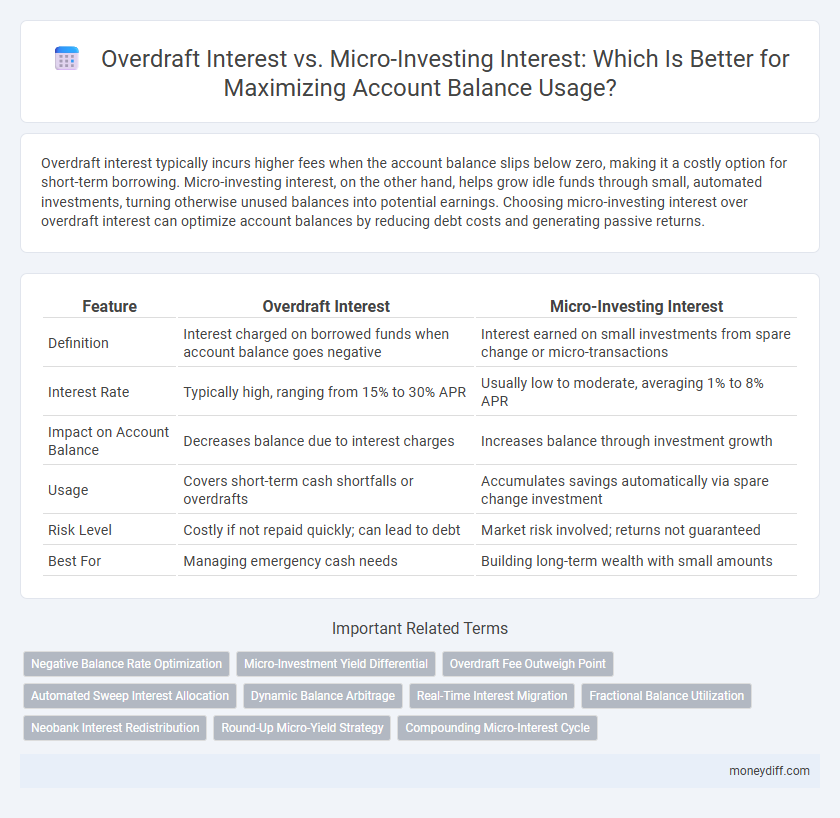

Overdraft interest typically incurs higher fees when the account balance slips below zero, making it a costly option for short-term borrowing. Micro-investing interest, on the other hand, helps grow idle funds through small, automated investments, turning otherwise unused balances into potential earnings. Choosing micro-investing interest over overdraft interest can optimize account balances by reducing debt costs and generating passive returns.

Table of Comparison

| Feature | Overdraft Interest | Micro-Investing Interest |

|---|---|---|

| Definition | Interest charged on borrowed funds when account balance goes negative | Interest earned on small investments from spare change or micro-transactions |

| Interest Rate | Typically high, ranging from 15% to 30% APR | Usually low to moderate, averaging 1% to 8% APR |

| Impact on Account Balance | Decreases balance due to interest charges | Increases balance through investment growth |

| Usage | Covers short-term cash shortfalls or overdrafts | Accumulates savings automatically via spare change investment |

| Risk Level | Costly if not repaid quickly; can lead to debt | Market risk involved; returns not guaranteed |

| Best For | Managing emergency cash needs | Building long-term wealth with small amounts |

Understanding Overdraft Interest: What It Means for Account Holders

Overdraft interest is the cost charged by banks when account holders withdraw more money than their available balance, typically at higher rates than standard loan interest. It directly impacts account holders by increasing their debt and can accumulate quickly if the overdraft is not repaid promptly. Understanding overdraft interest is crucial for managing account balances responsibly and avoiding unexpected financial charges.

Micro-Investing Interest: Building Wealth with Small Balances

Micro-investing interest enables account holders to accumulate wealth gradually by earning returns on small balance amounts, leveraging consistent contributions and compounding growth. Unlike overdraft interest, which incurs costs when spending exceeds the account balance, micro-investing interest transforms idle funds into potential investment gains. This approach maximizes the utility of spare change, turning everyday transactions into opportunities for building long-term financial security.

Comparing Overdraft Fees and Micro-Investing Returns

Overdraft interest rates typically range from 18% to 35%, resulting in high fees that erode account balances quickly when used. In contrast, micro-investing platforms offer average annual returns between 5% and 12%, potentially growing small surpluses over time through diversified portfolios. Comparing these, overdraft fees deplete funds immediately, while micro-investing yields compound growth, making the latter a more financially advantageous option for managing idle account balances.

How Overdraft Interest Impacts Your Financial Health

Overdraft interest rates are typically higher than micro-investing returns, causing significant costs when your account balance goes negative. Persistent overdraft fees can erode your financial stability by increasing debt and reducing available funds for essential expenses. In contrast, micro-investing interest grows your balance gradually, promoting positive financial health through compound earnings rather than penalties.

Maximizing Account Balance Usage through Micro-Investing

Maximizing account balance usage through micro-investing leverages earned interest more effectively than overdraft interest, which often incurs high fees and negative rates. Micro-investing allows small, regular contributions to grow over time with compound interest, enhancing overall returns on available funds. Utilizing micro-investing opportunities transforms idle balances into profit-generating assets, optimizing financial growth beyond overdraft cost burdens.

Short-Term vs Long-Term Interest: Overdrafts and Micro-Investments

Overdraft interest typically incurs higher short-term rates due to borrowing costs and immediate liquidity use, making it costly for brief account deficits. Micro-investing interest, on the other hand, compounds over the long term, leveraging small, consistent contributions to grow account balances through market gains. Optimizing account balance usage involves minimizing overdraft reliance and maximizing micro-investment benefits for sustained financial growth.

Risk Assessment: Overdraft Penalties vs Micro-Investing Volatility

Overdraft interest typically incurs high penalties and immediate financial risk due to fees imposed when account balances fall below zero, increasing borrower costs and potential credit damage. In contrast, micro-investing interest exposes users to market volatility and investment risk, with potential gains or losses tied to asset price fluctuations rather than fixed fees. Evaluating overdraft penalties versus micro-investing volatility requires assessing personal risk tolerance, financial stability, and long-term growth objectives.

Hidden Costs: Overdraft Interest vs Micro-Investing Fees

Overdraft interest rates typically range from 18% to 35% APR, leading to significant hidden costs when account balances dip below zero, while micro-investing fees, often charged as a small percentage of assets under management or fixed monthly fees, tend to be more transparent but can still erode returns over time. Overdraft interest compounds daily, accumulating rapidly during prolonged negative balances, whereas micro-investing fees apply even when the balance is low or changes minimally. Consumers should carefully compare the effective annual rates of overdraft charges versus the cumulative impact of micro-investing fees to optimize account balance usage and avoid unexpected financial losses.

Choosing the Right Strategy: Overdraft Coverage or Micro-Investment Growth

Overdraft interest rates typically range from 15% to 25% annually, creating a costly liability when using overdraft coverage for account balance management. In contrast, micro-investing platforms often yield average annual returns between 5% and 8%, offering potential growth by investing small, frequent amounts from spare change. Selecting the right approach depends on comparing high-cost overdraft fees with lower-risk, incremental investment returns to optimize overall financial health.

Practical Tips to Optimize Interest for Account Balance Usage

Maximize your account balance usage by prioritizing micro-investing interest, which often yields higher returns on smaller amounts compared to overdraft interest, typically charged at steep rates. Track your spending closely to avoid overdraft fees that accumulate high-interest costs, while regularly allocating surplus funds into micro-investment platforms that compound interest effectively. Employ automated transfers to micro-investing accounts to ensure consistent growth, and set alerts to maintain balances above overdraft thresholds, optimizing overall interest benefits.

Related Important Terms

Negative Balance Rate Optimization

Overdraft interest charges typically carry higher rates, increasing costs on negative balances, whereas micro-investing interest can generate returns on idle funds, partially offsetting interest expenses. Optimizing account usage by minimizing overdraft occurrences and leveraging micro-investing strategies improves negative balance rate efficiency and overall financial health.

Micro-Investment Yield Differential

Micro-investing typically delivers higher interest yields on account balances compared to overdraft interest charges, creating a favorable micro-investment yield differential that benefits account holders. This differential incentivizes users to allocate surplus funds into micro-investing platforms rather than incurring costly overdraft fees, enhancing overall financial growth.

Overdraft Fee Outweigh Point

Overdraft interest rates often exceed micro-investing returns, causing account users to incur higher costs when negative balances trigger fees. While micro-investing interest can grow funds modestly, the financial burden of overdraft fees disproportionately outweighs these benefits, emphasizing prudent balance management.

Automated Sweep Interest Allocation

Automated sweep interest allocation automatically transfers surplus funds from checking accounts to micro-investing portfolios, maximizing returns by earning higher micro-investing interest rates instead of lower overdraft interest costs. This system minimizes overdraft fees while optimizing account balance usage through seamless interest accrual on invested funds.

Dynamic Balance Arbitrage

Dynamic Balance Arbitrage leverages the contrast between overdraft interest rates, often exceeding 20% APR, and micro-investing returns that average 5-10% annually, optimizing account balance utilization. By strategically managing funds to minimize overdraft fees while maximizing incremental investment gains, individuals can enhance overall financial efficiency and growth potential.

Real-Time Interest Migration

Overdraft interest typically incurs higher fees when account balances drop below zero, while micro-investing interest applies smaller, incremental earnings on positive balances through automated savings allocations. Real-time interest migration enables seamless transition between overdraft charges and micro-investing gains, optimizing account balance usage by minimizing costs and maximizing growth potential instantaneously.

Fractional Balance Utilization

Overdraft interest rates typically incur higher fees on negative balances, reducing overall account value, whereas micro-investing interest leverages fractional balance utilization by investing spare change or small amounts, optimizing returns on otherwise idle funds. Fractional balance utilization maximizes financial efficiency by turning unused portions of an account balance into incremental earnings through compounding micro-investments instead of costly overdraft penalties.

Neobank Interest Redistribution

Neobanks often redistribute overdraft interest by investing the funds into micro-investing platforms, allowing account holders to potentially earn higher returns compared to traditional overdraft fees. This interest redistribution leverages user account balances to optimize financial growth through targeted micro-investments, enhancing overall account value and user engagement.

Round-Up Micro-Yield Strategy

Overdraft interest rates typically range from 18% to 36% annually, leading to significant costs on negative balances, whereas the Round-Up Micro-Yield Strategy in micro-investing channels small spare change increments into diversified portfolios, generating compound returns often exceeding 5% annually. Utilizing round-up micro-investing maximizes account balance productivity by transforming routine transactions into incremental wealth growth, contrasting sharply with the expense incurred from overdraft interest charges.

Compounding Micro-Interest Cycle

Overdraft interest typically accrues at higher annual percentage rates (APRs), compounding daily and increasing the overall debt quickly, whereas micro-investing interest compounds in small, frequent cycles, allowing account balances to grow steadily through reinvested micro-earnings. Utilizing compounding micro-interest cycles leverages the power of exponential growth by continuously adding earned interest to the principal, optimizing balance usage compared to the costly, compounding fees of overdraft interest.

Overdraft Interest vs Micro-Investing Interest for account balance usage. Infographic

moneydiff.com

moneydiff.com