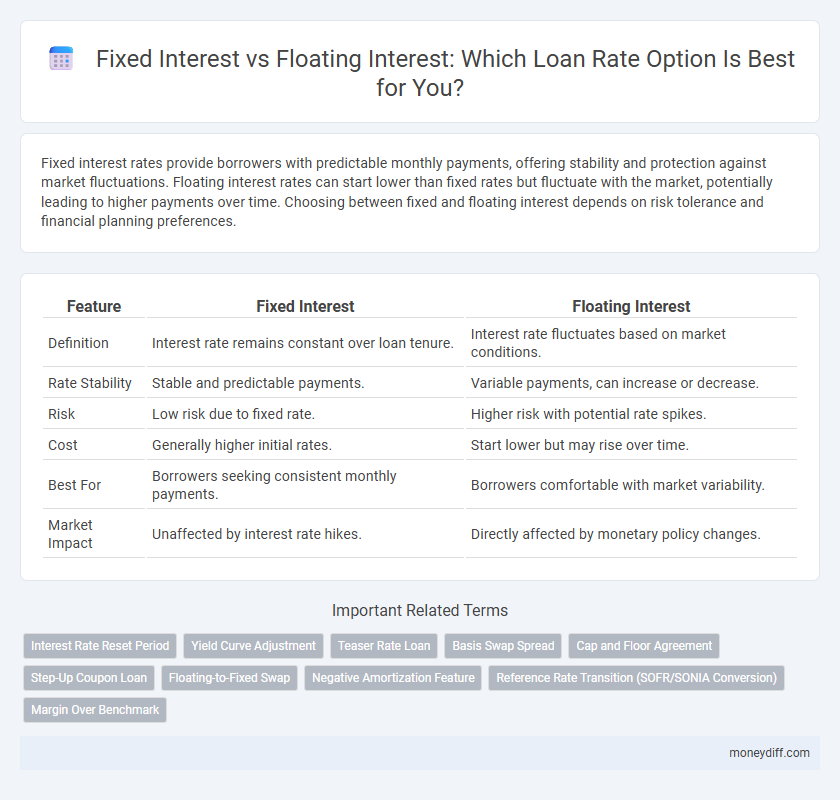

Fixed interest rates provide borrowers with predictable monthly payments, offering stability and protection against market fluctuations. Floating interest rates can start lower than fixed rates but fluctuate with the market, potentially leading to higher payments over time. Choosing between fixed and floating interest depends on risk tolerance and financial planning preferences.

Table of Comparison

| Feature | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant over loan tenure. | Interest rate fluctuates based on market conditions. |

| Rate Stability | Stable and predictable payments. | Variable payments, can increase or decrease. |

| Risk | Low risk due to fixed rate. | Higher risk with potential rate spikes. |

| Cost | Generally higher initial rates. | Start lower but may rise over time. |

| Best For | Borrowers seeking consistent monthly payments. | Borrowers comfortable with market variability. |

| Market Impact | Unaffected by interest rate hikes. | Directly affected by monetary policy changes. |

Understanding Fixed Interest in Loan Agreements

Fixed interest in loan agreements offers a predetermined rate that remains constant throughout the loan term, providing borrowers with predictable monthly payments and protection against market fluctuations. This stability facilitates accurate financial planning and budgeting, as the interest expense does not vary regardless of changes in benchmark rates like LIBOR or the prime rate. Fixed interest rates are particularly beneficial in environments with rising interest rates, ensuring cost certainty over the duration of the loan.

What Is Floating Interest and How Does It Work?

Floating interest rates fluctuate based on benchmark rates like the LIBOR or federal funds rate, resulting in variable loan payments over time. These rates typically start lower than fixed rates but can increase or decrease depending on market conditions and central bank policies. Borrowers with floating interest loans benefit from potential decreases in rates but face uncertainty and risk if rates rise significantly during the loan term.

Key Differences Between Fixed and Floating Interest Rates

Fixed interest rates remain constant throughout the loan tenure, providing predictable monthly payments and shielding borrowers from market fluctuations. Floating interest rates vary based on benchmark rates like LIBOR or the central bank's base rate, causing repayments to rise or fall with market conditions. Choosing between fixed and floating depends on risk tolerance, with fixed rates offering stability and floating rates potentially benefiting from declining interest trends.

Pros and Cons of Fixed Interest Loans

Fixed interest loans offer predictable monthly payments, making budgeting easier and protecting borrowers from rising interest rates throughout the loan term. They typically come with higher initial rates compared to floating interest loans, which can result in higher overall costs if market rates fall. However, fixed interest loans provide financial stability and reduce the risk of payment shocks during economic fluctuations.

Advantages and Risks of Floating Interest Rates

Floating interest rates offer the advantage of potentially lower initial payments and benefits from market rate decreases, enhancing affordability during periods of declining interest. However, these rates carry the risk of increased payments if market interest rates rise, leading to unpredictable loan costs and budget challenges. Borrowers must assess their risk tolerance and financial stability before opting for floating interest rates to avoid potential payment shocks.

Who Should Choose Fixed Interest Loans?

Borrowers seeking stability and predictable monthly payments should choose fixed interest loans, especially those with a low tolerance for financial risk or limited budget flexibility. Homebuyers planning long-term ownership and individuals with steady income streams benefit most from locking in fixed rates during periods of low interest. Fixed interest is ideal for financial planning and protection against rising market rates, ensuring consistent repayment amounts throughout the loan term.

When Floating Interest Loans Make Sense

Floating interest loans make sense when borrowers anticipate a decline or stability in market interest rates, allowing them to benefit from lower payments over the loan term. These loans provide flexibility with adjustments tied to benchmark rates such as LIBOR or SOFR, making them suitable for short-term financing or fluctuating cash flows. Borrowers with higher risk tolerance and variable income streams often prefer floating rates to capitalize on potential interest rate drops and reduce overall borrowing costs.

Impact of Market Fluctuations on Loan Repayments

Fixed interest loans maintain a constant rate throughout the loan term, providing stability in monthly repayments regardless of market fluctuations. Floating interest rates adjust periodically based on benchmark rates like LIBOR or the prime rate, causing repayments to increase or decrease in response to market volatility. Borrowers with floating rates may face higher payment uncertainty and potential financial strain during periods of rising interest rates.

Comparing Total Costs: Fixed vs Floating Interest

Fixed interest loans provide predictable monthly payments and overall cost stability, making it easier to budget over the loan term. Floating interest rates, tied to market benchmarks like LIBOR or SOFR, may offer lower initial rates but introduce variability that can increase total repayment costs if rates rise. Comparing total costs involves analyzing rate trends, loan duration, and risk tolerance to determine whether the stability of fixed interest or the potential savings of floating rates align better with financial goals.

How to Decide Between Fixed and Floating Interest for Your Loan

When deciding between fixed and floating interest rates for your loan, consider the stability of your financial situation and market trends. Fixed interest rates offer predictable monthly payments and protection against rising rates, ideal for those seeking budget certainty. Floating interest rates, which fluctuate with market conditions, might benefit borrowers expecting interest rates to fall or planning to repay the loan quickly.

Related Important Terms

Interest Rate Reset Period

Fixed interest loans offer a constant interest rate throughout the loan term, providing predictable repayment amounts, while floating interest loans feature an interest rate reset period that adjusts periodically based on market benchmarks like LIBOR or the prime rate. The interest rate reset period in floating loans typically ranges from monthly to annually, affecting the variability and potential cost of the loan over time.

Yield Curve Adjustment

Fixed interest rates provide predictability by locking the rate throughout the loan term, while floating interest rates fluctuate based on benchmark rates influenced by yield curve adjustments. Yield curve shifts impact floating rates directly, causing payments to vary with changes in short-term and long-term interest expectations, affecting overall loan cost and risk management.

Teaser Rate Loan

Teaser rate loans offer initially low fixed interest rates, attracting borrowers with affordable early payments before transitioning to higher floating interest rates tied to market indexes such as LIBOR or SOFR. Borrowers should evaluate potential payment increases during the floating rate period to avoid financial strain when the teaser rate expires.

Basis Swap Spread

Fixed interest loans offer predictable payments by locking in a set rate, whereas floating interest rates fluctuate based on benchmark indices like LIBOR or SOFR; the basis swap spread represents the difference between these indices, reflecting market risk and liquidity conditions. Understanding the basis swap spread is crucial when evaluating loan costs, as it influences whether a fixed or floating rate is more cost-effective over the loan term.

Cap and Floor Agreement

Fixed interest loans provide consistent payment amounts by setting a predetermined rate, offering predictability without exposure to market fluctuations. Floating interest loans adjust with reference rates like LIBOR or SOFR but may include a cap and floor agreement to limit rate volatility, ensuring payments remain within defined upper and lower bounds for risk management.

Step-Up Coupon Loan

Step-Up Coupon Loans feature fixed interest rates that increase at predetermined intervals, providing predictable payment schedules compared to floating interest rates that fluctuate with market conditions. This structure offers borrowers stability in budgeting while benefiting from potential rate adjustments aligned with changing economic environments.

Floating-to-Fixed Swap

Floating-to-fixed interest rate swaps allow borrowers to convert variable-rate loan obligations into stable fixed payments, mitigating exposure to interest rate volatility. This financial instrument effectively manages interest rate risk by locking in predictable costs, enhancing budgeting accuracy and financial planning for businesses and individuals with fluctuating loan rates.

Negative Amortization Feature

Fixed interest loans maintain a constant rate throughout the term, preventing negative amortization as payments consistently cover interest and principal. Floating interest loans risk negative amortization during rate increases, where payments may fall short of accrued interest, causing the loan balance to grow.

Reference Rate Transition (SOFR/SONIA Conversion)

Fixed interest loans offer stability with predetermined rates, while floating interest loans fluctuate based on benchmark reference rates like SOFR and SONIA, which are undergoing significant transitions replacing LIBOR. The shift to SOFR and SONIA as reference rates impacts loan pricing, risk assessment, and contractual terms, requiring borrowers and lenders to adapt to new interest rate calculation methodologies and market conventions.

Margin Over Benchmark

Fixed interest rates maintain a constant margin over a benchmark rate, providing predictable loan repayments and protection against market fluctuations. Floating interest rates, with a margin over a reference rate like LIBOR or SOFR, vary according to market conditions, potentially lowering or raising loan costs depending on benchmark movements.

Fixed Interest vs Floating Interest for loan rates Infographic

moneydiff.com

moneydiff.com