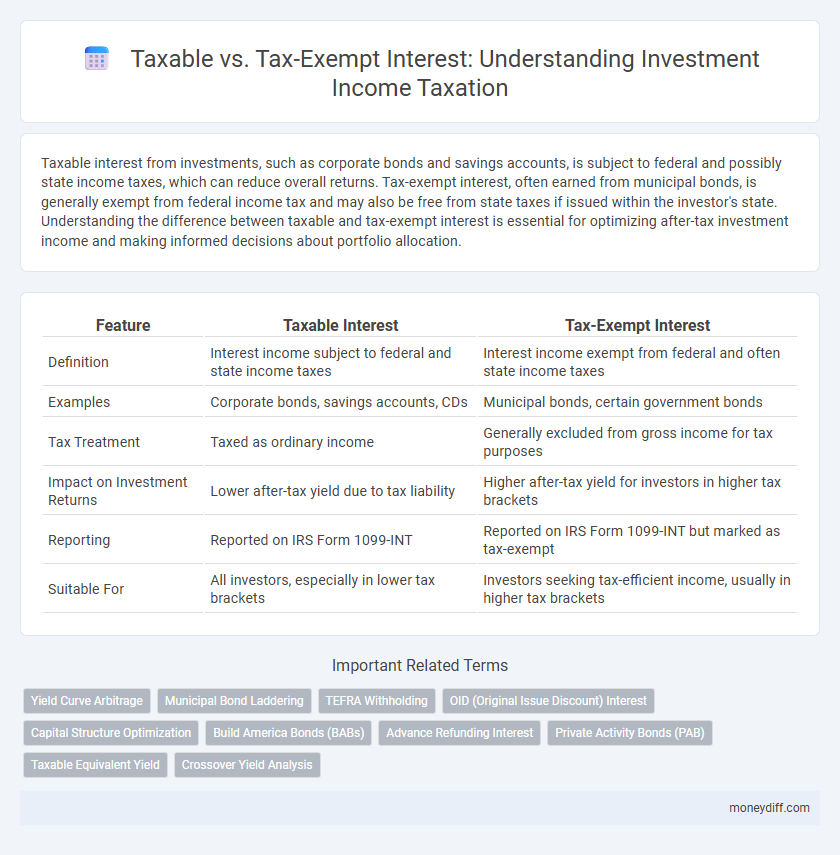

Taxable interest from investments, such as corporate bonds and savings accounts, is subject to federal and possibly state income taxes, which can reduce overall returns. Tax-exempt interest, often earned from municipal bonds, is generally exempt from federal income tax and may also be free from state taxes if issued within the investor's state. Understanding the difference between taxable and tax-exempt interest is essential for optimizing after-tax investment income and making informed decisions about portfolio allocation.

Table of Comparison

| Feature | Taxable Interest | Tax-Exempt Interest |

|---|---|---|

| Definition | Interest income subject to federal and state income taxes | Interest income exempt from federal and often state income taxes |

| Examples | Corporate bonds, savings accounts, CDs | Municipal bonds, certain government bonds |

| Tax Treatment | Taxed as ordinary income | Generally excluded from gross income for tax purposes |

| Impact on Investment Returns | Lower after-tax yield due to tax liability | Higher after-tax yield for investors in higher tax brackets |

| Reporting | Reported on IRS Form 1099-INT | Reported on IRS Form 1099-INT but marked as tax-exempt |

| Suitable For | All investors, especially in lower tax brackets | Investors seeking tax-efficient income, usually in higher tax brackets |

Understanding Taxable Interest and Tax-Exempt Interest

Taxable interest includes income earned from sources such as savings accounts, certificates of deposit, and corporate bonds, which must be reported as income on federal tax returns. Tax-exempt interest typically comes from municipal bonds and certain government-issued bonds, which are excluded from federal income tax and sometimes state taxes. Understanding the distinction helps investors optimize their portfolio by minimizing tax liability while maximizing net returns.

Key Differences Between Taxable and Tax-Exempt Interest

Taxable interest income is subject to federal and state income taxes, commonly earned from sources such as corporate bonds, savings accounts, and CDs, while tax-exempt interest typically comes from municipal bonds and is free from federal income tax, sometimes also exempt from state taxes if issued within the taxpayer's state. The key differences include the tax treatment of the interest earned, reporting requirements on tax returns, and potential impact on other taxable income thresholds. Understanding these distinctions is crucial for investors aiming to optimize after-tax returns and comply with IRS reporting rules.

How Taxable Interest Impacts Your Investment Returns

Taxable interest directly reduces your overall investment returns by increasing your tax liability, meaning a larger portion of your earnings is paid to the government. Unlike tax-exempt interest, such as municipal bond income, taxable interest is subject to federal income tax and potentially state taxes, which can significantly diminish your net gains. Monitoring taxable interest income is crucial for effective tax planning and maximizing after-tax investment performance.

The Benefits of Tax-Exempt Interest Investments

Tax-exempt interest investments generate income free from federal income tax, enhancing after-tax returns compared to taxable interest. Municipal bonds are a primary source of tax-exempt interest, offering state and local tax advantages, especially for investors in higher tax brackets. These investments provide diversified portfolio benefits while reducing tax liability, supporting long-term wealth accumulation.

Common Sources of Taxable Interest Income

Common sources of taxable interest income include savings accounts, certificates of deposit (CDs), corporate bonds, and Treasury securities. Interest earned on these instruments is subject to federal income tax and may also be taxable at the state level, depending on the jurisdiction. Investors should report this income accurately to avoid penalties and optimize their investment tax strategy.

Popular Tax-Exempt Investment Options

Tax-exempt interest primarily comes from municipal bonds, which offer income free from federal income tax and sometimes state tax, making them attractive for investors in higher tax brackets. Popular tax-exempt investment options include Series EE and Series I savings bonds issued by the U.S. Treasury, which provide interest exempt from state and local taxes when used for qualified educational expenses. Investing in these tax-exempt instruments can enhance after-tax returns compared to taxable interest from corporate bonds or savings accounts.

Federal and State Tax Implications for Interest Income

Taxable interest income, such as that from corporate bonds or savings accounts, is subject to federal income tax and may also be taxed by state authorities depending on the state's tax regulations. Tax-exempt interest, typically earned from municipal bonds, is generally exempt from federal income tax and often exempt from state taxes if the bond is issued within the investor's state of residence. Understanding these distinctions helps investors optimize after-tax returns by selecting investments aligned with their federal and state tax situations.

Choosing Between Taxable and Tax-Exempt Interest Investments

Taxable interest investments generally offer higher yields but are subject to federal and state income taxes, impacting overall returns. Tax-exempt interest, often from municipal bonds, provides income free from federal taxes and sometimes state taxes, which can be advantageous for investors in higher tax brackets. Evaluating the effective after-tax return helps investors decide whether the tax savings from exempt interest outweigh the typically lower yields compared to taxable options.

Tax Filing and Reporting Requirements for Interest Income

Taxable interest income must be reported on IRS Form 1040, typically using Schedule B if total interest exceeds $1,500, with institutions providing Form 1099-INT to detail interest earned. Tax-exempt interest, such as from municipal bonds, is reported on Form 1040 but generally not subject to federal income tax, requiring accurate disclosure on Schedule B for state tax considerations. Proper distinction between taxable and tax-exempt interest is essential for compliance and accurate calculation of taxable income to avoid penalties during tax filing.

Strategies to Optimize Investment Income Tax Efficiency

Maximizing investment income tax efficiency involves prioritizing tax-exempt interest from municipal bonds while balancing taxable interest from corporate bonds and savings accounts to optimize after-tax returns. Utilizing tax-advantaged accounts like IRAs and 401(k)s can shield taxable interest from immediate taxation, enhancing compounding growth. Strategic asset location--placing high-taxable interest investments in tax-deferred accounts and tax-exempt securities in taxable accounts--further reduces tax liabilities and improves overall portfolio performance.

Related Important Terms

Yield Curve Arbitrage

Taxable interest generates income subject to federal and state income taxes, affecting net returns on yield curve arbitrage strategies by increasing effective borrowing costs or reducing after-tax profits. Tax-exempt interest, often derived from municipal bonds, provides a tax advantage that can enhance yield curve arbitrage by allowing investors to capture spreads with lower tax liabilities, improving arbitrage efficiency and risk-adjusted returns.

Municipal Bond Laddering

Taxable interest from corporate bonds is subject to federal and state income taxes, reducing net returns, whereas tax-exempt interest from municipal bond laddering provides steady, federally tax-free income streams often exempt from state taxes as well. Municipal bond laddering strategically staggers maturities to manage interest rate risk, enhance liquidity, and maximize tax efficiency, making it a favored approach for investors seeking predictable, tax-advantaged income.

TEFRA Withholding

TEFRA withholding applies primarily to taxable interest income, requiring payers to withhold a specific percentage to ensure tax compliance on investment earnings. Tax-exempt interest, typically from municipal bonds, is not subject to TEFRA withholding, allowing investors to retain full interest amounts without mandatory deductions.

OID (Original Issue Discount) Interest

Original Issue Discount (OID) interest is generally classified as taxable interest and must be reported as ordinary income even if the bondholder does not receive the interest payments until maturity. In contrast, tax-exempt interest, often associated with municipal bonds, does not include OID income and is excluded from federal income tax, providing investors with a tax-advantaged way to earn interest income.

Capital Structure Optimization

Taxable interest from corporate bonds increases after-tax cost of debt, influencing capital structure decisions toward more tax-efficient financing strategies, while tax-exempt interest from municipal bonds reduces taxable income, enhancing net returns and enabling firms to optimize leverage ratios for lower overall capital costs. Balancing taxable and tax-exempt interest sources is critical in capital structure optimization to minimize weighted average cost of capital and boost shareholder value.

Build America Bonds (BABs)

Build America Bonds (BABs) generate taxable interest income that must be reported on federal tax returns, unlike tax-exempt municipal bonds whose interest is excluded from federal taxes. Investors in BABs benefit from federally subsidized interest payments, but the interest earned is subject to federal income tax, impacting overall after-tax returns.

Advance Refunding Interest

Advance refunding interest often generates taxable interest income, as it is derived from bonds issued to refinance existing debt before maturity, with the interest subject to federal income tax. In contrast, interest income from tax-exempt bonds used for advance refunding may qualify for exemption under specific municipal bond regulations, reducing overall tax liability for investors.

Private Activity Bonds (PAB)

Interest earned from Private Activity Bonds (PAB) typically counts as taxable interest for federal income tax purposes despite many municipal bonds being tax-exempt. Investors should carefully evaluate PAB interest income since it may be subject to regular federal income tax, unlike most other municipal bond interest that is excluded from federal tax.

Taxable Equivalent Yield

Taxable equivalent yield calculates the yield on a tax-exempt investment as if it were taxable, providing investors with a standardized comparison to taxable interest income. This metric is essential for evaluating municipal bonds versus corporate bonds, especially by applying the formula: Tax-Exempt Yield / (1 - Tax Bracket).

Crossover Yield Analysis

Crossover yield analysis compares taxable interest rates with tax-exempt interest rates to determine the point where an investor benefits equally from both, considering their marginal tax bracket. This evaluation helps investors optimize after-tax returns by identifying when tax-exempt bonds offer a superior yield compared to taxable investments.

Taxable Interest vs Tax-Exempt Interest for investment income Infographic

moneydiff.com

moneydiff.com