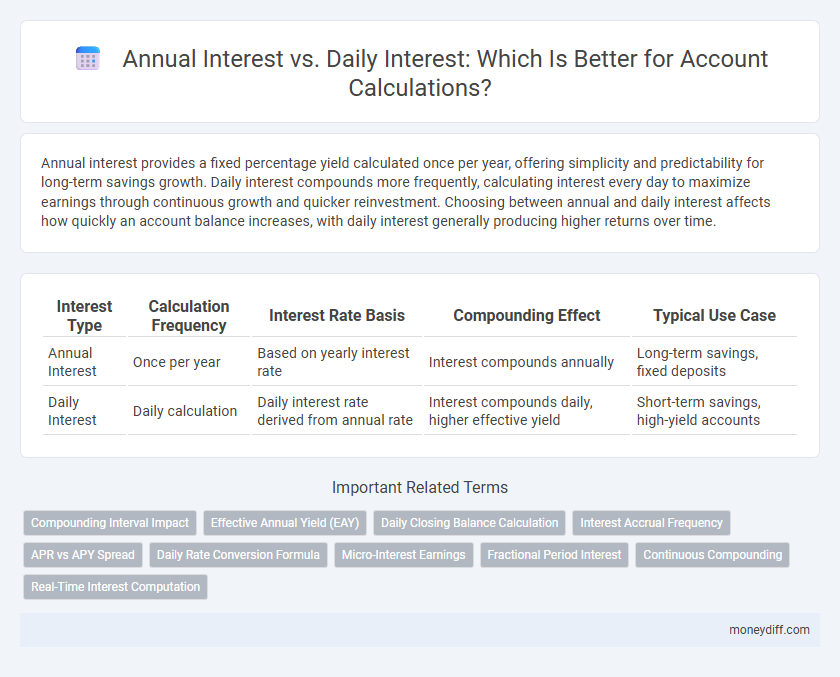

Annual interest provides a fixed percentage yield calculated once per year, offering simplicity and predictability for long-term savings growth. Daily interest compounds more frequently, calculating interest every day to maximize earnings through continuous growth and quicker reinvestment. Choosing between annual and daily interest affects how quickly an account balance increases, with daily interest generally producing higher returns over time.

Table of Comparison

| Interest Type | Calculation Frequency | Interest Rate Basis | Compounding Effect | Typical Use Case |

|---|---|---|---|---|

| Annual Interest | Once per year | Based on yearly interest rate | Interest compounds annually | Long-term savings, fixed deposits |

| Daily Interest | Daily calculation | Daily interest rate derived from annual rate | Interest compounds daily, higher effective yield | Short-term savings, high-yield accounts |

Annual Interest vs Daily Interest: Key Differences Explained

Annual interest is calculated based on the total interest accrued over a year, providing a comprehensive view of earnings or costs on an account, while daily interest is computed each day, reflecting more frequent compounding effects. Daily interest offers more precise calculations for accounts with variable balances or frequent transactions, leading to potentially higher effective returns or costs due to interest compounding daily. Understanding these differences is crucial for optimizing account management and accurately predicting financial outcomes.

How Daily Interest Calculation Impacts Your Earnings

Daily interest calculation compounds earnings more frequently than annual interest, resulting in higher overall returns on your account balance. By crediting interest every day, the invested principal grows continuously, amplifying the effects of compounding and increasing your total interest earned throughout the year. This method benefits savers by maximizing earnings compared to accounts using a simple annual interest calculation.

The Benefits of Annual Interest for Long-Term Savings

Annual interest offers consistent growth by compounding once per year, maximizing returns for long-term savings accounts through higher effective yield over extended periods. This method reduces the complexity of frequent calculations and helps investors plan finances with predictable accrued earnings. Compared to daily interest, annual interest minimizes volatility and fosters disciplined saving habits that benefit retirement funds and major future expenses.

Daily Interest: Maximizing Short-Term Account Growth

Daily interest compounds more frequently than annual interest, allowing account balances to grow faster by earning interest on previously accrued amounts each day. This method is especially beneficial for short-term investments or savings accounts where maximizing daily compound returns can significantly increase the total yield within a shorter period. Financial institutions offering daily interest rates typically calculate interest based on the account's daily closing balance, ensuring precise and timely growth.

Annual vs Daily Interest: Which Offers Better Returns?

Annual interest compounds once per year, often resulting in higher effective returns compared to daily interest, which compounds every day but at a lower rate per period. Daily interest benefits from more frequent compounding, accelerating growth when rates are comparable, but careful calculation of the annual percentage yield (APY) determines true profitability. Evaluating account terms, compounding frequency, and APY helps investors decide whether annual or daily interest offers better returns for their specific financial goals.

Understanding Compounding Frequency in Interest Calculations

Annual interest compounds once per year, resulting in interest calculated on the principal and accumulated interest after a full 12-month period, whereas daily interest compounds every day, leading to interest being calculated and added to the principal 365 times annually. The compounding frequency directly impacts the effective interest rate, with daily compounding generating higher returns over time due to interest earning interest more frequently. Understanding the difference between annual and daily compounding is crucial for accurate account calculations and optimizing investment or loan growth.

Daily Interest Accounts: Pros and Cons for Investors

Daily interest accounts calculate earned interest based on the account balance each day, allowing for more frequent compounding and potentially higher returns compared to annual interest accounts. Investors benefit from increased liquidity and the ability to capitalize on daily changes in their balance, but must also manage more complex tracking and potential fluctuations in interest income. However, the compounding effect in daily interest accounts can significantly enhance long-term growth, making them attractive for investors aiming for steady accumulation.

Annual Interest Calculation Methods Demystified

Annual interest calculation methods, such as simple interest and compound interest, significantly impact the total earnings on an account compared to daily interest calculations. Simple annual interest is computed based on the principal amount over a year, while compound interest compounds periodically, amplifying growth through interest-on-interest effects. Daily interest calculations divide the annual rate by 365, applying interest to the balance each day, resulting in potentially higher returns due to more frequent compounding.

Impact of Interest Compounding on Account Balances

Annual interest compounds less frequently than daily interest, resulting in lower overall returns on account balances over time. Daily interest calculations enable interest to be added to the principal balance more often, accelerating the growth through the effect of compounding. The impact of interest compounding significantly enhances account balances, with more frequent compounding periods providing exponential growth benefits.

Choosing Between Annual and Daily Interest for Financial Goals

Choosing between annual and daily interest significantly impacts account growth and financial goals. Daily interest compounds more frequently, potentially yielding higher returns over time compared to annual interest, which compounds once per year. Evaluating factors like investment duration and cash flow needs helps determine whether daily compounding or annual compounding aligns best with your financial objectives.

Related Important Terms

Compounding Interval Impact

Annual interest compounds once per year, resulting in slower growth compared to daily interest, which compounds 365 times annually and accelerates the accumulation of earned interest. The frequency of compounding intervals directly impacts the effective annual rate (EAR), with daily compounding generating higher returns than annual compounding for the same nominal interest rate.

Effective Annual Yield (EAY)

Annual Interest compounds less frequently than Daily Interest, resulting in a lower Effective Annual Yield (EAY) when compared to daily compounding methods. Daily Interest calculations leverage more frequent compounding periods, maximizing the EAY by effectively increasing the investment's growth through interest-on-interest effects.

Daily Closing Balance Calculation

Daily interest uses the account's daily closing balance to calculate precise earnings by applying the interest rate each day, reflecting actual fluctuations in the account. Annual interest rates divided by 365 allow for daily compounding, which can result in higher overall returns compared to applying interest once per year based on an average balance.

Interest Accrual Frequency

Annual interest accrual compounds once per year, resulting in a singular interest application that can yield lower effective returns compared to daily interest, which compounds interest every day, increasing overall earnings through more frequent addition of interest to the principal. The frequency of interest accrual directly impacts account growth, with daily interest offering the advantage of accelerated compounding, making it crucial for accurate account calculations and maximizing investment benefits.

APR vs APY Spread

Annual Percentage Rate (APR) measures the yearly interest without compounding, while Annual Percentage Yield (APY) reflects the effective annual interest with daily compounding considered, often resulting in a higher return. The spread between APR and APY highlights the impact of compounding frequency on account calculations, crucial for accurately comparing investment or loan yields.

Daily Rate Conversion Formula

The daily interest rate is calculated by dividing the annual interest rate by 365, allowing for precise daily compounding and accurate account balance updates. This conversion formula ensures interest accrual reflects the time value of money on a daily basis, improving financial modeling and client transparency.

Micro-Interest Earnings

Annual interest rates provide a fixed percentage return calculated once per year, while daily interest compounds micro-interest earnings by applying fractional interest amounts every day, significantly increasing overall account growth in high-frequency compounding scenarios. Micro-interest earnings leverage daily compounding to maximize returns on small balances, making them crucial for accounts with frequent transactions or low principal amounts.

Fractional Period Interest

Annual interest calculates earnings once per year and may overlook precise gains during shorter periods, whereas daily interest accounts for fractional periods by compounding interest every day, providing more accurate and timely growth in account balances. This granular calculation method benefits accounts with frequent transactions or partial periods, optimizing the total interest accrued over time.

Continuous Compounding

Annual interest is typically calculated once per year, while daily interest involves computations based on daily balances, but continuous compounding applies interest instantaneously and infinitely often, maximizing the growth of the account balance over time. Continuous compounding uses the formula A = P * e^(rt), where P is the principal, r is the annual interest rate, t is time in years, and e is Euler's number, reflecting the most precise and optimal method for interest accumulation.

Real-Time Interest Computation

Annual interest is calculated once per year based on the principal, while daily interest accrues each day and compounds in real-time, enabling more accurate and timely account balance updates. Real-time interest computation leverages daily interest rates to reflect instant growth, enhancing financial transparency and optimizing earnings on savings or investment accounts.

Annual Interest vs Daily Interest for account calculations. Infographic

moneydiff.com

moneydiff.com