Bank savings interest offers a stable, low-risk return that benefits personal financial growth but typically yields lower rates compared to green bond interest. Green bonds provide higher interest rates while actively supporting environmental projects, making them an attractive option for investors seeking to align profits with sustainability goals. Investing in green bonds not only promotes ecological impact but also diversifies portfolio returns beyond traditional savings accounts.

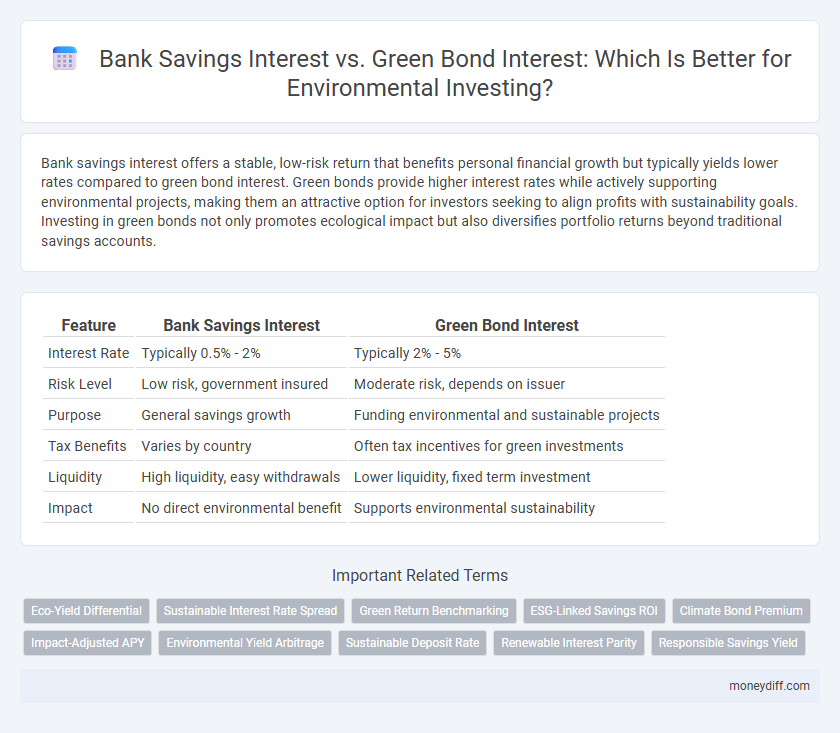

Table of Comparison

| Feature | Bank Savings Interest | Green Bond Interest |

|---|---|---|

| Interest Rate | Typically 0.5% - 2% | Typically 2% - 5% |

| Risk Level | Low risk, government insured | Moderate risk, depends on issuer |

| Purpose | General savings growth | Funding environmental and sustainable projects |

| Tax Benefits | Varies by country | Often tax incentives for green investments |

| Liquidity | High liquidity, easy withdrawals | Lower liquidity, fixed term investment |

| Impact | No direct environmental benefit | Supports environmental sustainability |

Understanding Bank Savings Interest: Fundamentals and Trends

Bank savings interest rates typically range from 0.01% to 2.5%, reflecting the monetary policy and economic conditions set by central banks. These rates offer low risk with guaranteed returns but are often below inflation, limiting real growth potential for investors. Understanding the fluctuations in bank savings interest helps investors weigh secure, liquid options against alternative instruments like green bonds that may offer higher returns tied to environmental impact.

What Are Green Bonds? An Overview for Investors

Green bonds are fixed-income securities issued to finance projects with positive environmental benefits, attracting investors seeking sustainable investment opportunities. Unlike traditional bank savings interest, typically offering stable but lower returns, green bonds often provide competitive yields while supporting renewable energy, pollution reduction, and climate change mitigation initiatives. Investing in green bonds aligns financial goals with environmental impact, reflecting a growing demand for responsible investing that balances profitability with sustainability.

Comparing Bank Savings and Green Bonds: Key Differences

Bank savings interest rates typically range between 0.01% and 2%, offering low-risk, liquid returns, whereas green bond interest rates often yield higher returns around 3% to 5%, reflecting investment in environmentally sustainable projects. Green bonds fund renewable energy, clean transportation, and climate adaptation, providing both financial growth and positive environmental impact compared to traditional bank savings accounts. Investors prioritizing environmental responsibility may favor green bonds for their combination of sustainable impact and potentially higher returns despite slightly increased risk.

Interest Rate Mechanics: Savings Accounts vs Green Bonds

Bank savings interest rates are typically fixed or variable, influenced by central bank policies and often offer lower yields due to minimal risk and high liquidity. Green bond interest rates, tied to environmental project outcomes, may offer higher returns reflecting project-specific risks and longer maturities. Investors seeking to align financial returns with sustainability goals often weigh savings account stability against green bond potential for enhanced interest earnings linked to environmental impact.

Environmental Impact: How Green Bonds Drive Change

Green bonds generate interest by funding projects that reduce carbon emissions, promote renewable energy, and support sustainable infrastructure, directly contributing to environmental preservation. Unlike traditional bank savings interest, which offers financial returns without ecological benefits, green bond interest links earnings to measurable positive environmental impact. Investors in green bonds not only gain competitive returns but also drive systemic change towards a low-carbon economy.

Risks and Rewards: Evaluating Investment Safety

Bank savings interest typically offers lower but more stable returns with minimal risk, providing a secure option for conservative investors. Green bond interest, linked to environmental projects, may yield higher returns but carries risks such as project performance variability and market fluctuations. Assessing these factors helps investors balance the safety of capital preservation against the potential for impactful, sustainable gains.

Potential Returns: Real-World Examples and Projections

Bank savings accounts typically offer interest rates ranging from 0.5% to 2%, providing stable but modest returns with minimal risk, while green bonds historically yield between 2% and 5%, reflecting higher potential returns associated with environmental project financing. For instance, the Climate Bonds Initiative reported an average green bond yield of 3.5% in 2023, outperforming many traditional savings products. Projections indicate that growing demand for sustainable investment options could drive green bond interest rates upward as governments and corporations increase funding for renewable energy and climate resilience projects.

Sustainability and Ethics: Investing for a Greener Future

Bank savings interest offers low, stable returns with minimal risk but lacks direct environmental impact, while green bond interest provides moderate returns by financing renewable energy and sustainable infrastructure projects. Investing in green bonds aligns financial goals with ethical commitments, promoting sustainability by supporting environmentally responsible initiatives. Choosing green bonds contributes to a greener future by channeling capital toward carbon reduction, biodiversity preservation, and climate resilience efforts.

Tax Implications: Savings Accounts vs Green Bonds

Bank savings interest is typically subject to standard income tax rates, reducing the net returns for investors. Green bonds often offer tax incentives, such as tax-exempt or tax-credit returns, encouraging investments in environmentally sustainable projects. These tax benefits make green bonds a more attractive option for investors seeking both financial returns and environmental impact.

Choosing the Best Option: Portfolio Strategies for Different Goals

Bank savings interest offers low-risk, fixed returns ideal for short-term liquidity and emergency funds, typically yielding around 0.5% to 2% annually depending on the institution. Green bond interest, often ranging from 2% to 6%, provides moderate returns while directly supporting environmentally sustainable projects, aligning with impact investing strategies. Selecting between these options depends on individual financial goals, risk tolerance, and commitment to environmental impact, where a diversified portfolio can balance stable income with socially responsible growth.

Related Important Terms

Eco-Yield Differential

Bank savings interest rates typically range between 0.01% and 1.5%, offering low returns with minimal environmental impact, while green bond interest rates can yield 2% to 6%, reflecting an eco-yield differential that incentivizes investment in sustainability projects. This eco-yield differential highlights the financial advantage of green bonds, which not only provide higher returns but also support renewable energy, conservation, and climate resilience efforts.

Sustainable Interest Rate Spread

Sustainable interest rate spread compares the returns on traditional bank savings accounts with green bond interest rates, highlighting the financial incentives for environmentally responsible investments. Green bonds often offer competitive interest rates that balance profitability with positive environmental impact, making them attractive for investors seeking both financial returns and sustainability.

Green Return Benchmarking

Green Bond Interest rates typically offer competitive returns compared to traditional bank savings interest, aligning financial gain with environmental impact. Benchmarking green returns involves comparing these yields to standard savings rates while factoring in sustainability metrics, highlighting the dual value of ecological benefits and attractive financial performance.

ESG-Linked Savings ROI

ESG-linked savings typically offer lower nominal interest rates than traditional bank savings but generate higher long-term value through positive environmental impact and sustainable growth. Green bond interest rates combine moderate financial returns with measurable ecological benefits, making them an attractive option for investors prioritizing green portfolio diversification and carbon footprint reduction.

Climate Bond Premium

Green bond interest rates often include a Climate Bond Premium, reflecting investor willingness to accept lower yields for environmental benefits, contrasting with higher, traditional bank savings interest that lacks such sustainability incentives. This premium incentivizes capital flow toward climate-friendly projects, enhancing the financial appeal of green bonds in environmental investing.

Impact-Adjusted APY

Bank savings interest typically offers a fixed, lower APY that provides steady, risk-free returns, while green bonds feature impact-adjusted APYs that factor in both financial returns and measurable environmental benefits, appealing to investors seeking sustainable impact alongside profit. Impact-adjusted APY on green bonds integrates carbon reduction metrics or renewable energy project outcomes, enhancing traditional yield calculations with social and ecological value.

Environmental Yield Arbitrage

Bank savings interest rates typically range from 0.01% to 1%, offering minimal returns with low risk, while green bonds often yield between 1.5% and 3%, providing moderate returns alongside positive environmental impact. Environmental yield arbitrage leverages the higher interest of green bonds to maximize financial gains while promoting sustainable projects and reducing carbon footprints.

Sustainable Deposit Rate

Bank savings interest rates typically range between 0.01% and 1.5%, offering low returns with minimal environmental impact, whereas green bond interest rates average around 2% to 5%, providing investors a sustainable deposit rate that supports renewable energy and climate projects. Sustainable deposit rates in green bonds not only yield higher financial returns but also drive capital towards eco-friendly initiatives, aligning investment growth with environmental responsibility.

Renewable Interest Parity

Bank savings interest rates generally remain lower due to traditional financial models, while green bond interest offers premium returns that reflect growing demand for sustainable assets under Renewable Interest Parity conditions. This parity principle ensures investors receive comparable yields adjusted for environmental risk and regulatory incentives, promoting capital flows into renewable energy projects.

Responsible Savings Yield

Bank savings interest rates typically offer low, stable returns with minimal risk, while green bond interest rates provide competitive yields aimed at financing sustainable environmental projects, aligning financial growth with ecological responsibility. Investors seeking responsible savings yield may prefer green bonds for their potential to generate moderate interest income alongside positive environmental impact.

Bank Savings Interest vs Green Bond Interest for environmental investing. Infographic

moneydiff.com

moneydiff.com