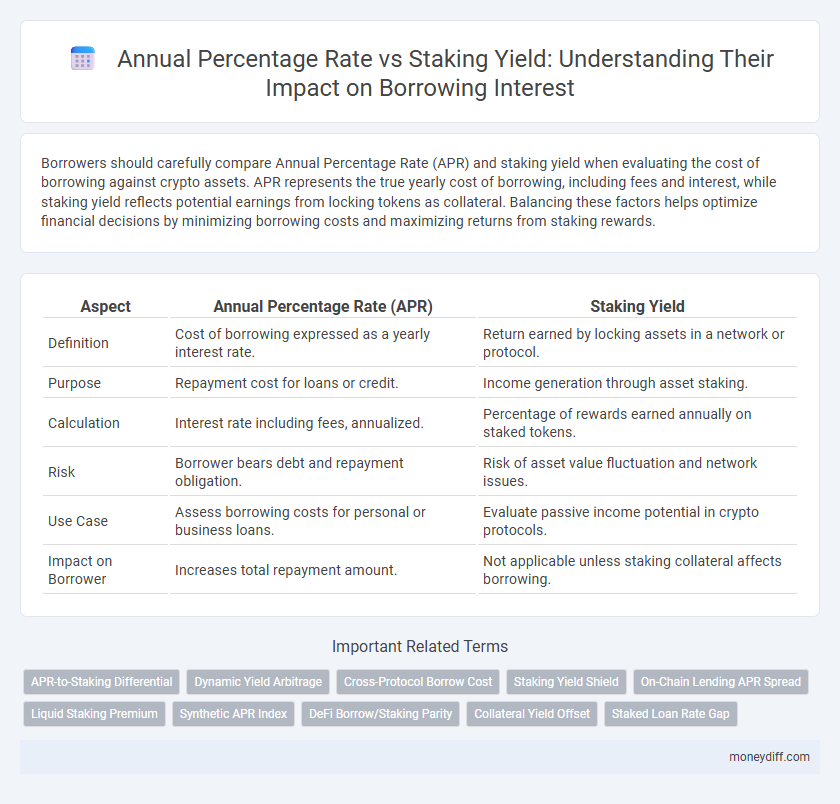

Borrowers should carefully compare Annual Percentage Rate (APR) and staking yield when evaluating the cost of borrowing against crypto assets. APR represents the true yearly cost of borrowing, including fees and interest, while staking yield reflects potential earnings from locking tokens as collateral. Balancing these factors helps optimize financial decisions by minimizing borrowing costs and maximizing returns from staking rewards.

Table of Comparison

| Aspect | Annual Percentage Rate (APR) | Staking Yield |

|---|---|---|

| Definition | Cost of borrowing expressed as a yearly interest rate. | Return earned by locking assets in a network or protocol. |

| Purpose | Repayment cost for loans or credit. | Income generation through asset staking. |

| Calculation | Interest rate including fees, annualized. | Percentage of rewards earned annually on staked tokens. |

| Risk | Borrower bears debt and repayment obligation. | Risk of asset value fluctuation and network issues. |

| Use Case | Assess borrowing costs for personal or business loans. | Evaluate passive income potential in crypto protocols. |

| Impact on Borrower | Increases total repayment amount. | Not applicable unless staking collateral affects borrowing. |

Annual Percentage Rate vs Staking Yield: Key Differences Explained

Annual Percentage Rate (APR) measures the total cost of borrowing annually, including interest and fees, providing a clear view of loan expenses. Staking yield represents the return earned by locking cryptocurrencies in a blockchain network, often expressed as an annual percentage based on rewards or dividends. Unlike APR, which indicates a borrowing cost, staking yield reflects passive income potential, highlighting their fundamentally different roles in financial decision-making.

How APR Impacts Borrowers Compared to Staking Yield

The Annual Percentage Rate (APR) directly affects borrowers by determining the total cost of borrowing, including interest and fees, which can significantly increase repayment amounts over time. Unlike staking yield, which offers potential passive income by holding assets, APR represents an expense that reduces a borrower's net financial position. High APRs discourage borrowing and can outweigh benefits gained from staking yields, making it crucial for borrowers to minimize APR to optimize overall returns.

Understanding Staking Yield in Crypto Loans

Staking yield in crypto loans represents the earnings generated by locking cryptocurrency as collateral, often higher than traditional Annual Percentage Rate (APR) on borrowed funds. This yield depends on factors such as network inflation, validator rewards, and the specific blockchain protocol's incentive mechanisms. Comparing staking yield to APR helps borrowers evaluate the net cost or profit from borrowing while earning passive income through staking rewards.

Calculating APR: What Borrowers Need to Know

Borrowers must understand that the Annual Percentage Rate (APR) reflects the true cost of borrowing by including interest rates and additional fees over a year, offering a comprehensive measure beyond just nominal interest. Calculating APR requires accounting for compounding frequency, loan term, and any upfront or ongoing charges, which can significantly impact the total repayment amount. Comparing APR to staking yield is crucial for borrowers considering alternative financing options or DeFi protocols, as staking yields represent potential earnings rather than borrowing costs.

Staking Yield: Hidden Opportunities for Borrowers

Staking yield offers borrowers an often overlooked advantage by allowing them to earn rewards while maintaining loan obligations, effectively reducing the net borrowing cost compared to traditional Annual Percentage Rate (APR) loans. Unlike APR, which solely represents the cost of borrowing, staking yield can generate passive income that offsets interest expenses, creating hidden financial benefits. Leveraging staking yield strategically turns borrowing into a dual opportunity for capital utilization and asset appreciation.

Comparing Costs: APR vs Staking Yield for Loans

Annual Percentage Rate (APR) represents the true cost of borrowing by including interest and fees, providing a comprehensive measure for loan expenses. Staking yield refers to the returns earned by locking cryptocurrency assets in a network, often serving as an opportunity cost when these assets are used as collateral for loans. Comparing APR with staking yield reveals the net cost of borrowing, highlighting whether the loan expenses outweigh potential staking earnings or if taking the loan offers financial advantage.

Risk Factors: APR Borrowing vs Staking Yield Strategies

Annual Percentage Rate (APR) borrowing carries the risk of accruing debt if interest payments exceed returns, especially in volatile markets. Staking yield strategies may offer passive income but are subject to market fluctuations and lock-up periods that limit liquidity and increase exposure to price drops. Understanding the risk factors between APR borrowing and staking yields is critical for optimizing portfolio performance and avoiding potential financial losses.

Maximizing Savings: Choosing Between APR and Staking Yield

Maximizing savings when borrowing involves comparing the Annual Percentage Rate (APR) and staking yield, where APR represents the total cost of borrowing including interest and fees, while staking yield reflects the potential returns from locking assets in a staking protocol. Borrowers benefit from selecting options where the staking yield exceeds the APR, effectively offsetting borrowing costs and generating net gains. Evaluating platform-specific APRs and staking yields is crucial to optimize financial outcomes in decentralized finance environments.

Real-World Examples: APR vs Staking Yield in Borrowing

Annual Percentage Rate (APR) directly impacts the cost of borrowing, as shown by real-world examples where borrowers face APRs ranging from 5% to 20% depending on creditworthiness and market conditions. In contrast, staking yield--common in decentralized finance (DeFi) platforms--provides a passive income rate often between 8% and 15%, effectively reducing net borrowing costs when leveraged strategically. Comparing APR and staking yield in borrowing reveals how integrating staking returns can offset interest expenses, creating a more cost-efficient financing approach.

Future Trends: Will Staking Yield Replace Traditional APR?

Staking yield is gaining traction as a decentralized finance mechanism offering potentially higher returns than traditional APR on borrowed assets. Future trends indicate a shift towards hybrid models combining staking rewards with conventional interest rates to optimize lender and borrower benefits. As blockchain adoption grows, staking yield could increasingly supplement or partially replace APR in borrowing markets, driven by transparency and programmable smart contracts.

Related Important Terms

APR-to-Staking Differential

The APR-to-Staking Differential measures the gap between the Annual Percentage Rate charged on borrowed funds and the staking yield earned, highlighting the net cost or profit potential for borrowers who stake assets while borrowing. A positive differential indicates a cost exceeding staking returns, while a negative differential reveals an opportunity for arbitrage by earning more through staking than the interest paid on loans.

Dynamic Yield Arbitrage

Dynamic Yield Arbitrage leverages discrepancies between Annual Percentage Rate (APR) on borrowed assets and staking yields to maximize returns by continuously adjusting borrowing and staking positions. This strategy exploits real-time interest rate fluctuations and staking rewards to generate optimized net gains, minimizing borrowing costs while capitalizing on higher staking yields.

Cross-Protocol Borrow Cost

Cross-protocol borrow cost varies significantly as Annual Percentage Rate (APR) directly impacts the expense of loans, while staking yield represents passive income earned on assets locked. Understanding the differential between APR and staking yield helps optimize borrowing strategies by identifying when borrowing costs outweigh potential staking rewards across DeFi platforms.

Staking Yield Shield

Staking Yield Shield offers a strategic advantage by providing predictable staking yields that can offset the higher Annual Percentage Rate (APR) associated with borrowing, enhancing overall portfolio efficiency. By leveraging Staking Yield Shield, borrowers can effectively reduce the net cost of loans through secure and optimized yield generation.

On-Chain Lending APR Spread

On-chain lending APR spread represents the difference between borrowing costs indicated by the Annual Percentage Rate (APR) and the staking yield earned by lenders, directly impacting profitability in decentralized finance (DeFi) protocols. A wider APR spread signals higher net returns for liquidity providers by borrowing at elevated APRs while earning lower staking rewards, crucial for assessing risk-adjusted performance in crypto lending markets.

Liquid Staking Premium

The Annual Percentage Rate (APR) for borrowing typically reflects the cost of debt, while staking yield represents the income earned from locking assets in a protocol; Liquid Staking Premium bridges these by allowing users to earn staking rewards without sacrificing liquidity, often resulting in higher effective returns compared to traditional staking. Understanding the Liquid Staking Premium is crucial for borrowers aiming to optimize their net cost by leveraging liquid staking derivatives that capture staking rewards alongside the ability to access capital.

Synthetic APR Index

The Synthetic APR Index offers a comprehensive metric by incorporating both borrowing costs reflected in the Annual Percentage Rate (APR) and potential earnings from staking yield, providing a clearer picture of net interest impact. This index enables borrowers to assess the true cost of borrowing against staking returns, optimizing financial strategies in decentralized finance (DeFi) platforms.

DeFi Borrow/Staking Parity

Annual Percentage Rate (APR) represents the cost of borrowing in DeFi platforms, reflecting the interest borrowers must pay annually, while staking yield indicates the annualized return earned by locking assets in staking protocols. Understanding DeFi borrow/staking parity helps users optimize capital efficiency by comparing APR against staking yield, identifying when staking returns outweigh borrowing costs or vice versa.

Collateral Yield Offset

When borrowing against crypto assets, the Annual Percentage Rate (APR) represents the cost of the loan, while staking yield from collateral can offset this expense by generating passive income. This Collateral Yield Offset effectively reduces net borrowing costs, optimizing overall financial efficiency in decentralized finance (DeFi) platforms.

Staked Loan Rate Gap

The staked loan rate gap highlights the difference between the Annual Percentage Rate (APR) charged on borrowed funds and the higher staking yield earned by collateralizing assets, often incentivizing borrowers to leverage staked positions. A narrower gap reduces borrowing costs relative to staking returns, optimizing capital efficiency for yield-focused investors in decentralized finance ecosystems.

Annual Percentage Rate vs Staking Yield for borrowing. Infographic

moneydiff.com

moneydiff.com