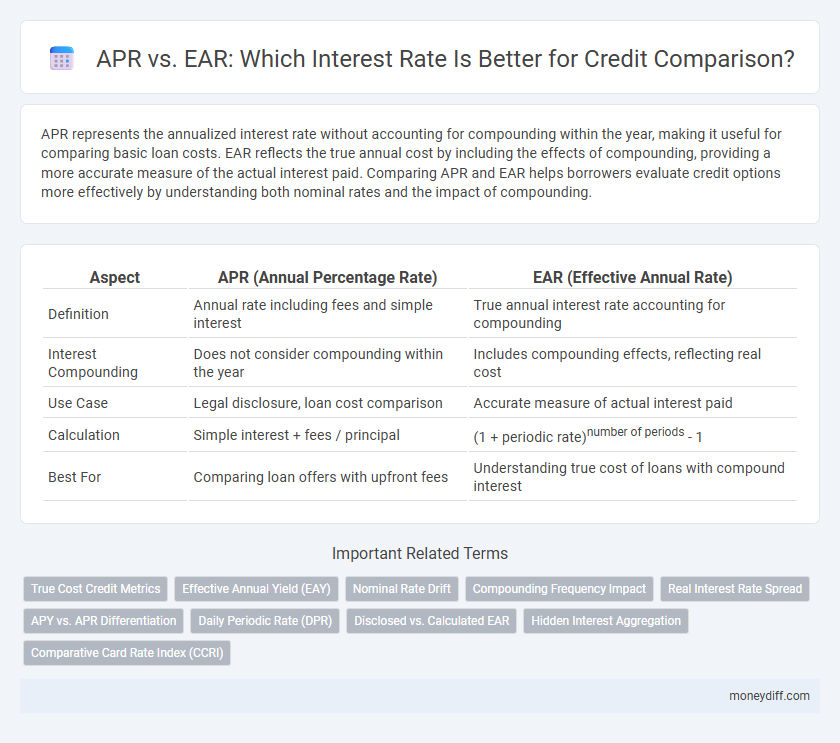

APR represents the annualized interest rate without accounting for compounding within the year, making it useful for comparing basic loan costs. EAR reflects the true annual cost by including the effects of compounding, providing a more accurate measure of the actual interest paid. Comparing APR and EAR helps borrowers evaluate credit options more effectively by understanding both nominal rates and the impact of compounding.

Table of Comparison

| Aspect | APR (Annual Percentage Rate) | EAR (Effective Annual Rate) |

|---|---|---|

| Definition | Annual rate including fees and simple interest | True annual interest rate accounting for compounding |

| Interest Compounding | Does not consider compounding within the year | Includes compounding effects, reflecting real cost |

| Use Case | Legal disclosure, loan cost comparison | Accurate measure of actual interest paid |

| Calculation | Simple interest + fees / principal | (1 + periodic rate)number of periods - 1 |

| Best For | Comparing loan offers with upfront fees | Understanding true cost of loans with compound interest |

Understanding APR and EAR: Key Definitions

APR (Annual Percentage Rate) represents the yearly interest cost of a loan, including fees, expressed as a percentage, making it essential for comparing credit offers. EAR (Effective Annual Rate) accounts for compounding interest within the year, providing a more accurate measure of the true cost of borrowing. Understanding APR and EAR enables consumers to make informed decisions by comparing credit products on a consistent basis.

Why APR and EAR Matter in Credit Decisions

APR represents the annual cost of borrowing, including interest and fees, providing a standardized measure for comparing credit options. EAR accounts for compounding periods, reflecting the true annual interest rate paid on a loan or earned on an investment. Understanding both APR and EAR enables borrowers to make informed credit decisions by accurately assessing loan costs and comparing different credit products.

Calculating APR: What’s Included?

Calculating APR involves including the nominal interest rate combined with fees and other costs spread over the loan's term, providing a comprehensive measure of borrowing cost. Unlike EAR, which focuses solely on the compounding effect of interest, APR captures administrative fees, origination charges, and insurance costs, offering a more accurate reflection of total credit expenses. Understanding the components included in APR calculations helps consumers compare credit offers more effectively by revealing the true cost beyond just interest rates.

Breaking Down EAR: The Impact of Compounding

The Effective Annual Rate (EAR) accounts for the impact of compounding periods within a year, making it a more accurate reflection of the true cost of credit compared to the Annual Percentage Rate (APR), which does not consider compounding frequency. EAR calculations factor in how often interest compounds--monthly, quarterly, or daily--thereby increasing the overall interest paid or earned. Understanding EAR is essential for borrowers and investors to compare credit products fairly, as it reveals the actual amount of interest accrued over a year.

Core Differences Between APR and EAR

APR (Annual Percentage Rate) represents the yearly cost of borrowing, including interest and fees, expressed as a simple interest rate without compounding effects. EAR (Effective Annual Rate) accounts for compounding periods within the year, reflecting the actual annual cost of credit by incorporating how often interest is applied. When comparing credit offers, EAR provides a more accurate measure of true borrowing costs, while APR is useful for understanding fees and nominal rates without compounding influence.

Which is More Accurate for Credit Comparison: APR or EAR?

EAR provides a more accurate measure for credit comparison because it accounts for compounding periods within the year, reflecting the true cost of borrowing. APR represents the nominal interest rate without compounding effects, often underestimating the actual cost. Comparing credit offers using EAR ensures a clear understanding of the effective interest paid over time.

How Loan Structure Influences APR and EAR

Loan structure significantly impacts the Annual Percentage Rate (APR) and Effective Annual Rate (EAR) by determining how interest is calculated and compounded over time. Fixed-rate loans typically feature a straightforward APR, while variable-rate loans with frequent compounding periods tend to have a higher EAR due to interest-on-interest effects. Understanding amortization schedules and compounding frequency allows borrowers to better compare credit options by assessing total interest costs reflected through APR and EAR differences.

APR vs EAR Examples: Real-World Credit Scenarios

APR (Annual Percentage Rate) represents the yearly interest rate charged on a loan without compounding, making it simpler but sometimes less accurate for comparisons. EAR (Effective Annual Rate) accounts for the effects of compounding within the year, offering a more precise measure of true loan cost. For example, a credit card with a 12% APR compounded monthly has an EAR of approximately 12.68%, revealing the higher actual interest cost compared to a loan with a similar APR but different compounding frequency.

Tips for Consumers: Choosing the Best Rate

Compare APR (Annual Percentage Rate) and EAR (Effective Annual Rate) to understand the true cost of credit, as APR reflects annual interest including fees, while EAR accounts for compounding effects. Focus on EAR for a more accurate comparison of loans with different compounding periods and prioritize lower EAR to minimize interest payments. Always request both rates from lenders and consider the impact of compounding frequency on your total cost to choose the best credit option.

Common Pitfalls in Comparing APR and EAR

APR often excludes compounding effects, leading to an understated cost of credit compared to EAR, which incorporates these factors for a true annual rate. Lenders may advertise lower APRs without revealing the frequency of compounding, causing consumers to underestimate the actual interest burden. Comparing APR and EAR without adjusting for compounding periods can result in misleading conclusions about loan affordability and effective cost.

Related Important Terms

True Cost Credit Metrics

APR measures the annual cost of borrowing without accounting for compounding fees, providing a basic comparison of loan costs. EAR reflects the effective interest rate including compounding effects, offering a more accurate representation of the true cost of credit over time.

Effective Annual Yield (EAY)

Effective Annual Yield (EAY) provides a more accurate measure of true interest costs compared to Annual Percentage Rate (APR) by accounting for compounding periods within a year. Credit comparison using EAY enables borrowers to evaluate the real financial impact of loan offers, reflecting the actual annualized return or expense on borrowed funds.

Nominal Rate Drift

Nominal Rate Drift impacts APR and EAR by causing the nominal interest rate to vary over time, leading to discrepancies between the annual percentage rate (APR) and the effective annual rate (EAR) when comparing credit offers. Understanding how Nominal Rate Drift affects compounding periods is essential for accurate credit cost evaluation and selecting the most cost-effective loan.

Compounding Frequency Impact

APR (Annual Percentage Rate) reflects the simple interest rate without accounting for compounding effects, while EAR (Effective Annual Rate) incorporates the compounding frequency, providing a more accurate measure of the true cost of credit. Higher compounding frequency increases the EAR significantly compared to the APR, making EAR a crucial factor for consumers when comparing credit offers with different compounding intervals.

Real Interest Rate Spread

The Real Interest Rate Spread measures the difference between the Annual Percentage Rate (APR) and the Effective Annual Rate (EAR), reflecting the true cost of credit after accounting for compounding effects. Understanding this spread helps borrowers compare credit offers by revealing the actual interest burden beyond nominal rates, enabling more informed financial decisions.

APY vs. APR Differentiation

APR (Annual Percentage Rate) represents the yearly interest charge without compounding effects, while EAR (Effective Annual Rate), also known as APY (Annual Percentage Yield), accounts for compounding within the year, providing a more accurate measure of the true cost or yield on credit products. Comparing credit offers using EAR/APY reveals the actual interest burden or earnings, making it a crucial metric for borrowers aiming to understand total financial impact over APR alone.

Daily Periodic Rate (DPR)

The Daily Periodic Rate (DPR) is fundamental in calculating both the Annual Percentage Rate (APR) and the Effective Annual Rate (EAR), as it represents the interest accrued each day on a credit balance. While APR provides a nominal yearly interest without compounding, EAR incorporates the effects of daily compounding by raising (1 + DPR) to the power of 365, offering a more accurate measure of the true cost of credit over a year.

Disclosed vs. Calculated EAR

Disclosed EAR represents the Effective Annual Rate explicitly provided by lenders, incorporating compounding effects for a true cost comparison of credit offers. Calculated EAR derives from the stated APR by factoring in the compounding frequency, revealing the actual annual interest burden often hidden in nominal rates.

Hidden Interest Aggregation

APR (Annual Percentage Rate) often underrepresents the true cost of credit due to hidden interest aggregation from compounding within billing cycles, while EAR (Effective Annual Rate) reflects the actual interest accumulated over a year, providing a more accurate comparison of loan or credit costs. Consumers relying solely on APR risk underestimating total debt burden, making EAR essential for transparent financial decision-making.

Comparative Card Rate Index (CCRI)

The Comparative Card Rate Index (CCRI) evaluates credit offers by comparing the Annual Percentage Rate (APR) and Effective Annual Rate (EAR) to provide a clearer picture of true borrowing costs, accounting for compounding frequency and fees. EAR reflects the real interest accrued annually, making it a more accurate metric than APR for comparing credit card products in competitive markets.

APR vs EAR for credit comparison. Infographic

moneydiff.com

moneydiff.com