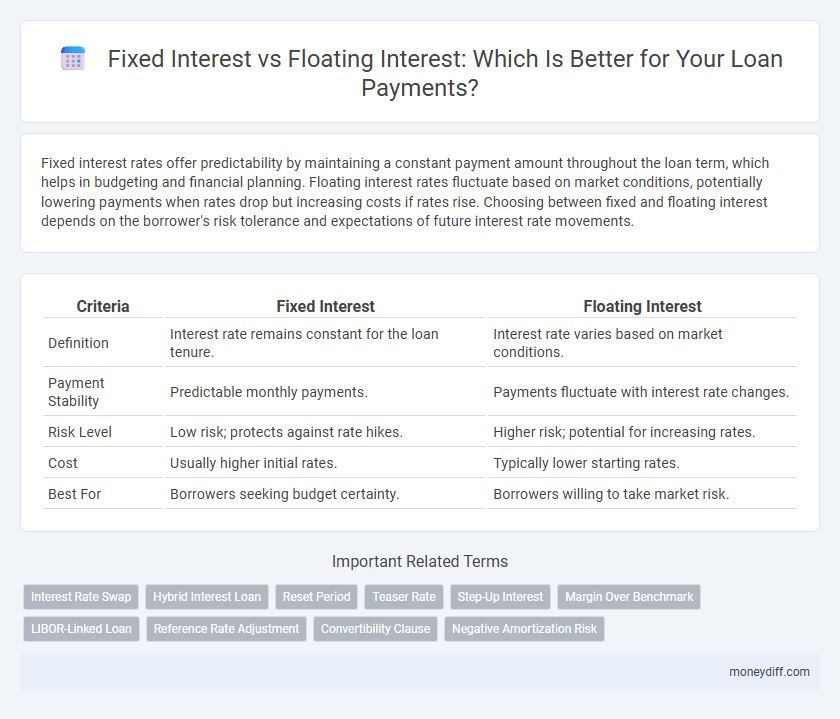

Fixed interest rates offer predictability by maintaining a constant payment amount throughout the loan term, which helps in budgeting and financial planning. Floating interest rates fluctuate based on market conditions, potentially lowering payments when rates drop but increasing costs if rates rise. Choosing between fixed and floating interest depends on the borrower's risk tolerance and expectations of future interest rate movements.

Table of Comparison

| Criteria | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant for the loan tenure. | Interest rate varies based on market conditions. |

| Payment Stability | Predictable monthly payments. | Payments fluctuate with interest rate changes. |

| Risk Level | Low risk; protects against rate hikes. | Higher risk; potential for increasing rates. |

| Cost | Usually higher initial rates. | Typically lower starting rates. |

| Best For | Borrowers seeking budget certainty. | Borrowers willing to take market risk. |

Understanding Fixed and Floating Interest Rates

Fixed interest rates remain constant throughout the loan term, providing predictable monthly payments and protection against market fluctuations. Floating interest rates fluctuate based on benchmark rates like LIBOR or the prime rate, potentially lowering costs when rates fall but increasing payments if rates rise. Choosing between fixed and floating interest depends on risk tolerance, loan duration, and market interest rate trends.

Key Differences Between Fixed and Floating Interest

Fixed interest rates remain constant throughout the loan tenure, providing predictable monthly payments and protection against market fluctuations. Floating interest rates vary according to benchmark rates like the LIBOR or central bank rates, causing payment amounts to rise or fall over time. Borrowers choosing fixed rates benefit from stability, while those opting for floating rates may gain from potential decreases in interest costs when market rates drop.

Pros and Cons of Fixed Interest Loans

Fixed interest loans provide predictable monthly payments, making budgeting easier and protecting borrowers from rising interest rates. However, they typically come with higher initial rates compared to floating interest loans, which can be disadvantageous when market rates decline. Borrowers face limited flexibility, as refinancing or prepayment penalties may apply, potentially increasing overall loan costs.

Pros and Cons of Floating Interest Loans

Floating interest loans offer flexibility with rates that adjust based on market conditions, often leading to lower initial payments compared to fixed interest loans. Borrowers benefit from potential rate decreases, but face uncertainty and the risk of increased payments if interest rates rise. These loans suit individuals with variable income or those planning short-term borrowing, though rate volatility requires careful financial planning.

Impact of Market Changes on Loan Payments

Fixed interest rates provide stability in loan payments by maintaining a constant rate regardless of market fluctuations, ensuring predictable monthly repayments. Floating interest rates fluctuate in response to changes in benchmark rates such as the prime rate or LIBOR, causing loan payments to vary and potentially increase during rising market conditions. Borrowers with floating rates face uncertainty as payment amounts can escalate with economic shifts, impacting overall loan affordability.

Which Borrower Should Choose Fixed Interest?

Borrowers seeking predictable monthly payments and protection against rising interest rates should choose fixed interest loans for financial stability. Fixed interest is ideal for individuals with fixed incomes or long-term financial plans who want to avoid payment fluctuations. This option provides certainty by locking in the interest rate for the loan term, reducing payment volatility and budgeting risks.

When Floating Interest Makes Sense

Floating interest rates make sense when borrowers expect interest rates to remain stable or decrease over the loan term, potentially lowering overall payment costs compared to fixed rates. This option benefits those with flexible budgets who can handle rate fluctuations and capitalize on market conditions to save money. Businesses and individuals anticipating short-term loans or refinancing before rates rise often prefer floating interest to minimize interest expenses.

Comparing Long-term Loan Costs

Fixed interest rates provide consistent payment amounts throughout the loan term, offering predictability and protection against market fluctuations. Floating interest rates fluctuate with benchmark rates like LIBOR or SOFR, which can lead to lower initial costs but increased repayment uncertainty over time. Comparing long-term loan costs, fixed interest loans often result in higher initial payments but stable expenses, while floating rates may save money if interest rates remain low but risk escalating costs in a rising rate environment.

Risk Management in Interest Rate Selection

Fixed interest rates provide predictability in loan payments, enabling borrowers to manage financial risk by locking in a constant repayment amount regardless of market fluctuations. Floating interest rates, while potentially lower initially, expose borrowers to the risk of rising interest costs as rates adjust with market conditions, increasing uncertainty in budgeting and cash flow management. Effective risk management in interest rate selection involves balancing the stability of fixed rates against the cost-saving potential and rate variability of floating rates, depending on the borrower's financial strategy and market outlook.

Making the Right Choice: Fixed vs Floating Interest

Fixed interest loans offer predictable monthly payments and shield borrowers from market fluctuations, ideal for those seeking stability in budgeting. Floating interest rates fluctuate with the market, potentially lowering costs when rates drop but increasing payment uncertainty. Evaluating personal financial goals, risk tolerance, and current economic trends is crucial in selecting between fixed and floating interest options.

Related Important Terms

Interest Rate Swap

An Interest Rate Swap allows borrowers to exchange fixed interest payments for floating rates or vice versa, managing exposure to interest rate fluctuations. This financial derivative is commonly used to hedge against rising rates in floating loans or to capitalize on potential rate decreases in fixed loans.

Hybrid Interest Loan

Hybrid interest loans combine fixed and floating interest rates, offering borrowers the stability of fixed payments for an initial period followed by the flexibility of floating rates that fluctuate with market conditions. This structure balances predictable budgeting with the potential for lower costs when interest rates decline, making it a strategic choice for managing loan payments amid varying economic environments.

Reset Period

Fixed interest loans maintain a constant interest rate throughout the loan term, providing predictable payments and no reset periods. Floating interest loans have variable rates that reset periodically based on market benchmarks, causing payment amounts to fluctuate with each reset period.

Teaser Rate

Teaser rates on loans offer temporarily low fixed interest rates that attract borrowers before adjusting to higher floating interest rates, which fluctuate with market conditions. Understanding the impact of teaser rates helps borrowers assess potential payment increases when the initial fixed period ends and the loan shifts to a variable rate.

Step-Up Interest

Step-up interest rates start low and increase at predetermined intervals, offering initial payment relief compared to fixed interest loans that maintain constant rates throughout the term. Floating interest rates fluctuate based on market benchmarks, making step-up interest plans a hybrid that combines predictable increases with the flexibility to manage cash flow during early loan periods.

Margin Over Benchmark

Margin over benchmark represents the fixed percentage added to the reference interest rate in both fixed and floating interest loans, directly influencing total loan payment costs. Fixed interest loans lock in a constant margin over benchmark for predictable payments, while floating interest loans adjust the margin periodically based on market benchmarks, causing variable payment amounts.

LIBOR-Linked Loan

LIBOR-linked loans typically feature floating interest rates that adjust periodically based on the London Interbank Offered Rate, exposing borrowers to market rate fluctuations and potential payment variability. Fixed interest loans, in contrast, offer stable repayments by locking in a constant rate, providing predictability but potentially higher initial costs compared to LIBOR-linked floating rates.

Reference Rate Adjustment

Fixed interest loans maintain a constant reference rate throughout the loan term, providing predictable monthly payments and protecting borrowers from market fluctuations. Floating interest loans, however, adjust the reference rate periodically based on benchmarks like LIBOR or SOFR, causing payment amounts to vary with changes in market interest rates.

Convertibility Clause

A convertibility clause in loan agreements allows borrowers to switch between fixed interest rates and floating interest rates during the loan tenure, offering flexibility to capitalize on market conditions. This feature helps manage interest rate risk by enabling adjustments to either stable fixed payments or variable rates aligned with economic fluctuations.

Negative Amortization Risk

Fixed interest loans provide predictable repayment amounts, minimizing the risk of negative amortization where loan balances increase due to unpaid interest. Floating interest loans expose borrowers to fluctuating rates that can cause monthly payments to fall below accruing interest, leading to potential negative amortization and increased debt over time.

Fixed Interest vs Floating Interest for loan payments. Infographic

moneydiff.com

moneydiff.com