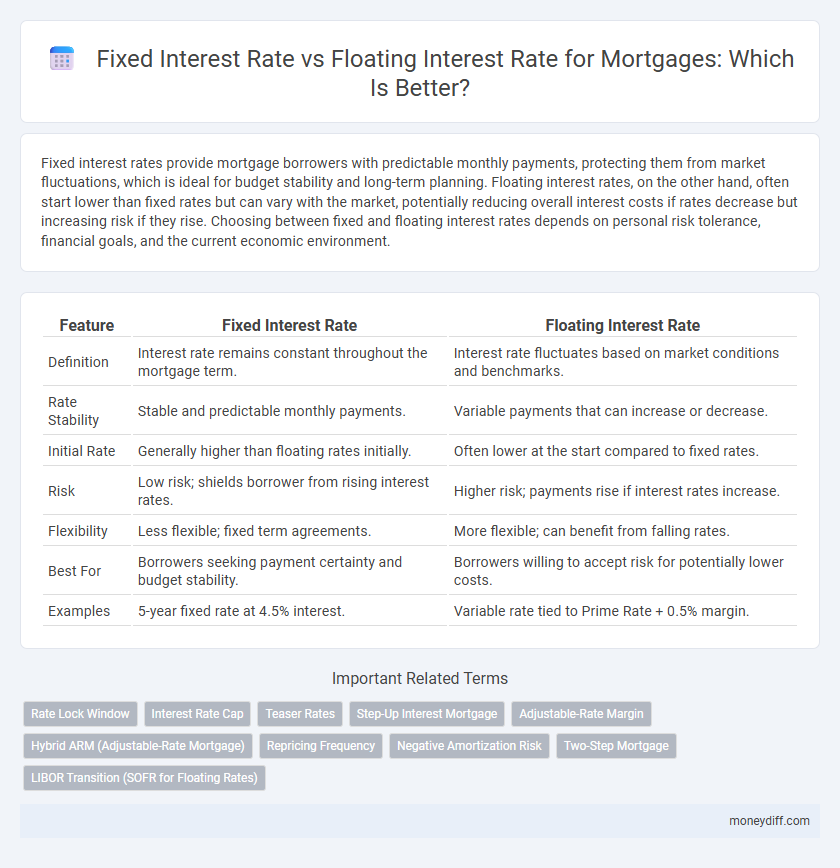

Fixed interest rates provide mortgage borrowers with predictable monthly payments, protecting them from market fluctuations, which is ideal for budget stability and long-term planning. Floating interest rates, on the other hand, often start lower than fixed rates but can vary with the market, potentially reducing overall interest costs if rates decrease but increasing risk if they rise. Choosing between fixed and floating interest rates depends on personal risk tolerance, financial goals, and the current economic environment.

Table of Comparison

| Feature | Fixed Interest Rate | Floating Interest Rate |

|---|---|---|

| Definition | Interest rate remains constant throughout the mortgage term. | Interest rate fluctuates based on market conditions and benchmarks. |

| Rate Stability | Stable and predictable monthly payments. | Variable payments that can increase or decrease. |

| Initial Rate | Generally higher than floating rates initially. | Often lower at the start compared to fixed rates. |

| Risk | Low risk; shields borrower from rising interest rates. | Higher risk; payments rise if interest rates increase. |

| Flexibility | Less flexible; fixed term agreements. | More flexible; can benefit from falling rates. |

| Best For | Borrowers seeking payment certainty and budget stability. | Borrowers willing to accept risk for potentially lower costs. |

| Examples | 5-year fixed rate at 4.5% interest. | Variable rate tied to Prime Rate + 0.5% margin. |

Understanding Fixed vs Floating Interest Rates

Fixed interest rates offer mortgage borrowers consistent monthly payments and protection against market fluctuations, ideal for budgeting and long-term financial stability. Floating interest rates fluctuate with market conditions, often starting lower than fixed rates but carrying the risk of increased payments if benchmark rates rise. Choosing between fixed and floating rates depends on the borrower's risk tolerance, financial goals, and market outlook.

How Fixed Interest Rates Work in Mortgages

Fixed interest rates in mortgages maintain the same percentage throughout the loan term, providing predictable monthly payments regardless of market fluctuations. Lenders set this rate based on economic indicators and borrower creditworthiness at the time of loan approval. Borrowers benefit from budget stability and protection against rising interest rates, although initial rates might be higher compared to floating-rate options.

Pros and Cons of Fixed Interest Rate Mortgages

Fixed interest rate mortgages provide predictable monthly payments, shielding borrowers from market fluctuations and budgeting challenges. However, they often come with higher initial rates compared to floating options and lack flexibility to benefit from falling interest rates. Choosing a fixed rate suits risk-averse borrowers seeking stability, but may limit potential savings during economic downturns.

How Floating Interest Rates Work in Mortgages

Floating interest rates in mortgages fluctuate based on benchmark rates such as the LIBOR or the Federal Reserve's prime rate, causing monthly payments to vary over the loan term. These rates typically start lower than fixed interest rates, offering potential savings if market rates decline but exposing borrowers to increased costs when rates rise. Mortgage agreements with floating rates often include caps or floors to limit extreme payment changes, balancing risk and flexibility for homeowners.

Pros and Cons of Floating Interest Rate Mortgages

Floating interest rate mortgages offer the advantage of lower initial rates compared to fixed-rate loans, potentially reducing monthly payments when market interest rates decline. Borrowers benefit from flexibility and the possibility of capitalizing on falling rates, but face the risk of increasing payments if rates rise, leading to budgeting uncertainty. This variable nature suits those with higher risk tolerance and the ability to absorb payment fluctuations, but may pose challenges for predictable financial planning.

Comparative Cost Analysis: Fixed vs Floating Rates

Fixed interest rates offer predictable monthly mortgage payments, providing stability against market fluctuations, which can be beneficial during periods of rising interest rates. Floating interest rates typically start lower than fixed rates but can increase or decrease over time, potentially leading to lower overall costs if market rates decline. Homebuyers must weigh the certainty of fixed payments against the potential savings and risks associated with variable market conditions when choosing between these options.

Impact of Market Fluctuations on Mortgage Rates

Fixed interest rates provide mortgage stability by maintaining a consistent payment amount regardless of market fluctuations, protecting borrowers from rising interest rates. Floating interest rates, tied to benchmark indices like LIBOR or the Federal Reserve rate, fluctuate with market conditions, causing mortgage payments to vary over time. Borrowers with floating rates may benefit from falling interest rates but face increased risk of higher payments during market volatility.

Which Borrower Should Choose Fixed Interest Rate

Borrowers seeking stability and predictable monthly payments should opt for a fixed interest rate mortgage, as it protects against interest rate fluctuations over the loan term. This option benefits individuals with a tight budget who want to avoid payment surprises and plan long-term finances confidently. Fixed rates are ideal for those expecting rates to rise or who intend to stay in their home for several years.

Who Benefits Most from Floating Interest Rate Mortgages

Homebuyers with strong risk tolerance and flexible financial situations benefit most from floating interest rate mortgages, as these loans offer potential savings when market rates decline. Borrowers expecting short-term homeownership or looking to refinance quickly can capitalize on lower initial rates without committing to a long-term fixed rate. Investors and professionals with variable income streams also prefer floating rates for the adaptability and potential cost-efficiency they provide during fluctuating economic conditions.

Key Factors to Consider Before Choosing Your Mortgage Rate

Fixed interest rates provide predictable monthly payments, ensuring stability regardless of market fluctuations, ideal for budgeting and long-term financial planning. Floating interest rates often start lower but vary with market conditions, potentially lowering costs but increasing the risk of payment hikes. Key factors to consider include your financial stability, risk tolerance, projected market trends, and the potential length of your mortgage commitment.

Related Important Terms

Rate Lock Window

Fixed interest rate mortgages provide certainty with a locked-in rate throughout the loan term, minimizing risks from market fluctuations during the rate lock window, typically 30 to 60 days. Floating interest rate mortgages offer potential savings if rates drop but expose borrowers to rate increases after the lock window expires, requiring careful monitoring before loan closing.

Interest Rate Cap

A fixed interest rate maintains a consistent mortgage payment over the loan term, providing stability and protection against market fluctuations, while a floating interest rate varies with benchmark rates and can lead to unpredictable payments. An interest rate cap on a floating rate mortgage limits the maximum rate increase, offering borrowers a safeguard against steep interest hikes while benefiting from potential rate decreases.

Teaser Rates

Teaser rates, commonly associated with fixed interest rate mortgages, offer an initially low fixed rate for a short period before reverting to a higher standard rate, providing temporary affordability but potential long-term cost increases. Floating interest rates fluctuate based on market benchmarks like the prime rate, which can lead to variable mortgage payments and increased financial uncertainty after the teaser period ends.

Step-Up Interest Mortgage

Step-Up Interest Mortgages begin with a lower fixed interest rate that increases at predetermined intervals, offering borrowers initial affordability and planned rate increments. This contrasts with Floating Interest Rates, which fluctuate with market indices, providing potential savings but exposing borrowers to unpredictable payment changes.

Adjustable-Rate Margin

The adjustable-rate margin in floating interest mortgages is a fixed percentage added to the index rate to determine the overall interest rate, impacting monthly payments as market rates fluctuate. Fixed interest rates remain constant throughout the loan term, offering stable payments but typically higher initial rates compared to adjustable-rate margins that adjust periodically based on the underlying index.

Hybrid ARM (Adjustable-Rate Mortgage)

Hybrid ARM mortgages combine fixed interest rates for an initial period, typically 3, 5, 7, or 10 years, with floating rates that adjust periodically based on an index plus a margin, offering a balance between payment stability and potential savings. This structure allows borrowers to benefit from lower initial fixed rates compared to traditional fixed-rate mortgages while managing risks associated with future interest rate fluctuations inherent in floating rates.

Repricing Frequency

Fixed interest rate mortgages maintain the same interest rate throughout the loan term, eliminating repricing frequency concerns and providing payment stability. Floating interest rate mortgages adjust periodically based on market rates, often every 3, 6, or 12 months, affecting monthly payments due to repricing frequency.

Negative Amortization Risk

Fixed interest rate mortgages provide stability by locking in a consistent payment schedule, eliminating the risk of negative amortization where loan balances increase due to insufficient payments. Floating interest rate mortgages expose borrowers to potential negative amortization risk when interest rate rises cause monthly payments to cover less than the accrued interest, leading to higher overall debt.

Two-Step Mortgage

A two-step mortgage begins with a fixed interest rate for an initial period, offering stability and predictable payments, then shifts to a floating interest rate that fluctuates with market benchmarks like the prime rate. This hybrid approach balances initial financial security with potential savings if interest rates decline during the adjustable phase.

LIBOR Transition (SOFR for Floating Rates)

Fixed interest rates offer borrowers stability with predictable monthly mortgage payments, while floating interest rates, historically tied to LIBOR, are now transitioning to SOFR, reflecting a more transparent and risk-sensitive benchmark in the post-LIBOR era. This transition to SOFR impacts the calculation of floating mortgage rates, potentially causing fluctuations based on real-time market conditions compared to the consistent nature of fixed rates.

Fixed Interest Rate vs Floating Interest Rate for mortgages. Infographic

moneydiff.com

moneydiff.com