Traditional interest compounding calculates returns based on initial principal and accumulated interest over fixed intervals, leading to steady growth. Hypercompounding interest accelerates yield optimization by reinvesting earnings continuously, exponentially increasing the investment's value in shorter periods. This dynamic approach maximizes returns by leveraging the power of cumulative gains more effectively than conventional compounding methods.

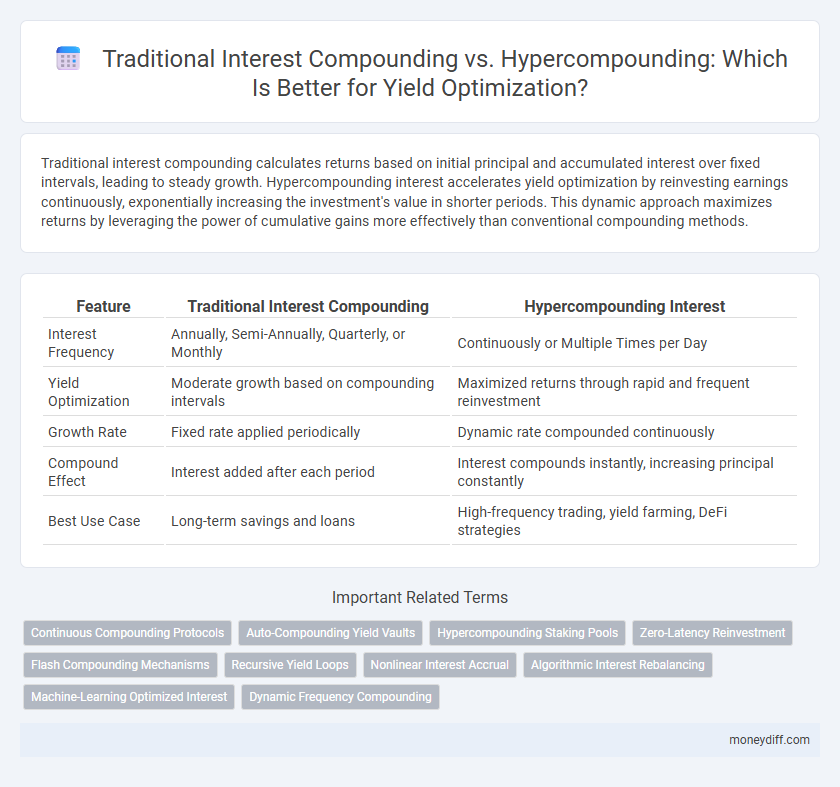

Table of Comparison

| Feature | Traditional Interest Compounding | Hypercompounding Interest |

|---|---|---|

| Interest Frequency | Annually, Semi-Annually, Quarterly, or Monthly | Continuously or Multiple Times per Day |

| Yield Optimization | Moderate growth based on compounding intervals | Maximized returns through rapid and frequent reinvestment |

| Growth Rate | Fixed rate applied periodically | Dynamic rate compounded continuously |

| Compound Effect | Interest added after each period | Interest compounds instantly, increasing principal constantly |

| Best Use Case | Long-term savings and loans | High-frequency trading, yield farming, DeFi strategies |

Understanding Traditional Interest Compounding

Traditional interest compounding calculates earnings by reinvesting interest earned over regular periods, such as annually or monthly, resulting in exponential growth of the principal amount. The compounding frequency directly impacts yield optimization, with more frequent compounding leading to higher returns over time. Understanding traditional compounding fundamentals is essential before exploring hypercompounding, which accelerates growth through dynamic interest rate adjustments and reinvestment strategies.

What Is Hypercompounding Interest?

Hypercompounding interest occurs when the accrued interest is continuously reinvested at an increasingly accelerated rate, generating exponential growth beyond traditional compounding methods. Unlike standard compounding, which calculates interest on the principal plus accumulated interest at fixed intervals, hypercompounding leverages more frequent or algorithmic reinvestment strategies to maximize yield over time. This approach optimizes capital growth by exploiting the power of rapid interest accrual cycles, making it a powerful tool for yield optimization in investments.

Key Differences: Traditional vs Hypercompounding

Traditional interest compounding calculates returns based on the initial principal and accumulated interest at fixed intervals, typically annually or monthly, which limits the frequency of earning interest on interest. Hypercompounding accelerates yield optimization by reinvesting earned interest continuously or at significantly shorter intervals, maximizing the effect of interest on interest growth. This results in exponentially higher returns over time compared to traditional compounding methods, especially in high-frequency or automated investment platforms.

How Traditional Compounding Impacts Yield

Traditional interest compounding calculates yield by applying interest on both the initial principal and accumulated interest over fixed periods, resulting in exponential growth. The compounding frequency--daily, monthly, or annually--significantly influences the overall return, with more frequent compounding periods delivering higher yields. However, traditional compounding limits yield optimization as it solely depends on periodic interest additions without leveraging advanced mechanisms like dynamic rate adjustments or reinvestment strategies.

The Mechanics Behind Hypercompounding Interest

Hypercompounding interest accelerates yield optimization by reinvesting earnings at exponentially increasing intervals, unlike traditional interest compounding which applies interest periodically on a static principal. The mechanics involve continuous recalibration of the interest rate based on cumulative gains, effectively generating interest on previously compounded interest at an amplified rate. This dynamic process results in significantly higher returns over time, leveraging both time value and growth rate adjustments to maximize investment performance.

Yield Optimization: Which Strategy Wins?

Traditional interest compounding calculates earnings on the initial principal and accumulated interest at regular intervals, ensuring steady growth over time. Hypercompounding interest accelerates this process by continuously reinvesting yields at increasingly higher rates, maximizing exponential growth potential. For yield optimization, hypercompounding consistently outperforms traditional compounding, delivering superior returns through its intensified reinvestment strategy.

Risks Associated with Hypercompounding

Hypercompounding interest accelerates yield growth by reinvesting earnings at exponentially increasing rates but introduces higher risks such as liquidity constraints and amplified market volatility exposure. This method intensifies potential losses during downturns due to compounding negative returns, unlike traditional interest compounding which offers steadier, more predictable growth. Investors leveraging hypercompounding must carefully manage risk tolerance and market stability to avoid catastrophic capital erosion.

Real-World Examples: Comparing Yields

Traditional interest compounding typically yields steady returns, as seen in bank savings accounts offering 2-3% annual interest compounded monthly or quarterly. Hypercompounding interest leverages accelerating growth through frequent reinvestments and higher compounding frequencies, exemplified by DeFi protocols achieving yield rates exceeding 20% by reinvesting rewards daily. Real-world comparisons highlight that hypercompounding strategies in decentralized finance substantially outperform conventional banking compounding models by maximizing yield optimization via continuous capital growth.

Tools and Platforms for Hypercompounding

Tools and platforms for hypercompounding leverage advanced algorithms and real-time data analytics to maximize yield optimization beyond traditional interest compounding methods. Decentralized finance (DeFi) platforms such as Yearn Finance and Curve offer automated yield aggregation and reinvestment strategies, enabling exponential growth of investments through hypercompounding. Integration with blockchain technology ensures transparent, efficient, and secure compounding processes, which traditional banks and financial institutions often lack.

Making the Right Choice for Your Investment Goals

Traditional interest compounding calculates returns based on the principal and accumulated interest over fixed periods, providing steady growth aligned with conservative investment goals. Hypercompounding interest leverages continuous reinvestment at increasing rates, significantly accelerating yield optimization for aggressive portfolios focused on maximizing returns. Choosing the right method depends on balancing risk tolerance, investment horizon, and desired growth velocity to optimize overall financial outcomes.

Related Important Terms

Continuous Compounding Protocols

Continuous compounding protocols exponentially enhance yield optimization by calculating interest at every possible instant, surpassing traditional interest compounding methods that compound at fixed intervals such as daily, monthly, or yearly. This seamless accumulation of returns leverages the mathematical constant e, maximizing growth potential and enabling hypercompounding effects that significantly accelerate wealth accumulation over time.

Auto-Compounding Yield Vaults

Auto-compounding yield vaults leverage hypercompounding interest mechanisms that reinvest earnings at high frequency to maximize returns, outperforming traditional interest compounding which typically compounds at fixed intervals. This approach accelerates portfolio growth by continuously adding interest to the principal, optimizing yield generation through dynamic, algorithm-driven strategies.

Hypercompounding Staking Pools

Hypercompounding staking pools exponentially amplify returns by reinvesting earnings at a significantly higher frequency than traditional interest compounding, leveraging blockchain protocols to optimize yield. This advanced mechanism enables investors to maximize passive income through accelerated growth, outperforming conventional compounding methods in DeFi ecosystems.

Zero-Latency Reinvestment

Zero-latency reinvestment in hypercompounding interest allows for immediate redeployment of earnings, significantly accelerating yield optimization compared to traditional interest compounding, which typically involves fixed, periodic intervals. This continuous compounding approach maximizes exponential growth by eliminating delays between interest accrual and reinvestment, enhancing overall portfolio performance.

Flash Compounding Mechanisms

Flash compounding mechanisms accelerate yield optimization by executing rapid, high-frequency interest calculations that surpass traditional interest compounding intervals, maximizing capital growth within shorter timeframes. This hypercompounding approach leverages instantaneous reinvestment and algorithmic precision to exponentially enhance returns compared to standard compounding methods.

Recursive Yield Loops

Recursive yield loops in traditional interest compounding generate steady growth by reinvesting earned interest at regular intervals, effectively increasing the principal over time. Hypercompounding interest accelerates this process by continuously reinvesting returns at exponentially shorter periods, maximizing yield optimization through compounded recursive feedback cycles.

Nonlinear Interest Accrual

Nonlinear interest accrual in hypercompounding interest leverages the exponential growth of returns by reinvesting earnings more frequently than traditional interest compounding, significantly boosting yield optimization over time. Unlike standard compounding, which accumulates interest periodically at fixed intervals, hypercompounding utilizes accelerated compounding frequency and dynamic rate adjustments to maximize capital growth in financial portfolios.

Algorithmic Interest Rebalancing

Algorithmic interest rebalancing dynamically adjusts investment allocations to optimize yield by leveraging hypercompounding interest, which accelerates growth through frequent compounding intervals exceeding traditional schedules. This method outperforms standard interest compounding by continuously recalibrating capital to maximize returns on reinvested interest across diverse assets.

Machine-Learning Optimized Interest

Machine-learning optimized interest leverages advanced algorithms to dynamically adjust compounding frequencies and rates, outperforming traditional interest compounding methods by maximizing yield potential through data-driven decision-making. This hypercompounding approach harnesses predictive modeling to optimize reinvestment intervals, significantly enhancing returns compared to static, fixed-rate compounding strategies.

Dynamic Frequency Compounding

Dynamic Frequency Compounding adjusts the interest compounding intervals based on market conditions, significantly enhancing yield optimization compared to traditional fixed-interval compounding methods. Hypercompounding leverages this flexibility to reinvest returns more frequently, exponentially increasing capital growth over time.

Traditional Interest Compounding vs Hypercompounding Interest for yield optimization. Infographic

moneydiff.com

moneydiff.com