Overdraft interest is charged on the actual amount overdrawn and accrues daily based on the outstanding balance, reflecting the cost of borrowing within an agreed limit. Penalty interest, by contrast, applies when the credit limit is exceeded or repayments are missed, often at a higher rate to discourage misuse and cover additional risk for the lender. Understanding these differences helps manage credit wisely and avoid unnecessary financial charges.

Table of Comparison

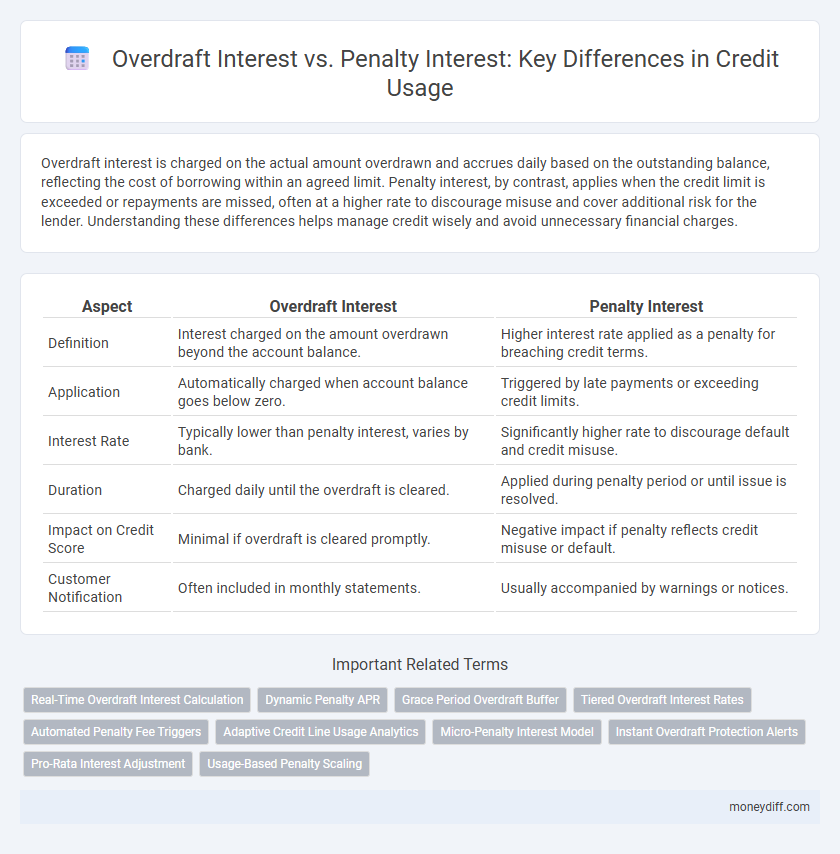

| Aspect | Overdraft Interest | Penalty Interest |

|---|---|---|

| Definition | Interest charged on the amount overdrawn beyond the account balance. | Higher interest rate applied as a penalty for breaching credit terms. |

| Application | Automatically charged when account balance goes below zero. | Triggered by late payments or exceeding credit limits. |

| Interest Rate | Typically lower than penalty interest, varies by bank. | Significantly higher rate to discourage default and credit misuse. |

| Duration | Charged daily until the overdraft is cleared. | Applied during penalty period or until issue is resolved. |

| Impact on Credit Score | Minimal if overdraft is cleared promptly. | Negative impact if penalty reflects credit misuse or default. |

| Customer Notification | Often included in monthly statements. | Usually accompanied by warnings or notices. |

Understanding Overdraft Interest and Penalty Interest

Overdraft interest is the fee charged on the amount of credit used beyond the account balance, calculated daily and typically lower than penalty interest. Penalty interest applies when the credit limit is exceeded or payments are missed, often at a higher rate to discourage misuse. Understanding the differences helps in managing credit wisely and avoiding costly charges.

Key Differences Between Overdraft and Penalty Interest

Overdraft interest is charged on the amount overdrawn from a bank account, reflecting the cost of borrowing within an agreed overdraft limit, while penalty interest applies when the overdraft exceeds the authorized limit or is used improperly. Overdraft interest rates are typically lower and part of the standard terms of credit usage, whereas penalty interest rates are significantly higher, designed to discourage misuse or unauthorized borrowing. Understanding these differences helps manage credit costs by maintaining usage within agreed limits and avoiding excessive financial penalties.

How Overdraft Interest Works in Credit Accounts

Overdraft interest is charged only on the amount and duration of the negative balance in credit accounts, reflecting the cost of borrowing beyond the available credit limit. It typically accrues daily and is calculated using a specific annual percentage rate (APR) set by the financial institution, ensuring transparency in interest expenses. Unlike penalty interest, overdraft interest is a standard fee for authorized or unauthorized credit overuse but does not imply punitive charges, making it essential to monitor account balances closely.

What Triggers Penalty Interest on Credit Usage

Penalty interest on credit usage is triggered when borrowers fail to meet minimum repayment requirements or exceed their credit limits, signaling a higher risk of default. This type of interest rate is typically significantly higher than standard overdraft interest, designed to discourage delinquent or excessive borrowing behavior. Financial institutions impose penalty interest to recover potential losses and incentivize timely repayments, directly impacting the cost of credit.

Financial Implications of Overdraft vs Penalty Interest

Overdraft interest typically accrues at a lower rate compared to penalty interest, making it a less costly option for short-term credit usage. Penalty interest rates are significantly higher and are imposed as a punitive charge for breaching credit terms, which can drastically increase overall debt. Understanding the financial implications of these rates is crucial, as prolonged penalty interest periods can lead to substantial debt accumulation and credit score damage.

Factors Affecting Overdraft and Penalty Interest Rates

Overdraft interest rates are typically influenced by factors such as the creditworthiness of the account holder, the bank's risk assessment policies, and prevailing market interest rates. Penalty interest rates often depend on the severity of the breach, regulatory guidelines, and the financial institution's specific penalty framework. Both rates can vary significantly based on the lending institution's internal risk models and customer credit profiles.

Managing Credit Accounts to Avoid Penalty Interest

Overdraft interest typically applies when you withdraw more money than your available balance within an authorized limit, charged at a relatively lower rate compared to penalty interest. Penalty interest is incurred when credit account terms are violated, such as exceeding the overdraft limit or missing payments, resulting in significantly higher interest rates. Effective management of credit accounts involves monitoring balances closely and making timely payments to prevent triggering costly penalty interest charges.

Strategies to Minimize Overdraft Interest Charges

To minimize overdraft interest charges, customers should monitor their account balances regularly using real-time banking alerts and maintain a buffer fund to avoid overdrawing. Opting for linked savings accounts or overdraft protection plans can reduce reliance on costly overdraft credit. Paying off overdraft balances promptly and negotiating lower overdraft interest rates with banks further helps in managing and minimizing interest expenses effectively.

Impact on Credit Score: Overdraft vs Penalty Interest

Overdraft interest typically reflects regular borrowing costs and may have a minimal direct impact on credit score if payments are made on time, whereas penalty interest often signals default or late payments, leading to a significant negative effect on credit score. Credit scoring models prioritize payment history and overdue amounts, making penalty interest occurrences more detrimental to creditworthiness. Maintaining timely repayments of overdraft balances helps preserve credit scores, while penalty interest usually indicates financial distress that can lower credit ratings substantially.

Choosing the Best Credit Products for Lower Interest

Overdraft interest is typically charged on the amount you withdraw beyond your available balance, often at a lower rate than penalty interest, which is applied when you fail to meet minimum payment requirements or breach credit terms. Choosing credit products with transparent overdraft policies and lower penalty rates can significantly reduce your overall borrowing costs. Comparing APRs and reviewing terms carefully ensures you select credit options that minimize both overdraft and penalty interest charges for optimal financial management.

Related Important Terms

Real-Time Overdraft Interest Calculation

Real-time overdraft interest calculation dynamically adjusts interest charges based on the exact duration and amount of credit used, providing precise cost accuracy compared to penalty interest, which is a fixed charge applied after breaches of credit terms. This method ensures borrowers are charged fairly, reflecting their actual overdraft behavior rather than punitive fees.

Dynamic Penalty APR

Dynamic Penalty APR adjusts based on a borrower's credit behavior, often increasing significantly after overdraft occurrences, unlike standard overdraft interest which remains fixed or follows a preset rate. This variable rate mechanism results in higher penalty interest charges, reflecting the elevated risk of credit misuse and incentivizing timely repayment.

Grace Period Overdraft Buffer

Grace Period Overdraft Buffer allows a short-term, interest-free overdraft on credit accounts, reducing the need to immediately pay higher penalty interest rates associated with unauthorized credit usage. This buffer prioritizes overdraft interest, which is typically lower and more predictable than penalty interest, effectively minimizing overall borrowing costs during temporary cash shortfalls.

Tiered Overdraft Interest Rates

Tiered overdraft interest rates apply varying charges based on the overdrawn amount, often resulting in lower interest for smaller overdrafts and higher rates as the overdraft increases, optimizing cost for users with modest credit usage. Penalty interest, by contrast, imposes a flat or elevated rate as a punitive measure for breaching credit limits, making tiered overdraft interest rates more cost-effective and fair for responsible borrowers.

Automated Penalty Fee Triggers

Overdraft interest applies to the borrowed amount exceeding your account balance, typically calculated daily at a lower rate, while penalty interest is triggered automatically when specific credit terms are violated, such as missed payments or credit limit breaches, often calculated at a higher rate to discourage misuse. Automated penalty fee triggers use advanced algorithms to instantly detect violations, ensuring immediate application of penalty interest and fees, which can significantly increase the cost of credit usage.

Adaptive Credit Line Usage Analytics

Overdraft interest is charged based on the actual negative balance duration and amount, reflecting adaptive credit line usage analytics that monitor customer spending behavior in real-time. Penalty interest applies a higher fixed rate triggered by specific violations like exceeding credit limits, serving as a deterrent rather than a flexible cost tied to usage patterns.

Micro-Penalty Interest Model

Overdraft interest applies to funds withdrawn beyond the available balance, calculated daily based on the overdraft limit, while penalty interest in the Micro-Penalty Interest Model imposes a higher rate on specific credit usage violations to discourage excessive or risky borrowing behavior. The Micro-Penalty Interest Model targets minor infractions with incremental penalties, promoting responsible credit use and reducing default risk through finely tuned interest adjustments.

Instant Overdraft Protection Alerts

Overdraft interest applies to the borrowed amount when account holders use instant overdraft protection alerts to manage credit usage, typically charged at a lower rate than penalty interest, which is imposed for unauthorized overdrafts or breaches of credit terms. Instant overdraft protection alerts help users avoid higher penalty interest by providing immediate notifications to control spending and maintain account balances within authorized limits.

Pro-Rata Interest Adjustment

Overdraft interest is calculated on the actual amount and duration of the credit used, reflecting a pro-rata interest adjustment based on daily balances, whereas penalty interest is applied at a fixed higher rate regardless of usage time or amount. Pro-rata interest adjustment ensures that borrowers pay interest proportionate to their specific overdraft consumption, providing a fairer and more precise cost compared to blanket penalty interest charges.

Usage-Based Penalty Scaling

Overdraft interest is typically calculated based on the daily outstanding balance, reflecting actual credit usage, whereas penalty interest often employs usage-based penalty scaling, imposing higher rates as the overdraft amount or duration increases to discourage prolonged or excessive credit misuse. This dynamic penalty structure aims to incentivize timely repayments while mitigating the risk of escalating debt for consumers.

Overdraft Interest vs Penalty Interest for credit usage. Infographic

moneydiff.com

moneydiff.com