Traditional interest involves charging a fixed or variable percentage on loans, often leading to ethical concerns like exploitation and inequality. Islamic profit rates follow Sharia principles, emphasizing risk-sharing and avoiding riba (usury), promoting fairness and ethical finance. This approach encourages investments based on profit and loss rather than predetermined interest, aligning financial practices with moral and social responsibility.

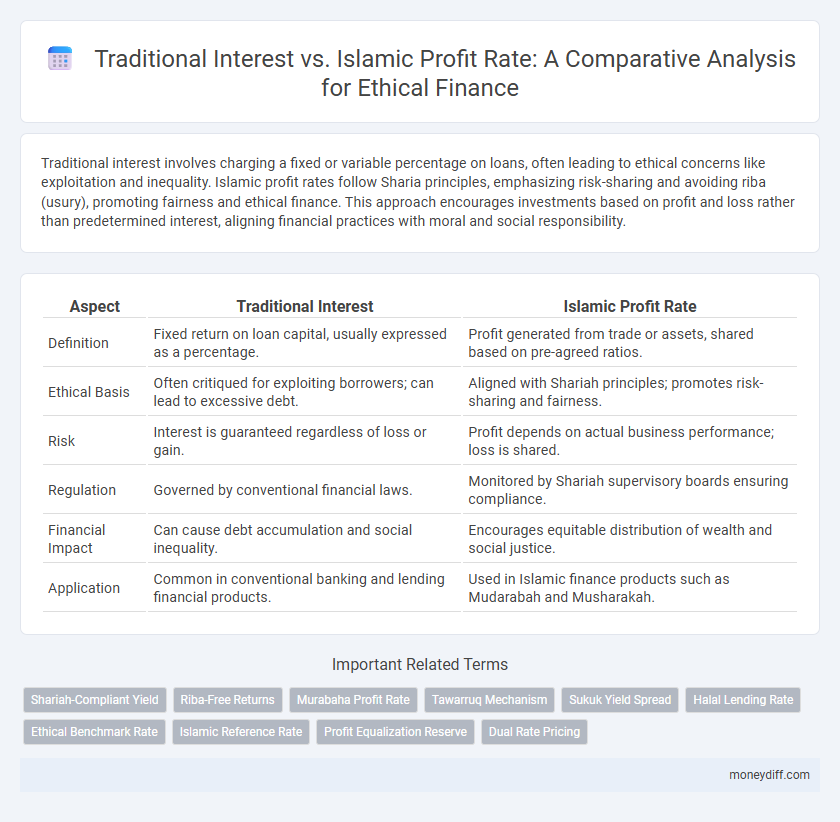

Table of Comparison

| Aspect | Traditional Interest | Islamic Profit Rate |

|---|---|---|

| Definition | Fixed return on loan capital, usually expressed as a percentage. | Profit generated from trade or assets, shared based on pre-agreed ratios. |

| Ethical Basis | Often critiqued for exploiting borrowers; can lead to excessive debt. | Aligned with Shariah principles; promotes risk-sharing and fairness. |

| Risk | Interest is guaranteed regardless of loss or gain. | Profit depends on actual business performance; loss is shared. |

| Regulation | Governed by conventional financial laws. | Monitored by Shariah supervisory boards ensuring compliance. |

| Financial Impact | Can cause debt accumulation and social inequality. | Encourages equitable distribution of wealth and social justice. |

| Application | Common in conventional banking and lending financial products. | Used in Islamic finance products such as Mudarabah and Musharakah. |

Understanding Traditional Interest: Foundations and Implications

Traditional interest is a fixed percentage charged on borrowed capital, derived from a lender's right to profit without sharing underlying business risks. Rooted in conventional finance, this interest model often leads to income inequality and exploitation concerns due to compounding effects and guaranteed returns irrespective of borrower success. Ethical finance critiques this system for fostering economic disparity and advocates profit-sharing alternatives aligned with social justice and risk-sharing principles.

Islamic Profit Rate: Principles and Practices

Islamic Profit Rate is grounded in Sharia-compliant ethical finance principles, emphasizing profit and loss sharing instead of fixed interest charges found in traditional interest systems. This model prohibits Riba (interest), promoting risk-sharing and equitable transactions that align with Islamic law. Key practices include Musharakah (partnership), Mudarabah (profit-sharing), and Murabaha (cost-plus financing), ensuring financial activities adhere to moral and social justice values.

Key Differences Between Interest and Profit Rate

Traditional interest involves a fixed percentage paid on borrowed money, often leading to guaranteed returns regardless of business performance, which may risk ethical concerns in finance. In contrast, the Islamic profit rate is based on shared risk and reward, aligning returns with the actual profitability of the enterprise, promoting fairness and ethical investment principles. This fundamental difference highlights Islamic finance's emphasis on risk-sharing and prohibition of guaranteed interest, ensuring transactions are equitable and socially responsible.

Ethical Finance: Concepts and Approaches

Ethical finance emphasizes fairness and social responsibility, contrasting Traditional Interest which charges fixed rates regardless of outcomes, with Islamic Profit Rate that aligns profit-sharing with actual business performance. This approach promotes risk-sharing and prohibits exploitative interest (riba), ensuring investments comply with Shariah principles. By prioritizing equitable returns and ethical transparency, Islamic finance fosters sustainable economic development and social justice.

Impact of Interest-Based Systems on Society

Interest-based financial systems often lead to wealth concentration and social inequality due to the compounding nature of interest charges on debt. Islamic profit rate models, rooted in risk-sharing and asset-backed financing, promote ethical finance by encouraging equitable distribution of returns and reducing exploitation. This shift supports economic justice and sustainable development within communities.

Social Justice in Islamic Financial Models

Islamic financial models prioritize social justice by replacing traditional interest with profit-sharing mechanisms, promoting equitable wealth distribution and ethical investment. Unlike conventional interest, which often leads to fixed returns irrespective of social impact, Islamic profit rates encourage risk-sharing and community-oriented growth aligned with Sharia principles. This approach fosters inclusive economic development and reduces exploitation, making finance more socially responsible and ethically grounded.

Risk Sharing vs. Risk Transfer in Finance

Traditional interest-based finance involves risk transfer, where the lender receives fixed returns regardless of the investment outcome, potentially burdening the borrower during losses. Islamic finance employs a profit rate system rooted in risk sharing, aligning the interests of both parties by distributing profits and losses equitably. This ethical approach promotes financial justice and stability by encouraging responsible investment and mutual accountability.

Transparency and Fairness in Financial Contracts

Traditional interest often involves fixed rates that can lead to unequal risk distribution and potential exploitation, whereas Islamic profit rates emphasize risk-sharing and ethical transparency in financial contracts. Islamic finance principles ensure fairness by requiring clear disclosure of profit and loss sharing terms, promoting equitable outcomes for all parties involved. This transparency fosters trust and accountability, aligning financial practices with ethical values and social justice.

Global Trends: Adopting Ethical Financial Practices

Global trends reveal a growing shift towards ethical finance, where Islamic profit rates are increasingly favored over traditional interest due to their compliance with Shariah principles that prohibit usury. This movement aligns with the rising demand for socially responsible investments that emphasize fairness, transparency, and risk-sharing, key features of Islamic finance. Financial markets worldwide are integrating these profit-sharing models, reflecting a broader commitment to sustainable economic development and ethical financial practices.

Choosing Between Traditional and Islamic Approaches for Ethical Wealth Growth

Choosing between traditional interest and Islamic profit rates involves understanding their impact on ethical wealth growth. Traditional interest entails a fixed percentage return regardless of business outcomes, often criticized for promoting risk-free gains that may exploit borrowers. Islamic profit rates align with Sharia principles by sharing both profits and losses, fostering equitable and socially responsible financial growth.

Related Important Terms

Shariah-Compliant Yield

Traditional interest involves fixed or variable interest rates that generate returns through lending capital, often attracting ethical concerns over exploitative practices, whereas Islamic profit rates, based on Shariah-compliant principles, emphasize risk-sharing and asset-backed financing to ensure fairness and avoid usury (riba). Shariah-compliant yield aligns with ethical finance by promoting profit and loss sharing mechanisms, fostering social justice, and supporting equitable economic growth within Islamic financial frameworks.

Riba-Free Returns

Traditional interest involves earning fixed or variable returns on loans, often viewed as exploitative under Islamic finance principles, which prohibit Riba or usury. Islamic profit rates ensure Riba-free returns by sharing risk and profit through Sharia-compliant contracts such as Mudarabah or Musharakah, promoting ethical and equitable financing.

Murabaha Profit Rate

Murabaha profit rate in Islamic finance offers an ethical alternative to traditional interest by structuring transactions based on cost-plus-profit rather than charging interest on loans, thereby aligning with Shariah law principles. This profit rate ensures transparency and fairness, avoiding usury while providing a predictable return for financial institutions and ethical investors.

Tawarruq Mechanism

The Tawarruq mechanism in Islamic finance provides a Shariah-compliant alternative to traditional interest by facilitating liquidity through a series of commodity transactions that avoid riba and ensure ethical profit rates. This structure aligns with Islamic principles by promoting transparency and fairness while enabling access to financial resources without relying on conventional interest-based lending.

Sukuk Yield Spread

The Sukuk yield spread typically reflects a lower risk premium compared to traditional interest-based bonds, aligning with Islamic finance principles that prohibit riba (interest) and emphasize profit-sharing structures. This ethical finance approach promotes transparency and asset-backed returns, distinguishing Sukuk yields from conventional interest rates by prioritizing Shariah-compliant profit rates over fixed interest payments.

Halal Lending Rate

Traditional interest involves charging a predetermined percentage on loans, often criticized for exploiting borrowers, whereas Islamic profit rates prioritize profit-sharing and risk exchange to comply with Shariah law, ensuring ethical finance practices. The Halal lending rate, rooted in Islamic finance principles, prohibits riba (interest) and emphasizes equity-based transactions, promoting fairness and social justice in financial dealings.

Ethical Benchmark Rate

Traditional interest rates charge a fixed percentage on loans regardless of the project's success, often leading to unethical exploitation or excessive debt burdens; conversely, the Islamic profit rate, grounded in Sharia principles, aligns returns with actual business performance, promoting risk-sharing and fairness. The Ethical Benchmark Rate in Islamic finance serves as a transparent standard ensuring profit rates reflect genuine economic activity and social responsibility, fostering equitable financial practices.

Islamic Reference Rate

Islamic profit rates, based on the Islamic Reference Rate (IRR), ensure compliance with Shariah by avoiding riba (interest) and emphasizing profit-and-loss sharing principles, contrasting with traditional interest that generates fixed, predetermined returns regardless of economic outcomes. The IRR serves as a benchmark for ethical finance in Islamic banking, aligning financial products with principles of fairness, transparency, and social justice.

Profit Equalization Reserve

The Profit Equalization Reserve (PER) is a key mechanism in Islamic finance that ensures equitable profit distribution without charging interest, contrasting with traditional interest-based lending that generates predetermined fixed returns. By using PER, Islamic financial institutions maintain compliance with Shariah law while stabilizing returns for investors, promoting ethical finance through shared risk and profit rather than interest accrual.

Dual Rate Pricing

Traditional interest imposes a fixed or variable rate on borrowed capital, often leading to compounding debt burdens, while Islamic profit rate emphasizes risk-sharing and asset-backed transactions that comply with Shariah principles. Dual Rate Pricing bridges these models by offering a baseline profit rate aligned with Islamic ethics, combined with performance-based adjustments reflecting underlying asset returns, promoting both fairness and financial transparency.

Traditional Interest vs Islamic Profit Rate for ethical finance. Infographic

moneydiff.com

moneydiff.com