Traditional bank interest rates often offer lower yields due to regulatory constraints and conservative risk management, resulting in modest returns for depositors. DeFi protocol interest for yield farming can provide significantly higher returns by leveraging blockchain technology and decentralized liquidity pools, but this comes with increased risk and potential smart contract vulnerabilities. Investors seeking yield must balance the predictability and security of traditional banks against the higher, yet riskier, opportunities in DeFi platforms.

Table of Comparison

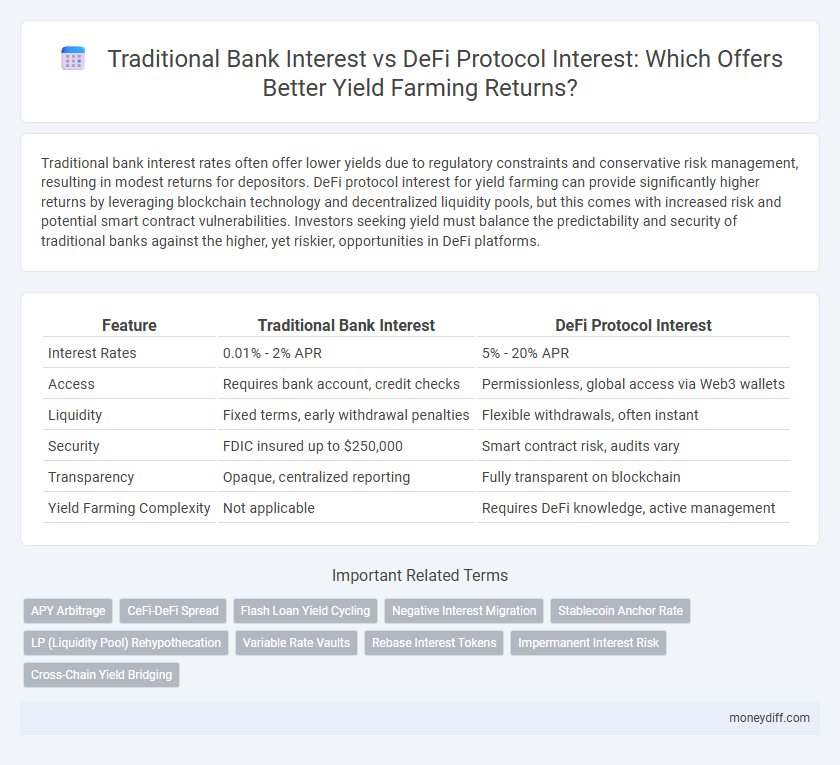

| Feature | Traditional Bank Interest | DeFi Protocol Interest |

|---|---|---|

| Interest Rates | 0.01% - 2% APR | 5% - 20% APR |

| Access | Requires bank account, credit checks | Permissionless, global access via Web3 wallets |

| Liquidity | Fixed terms, early withdrawal penalties | Flexible withdrawals, often instant |

| Security | FDIC insured up to $250,000 | Smart contract risk, audits vary |

| Transparency | Opaque, centralized reporting | Fully transparent on blockchain |

| Yield Farming Complexity | Not applicable | Requires DeFi knowledge, active management |

Understanding Traditional Bank Interest: Key Concepts

Traditional bank interest is typically defined as the fixed or variable percentage earned on deposited funds, calculated using simple or compound interest formulas over a specified period. Key concepts include Annual Percentage Yield (APY), which reflects the actual yearly return including compounding, and interest rates influenced by central bank policies and economic conditions. Unlike DeFi protocols, traditional banks offer regulated, lower-risk interest through institutions insured by government bodies such as the FDIC.

What Is DeFi and Yield Farming?

DeFi, or decentralized finance, leverages blockchain technology to offer financial services without traditional intermediaries, enabling users to participate directly in yield farming. Yield farming involves lending or staking cryptocurrencies in DeFi protocols to earn interest or rewards, often providing higher returns compared to traditional bank interest rates. These protocols use smart contracts to automate transactions, creating a transparent and efficient ecosystem for generating passive income.

How Traditional Banks Calculate Interest

Traditional banks calculate interest primarily using simple or compound interest formulas based on the principal amount, interest rate, and time period, often compounded monthly or annually. The interest rates are typically fixed or variable, influenced by central bank policies, inflation, and credit risk assessments. Unlike DeFi protocols, traditional banks rely on centralized intermediaries and regulatory frameworks to guarantee interest payments and minimize risk.

DeFi Protocols: Earning Interest on Crypto Assets

DeFi protocols offer significantly higher interest rates on crypto assets compared to traditional banks, often ranging from 5% to over 20% APY depending on the platform and asset. These protocols enable yield farming by leveraging decentralized liquidity pools and smart contracts, providing more flexible and automated earning mechanisms. Unlike traditional banks, DeFi interest earnings are accessible 24/7, borderless, and typically free from intermediaries, maximizing liquidity and potential returns.

Risk Factors: Banks vs. DeFi Yield Farming

Traditional banks offer interest rates with lower risk due to regulatory oversight, FDIC insurance, and stable financial infrastructure, minimizing the chances of loss. DeFi yield farming provides higher potential returns but carries significant risks including smart contract vulnerabilities, platform insolvency, and impermanent loss in volatile markets. Users must weigh the safety of regulated banking interest against the unpredictable nature and technical complexities of DeFi protocols.

Comparing Interest Rates: Banking versus DeFi

Traditional bank interest rates for savings accounts typically range from 0.01% to 0.5% annually, offering low but stable returns with federal insurance protections. DeFi protocols provide yield farming opportunities with interest rates often exceeding 10% APY, driven by liquidity mining incentives and volatile token rewards, though they carry higher risks including smart contract vulnerabilities. Comparing these, DeFi interest rates outperform traditional banks by a significant margin but require careful risk assessment due to the lack of regulatory oversight and potential for impermanent loss.

Security and Insurance: Protecting Your Investments

Traditional bank interest offers regulatory-backed security and federally insured deposits through entities like the FDIC, ensuring principal protection against bank failures. DeFi protocol interest entails smart contract-based yield farming with varying degrees of risk, where security depends on code audits and platform credibility but typically lacks formal insurance. Investors in DeFi must assess the risk of hacks, bugs, and platform insolvency, often mitigating losses through decentralized insurance options like Nexus Mutual or Cover Protocol.

Liquidity and Accessibility: Which Is Better?

Traditional bank interest rates are generally lower and offer limited liquidity due to fixed deposit terms and withdrawal restrictions, whereas DeFi protocol interest rates for yield farming provide higher returns with more flexible liquidity options, enabling users to access their funds or reinvest at any time. DeFi platforms leverage blockchain technology to eliminate intermediaries, enhancing accessibility globally without the need for credit checks or extensive documentation, which contrasts with the more rigid and location-dependent structures of traditional banks. While traditional banks provide regulatory security and insured deposits, DeFi yield farming attracts users seeking decentralized, permissionless access and dynamic liquidity management.

Regulatory Environment: Compliance in Banks and DeFi

Traditional banks operate under strict regulatory frameworks enforced by government authorities, ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) policies that protect depositors and maintain financial stability. DeFi protocols, while offering higher yield farming interest rates through decentralized mechanisms, face a largely unregulated environment with evolving regulatory scrutiny focused on transparency and security risks. The disparity in compliance requirements contributes to differing risk profiles and investor protections between traditional bank interest and DeFi yield farming interest.

Future Trends: The Evolution of Interest in Finance

Future trends in finance indicate a shift from traditional bank interest rates, typically ranging between 0.01% and 1%, toward decentralized finance (DeFi) protocol yields that can exceed 10% annually through yield farming. Innovations in smart contract technology and blockchain transparency drive higher interest returns and enhanced user control in DeFi platforms compared to conventional banking systems. Institutional adoption and regulatory developments will further shape the evolution of interest models, potentially blending traditional stability with DeFi's high-yield mechanisms.

Related Important Terms

APY Arbitrage

Traditional bank interest rates typically range between 0.01% to 1.5% APY, offering low-risk but minimal returns, while DeFi protocols provide access to yield farming opportunities with APYs often exceeding 10%, leveraging smart contracts and liquidity pools. APY arbitrage in DeFi exploits discrepancies between different protocols' yield rates, maximizing profits by strategically reallocating assets in response to market fluctuations and incentivized reward mechanisms.

CeFi-DeFi Spread

Traditional bank interest rates typically range from 0.01% to 1%, offering low-yield, stable returns, while DeFi protocols provide significantly higher yields, often between 5% and 50%, driven by liquidity mining and yield farming incentives. The CeFi-DeFi spread reflects this disparity, highlighting DeFi's potential for amplified returns alongside increased smart contract and market risks.

Flash Loan Yield Cycling

Traditional bank interest rates typically range from 0.01% to 2%, offering stable but low returns, whereas DeFi protocols enable significantly higher yield farming opportunities through mechanisms like Flash Loan Yield Cycling, which leverages rapid, uncollateralized loans to amplify profits across multiple liquidity pools within a single transaction. Flash Loan Yield Cycling exploits arbitrage and liquidity provision inefficiencies, allowing users to optimize returns by cycling borrowed assets swiftly, an approach unavailable in conventional banking due to regulatory and operational constraints.

Negative Interest Migration

Traditional bank interest rates typically remain low and can sometimes turn negative due to central bank policies, driving depositors to seek higher returns elsewhere. DeFi protocol interest rates for yield farming often offer significantly higher yields, attracting capital migration away from conventional banks despite associated smart contract risks.

Stablecoin Anchor Rate

Traditional bank interest rates for stablecoins typically hover around 1-2% APY, reflecting lower risk but limited returns. DeFi protocols offer significantly higher yield farming opportunities with stablecoin anchor rates ranging from 5% to 12% APY, driven by decentralized liquidity pools and governance incentives.

LP (Liquidity Pool) Rehypothecation

Traditional bank interest offers fixed, often lower yields derived from centralized lending practices, whereas DeFi protocol interest in yield farming leverages LP rehypothecation, enabling liquidity providers to maximize returns by reusing staked assets across multiple DeFi platforms. This rehypothecation amplifies capital efficiency and yield potential but introduces higher smart contract risk compared to regulated banking environments.

Variable Rate Vaults

Variable rate vaults in DeFi protocols offer yield farming opportunities with fluctuating interest rates driven by real-time supply and demand dynamics, often resulting in higher returns compared to traditional banks' fixed or modestly variable interest rates. Unlike traditional bank interest, which is typically stable and regulated, DeFi vaults provide decentralized, algorithmic interest accrual with transparent, on-chain tracking and the potential for compounding yields.

Rebase Interest Tokens

Traditional bank interest typically offers fixed, low-yield returns based on simple or compound interest rates set by financial institutions, whereas DeFi protocols utilize rebase interest tokens that automatically adjust token supply to reflect yield farming rewards, resulting in potentially higher and more dynamic returns. Rebase tokens enable users to accrue interest directly in their wallet balance through periodic supply increases, bypassing the need for manual claim processes and enhancing yield efficiency.

Impermanent Interest Risk

Traditional bank interest offers fixed returns with minimal risk, whereas DeFi protocol interest involves variable yield farming rewards subject to impermanent interest risk, where token price fluctuations can erode accumulated gains. Yield farming participants must manage potential losses from asset pair volatility despite high APYs, contrasting the predictable but generally lower returns of conventional banking.

Cross-Chain Yield Bridging

Traditional bank interest rates typically range from 0.01% to 2%, offering low but stable returns through centralized financial systems. DeFi protocol interest for yield farming, especially with cross-chain yield bridging, leverages multiple blockchains to optimize returns often exceeding 10%, enabling users to maximize profits by accessing diversified liquidity pools and better interest rates across different ecosystems.

Traditional Bank Interest vs DeFi Protocol Interest for yield farming. Infographic

moneydiff.com

moneydiff.com