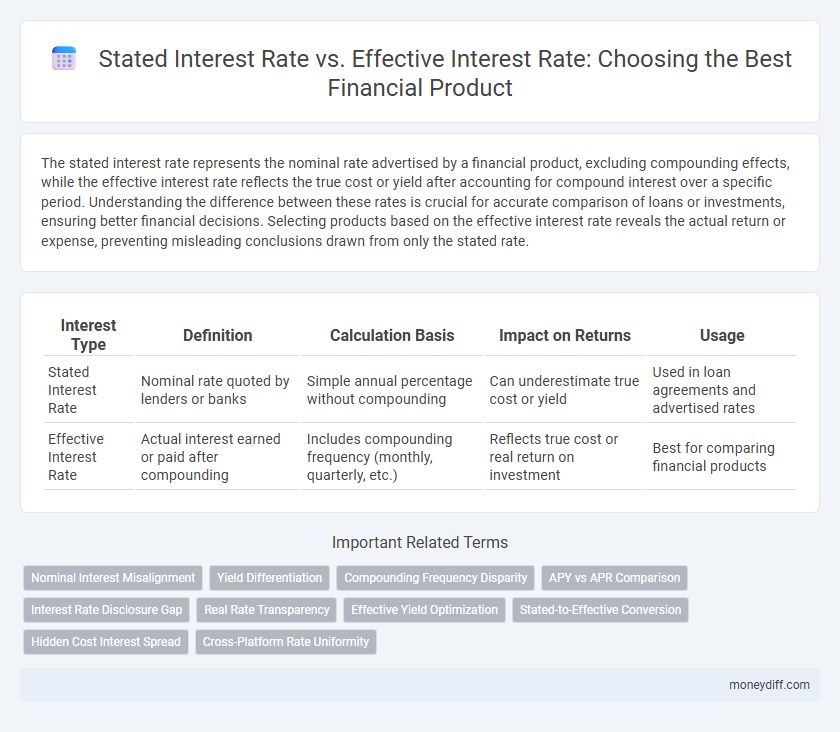

The stated interest rate represents the nominal rate advertised by a financial product, excluding compounding effects, while the effective interest rate reflects the true cost or yield after accounting for compound interest over a specific period. Understanding the difference between these rates is crucial for accurate comparison of loans or investments, ensuring better financial decisions. Selecting products based on the effective interest rate reveals the actual return or expense, preventing misleading conclusions drawn from only the stated rate.

Table of Comparison

| Interest Type | Definition | Calculation Basis | Impact on Returns | Usage |

|---|---|---|---|---|

| Stated Interest Rate | Nominal rate quoted by lenders or banks | Simple annual percentage without compounding | Can underestimate true cost or yield | Used in loan agreements and advertised rates |

| Effective Interest Rate | Actual interest earned or paid after compounding | Includes compounding frequency (monthly, quarterly, etc.) | Reflects true cost or real return on investment | Best for comparing financial products |

Understanding Stated Interest Rate and Effective Interest Rate

The stated interest rate, often called the nominal rate, represents the annual percentage rate announced by financial institutions without accounting for compounding within the year. The effective interest rate reflects the true cost of borrowing or actual return on investment by incorporating the effects of compounding periods, providing a more accurate comparison between financial products. Evaluating both rates is essential for selecting loans or savings accounts to understand the real financial impact over time.

Key Differences Between Stated and Effective Interest Rates

Stated interest rate represents the nominal annual percentage rate without accounting for compounding within the year, while the effective interest rate reflects the actual annual cost or yield, incorporating compounding effects. Financial product selection requires comparing effective rates to understand true borrowing costs or investment returns, as stated rates can underestimate expenses or gains. The key difference lies in the compounding frequency, making effective interest rate a more accurate metric for evaluating financial products.

Why Effective Interest Rate Matters in Financial Product Choice

Effective interest rate reflects the true cost of borrowing by accounting for compounding periods within a year, making it a more accurate measure than the stated interest rate. Selecting financial products based on the effective interest rate ensures clarity on actual expenses or returns, preventing underestimation of costs or overestimation of yields. Understanding the difference between these rates enables consumers to make informed decisions that align with their financial goals and minimize hidden charges.

How to Calculate Effective Interest Rate

The effective interest rate is calculated by compounding the stated interest rate over the number of periods within a year, using the formula \( (1 + \frac{r}{n})^n - 1 \), where \( r \) is the stated annual interest rate and \( n \) is the number of compounding periods. Precise calculation of the effective interest rate reveals the true cost or return of a financial product, vital for comparing loans or investments with different compounding intervals. Understanding this metric enables informed decisions by accurately reflecting the impact of compounding frequency on overall interest incurred or earned.

Common Misconceptions About Stated Interest Rates

Stated interest rates often mislead consumers by ignoring the effects of compounding periods, resulting in underestimation of the true cost of a loan. Many borrowers confuse the nominal rate with the effective interest rate, which includes compounding and provides a more accurate measure of financial product costs. Financial product selection should prioritize the effective interest rate to avoid hidden fees and accurately compare loan offers.

Impact of Compounding on Interest Rates

The stated interest rate, also known as the nominal rate, does not account for the effects of compounding periods within a year, making it an incomplete indicator of the true cost or return of a financial product. The effective interest rate (EIR) reflects the actual annualized return or cost by incorporating compounding frequency, such as monthly or quarterly compounding, which can significantly increase the amount of interest accrued or paid. When selecting financial products, understanding the impact of compounding on the effective interest rate helps investors and borrowers compare options on a standardized basis, ensuring more informed decision-making.

Comparing Loan Offers: Looking Beyond the Stated Rate

Examining loan offers requires understanding the difference between the stated interest rate and the effective interest rate, which accounts for compounding periods and fees. The effective interest rate provides a more accurate measure of the true cost of borrowing by reflecting the total annualized cost. Comparing effective rates across financial products ensures borrowers select the most cost-efficient loan beyond just the nominal or stated rates.

Effective Rate in Savings and Investment Products

Effective interest rate provides a more accurate reflection of true earnings on savings and investment products by accounting for compounding periods within the year. It allows investors to compare financial products with different compounding methods more effectively than stated interest rates, which only indicate nominal returns. Prioritizing effective rates helps optimize investment strategies by revealing the actual growth potential of savings accounts, bonds, or fixed deposits.

Tips for Evaluating Financial Products Using Interest Rates

Compare the stated interest rate and the effective interest rate to gauge the true cost or yield of financial products, as the effective rate accounts for compounding periods within a year. Prioritize products with lower effective interest rates for loans and higher effective rates for investments to maximize financial returns or minimize borrowing costs. Analyze the compounding frequency alongside stated rates to ensure accurate comparisons between different financial offers.

Avoiding Financial Pitfalls: Choosing the Right Rate

Understanding the difference between the stated interest rate and the effective interest rate is crucial for avoiding financial pitfalls when selecting a financial product. The stated interest rate, often advertised, does not account for compounding periods, while the effective interest rate reflects the true cost of borrowing or the actual yield on an investment. Prioritizing products with a lower effective interest rate ensures clearer insight into costs and returns, preventing unexpected expenses and improving financial decision-making.

Related Important Terms

Nominal Interest Misalignment

The stated interest rate, often referred to as the nominal interest rate, can mislead borrowers and investors by not accounting for compounding periods within a year, causing a significant misalignment when compared to the effective interest rate. Selecting financial products based on nominal rates alone risks underestimating the actual cost or return, as the effective interest rate accurately reflects the true annualized cost or yield by incorporating compounding effects.

Yield Differentiation

The stated interest rate represents the nominal percentage rate advertised by a financial product, while the effective interest rate accounts for compounding periods, providing a more accurate measure of true yield. Yield differentiation becomes critical in selecting financial products, as two instruments with identical stated rates can yield significantly different returns due to variations in compounding frequency and fees.

Compounding Frequency Disparity

The stated interest rate often underrepresents the true cost or return due to differing compounding frequencies, while the effective interest rate accounts for compound interest periods within a year, providing a more accurate measure of financial product performance. Understanding the disparity between nominal and effective rates enables consumers to make informed decisions by comparing products with varied compounding intervals such as daily, monthly, or annually.

APY vs APR Comparison

The Annual Percentage Yield (APY) reflects the effective annual interest rate, accounting for compounding, while the Annual Percentage Rate (APR) represents the stated interest rate without compounding effects. Comparing APY and APR is crucial for financial product selection as APY provides a more accurate measure of actual earnings or costs, enabling consumers to assess the true value of loans, savings accounts, or investments.

Interest Rate Disclosure Gap

The disparity between the stated interest rate and the effective interest rate creates an interest rate disclosure gap that often misleads consumers when selecting financial products. Understanding the effective interest rate, which includes compounding effects and fees, is crucial for accurately comparing the true cost of loans or returns on investments.

Real Rate Transparency

Stated interest rate often excludes fees and compounding effects, leading to potential underestimation of true borrowing costs, whereas the effective interest rate incorporates all charges and compounding periods, providing a transparent measure of the real cost of a financial product. Real rate transparency enables borrowers to make informed decisions by comparing the actual expense of loans or investments beyond nominal rates.

Effective Yield Optimization

Effective interest rate accounts for compounding periods within a year, providing a more accurate measure of the true cost or return on a financial product compared to the stated interest rate. Optimizing effective yield requires analyzing the frequency of compounding and selecting options where interest compounds more frequently, maximizing overall earnings or minimizing borrowing costs.

Stated-to-Effective Conversion

The stated interest rate represents the nominal annual rate without accounting for compounding periods, while the effective interest rate reflects the true annual cost or yield by incorporating compounding effects. Accurate financial product selection requires converting stated rates to effective rates using the formula \( (1 + \frac{i}{n})^n - 1 \), where \( i \) is the stated rate and \( n \) is the number of compounding periods per year.

Hidden Cost Interest Spread

The stated interest rate on financial products often underrepresents the true cost due to hidden fees and compounding effects, making the effective interest rate a more accurate measure of total expense. Understanding the interest spread between these rates is crucial for selecting the most cost-efficient loan or investment option.

Cross-Platform Rate Uniformity

Stated interest rate represents the nominal percentage without accounting for compounding periods, while the effective interest rate reflects the true annual cost by incorporating compounding frequency. Cross-platform rate uniformity ensures that interest rates presented on different financial platforms are consistently calculated and comparable, enabling accurate selection of financial products.

Stated Interest Rate vs Effective Interest Rate for financial product selection. Infographic

moneydiff.com

moneydiff.com