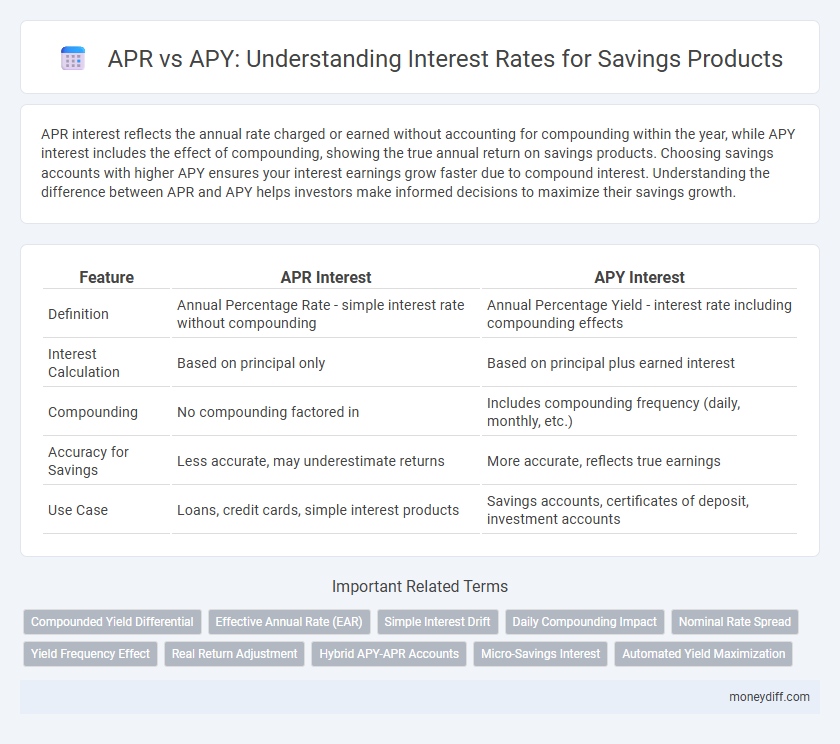

APR interest reflects the annual rate charged or earned without accounting for compounding within the year, while APY interest includes the effect of compounding, showing the true annual return on savings products. Choosing savings accounts with higher APY ensures your interest earnings grow faster due to compound interest. Understanding the difference between APR and APY helps investors make informed decisions to maximize their savings growth.

Table of Comparison

| Feature | APR Interest | APY Interest |

|---|---|---|

| Definition | Annual Percentage Rate - simple interest rate without compounding | Annual Percentage Yield - interest rate including compounding effects |

| Interest Calculation | Based on principal only | Based on principal plus earned interest |

| Compounding | No compounding factored in | Includes compounding frequency (daily, monthly, etc.) |

| Accuracy for Savings | Less accurate, may underestimate returns | More accurate, reflects true earnings |

| Use Case | Loans, credit cards, simple interest products | Savings accounts, certificates of deposit, investment accounts |

Understanding APR vs APY: Key Differences Explained

APR (Annual Percentage Rate) represents the simple interest rate charged or earned annually without factoring in compounding periods, while APY (Annual Percentage Yield) includes the effects of compounding interest over a year, offering a more accurate measure of actual earnings or costs. Savings products typically advertise APY to show the real growth of an investment, reflecting how interest is added to the principal at regular intervals. Understanding the distinction between APR and APY helps consumers compare financial products effectively by recognizing how compounding impacts overall returns.

How APR Impacts Your Savings Growth

APR (Annual Percentage Rate) reflects the simple interest rate without accounting for compound interest effects, directly influencing how much your savings grow over a year. A lower APR means slower accumulation of interest compared to APY (Annual Percentage Yield), which includes compounding frequency and provides a more accurate measure of potential earnings. Understanding the difference between APR and APY helps in choosing savings products that maximize growth by leveraging compound interest effectively.

The Role of APY in Maximizing Savings Returns

APY (Annual Percentage Yield) represents the true return on savings by accounting for compound interest, making it more accurate than APR (Annual Percentage Rate) for evaluating savings products. Savers seeking to maximize returns should prioritize APY since it reflects the effect of interest compounding within a year. Understanding APY helps consumers compare account yields effectively and select options that grow their savings faster.

Why APY Matters More Than APR for Savers

APY (Annual Percentage Yield) reflects the real return on savings by accounting for compound interest, unlike APR (Annual Percentage Rate), which only shows the nominal interest without compounding effects. For savers, APY is a more accurate measure of potential earnings because it includes the frequency of interest compounding, directly impacting the growth of their savings. Choosing savings products with higher APYs can significantly enhance wealth accumulation over time compared to those advertised solely with APR.

Calculating Savings Earnings: APR vs APY

APR (Annual Percentage Rate) represents the simple interest rate applied to a savings account without accounting for compounding within the year. APY (Annual Percentage Yield) reflects the total interest earned on savings, including the effect of compounding interest over the year, offering a more accurate measure of real earnings. Calculating savings earnings using APY provides a clearer comparison between products, as it incorporates frequency and timing of interest payments, unlike APR which may underestimate actual growth.

Compound Interest: The APY Advantage

Compound interest significantly boosts savings growth by calculating interest on both the initial principal and accumulated interest, making APY (Annual Percentage Yield) a more accurate reflection of true earnings compared to APR (Annual Percentage Rate). APY accounts for compounding frequency, which directly impacts the amount of interest earned over time, whereas APR only represents the simple interest rate without compounding effects. Choosing savings products with higher APY ensures maximizing returns through compound interest, optimizing long-term wealth accumulation.

Comparing Bank Offers: APR and APY Side by Side

APR (Annual Percentage Rate) represents the simple interest rate charged or earned annually without compounding, while APY (Annual Percentage Yield) includes the effects of compounding interest within a year, providing a more comprehensive measure of actual earnings or costs. When comparing savings accounts, APY offers a clearer insight into potential returns because it reflects how often interest is compounded, which directly impacts growth over time. Consumers should prioritize APY in bank offers to accurately evaluate savings product profitability and maximize interest earnings.

Common Misconceptions About APR and APY

Many individuals mistakenly equate Annual Percentage Rate (APR) with Annual Percentage Yield (APY), overlooking that APR does not account for compound interest while APY does. APR reflects the simple interest rate without compounding effects, making it lower than APY for the same investment. Understanding that APY provides a more accurate measure of actual earnings on savings products helps avoid misinterpretation of potential returns.

Choosing the Best Savings Product Based on Interest Type

APR interest reflects the annual rate charged or earned without compounding, making it a straightforward measure for comparing loan costs or investment yields. APY interest includes the effect of compounding within the year, providing a more accurate representation of total earnings on savings products. Selecting the best savings product requires focusing on APY to assess true growth potential, especially when compounded interest significantly impacts returns.

Tips for Evaluating Savings Accounts Using APR and APY

Compare savings accounts by examining both APR and APY to understand the true cost and potential earnings. APR indicates the annual interest rate without compounding, while APY accounts for compounding effects, providing a more accurate measure of actual returns. Focus on APY for evaluating savings products to maximize growth by identifying accounts with higher compounding frequency and better interest rates.

Related Important Terms

Compounded Yield Differential

APR interest represents the annual percentage rate without accounting for compounding effects, while APY interest includes the impact of compound interest, resulting in a higher effective yield. The compounded yield differential highlights the enhanced growth potential of savings products with frequent compounding periods, making APY a more accurate measure of true interest earnings.

Effective Annual Rate (EAR)

APR (Annual Percentage Rate) represents the nominal interest rate without compounding effects, while APY (Annual Percentage Yield) reflects the Effective Annual Rate (EAR), accounting for compound interest over a year. Understanding APY is crucial for savings products as it provides a true measure of the earning potential by incorporating compounding frequency, making it a more accurate indicator of actual interest gained.

Simple Interest Drift

APR interest reflects the annual rate without accounting for compounding effects, while APY interest includes the impact of interest compounding, resulting in a higher effective yield. Understanding simple interest drift, which occurs when APR-based calculations underestimate actual earnings due to ignoring compounding, is crucial for accurately comparing savings product returns.

Daily Compounding Impact

APR measures the annual interest rate without accounting for compounding, while APY reflects the true annual return including daily compounding effects. Daily compounding increases the effective yield on savings by calculating interest on accumulated interest each day, resulting in higher overall growth compared to a simple APR.

Nominal Rate Spread

APR interest represents the nominal rate spread, indicating the basic annualized interest without compounding, while APY interest incorporates compounding effects, showing the actual earned yield on savings products. Understanding the nominal rate spread between APR and APY helps savers evaluate the true return by comparing how frequently interest compounds within a given period.

Yield Frequency Effect

APR interest represents the annual percentage rate without accounting for the compounding effect, whereas APY interest reflects the actual annual yield including the frequency of compounding periods. The yield frequency effect causes APY to be higher than APR when interest compounds more than once per year, maximizing the growth potential of savings products.

Real Return Adjustment

APR interest rates represent the nominal annual percentage rate without compounding, while APY interest rates include the effect of compound interest, providing a more accurate measure of real return adjustment for savings products. Understanding APY enables savers to compare the true growth potential of their investments by accounting for interest-on-interest effects, thus reflecting the actual annualized yield.

Hybrid APY-APR Accounts

Hybrid APY-APR accounts combine the advantages of Annual Percentage Rate (APR) for consistent interest accrual with Annual Percentage Yield (APY) that reflects compound interest benefits, maximizing savings growth potential. These accounts leverage daily compounding frequencies and transparent rate disclosures to optimize returns compared to standard savings products that solely use APR or APY metrics.

Micro-Savings Interest

APR interest for micro-savings products represents the annual percentage rate without accounting for compound interest, while APY interest includes the effects of compounding, providing a more accurate depiction of total earnings over time. Choosing micro-savings accounts with higher APY ensures better growth potential by maximizing interest accumulation on smaller deposits.

Automated Yield Maximization

APR (Annual Percentage Rate) reflects the simple interest earned on savings products without accounting for compounding, while APY (Annual Percentage Yield) incorporates compound interest, providing a more accurate measure of true earnings. Automated yield maximization leverages APY by reinvesting interest periodically, enhancing growth potential by capturing compounding effects automatically.

APR Interest vs APY Interest for savings products Infographic

moneydiff.com

moneydiff.com