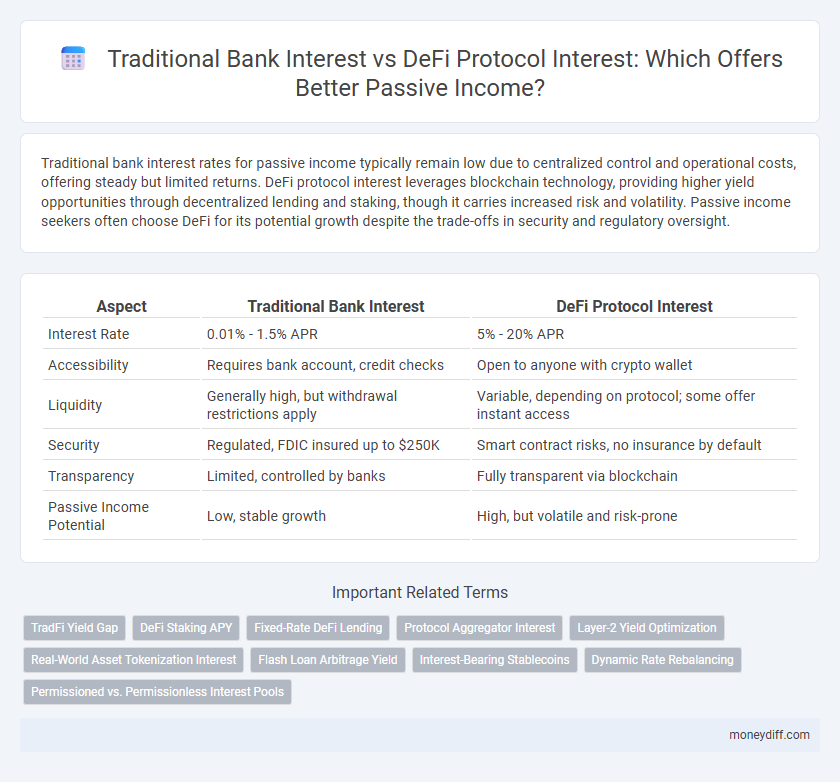

Traditional bank interest rates for passive income typically remain low due to centralized control and operational costs, offering steady but limited returns. DeFi protocol interest leverages blockchain technology, providing higher yield opportunities through decentralized lending and staking, though it carries increased risk and volatility. Passive income seekers often choose DeFi for its potential growth despite the trade-offs in security and regulatory oversight.

Table of Comparison

| Aspect | Traditional Bank Interest | DeFi Protocol Interest |

|---|---|---|

| Interest Rate | 0.01% - 1.5% APR | 5% - 20% APR |

| Accessibility | Requires bank account, credit checks | Open to anyone with crypto wallet |

| Liquidity | Generally high, but withdrawal restrictions apply | Variable, depending on protocol; some offer instant access |

| Security | Regulated, FDIC insured up to $250K | Smart contract risks, no insurance by default |

| Transparency | Limited, controlled by banks | Fully transparent via blockchain |

| Passive Income Potential | Low, stable growth | High, but volatile and risk-prone |

Understanding Traditional Bank Interest

Traditional bank interest rates for savings accounts typically range from 0.01% to 0.5% annually, offering low-risk but modest returns. These rates are influenced by central bank policies, inflation, and overall economic conditions, often lagging behind inflation rates. Understanding these limitations helps investors compare the predictable but limited growth of traditional bank interest to potentially higher yields in DeFi protocols.

What Is DeFi Protocol Interest?

DeFi protocol interest is earned by lending or staking digital assets within decentralized finance platforms that operate on blockchain technology without intermediaries. These protocols offer variable interest rates determined by supply and demand dynamics and often provide higher yields compared to traditional bank interest. DeFi interest generates passive income through smart contracts, enabling direct peer-to-peer transactions and eliminating the need for centralized financial institutions.

Key Differences Between Bank and DeFi Interest

Traditional bank interest rates typically range from 0.01% to 2%, offering low but stable returns with FDIC insurance protection. DeFi protocols can yield significantly higher interest rates, sometimes exceeding 10-20%, by utilizing smart contracts and liquidity pools, but they carry higher risks such as smart contract vulnerabilities and lack of regulatory oversight. Banks provide centralized security and regulatory safeguards, while DeFi offers decentralized, permissionless access with the potential for greater rewards and increased exposure to market volatility.

Accessibility: Banking vs DeFi Platforms

Traditional banks offer passive income through interest-bearing accounts but often require minimum balances and lengthy approval processes, limiting accessibility for many users. DeFi protocols provide open access to interest opportunities without intermediaries, enabling anyone with a digital wallet to earn yield instantly. This decentralized approach reduces barriers, offering greater financial inclusion compared to conventional banking systems.

Interest Rate Comparison: Banks vs DeFi

Traditional banks typically offer interest rates ranging from 0.01% to 2% annually on savings accounts, reflecting low risk and regulatory guarantees. In contrast, DeFi protocols provide significantly higher interest rates, often between 5% and 15%, driven by blockchain-based lending, liquidity pools, and yield farming mechanisms. The elevated returns in DeFi come with increased volatility and smart contract risks, contrasting with the stability and insured protection of bank deposits.

Security and Risk Factors to Consider

Traditional bank interest offers lower risk due to FDIC insurance and stringent regulatory oversight, ensuring principal protection and predictable returns. DeFi protocol interest yields higher returns but involves smart contract vulnerabilities, lack of regulatory safeguards, and potential liquidity risks. Evaluating security frameworks and risk exposures is crucial for choosing between stable, insured bank interest and high-yield, but riskier, decentralized finance options.

Passive Income Potential in Traditional Banks

Traditional banks offer passive income through fixed deposits and savings accounts with annual interest rates typically ranging from 0.01% to 2%, providing low-risk, stable returns backed by government insurance schemes like FDIC or FSCS. Despite lower yields compared to DeFi protocols, traditional banking ensures predictable income and capital protection, appealing to conservative investors prioritizing security over high returns. Interest rates in traditional banks vary by region and economic conditions but generally remain less volatile than decentralized finance platforms.

Earning Passive Income Through DeFi

Earning passive income through DeFi protocols offers significantly higher interest rates compared to traditional banks, with yields often ranging from 5% to over 20% APY depending on the asset and platform. DeFi platforms like Aave, Compound, and Yearn Finance enable users to lend crypto assets directly on blockchain networks, eliminating intermediaries and increasing ROI potential. Smart contract-based protocols provide transparency and continuous compounding, creating a flexible and lucrative alternative to conventional banking interest schemes.

Fees and Costs: Hidden and Transparent

Traditional bank interest often involves hidden fees such as maintenance charges and processing costs that reduce effective returns on passive income, while DeFi protocols typically offer transparent fee structures directly embedded in smart contracts, allowing investors to clearly understand costs upfront. Banks may impose withdrawal penalties and minimum balance fees that further diminish net interest earned, whereas DeFi platforms charge decentralized transaction fees (gas fees) that fluctuate but remain visible before transactions. This transparency in DeFi reduces unexpected expenses, making it a more cost-efficient option for maximizing passive income compared to conventional banking interest models.

Future Trends in Saving: Bank vs DeFi Interest

Traditional bank interest rates for savings accounts typically range between 0.01% to 1.5%, offering lower returns due to regulatory safeguards and centralized control. DeFi protocols, leveraging blockchain technology, often provide significantly higher yields ranging from 3% to over 20% APY by enabling decentralized lending and staking mechanisms. Future trends indicate a gradual shift towards DeFi platforms as they innovate with automated smart contracts and liquidity pools, potentially outperforming traditional banks in passive income generation despite associated risks.

Related Important Terms

TradFi Yield Gap

Traditional bank interest rates typically range from 0.01% to 1.5%, significantly lower than DeFi protocol yields which often offer annual percentage yields (APYs) between 5% and 20%, exposing the TradFi yield gap as a critical factor driving investors towards decentralized finance platforms for higher passive income. This substantial disparity stems from traditional banks' regulatory constraints and operational costs, contrasting with DeFi's permissionless, automated smart contracts that optimize capital efficiency and liquidity rewards.

DeFi Staking APY

DeFi protocols offer significantly higher staking APYs compared to traditional bank interest rates, often exceeding double-digit percentages due to decentralized finance's efficiency and reduced overhead costs. While traditional banks provide stable but low-interest returns typically under 1%, DeFi staking leverages blockchain technology to deliver enhanced passive income opportunities through liquidity provision and token rewards.

Fixed-Rate DeFi Lending

Fixed-rate DeFi lending protocols offer significantly higher interest yields compared to traditional bank savings accounts, often exceeding annual percentage rates (APRs) of 5-12%, while traditional banks typically provide below 1% APR. The transparency and automation of smart contracts in DeFi eliminate intermediaries, allowing users to lock in predictable returns on assets such as stablecoins without exposure to fluctuating rates common in variable-interest models.

Protocol Aggregator Interest

Protocol aggregators in DeFi offer significantly higher passive income rates compared to traditional bank interest by pooling liquidity across multiple platforms to maximize yield. These aggregators utilize advanced algorithms and smart contracts to optimize returns, often providing APYs that surpass conventional banking savings accounts by several multiples.

Layer-2 Yield Optimization

Layer-2 yield optimization in DeFi protocols significantly surpasses traditional bank interest rates by leveraging scalable blockchain solutions such as rollups and sidechains, enabling higher APRs through reduced gas fees and faster transaction speeds. These DeFi platforms automate yield farming strategies, compounding returns more efficiently than conventional banks, which typically offer fixed, lower-rate savings accounts with minimal growth potential.

Real-World Asset Tokenization Interest

Traditional bank interest rates for passive income typically range between 0.01% and 2%, constrained by regulatory environments and centralized control, whereas DeFi protocols leveraging real-world asset tokenization offer significantly higher yields, often exceeding 5% annually by enabling fractional ownership of tangible assets like real estate and commodities. Real-world asset tokenization in DeFi enhances liquidity and transparency, reducing counterparty risks while providing diversified passive income streams beyond the limitations of conventional banking interest models.

Flash Loan Arbitrage Yield

Flash loan arbitrage yield in DeFi protocols offers significantly higher passive income rates compared to traditional bank interest, leveraging instant, uncollateralized loans to exploit price discrepancies across decentralized exchanges. This method maximizes returns within minutes, far outperforming the stable but lower yields from savings accounts and fixed deposits in traditional banking systems.

Interest-Bearing Stablecoins

Interest-bearing stablecoins in DeFi protocols often yield higher annual percentage rates compared to traditional bank savings accounts, leveraging decentralized finance mechanisms and lower operational costs. These stablecoins provide passive income opportunities with enhanced liquidity and programmable smart contract features, unlike traditional banks which typically offer fixed, lower interest rates due to regulatory constraints and centralized management.

Dynamic Rate Rebalancing

Traditional bank interest rates remain fixed or change infrequently, limiting growth potential for passive income, while DeFi protocol interest leverages dynamic rate rebalancing to optimize returns based on real-time market conditions and liquidity demand. This adaptive mechanism in DeFi enables users to maximize earnings by automatically adjusting rates, outperforming static bank interest models through decentralized finance innovation.

Permissioned vs. Permissionless Interest Pools

Traditional banks offer interest through permissioned interest pools where access is controlled by central authorities, limiting participation and often resulting in lower rates. DeFi protocols utilize permissionless interest pools that enable anyone to earn passive income directly by lending or staking assets on blockchain networks, typically providing higher yields with greater transparency but increased risk.

Traditional Bank Interest vs DeFi Protocol Interest for passive income. Infographic

moneydiff.com

moneydiff.com