Flat rate interest calculates interest on the entire principal amount throughout the loan tenure, resulting in higher overall repayments. Reducing balance interest charges interest only on the outstanding loan principal, decreasing as repayments are made, making it more cost-effective. Borrowers benefit from reducing balance interest by paying less total interest compared to flat rate loans.

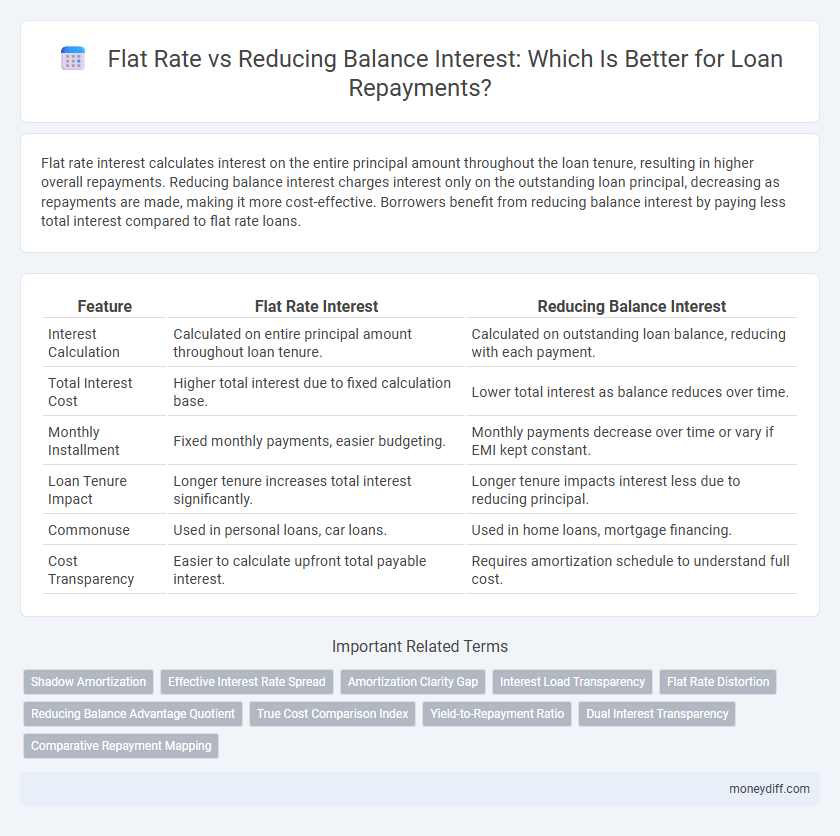

Table of Comparison

| Feature | Flat Rate Interest | Reducing Balance Interest |

|---|---|---|

| Interest Calculation | Calculated on entire principal amount throughout loan tenure. | Calculated on outstanding loan balance, reducing with each payment. |

| Total Interest Cost | Higher total interest due to fixed calculation base. | Lower total interest as balance reduces over time. |

| Monthly Installment | Fixed monthly payments, easier budgeting. | Monthly payments decrease over time or vary if EMI kept constant. |

| Loan Tenure Impact | Longer tenure increases total interest significantly. | Longer tenure impacts interest less due to reducing principal. |

| Commonuse | Used in personal loans, car loans. | Used in home loans, mortgage financing. |

| Cost Transparency | Easier to calculate upfront total payable interest. | Requires amortization schedule to understand full cost. |

Understanding Flat Rate vs Reducing Balance Interest

Flat rate interest calculates loan repayments based on the original principal amount throughout the loan tenure, resulting in fixed monthly payments but higher total interest costs. Reducing balance interest applies interest to the outstanding loan balance after each repayment, leading to decreasing interest charges and overall lower repayment amounts. Understanding these differences helps borrowers choose loans that best fit their financial strategy and minimize interest expenses.

Key Differences Between Flat Rate and Reducing Balance

Flat rate interest calculates loan repayments based on the original principal throughout the loan tenure, resulting in consistent monthly payments but higher total interest costs. Reducing balance interest is charged on the outstanding principal, causing interest payments and monthly installments to decrease over time as the loan balance reduces. The key difference lies in how interest accrues: flat rate applies a fixed percentage on the initial amount, while reducing balance applies interest on the diminishing loan balance, impacting overall affordability and total repayment.

How Flat Rate Interest Works

Flat rate interest is calculated on the original principal amount throughout the loan tenure, resulting in fixed interest charges for each repayment period. Borrowers pay interest on the total loan amount regardless of the outstanding balance, which often leads to higher total interest costs compared to reducing balance interest. This method is commonly used in personal loans and car loans for its simplicity and predictable monthly payments.

How Reducing Balance Interest Operates

Reducing balance interest operates by applying interest on the outstanding loan principal after each repayment, which decreases over time as the principal is paid down. This method results in lower interest payments compared to flat rate interest, where interest is calculated on the entire original loan amount throughout the loan tenure. Borrowers benefit from reduced total interest costs because interest charges decline in proportion to the decreasing loan balance.

Impact on Total Loan Repayment Amount

Flat rate interest calculates interest on the entire principal throughout the loan tenure, resulting in a higher total repayment amount compared to reducing balance interest, which charges interest only on the outstanding loan balance. Reducing balance interest decreases over time as the principal reduces with each payment, lowering the overall interest paid. Consequently, reducing balance interest is more cost-effective, minimizing the total loan repayment amount significantly.

Which Loan Type Offers Better Savings?

Reducing balance interest loans typically offer better savings compared to flat rate interest loans because interest is calculated on the outstanding loan principal, decreasing with each repayment. Flat rate interest charges interest on the entire principal amount throughout the loan tenure, resulting in higher overall interest payments. Borrowers usually save more with reducing balance loans, especially for longer loan terms, due to lower effective interest costs.

Pros and Cons of Flat Rate Interest

Flat rate interest loans offer predictable monthly payments, making budgeting easier for borrowers, but they often result in higher overall interest costs due to interest being calculated on the entire principal throughout the loan term. This method does not reduce the interest amount as the loan balance decreases, which can make it less cost-effective compared to reducing balance interest loans. Despite higher costs, flat rate loans are favored for their simplicity and transparency in repayment schedules.

Advantages and Disadvantages of Reducing Balance Interest

Reducing balance interest calculates interest on the outstanding loan principal, resulting in lower overall interest payments and faster loan amortization compared to flat rate interest. This method rewards borrowers who make early or extra repayments by reducing the principal and thus the interest cost over time. However, the complexity of calculations and higher initial installments can be challenging for some borrowers to manage effectively.

Typical Loan Products Using Each Interest Method

Typical loan products using flat rate interest include personal loans and vehicle loans, where the interest is calculated on the entire principal amount throughout the loan tenure. Reducing balance interest is commonly applied in mortgage loans and home equity loans, as interest is computed on the outstanding loan balance, decreasing over time. This method results in lower interest payments in later stages compared to flat rate interest loans, benefiting long-term borrowers.

Choosing the Right Interest Structure for Your Needs

Flat rate interest charges are calculated on the initial principal throughout the loan tenure, resulting in consistent but potentially higher overall payments. Reducing balance interest decreases over time as it's computed on the outstanding loan balance, lowering total interest costs and monthly installments. Selecting between flat rate and reducing balance interest depends on your cash flow stability and long-term affordability preferences.

Related Important Terms

Shadow Amortization

Shadow amortization reveals the discrepancy between flat rate interest, which calculates interest on the original principal throughout the loan term, and reducing balance interest, where interest is computed on the declining loan balance, resulting in lower overall interest costs. This method highlights how flat rate loans often lead to higher effective interest payments despite identical nominal rates, impacting borrowers' total repayment burden.

Effective Interest Rate Spread

Flat rate interest loans apply a fixed percentage on the entire principal throughout the loan tenure, resulting in a higher effective interest rate compared to reducing balance interest loans, where interest is calculated on the outstanding loan balance, decreasing over time. The effective interest rate spread between these two methods highlights the cost difference borrowers incur, often making reducing balance interest loans more economical despite similar nominal rates.

Amortization Clarity Gap

Flat rate interest calculates loan repayments on the original principal, leading to higher total interest and less transparency in amortization schedules compared to reducing balance interest, which recalculates interest on the diminishing principal, offering clearer insight into outstanding balances and interest costs. The amortization clarity gap arises because reducing balance interest aligns payments more closely with actual loan reduction, making it easier for borrowers to understand how much interest versus principal they are paying over time.

Interest Load Transparency

Flat Rate Interest calculates interest on the entire principal amount throughout the loan tenure, leading to higher overall interest paid and less transparency in interest load. Reducing Balance Interest charges interest only on the outstanding loan balance, providing clearer visibility on decreasing interest costs and more accurate repayment amounts.

Flat Rate Distortion

Flat rate interest on loans calculates interest on the entire principal amount throughout the loan tenure, leading to higher total interest payments than reducing balance interest, which charges interest only on the outstanding principal after each repayment. This flat rate distortion often results in borrowers paying significantly more interest, creating a misleading cost comparison and obscuring the true financial burden.

Reducing Balance Advantage Quotient

Reducing balance interest calculates interest on the outstanding loan principal, leading to lower overall interest costs compared to flat rate interest, where interest is charged on the initial principal throughout the loan tenure. This approach allows borrowers to save significantly on repayments by decreasing interest payments as the loan balance reduces over time, enhancing affordability and financial flexibility.

True Cost Comparison Index

Flat rate interest calculates interest on the entire original loan amount throughout the loan tenure, resulting in higher total interest payments compared to reducing balance interest, which charges interest only on the outstanding principal, lowering overall costs. The True Cost Comparison Index reveals that reducing balance interest offers more accurate cost assessment by reflecting actual repayment declines, making it a better metric for comparing loan affordability.

Yield-to-Repayment Ratio

Flat Rate Interest calculates interest on the entire principal throughout the loan tenure, resulting in a higher effective cost compared to Reducing Balance Interest, which charges interest on the outstanding loan balance, decreasing over time. The Yield-to-Repayment Ratio for Reducing Balance Interest tends to be lower, reflecting more accurate representation of the true cost and better alignment with the actual repayment schedule.

Dual Interest Transparency

Flat Rate Interest calculates interest on the entire principal throughout the loan tenure, resulting in higher total interest paid, whereas Reducing Balance Interest charges interest only on the outstanding loan balance, decreasing with each repayment and offering a more accurate cost representation. Dual Interest Transparency enhances borrower understanding by clearly disclosing both the flat rate and reducing balance interest calculations, enabling informed decisions and fairer comparisons across loan offers.

Comparative Repayment Mapping

Flat rate interest applies a fixed percentage on the entire principal throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance interest, which calculates interest on the outstanding principal after each repayment, leading to decreasing interest amounts over time. Comparative repayment mapping reveals that reducing balance interest offers lower total repayment amounts and greater savings on long-term loans, making it more cost-effective than flat rate interest.

Flat Rate Interest vs Reducing Balance Interest for loan repayments. Infographic

moneydiff.com

moneydiff.com