Nominal interest rate reflects the stated return on an investment without accounting for inflation, while the real interest rate adjusts for inflation to show the true growth of purchasing power. Investors seeking inflation-adjusted growth rely on the real interest rate to understand the actual increase in value over time. Failing to consider the difference between nominal and real rates can lead to overestimating the financial gains from an interest-bearing asset.

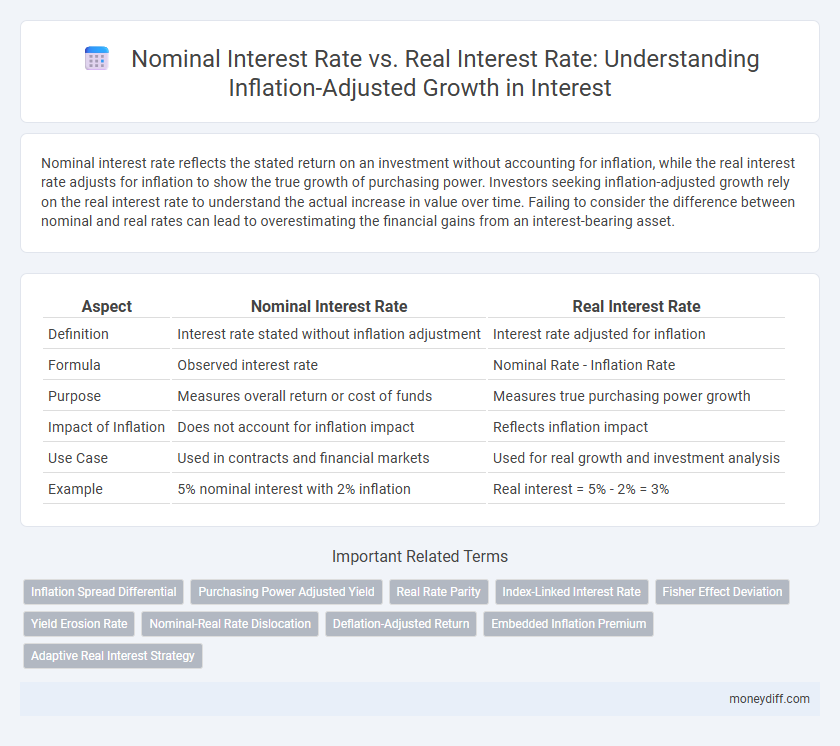

Table of Comparison

| Aspect | Nominal Interest Rate | Real Interest Rate |

|---|---|---|

| Definition | Interest rate stated without inflation adjustment | Interest rate adjusted for inflation |

| Formula | Observed interest rate | Nominal Rate - Inflation Rate |

| Purpose | Measures overall return or cost of funds | Measures true purchasing power growth |

| Impact of Inflation | Does not account for inflation impact | Reflects inflation impact |

| Use Case | Used in contracts and financial markets | Used for real growth and investment analysis |

| Example | 5% nominal interest with 2% inflation | Real interest = 5% - 2% = 3% |

Understanding Nominal vs Real Interest Rates

Nominal interest rate reflects the stated percentage charged or earned without adjusting for inflation, directly impacting loan payments and savings growth. Real interest rate accounts for inflation, representing the true increase in purchasing power and enabling more accurate comparisons of investment returns over time. Understanding the distinction between nominal and real interest rates is essential for evaluating inflation-adjusted growth and making informed financial decisions.

Why Inflation Matters in Interest Rate Calculations

Inflation directly impacts the real interest rate by eroding the purchasing power of nominal returns, making it crucial to differentiate between nominal and real interest rates for accurate investment growth assessment. Real interest rates adjust nominal rates for inflation, reflecting the true cost of borrowing and the actual yield on investments. Ignoring inflation in interest rate calculations can lead to overestimating returns and misjudging the true economic growth of assets.

Defining Nominal Interest Rate: The Basics

Nominal interest rate represents the percentage increase in money you pay or earn without adjusting for inflation, reflecting the actual cash flow exchange between borrower and lender. It serves as the baseline interest rate quoted on loans, deposits, and bonds, indicating the growth in monetary terms only. Understanding nominal rates is essential for distinguishing them from real interest rates, which account for inflation to show true purchasing power growth.

What Is Real Interest Rate and How Is It Calculated?

The real interest rate represents the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing and the real yield on investments. It is calculated by subtracting the inflation rate from the nominal interest rate, often expressed as Real Interest Rate = Nominal Interest Rate - Inflation Rate. This adjustment is critical for assessing inflation-adjusted growth, ensuring investors and borrowers understand the actual purchasing power of their returns or payments.

Comparing Nominal and Real Rates: Key Differences

Nominal interest rates represent the stated percentage return without accounting for inflation, while real interest rates adjust nominal rates by subtracting the inflation rate to reflect true purchasing power growth. The key difference lies in inflation adjustment, where real interest rates provide a more accurate measure of economic value by showing the inflation-adjusted return on investments or loans. Understanding this distinction is crucial for investors seeking inflation-adjusted growth and for policymakers targeting monetary stability.

The Impact of Inflation on Your Investment Returns

Nominal interest rate represents the stated percentage return on an investment without adjusting for inflation, while the real interest rate accounts for inflation's erosion of purchasing power, offering a clearer picture of true investment growth. Inflation reduces the real return, meaning that even high nominal rates may yield minimal or negative gains once inflation is considered. Investors must evaluate the real interest rate to understand the actual increase in wealth and make informed decisions about their investment strategies.

How to Calculate Real Interest Rates: Step-by-Step Guide

Calculate real interest rates by subtracting the inflation rate from the nominal interest rate to reflect inflation-adjusted growth. Use the Fisher equation: Real Interest Rate Nominal Interest Rate - Inflation Rate for a precise measure of purchasing power changes. This calculation is crucial for investors and economists to understand the true return on investments after accounting for inflation effects.

When to Use Nominal vs Real Interest Rates in Financial Planning

Nominal interest rates represent the stated percentage without adjusting for inflation, making them suitable for short-term financial decisions and contractual agreements. Real interest rates account for inflation, providing a clearer measure of purchasing power growth, essential for long-term investment analysis and retirement planning. Using real interest rates helps investors assess true returns and preserve wealth against inflation's erosion over time.

Limitations and Risks of Ignoring Inflation Adjustments

Nominal interest rates do not account for inflation, which can lead to an overestimation of true investment returns and purchasing power growth. Ignoring inflation adjustments increases the risk of making flawed financial decisions, as real interest rates provide a more accurate measure of inflation-adjusted growth. Failure to consider the real interest rate can result in underestimated costs, distorted savings goals, and insufficient income planning for future needs.

Strategies for Inflation-Proof Money Management

Nominal interest rate reflects the stated percentage return on investment without accounting for inflation, while the real interest rate adjusts for inflation, representing the true growth of purchasing power. Strategies for inflation-proof money management prioritize assets with real interest rate returns exceeding inflation, such as Treasury Inflation-Protected Securities (TIPS) and inflation-indexed bonds. Diversifying portfolios with these inflation-adjusted instruments helps safeguard investments from eroding value during inflationary periods.

Related Important Terms

Inflation Spread Differential

Nominal interest rate represents the stated return without adjusting for inflation, while real interest rate accounts for inflation, reflecting the true purchasing power growth. The inflation spread differential, defined as the gap between nominal and real rates, quantifies the erosion of investment returns due to inflation, crucial for accurate inflation-adjusted growth assessment.

Purchasing Power Adjusted Yield

Nominal interest rate represents the percentage increase in money without accounting for inflation, while real interest rate adjusts nominal returns by subtracting inflation, reflecting the true purchasing power adjusted yield. Investors prioritize real interest rates to evaluate the inflation-adjusted growth of their investments, ensuring that returns maintain or increase the actual purchasing power over time.

Real Rate Parity

Real interest rate parity ensures that nominal interest rates across countries adjust to reflect expected inflation differences, maintaining equilibrium in real returns and preventing arbitrage opportunities. This concept highlights that the real interest rate, which accounts for inflation-adjusted growth, is critical for accurately comparing investment yields and economic performance internationally.

Index-Linked Interest Rate

Index-linked interest rates adjust nominal interest rates by subtracting inflation, providing a real interest rate that reflects the true inflation-adjusted growth of investments. These rates protect investors from inflation eroding purchasing power by aligning returns directly with inflation indices.

Fisher Effect Deviation

Nominal interest rates reflect the stated rates without adjustment for inflation, while real interest rates account for inflation to measure true purchasing power growth. Deviations from the Fisher Effect occur when inflation expectations are inaccurate or volatile, causing nominal rates to misalign with real economic returns and impacting investment decisions.

Yield Erosion Rate

Nominal interest rate reflects the stated return without adjusting for inflation, while the real interest rate accounts for inflation's impact on purchasing power, providing a true measure of growth. The yield erosion rate quantifies how inflation diminishes nominal returns, eroding investment gains and emphasizing the importance of real interest rates in evaluating inflation-adjusted growth.

Nominal-Real Rate Dislocation

Nominal interest rates reflect the stated percentage without adjusting for inflation, whereas real interest rates account for inflation, offering a clearer measure of true purchasing power growth. The nominal-real rate dislocation occurs when inflation expectations shift unexpectedly, causing nominal rates to misrepresent real returns and potentially distorting investment decisions and economic policies.

Deflation-Adjusted Return

Nominal interest rate reflects the percentage increase in money without accounting for inflation, while real interest rate adjusts nominal returns by subtracting inflation, providing a deflation-adjusted return that accurately measures purchasing power growth. In deflationary environments, real interest rates can exceed nominal rates, indicating enhanced inflation-adjusted returns that boost investment value over time.

Embedded Inflation Premium

The nominal interest rate includes the embedded inflation premium, reflecting expected inflation's impact on returns, while the real interest rate adjusts nominal rates by subtracting inflation to reveal true purchasing power growth. Understanding this distinction is crucial for accurately assessing investment profitability and inflation-adjusted economic growth.

Adaptive Real Interest Strategy

Adaptive Real Interest Strategy adjusts the nominal interest rate by factoring in inflation rates, ensuring that the real interest rate reflects true purchasing power growth. This method dynamically responds to inflation fluctuations, optimizing investment returns and preserving capital value in varying economic conditions.

Nominal Interest Rate vs Real Interest Rate for inflation-adjusted growth. Infographic

moneydiff.com

moneydiff.com