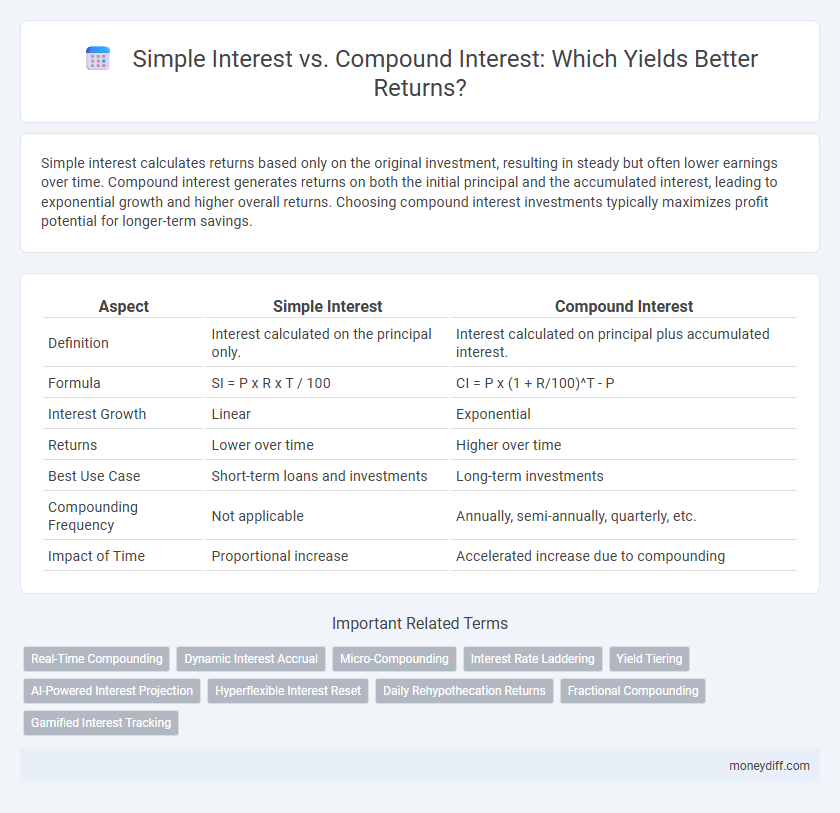

Simple interest calculates returns based only on the original investment, resulting in steady but often lower earnings over time. Compound interest generates returns on both the initial principal and the accumulated interest, leading to exponential growth and higher overall returns. Choosing compound interest investments typically maximizes profit potential for longer-term savings.

Table of Comparison

| Aspect | Simple Interest | Compound Interest |

|---|---|---|

| Definition | Interest calculated on the principal only. | Interest calculated on principal plus accumulated interest. |

| Formula | SI = P x R x T / 100 | CI = P x (1 + R/100)^T - P |

| Interest Growth | Linear | Exponential |

| Returns | Lower over time | Higher over time |

| Best Use Case | Short-term loans and investments | Long-term investments |

| Compounding Frequency | Not applicable | Annually, semi-annually, quarterly, etc. |

| Impact of Time | Proportional increase | Accelerated increase due to compounding |

Understanding the Basics: What Is Simple and Compound Interest?

Simple interest calculates returns based on the original principal amount, applying a fixed percentage rate over a specific period, making it straightforward and predictable. Compound interest, however, adds accumulated interest back into the principal, generating earnings on both the initial principal and the previously earned interest, which accelerates growth over time. This fundamental distinction impacts investment returns significantly, with compound interest typically yielding higher returns due to the effect of interest compounding at regular intervals.

How Simple Interest Works: A Clear Explanation

Simple interest calculates returns based on the original principal amount throughout the entire investment period, using the formula I = P x r x t, where I is interest, P is principal, r is the annual interest rate, and t is time in years. This method results in linear growth since the interest earned each period remains constant and does not compound. Investors receive a fixed rate of return proportional to the initial principal, making simple interest straightforward but less lucrative compared to compound interest over long durations.

The Power of Compound Interest: Maximizing Returns Over Time

Compound interest accelerates wealth growth by reinvesting earned interest, leading to exponential returns compared to simple interest, which calculates interest solely on the principal amount. Over long investment horizons, compound interest significantly outperforms simple interest, maximizing total returns by leveraging interest-on-interest effects. Financial strategies that harness compound interest, such as dividend reinvestment plans and regularly compounded savings accounts, optimize investment growth and wealth accumulation.

Key Differences Between Simple and Compound Interest

Simple interest calculates returns on the original principal only, resulting in linear growth over time, while compound interest generates returns on both the principal and accumulated interest, causing exponential growth. Simple interest is easy to compute and predictable, typically used for short-term loans or investments, whereas compound interest requires more complex calculations and is favored for long-term wealth accumulation. The frequency of compounding significantly impacts the total returns in compound interest, making it generally more profitable than simple interest in most financial scenarios.

Calculation Methods: Simple vs Compound Interest Formulas

Simple interest is calculated using the formula I = P x r x t, where P represents the principal amount, r is the annual interest rate, and t is the time in years, resulting in interest earned only on the original principal. Compound interest uses the formula A = P(1 + r/n)^(nt), where A is the amount accumulated, n is the number of compounding periods per year, and the interest is calculated on both the principal and previously earned interest. This exponential growth in compound interest typically results in higher returns over time compared to the linear growth of simple interest.

Real-Life Examples: Comparing Investment Growth

Simple interest generates returns based on the original principal, yielding linear growth exemplified by a $1,000 investment at 5% annually producing $50 each year. Compound interest accelerates growth by reinvesting earned interest, turning that same $1,000 at 5% compounded annually into approximately $1,628 after 10 years. Real-life comparisons illustrate how compound interest outperforms simple interest in long-term investments like savings accounts, retirement funds, and bonds.

Which Is Better for Long-Term Investments: Simple or Compound?

Compound interest outperforms simple interest for long-term investments due to its exponential growth effect, where interest earns additional interest over time. Simple interest calculates returns only on the initial principal, limiting growth potential. Investors aiming for higher returns over extended periods benefit significantly from compound interest's reinvestment mechanism.

Risks and Rewards: Evaluating Each Interest Type

Simple interest offers predictable returns by calculating interest solely on the principal, minimizing market risk but limiting growth potential. Compound interest generates higher rewards by reinvesting earned interest, accelerating wealth accumulation, though it entails increased risk exposure and complexity over time. Investors must weigh the safer, steady gains of simple interest against the amplified, volatile returns of compound interest to align with their risk tolerance and financial goals.

Which Interest Type Suits Your Financial Goals?

Simple interest calculates returns only on the principal amount, making it ideal for short-term loans or investments with predictable returns. Compound interest generates earnings on both principal and accumulated interest, offering exponential growth suitable for long-term financial goals like retirement planning. Choosing between simple and compound interest depends on your investment horizon and risk tolerance, with compound interest typically providing higher returns over extended periods.

Practical Tips for Choosing Simple or Compound Interest Accounts

Choosing between simple interest and compound interest accounts depends on your investment duration and financial goals. Simple interest accounts provide steady, predictable returns ideal for short-term savings or when liquidity is a priority. Compound interest accounts maximize growth by reinvesting earnings, making them suitable for long-term investments seeking exponential returns.

Related Important Terms

Real-Time Compounding

Real-time compounding accelerates the growth of investments by continuously calculating interest on the principal and accumulated interest, resulting in higher returns compared to simple interest, which only computes interest on the original principal. Investors benefit more from compound interest in scenarios with frequent compounding intervals, as this method maximizes earnings through exponential growth.

Dynamic Interest Accrual

Simple interest accrues linearly based on the principal amount, resulting in static growth, whereas compound interest calculates returns dynamically by reinvesting earned interest, leading to exponential growth. Dynamic interest accrual in compound interest leverages periodic capitalization, significantly enhancing long-term investment returns compared to simple interest.

Micro-Compounding

Simple interest calculates returns on the principal amount only, while compound interest generates earnings on both the initial principal and accumulated interest, accelerating growth. Micro-compounding enhances these returns by compounding at very high frequencies, such as daily or even every minute, maximizing the effect of interest accumulation over time.

Interest Rate Laddering

Interest rate laddering leverages varying simple and compound interest rates across multiple investments to optimize overall returns while managing risk. Simple interest provides predictable gains based on the principal, whereas compound interest accelerates growth by reinvesting earned interest, making laddering a strategic approach to balance liquidity and yield.

Yield Tiering

Simple interest calculates returns based solely on the principal amount, leading to linear growth and fixed yields, while compound interest generates returns on both principal and accumulated interest, resulting in exponential growth and higher yield tiers over time. Yield tiering in compound interest allows investors to benefit from increasing returns as interest compounds, maximizing long-term earnings compared to the static yields from simple interest.

AI-Powered Interest Projection

AI-powered interest projection enhances the accuracy of predicting returns by analyzing simple interest's linear growth and compound interest's exponential growth patterns. Utilizing machine learning algorithms, these tools optimize investment strategies by forecasting compound interest benefits over time, highlighting the long-term value of reinvested earnings compared to simple interest.

Hyperflexible Interest Reset

Simple interest calculates returns solely on the principal amount, resulting in linear growth, whereas compound interest applies interest on both principal and accumulated interest, driving exponential growth. Hyperflexible interest reset enhances compound interest benefits by allowing frequent adjustment of interest rates or reset intervals, optimizing returns according to market conditions and investment goals.

Daily Rehypothecation Returns

Simple interest calculates returns solely on the initial principal, resulting in linear growth, while compound interest incorporates daily rehypothecation returns that amplify gains by reinvesting interest earned each day. Daily rehypothecation accelerates compounding effects, significantly increasing overall returns compared to simple interest, especially over extended periods.

Fractional Compounding

Simple interest calculates returns based solely on the original principal, yielding linear growth, while compound interest applies interest on accumulated amounts, resulting in exponential growth. Fractional compounding enhances returns by compounding interest multiple times within a single year, such as daily or monthly compounding, significantly increasing the effective annual yield compared to annual compounding.

Gamified Interest Tracking

Simple interest calculates returns solely on the principal amount, while compound interest grows returns exponentially by applying interest on accumulated interest. Gamified interest tracking platforms enhance user engagement by visualizing compound interest growth through interactive progress bars and rewards, driving better financial habits and higher returns.

Simple Interest vs Compound Interest for returns Infographic

moneydiff.com

moneydiff.com