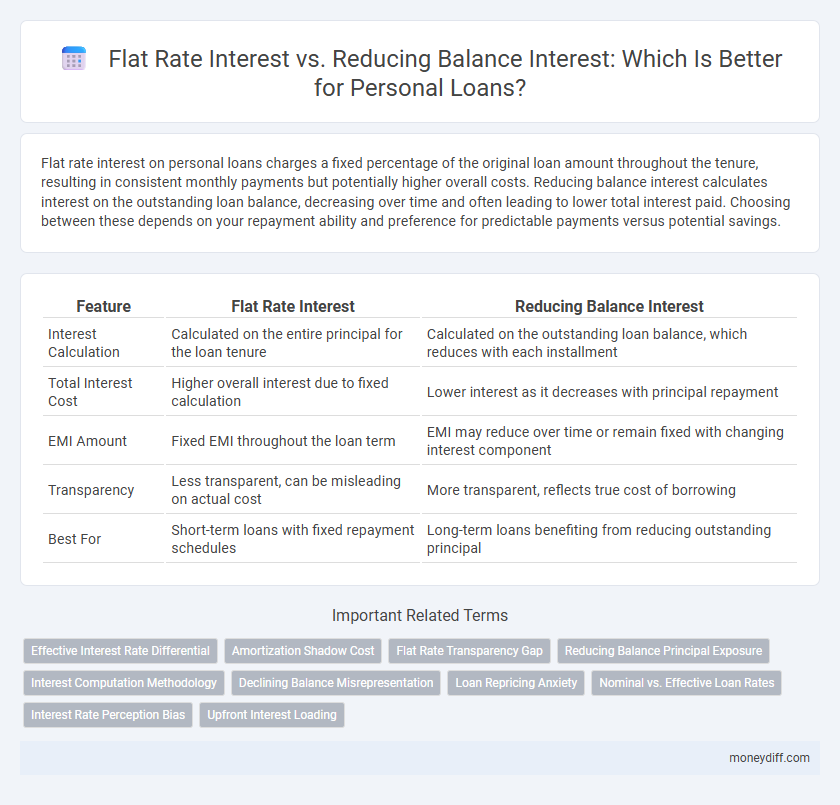

Flat rate interest on personal loans charges a fixed percentage of the original loan amount throughout the tenure, resulting in consistent monthly payments but potentially higher overall costs. Reducing balance interest calculates interest on the outstanding loan balance, decreasing over time and often leading to lower total interest paid. Choosing between these depends on your repayment ability and preference for predictable payments versus potential savings.

Table of Comparison

| Feature | Flat Rate Interest | Reducing Balance Interest |

|---|---|---|

| Interest Calculation | Calculated on the entire principal for the loan tenure | Calculated on the outstanding loan balance, which reduces with each installment |

| Total Interest Cost | Higher overall interest due to fixed calculation | Lower interest as it decreases with principal repayment |

| EMI Amount | Fixed EMI throughout the loan term | EMI may reduce over time or remain fixed with changing interest component |

| Transparency | Less transparent, can be misleading on actual cost | More transparent, reflects true cost of borrowing |

| Best For | Short-term loans with fixed repayment schedules | Long-term loans benefiting from reducing outstanding principal |

Understanding Flat Rate Interest: Key Features

Flat rate interest on personal loans is calculated on the entire principal amount throughout the loan tenure, resulting in fixed and predictable monthly payments. This method simplifies budgeting but typically leads to a higher effective interest rate compared to reducing balance interest. Borrowers should evaluate the flat rate percentage and loan duration carefully to understand the true cost of borrowing.

What is Reducing Balance Interest?

Reducing balance interest is a method where interest is calculated on the outstanding loan principal each month, leading to lower interest charges over time compared to flat rate interest. This approach results in decreasing interest payments as the loan principal is gradually repaid, making it more cost-effective for borrowers. Banks and financial institutions commonly use reducing balance interest to provide a transparent and fair loan repayment structure.

Flat Rate Interest vs Reducing Balance: Key Differences

Flat rate interest calculates interest on the entire principal amount throughout the loan tenure, resulting in higher total interest payments compared to reducing balance interest, which charges interest only on the outstanding loan balance after each repayment. Reducing balance interest reflects the actual loan burden more accurately, leading to lower effective interest rates and saving borrowers money over time. Choosing between flat rate and reducing balance interest can significantly impact the total loan cost and monthly repayment amounts for personal loans.

How Each Interest Method Impacts Your Loan Repayment

Flat rate interest calculates the interest on the entire principal amount throughout the loan tenure, resulting in higher overall interest payments compared to reducing balance interest. Reducing balance interest charges interest only on the outstanding loan balance after each repayment, leading to lower interest costs and faster principal reduction. This method significantly decreases total repayment and monthly installments, making it more cost-effective for personal loans.

Which Personal Loans Use Flat Rate Interest?

Personal loans offered by banks and non-banking financial companies (NBFCs) often use flat rate interest, especially in secured loans such as car loans and some fixed-term personal loans. Flat rate interest calculates interest on the entire principal amount throughout the loan tenure, making it common for smaller loan amounts or shorter durations. This method results in higher effective interest rates compared to reducing balance interest, which is typical in unsecured personal loans or credit cards.

When Do Lenders Offer Reducing Balance Interest?

Lenders typically offer reducing balance interest on personal loans when borrowers seek lower overall interest costs and more transparent repayment schedules. This interest method calculates charges on the outstanding loan principal, decreasing with each repayment and benefiting borrowers who prioritize long-term savings. Reducing balance interest is common in competitive lending markets where customers have greater access to loan comparisons and demand fairer interest calculations.

Calculating Flat Rate Interest: Step-by-Step

Calculating flat rate interest on personal loans involves applying a fixed percentage to the original principal amount throughout the loan tenure, disregarding any repayments made. To compute, multiply the loan principal by the flat interest rate and then by the loan period in years, which results in the total interest payable. Divide the sum of principal and total interest by the number of repayment installments to determine the fixed monthly payment amount.

Reducing Balance Interest Calculation Explained

Reducing balance interest calculation for personal loans is based on the outstanding principal amount, which decreases with every repayment, resulting in lower interest charges over time. Unlike flat rate interest that applies a fixed percentage on the entire loan amount throughout the tenure, reducing balance interest provides a more accurate reflection of the actual loan cost. This method benefits borrowers by reducing overall interest payments, making it a more cost-effective option for personal loan repayment.

Pros and Cons: Flat Rate vs Reducing Balance Loans

Flat rate interest loans offer predictable monthly payments and simpler calculations, which make budgeting easier but can result in higher overall interest costs compared to reducing balance loans. Reducing balance interest loans charge interest on the outstanding principal, leading to lower total interest payments and faster principal reduction, though the monthly payments can vary and are more complex to calculate. Choosing between flat rate and reducing balance loans depends on whether borrowers prioritize payment simplicity or cost efficiency in managing personal loans.

Choosing the Best Interest Type for Your Personal Loan

Choosing the best interest type for your personal loan depends on your repayment capacity and loan tenure. Flat rate interest calculates interest on the entire principal throughout the loan term, resulting in higher overall costs, while reducing balance interest charges interest only on the outstanding principal, lowering total interest payments over time. Understanding the impact of each method on monthly installments and total payable interest helps borrowers optimize loan affordability and financial planning.

Related Important Terms

Effective Interest Rate Differential

Flat rate interest on personal loans charges interest on the entire principal amount throughout the loan tenure, resulting in a higher effective interest rate compared to reducing balance interest, which calculates interest on the outstanding loan balance after each repayment. The effective interest rate differential can be significant, often making reducing balance interest more cost-effective due to lower interest accrual over time.

Amortization Shadow Cost

Flat rate interest on personal loans calculates interest on the entire principal throughout the loan tenure, resulting in a higher amortization shadow cost due to unchanging principal exposure. Reducing balance interest lowers the amortization shadow cost by charging interest only on the outstanding principal after each repayment, making it more cost-effective over time.

Flat Rate Transparency Gap

Flat rate interest calculates interest on the entire principal amount throughout the loan tenure, often creating a transparency gap as borrowers may underestimate the actual cost compared to reducing balance interest, which charges interest on the outstanding loan balance, decreasing with each repayment. This transparency gap in flat rate interest can lead to higher effective interest rates and increased overall loan costs, making it crucial for borrowers to understand the difference when comparing personal loan offers.

Reducing Balance Principal Exposure

Reducing Balance Interest on personal loans calculates interest based on the outstanding principal, decreasing with every repayment, resulting in lower total interest payments compared to Flat Rate Interest, which applies constant interest on the original principal throughout the loan tenure. This method more accurately reflects the borrower's principal exposure over time, making it a cost-effective and transparent option for managing loan costs.

Interest Computation Methodology

Flat rate interest on personal loans is calculated on the entire principal amount throughout the loan tenure, resulting in a fixed interest cost irrespective of the reducing loan balance. Reducing balance interest, however, is computed on the outstanding principal at each repayment period, yielding a lower effective interest cost as the loan amount decreases over time.

Declining Balance Misrepresentation

Flat rate interest often misrepresents the true cost by calculating interest on the entire principal throughout the loan term, unlike reducing balance interest which accurately charges interest on the outstanding loan amount, reflecting gradual principal repayment. This declining balance approach ensures transparency, preventing borrowers from underestimating total interest payments and enabling more precise comparisons between personal loan offers.

Loan Repricing Anxiety

Flat rate interest charges remain constant over the loan tenure, leading to lower monthly payments but higher total interest costs, while reducing balance interest decreases as the principal reduces, offering overall savings but causing fluctuating repayments that can trigger loan repricing anxiety. Borrowers often experience stress managing repayments with reducing balance interest due to recalculated EMIs after repricing, whereas flat rate loans provide predictable payments but less flexibility in cost savings.

Nominal vs. Effective Loan Rates

Flat rate interest calculates interest on the entire principal throughout the loan tenure, resulting in a lower nominal rate but a higher effective loan rate due to interest being charged on the unchanging principal. Reducing balance interest applies interest on the outstanding loan amount after each repayment, leading to a higher nominal rate but a lower effective loan rate, making it more cost-effective for personal loans.

Interest Rate Perception Bias

Flat rate interest loans appear attractive due to a constant interest amount calculated on the entire principal, masking the true higher cost compared to reducing balance interest, which calculates interest on the outstanding loan balance decreasing over time. This interest rate perception bias often leads borrowers to underestimate total interest payments, making reducing balance loans more cost-effective despite seemingly higher rates.

Upfront Interest Loading

Flat rate interest on personal loans calculates interest on the entire principal amount throughout the loan tenure, resulting in higher upfront interest loading compared to reducing balance interest. Reducing balance interest charges interest only on the outstanding loan principal after each repayment, minimizing total interest paid over the life of the loan and reducing upfront costs.

Flat Rate Interest vs Reducing Balance Interest for personal loans. Infographic

moneydiff.com

moneydiff.com