Annual interest provides a fixed percentage return calculated once per year, making it easier to predict earnings over a 12-month period. Daily accrual interest, however, compounds interest every day, resulting in slightly higher returns due to the effect of daily compounding. Selecting between annual interest and daily accrual interest depends on the account holder's preference for straightforward calculations or maximizing growth through frequent compounding.

Table of Comparison

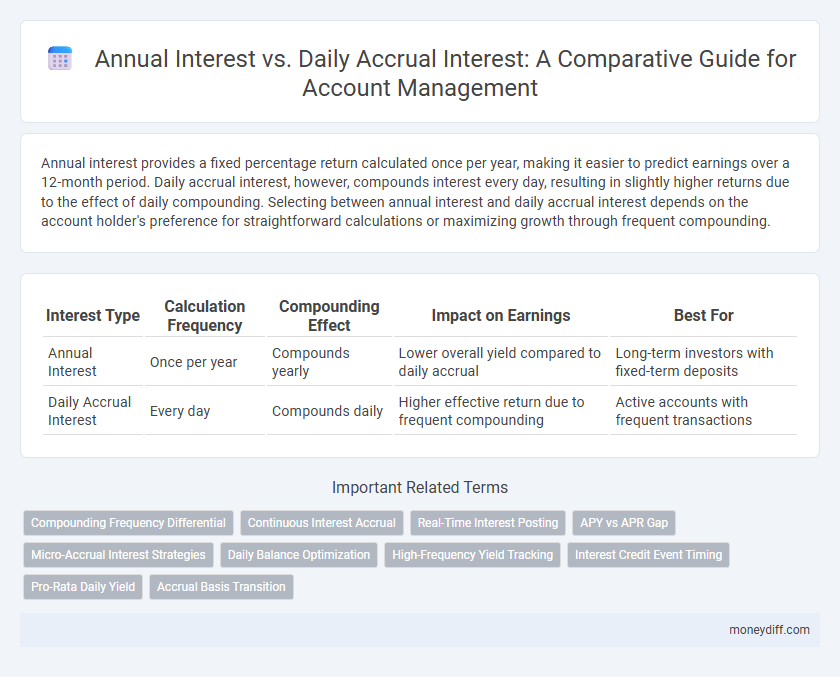

| Interest Type | Calculation Frequency | Compounding Effect | Impact on Earnings | Best For |

|---|---|---|---|---|

| Annual Interest | Once per year | Compounds yearly | Lower overall yield compared to daily accrual | Long-term investors with fixed-term deposits |

| Daily Accrual Interest | Every day | Compounds daily | Higher effective return due to frequent compounding | Active accounts with frequent transactions |

Understanding Annual and Daily Accrual Interest

Annual interest represents the total percentage earned on an account balance over a year, while daily accrual interest calculates earnings based on daily balances and interest rates, compounding over time. Understanding how daily accrual interest compounds can help account holders maximize returns by recognizing the impact of frequent balance changes and interest calculations. Financial institutions often use daily accrual to provide more accurate and timely interest payments compared to the simpler annual interest model.

Key Differences Between Annual and Daily Interest

Annual interest is calculated once per year based on the principal amount, resulting in a fixed interest amount that compounds annually. Daily accrual interest computes interest every day on the outstanding balance, allowing for more frequent compounding and potentially higher returns over time. The key differences lie in the compounding frequency, interest calculation method, and the impact on overall earnings or costs in account management.

How Annual Interest Impacts Account Growth

Annual interest compounds account growth by accumulating interest over a year, leading to higher returns compared to simple interest calculations. Investors benefit from the exponential effect of annual compounding, which increases the principal and future interest earned. Managing accounts with annual interest helps maximize long-term wealth accumulation through consistent reinvestment.

Daily Accrual Interest: Maximizing Short-Term Gains

Daily accrual interest calculates interest on account balances every day, allowing for more precise growth and immediate benefit from deposits or withdrawals. Compared to annual interest, it maximizes short-term gains by compounding daily, resulting in higher effective returns in fluctuating balance scenarios. Account holders leveraging daily accrual interest experience enhanced liquidity and accelerated interest accumulation throughout the year.

Compounding Frequency: Annual vs Daily Interest

Annual interest compounds once per year, resulting in interest being calculated on the principal plus accumulated interest only at year-end, which may limit earning potential. Daily accrual interest compounds interest every day, allowing account balances to grow faster through frequent application of interest on the accrued amount. Higher compounding frequency with daily interest maximizes returns by leveraging exponential growth within the account management process.

Which is Better? Comparing Returns Over Time

Annual interest compounds once per year, often resulting in a straightforward calculation and predictable returns, whereas daily accrual interest compounds every day, allowing earnings to grow faster due to more frequent application of interest. Over time, accounts with daily interest accrual typically yield higher returns because interest is calculated on an ever-increasing principal balance. Choosing between the two depends on the investment horizon and the compounding frequency's impact on overall growth potential.

Practical Examples: Annual vs Daily Interest Calculations

Annual interest calculations apply a fixed interest rate to the principal balance once per year, resulting in a straightforward but less frequent compounding effect. Daily accrual interest calculates interest on the account balance each day, allowing for more precise growth and higher effective yield due to daily compounding. For example, a $10,000 deposit at 5% annual interest yields $500 after one year under annual calculation, whereas daily accrual compounding results in approximately $511, reflecting the impact of continuous interest accumulation.

Pros and Cons of Annual Interest for Account Management

Annual interest simplifies account management by providing a clear, predictable amount earned or owed over the year, making budgeting and financial planning straightforward. However, it may result in less frequent compounding benefits compared to daily accrual interest, potentially reducing overall returns for savers or increasing costs for borrowers. Annual interest is easier to calculate and communicate but can delay interest recognition, affecting cash flow timing and investment reinvestment opportunities.

Advantages and Disadvantages of Daily Accrual Interest

Daily accrual interest calculates interest on a daily basis, allowing for more precise growth and potential for higher returns compared to annual interest, which accrues once per year. The advantage of daily accrual interest is that it captures interest earnings more frequently, enhancing the compounding effect for account holders with fluctuating balances. However, its complexity can complicate account management and understanding, possibly leading to confusion or miscalculations in interest income projections.

Choosing the Right Interest Accrual Method for Your Finances

Annual interest provides a straightforward calculation based on a fixed rate over a year, ideal for long-term savings with predictable returns. Daily accrual interest compounds interest each day, maximizing earnings for accounts with frequent transactions or variable balances. Selecting the right method depends on your financial habits, ensuring optimal growth and accurate account management.

Related Important Terms

Compounding Frequency Differential

Annual interest compounds once per year, potentially yielding lower overall returns compared to daily accrual interest, which compounds each day and accelerates growth through more frequent application of interest on the principal and accrued interest. The compounding frequency differential significantly impacts account management strategies by enhancing the effective annual rate (EAR) and increasing the total accumulated interest over time when using daily accrual methods.

Continuous Interest Accrual

Continuous interest accrual calculates interest by compounding account balances instantly, resulting in a more precise and potentially higher yield compared to standard annual interest that is applied once per year. This method optimizes account growth by reflecting real-time balance changes, ensuring that every transaction immediately influences earnings.

Real-Time Interest Posting

Daily accrual interest enables real-time interest posting by calculating and adding interest to the account balance every day, enhancing accuracy and allowing immediate reflection of earned interest. Annual interest, however, accumulates interest over the year and posts it only once, which can delay the impact of earned interest on account balances and limit timely financial decision-making.

APY vs APR Gap

Annual Percentage Yield (APY) reflects the total interest earned on an account with compounding over a year, while Annual Percentage Rate (APR) represents the simple interest rate without compounding, creating a gap that significantly impacts account management decisions. Understanding the difference between APY and APR is crucial for accurately comparing daily accrual interest to annual interest, as APY accounts for daily compounding effects that APR does not capture.

Micro-Accrual Interest Strategies

Annual interest calculations provide a fixed percentage return over a year, while daily accrual interest compounds earnings by calculating interest each day, optimizing micro-accrual strategies for account management. Utilizing daily accrual interest maximizes returns on small balances by continuously adding interest, enhancing account growth through frequent compounding.

Daily Balance Optimization

Daily accrual interest maximizes returns by calculating interest based on the account's daily balance, allowing for more precise growth compared to annual interest, which applies a fixed rate once per year. Optimizing daily balances ensures that funds consistently earn interest, reducing the impact of fluctuations and increasing overall account profitability.

High-Frequency Yield Tracking

Annual interest rates provide a fixed percentage return calculated once per year, while daily accrual interest compounds the yield daily, enabling more precise high-frequency yield tracking for account management. Daily accrual interest maximizes earnings by continuously updating balances and reflecting interest growth in real-time, enhancing short-term investment strategies.

Interest Credit Event Timing

Annual interest compounds once per year, crediting the earned interest at the end of the 12-month period, which can delay reinvestment benefits. Daily accrual interest calculates and credits interest each day, allowing for more frequent compounding and potentially higher overall returns through earlier credit event timing.

Pro-Rata Daily Yield

Pro-rata daily yield calculates interest based on the exact number of days funds are held, providing a precise and fair reflection of earnings compared to annual interest rates that assume fixed periods. This method enhances account management accuracy by aligning interest accrual with actual holding durations, optimizing returns for variable cash flows.

Accrual Basis Transition

Switching an account from annual interest to daily accrual interest enhances precise cash flow forecasting by calculating interest based on the actual days funds are held. This accrual basis transition ensures more accurate interest expenses, improves financial reporting accuracy, and allows for timely adjustments in account management strategies.

Annual Interest vs Daily Accrual Interest for account management. Infographic

moneydiff.com

moneydiff.com