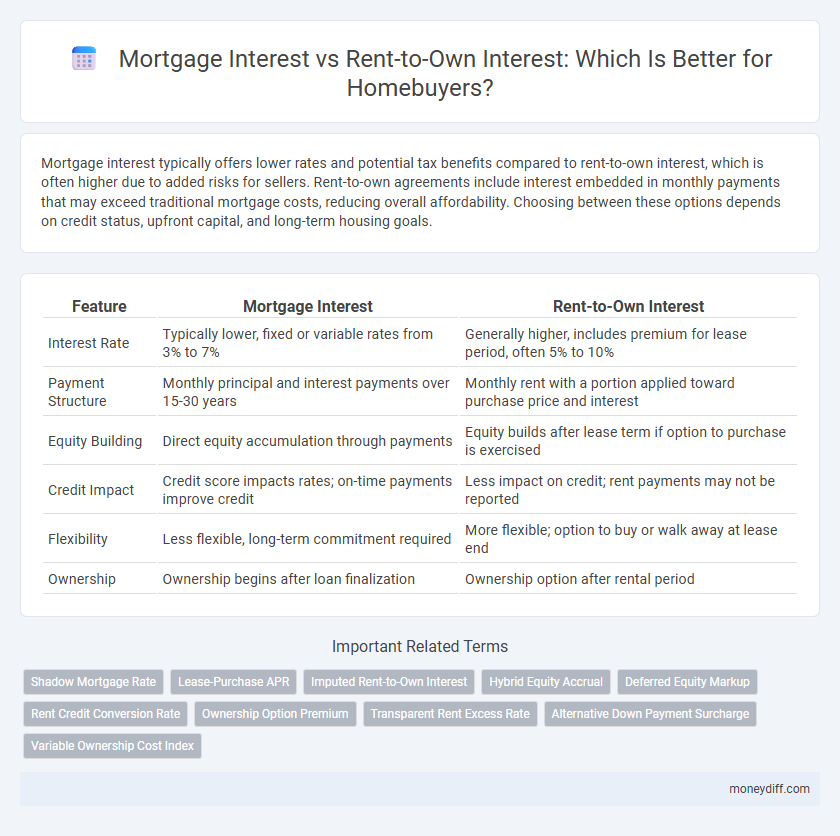

Mortgage interest typically offers lower rates and potential tax benefits compared to rent-to-own interest, which is often higher due to added risks for sellers. Rent-to-own agreements include interest embedded in monthly payments that may exceed traditional mortgage costs, reducing overall affordability. Choosing between these options depends on credit status, upfront capital, and long-term housing goals.

Table of Comparison

| Feature | Mortgage Interest | Rent-to-Own Interest |

|---|---|---|

| Interest Rate | Typically lower, fixed or variable rates from 3% to 7% | Generally higher, includes premium for lease period, often 5% to 10% |

| Payment Structure | Monthly principal and interest payments over 15-30 years | Monthly rent with a portion applied toward purchase price and interest |

| Equity Building | Direct equity accumulation through payments | Equity builds after lease term if option to purchase is exercised |

| Credit Impact | Credit score impacts rates; on-time payments improve credit | Less impact on credit; rent payments may not be reported |

| Flexibility | Less flexible, long-term commitment required | More flexible; option to buy or walk away at lease end |

| Ownership | Ownership begins after loan finalization | Ownership option after rental period |

Understanding Mortgage Interest: Key Concepts

Mortgage interest represents the cost of borrowing money from a lender to purchase a home, calculated as a percentage of the outstanding loan balance. Unlike rent-to-own agreements that may include built-in interest within monthly payments, mortgage interest directly affects the total amount paid over the loan term and can be tax-deductible depending on jurisdiction. Key concepts include understanding fixed versus variable interest rates, amortization schedules, and how interest impacts monthly payments and overall affordability.

What is Rent-to-Own Interest?

Rent-to-own interest refers to the portion of monthly payments in a lease-to-own housing agreement that is attributed to the future purchase price, effectively acting as an alternative form of interest over the rental period. Unlike traditional mortgage interest, which accrues on a loan borrowed to buy property, rent-to-own interest builds equity gradually while tenants pay rent premiums credited toward homeownership. This structure allows tenants to lock in purchase prices and accumulate down payment credit, serving as a financial bridge between renting and owning a home.

Mortgage Interest vs Rent-to-Own Interest: Core Differences

Mortgage interest is a fixed or variable rate charged on a loan taken to purchase a home, typically offering tax deductions and long-term equity building. Rent-to-own interest usually incorporates higher implicit costs within monthly payments, often lacking clear interest rate disclosure and offering limited tax benefits. The core difference lies in mortgage interest being explicit and regulated, while rent-to-own interest remains embedded and less transparent in rental agreements.

Long-Term Costs: Mortgage vs Rent-to-Own

Mortgage interest typically results in lower long-term costs compared to rent-to-own interest, as mortgage rates are generally fixed and amortized over 15 to 30 years, creating predictable monthly payments and eventual home equity. Rent-to-own agreements often carry higher implicit interest through premium rent payments and option fees, which do not contribute to home equity, increasing overall housing expenses. Choosing a mortgage can lead to significant savings and asset ownership in the long term, while rent-to-own may end up costing more without guaranteeing ownership benefits.

Tax Implications: Deducting Mortgage vs Rent-to-Own Interest

Mortgage interest payments are generally tax-deductible, allowing homeowners to reduce their taxable income and potentially lower their overall tax burden. Rent-to-own agreements often do not provide the same tax benefits because rent payments, including any portion labeled as interest, are typically considered non-deductible personal expenses. Understanding these tax implications can significantly impact the financial advantages of choosing a traditional mortgage over rent-to-own housing options.

Equity Building: Mortgage vs Rent-to-Own Payments

Mortgage interest payments contribute directly to building home equity, as monthly payments reduce the principal loan balance over time. In contrast, rent-to-own payments often include a portion credited toward future equity, but this amount tends to be lower and less guaranteed compared to traditional mortgage amortization. Homebuyers seeking long-term equity growth typically benefit more from a mortgage structure due to its systematic principal repayment and interest accumulation.

Flexibility and Commitment: Interest Impact

Mortgage interest typically involves a long-term financial commitment with fixed or adjustable rates that can affect monthly payments and overall affordability. Rent-to-own interest, often embedded in monthly rent premiums, offers greater flexibility by allowing tenants to build equity without immediate large loan obligations. This flexibility in rent-to-own agreements can reduce upfront financial strain while mortgage interest impacts credit and home equity accumulation over time.

Early Termination: Financial Penalties and Interest

Early termination of mortgage agreements typically involves paying off the remaining loan balance along with accrued interest, which can result in prepayment penalties depending on the loan's terms. Rent-to-own contracts often impose fees or forfeiture of down payments when terminated early, but do not accumulate traditional mortgage interest. Understanding the specific early termination clauses and associated financial penalties in both mortgage and rent-to-own agreements is essential for minimizing unexpected costs.

Credit Score Impacts: Mortgage vs Rent-to-Own

Mortgage interest directly affects credit scores by reflecting timely payments and reducing principal, which improves credit profiles over time; missing payments can severely damage credit. Rent-to-own agreements often do not report monthly payments to credit bureaus, limiting positive credit impact, but timely payments under these contracts may enhance credit if the provider reports them. Borrowers aiming to build or repair credit typically benefit more from mortgage interest payments documented by credit agencies than from rent-to-own arrangements with inconsistent reporting.

Choosing the Right Path: Financial Tips for Homebuyers

Mortgage interest often offers tax deductibility and builds equity over time, making it a financially strategic choice for long-term homeowners. Rent-to-own interest payments contribute partially to eventual home ownership but typically come with higher effective costs and limited financial benefits. Evaluating credit scores, loan terms, and upfront fees helps homebuyers select the most cost-efficient path tailored to their financial goals and market conditions.

Related Important Terms

Shadow Mortgage Rate

Shadow mortgage rates usually exceed traditional mortgage interest rates, reflecting higher risk and limited market transparency compared to conventional home loans. Rent-to-own interest structures often embed implicit financing costs that can surpass the shadow mortgage rate, making direct comparison crucial for assessing long-term homeownership affordability.

Lease-Purchase APR

Mortgage interest rates typically range from 3% to 7% APR depending on credit score and loan terms, offering long-term equity building through homeownership. Lease-purchase agreements often feature higher Lease-Purchase APRs, sometimes exceeding 8%, reflecting added risk and interest costs embedded in rent-to-own contracts that combine rental payments with future purchase options.

Imputed Rent-to-Own Interest

Imputed rent-to-own interest represents the inferred cost of financing a rent-to-own housing arrangement, often exceeding traditional mortgage interest rates due to higher risk premiums and less favorable loan terms. Understanding this imputed interest is crucial for comparing the true financial impact of rent-to-own agreements versus conventional mortgages on long-term housing costs.

Hybrid Equity Accrual

Mortgage interest builds equity gradually as monthly payments reduce the principal balance, offering long-term asset growth and potential tax benefits. Rent-to-own interest often includes hybrid equity accrual, where a portion of rent payments contributes toward homeownership, blending renting flexibility with future equity accumulation.

Deferred Equity Markup

Mortgage interest typically involves fixed or variable rates directly tied to loan principal, while rent-to-own interest often incorporates a Deferred Equity Markup, where a portion of monthly payments contributes to future home equity buildup instead of traditional interest. This Deferred Equity Markup model benefits renters by allowing gradual equity accumulation during the lease term, contrasting with mortgage interest that solely accrues cost without immediate ownership stake.

Rent Credit Conversion Rate

Rent-to-own interest often includes a rent credit conversion rate, allowing a portion of monthly rent payments to accumulate as equity towards the home's purchase price, unlike traditional mortgage interest which is solely a cost of borrowing. This rent credit mechanism can effectively reduce the overall cost of homeownership by converting rent into down payment, providing a financial advantage for buyers with limited initial capital.

Ownership Option Premium

Mortgage interest typically includes an ownership option premium reflected in accumulated equity, whereas rent-to-own interest often carries a higher effective premium due to combined rent costs and purchase price incentives. The ownership option premium in mortgage loans directly contributes to asset building, contrasting with rent-to-own arrangements where payments partially cover rent until ownership is acquired.

Transparent Rent Excess Rate

Mortgage interest rates typically reflect long-term financing costs with transparent annual percentage rates (APRs), while rent-to-own interest often includes a hidden transparent rent excess rate, which can significantly increase the effective cost of housing over time. Understanding the transparent rent excess rate in rent-to-own agreements is crucial for accurately comparing total payments and making informed decisions between purchasing through a mortgage or a rent-to-own contract.

Alternative Down Payment Surcharge

Mortgage interest typically offers tax-deductible benefits that reduce overall borrowing costs, whereas rent-to-own interest often includes an alternative down payment surcharge that increases the effective interest paid over time. Understanding the financial impact of this surcharge is crucial for evaluating the total cost of homeownership compared to traditional mortgage financing.

Variable Ownership Cost Index

Mortgage interest rates typically contribute to a lower Variable Ownership Cost Index compared to rent-to-own interest, as mortgage payments build home equity over time while rent-to-own agreements include higher interest premiums without equity accumulation. Analyzing long-term housing affordability, mortgage interest offers predictable costs and potential tax benefits, whereas rent-to-own interest often results in increased overall expenses due to elevated variable ownership costs.

Mortgage Interest vs Rent-to-Own Interest for housing. Infographic

moneydiff.com

moneydiff.com