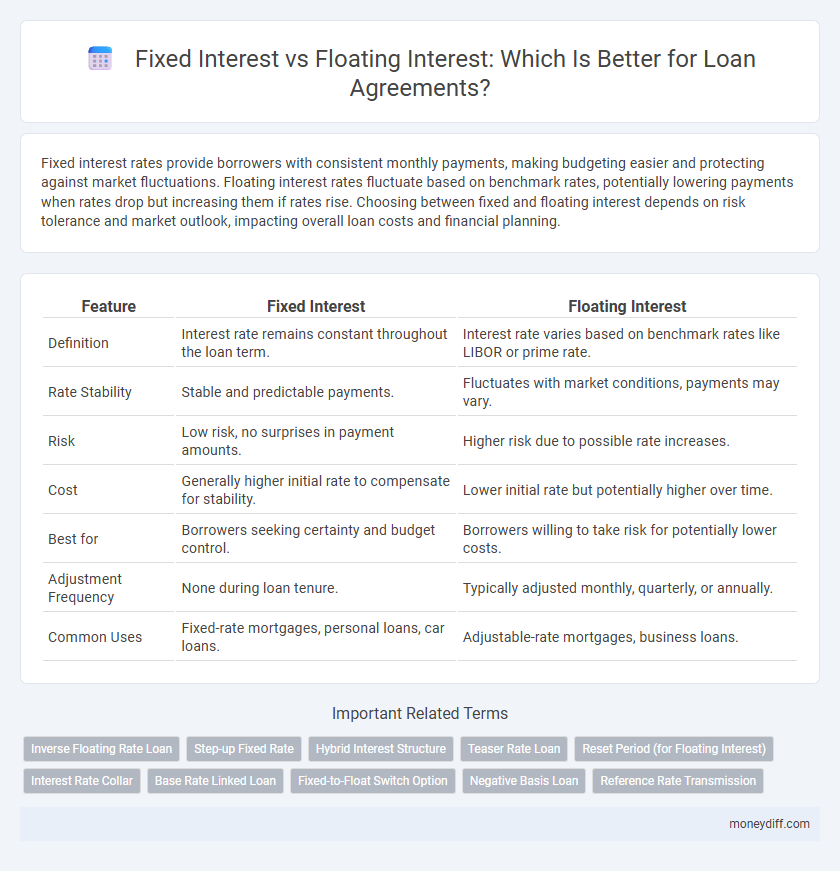

Fixed interest rates provide borrowers with consistent monthly payments, making budgeting easier and protecting against market fluctuations. Floating interest rates fluctuate based on benchmark rates, potentially lowering payments when rates drop but increasing them if rates rise. Choosing between fixed and floating interest depends on risk tolerance and market outlook, impacting overall loan costs and financial planning.

Table of Comparison

| Feature | Fixed Interest | Floating Interest |

|---|---|---|

| Definition | Interest rate remains constant throughout the loan term. | Interest rate varies based on benchmark rates like LIBOR or prime rate. |

| Rate Stability | Stable and predictable payments. | Fluctuates with market conditions, payments may vary. |

| Risk | Low risk, no surprises in payment amounts. | Higher risk due to possible rate increases. |

| Cost | Generally higher initial rate to compensate for stability. | Lower initial rate but potentially higher over time. |

| Best for | Borrowers seeking certainty and budget control. | Borrowers willing to take risk for potentially lower costs. |

| Adjustment Frequency | None during loan tenure. | Typically adjusted monthly, quarterly, or annually. |

| Common Uses | Fixed-rate mortgages, personal loans, car loans. | Adjustable-rate mortgages, business loans. |

Understanding Fixed vs Floating Interest Rates

Fixed interest rates maintain a constant percentage over the loan term, providing predictable monthly payments and shielding borrowers from market fluctuations. Floating interest rates, also known as variable rates, fluctuate based on benchmark rates like LIBOR or the prime rate, potentially lowering costs during market dips but increasing risk when rates rise. Choosing between fixed and floating rates depends on risk tolerance, market conditions, and financial goals, impacting overall loan affordability and repayment strategies.

Key Features of Fixed Interest Loans

Fixed interest loans offer a predetermined and stable interest rate throughout the loan term, ensuring consistent monthly payments that aid in budgeting and financial planning. These loans protect borrowers from market fluctuations, making them ideal for long-term financial commitments and reducing the risk of payment increases. Key features include predictable repayment schedules, protection against rising interest rates, and often higher initial rates compared to floating interest options.

What Defines a Floating Interest Loan?

A floating interest loan is characterized by an interest rate that varies in accordance with market benchmarks, such as the LIBOR or the prime rate, causing fluctuations over the loan term. This variability allows borrowers to benefit from lower rates during market downturns but also exposes them to increased costs if rates rise. Floating interest loans offer flexibility and potential savings compared to fixed interest loans, making them suitable for borrowers anticipating changing market conditions.

Pros and Cons of Fixed Interest Rates

Fixed interest rates offer predictable monthly payments, making budgeting easier and providing protection against market fluctuations. The downside includes potentially higher initial rates compared to floating interest, and less flexibility to benefit from falling market rates. Borrowers prioritizing stability over market variability often prefer fixed interest in loan agreements.

Advantages and Drawbacks of Floating Interest Rates

Floating interest rates offer borrowers the advantage of potentially lower initial costs compared to fixed rates, enabling savings when market rates decline. The main drawback lies in their inherent unpredictability, exposing borrowers to increased payment volatility and financial uncertainty if rates rise. This variability can complicate budgeting and long-term financial planning, despite the opportunity to benefit from favorable market fluctuations.

How Interest Rate Types Affect Repayment Amounts

Fixed interest rates remain constant throughout the loan term, ensuring stable and predictable repayment amounts that protect borrowers from market fluctuations. Floating interest rates vary based on benchmark indices like LIBOR or SOFR, causing repayment amounts to fluctuate and potentially increase or decrease over time. The choice between fixed and floating interest significantly impacts the total cost of borrowing and monthly financial planning for loan agreements.

Risk Assessment: Fixed vs Floating for Borrowers

Fixed interest rates offer borrowers predictable repayment amounts, reducing exposure to market fluctuations and enabling easier budgeting and financial planning. Floating interest rates fluctuate with market conditions, potentially lowering costs when rates decline but increasing risk during rate hikes, which can lead to higher repayment burdens. Assessing risk tolerance, future interest rate trends, and cash flow stability is essential for borrowers choosing between fixed and floating interest options in loan agreements.

Impact of Market Fluctuations on Loan Interest

Fixed interest rates provide stability by maintaining a constant loan interest rate throughout the agreement, insulating borrowers from market fluctuations. Floating interest rates fluctuate based on benchmark rates such as LIBOR or the Federal Funds Rate, causing monthly payments to vary with market conditions. Loan agreements with floating interest expose borrowers to potential increases in interest costs during periods of rising market rates, impacting overall affordability and budgeting.

Choosing the Right Interest Rate Structure

Choosing the right interest rate structure in loan agreements involves evaluating fixed interest rates, which provide payment stability and protection against market fluctuations, versus floating interest rates that offer potential cost savings when rates decrease. Fixed interest loans are preferable for borrowers seeking predictable monthly expenses and long-term budget certainty, while floating rates suit those comfortable with risk and aiming to benefit from lower initial rates. Analyzing factors such as loan duration, market interest trends, and personal financial tolerance is essential for optimizing borrowing costs.

Fixed or Floating: Which Suits Your Financial Goals?

Fixed interest loans provide predictable monthly payments, making budgeting easier and protecting borrowers from rising rates, ideal for those prioritizing stability and long-term financial planning. Floating interest loans fluctuate with market rates, potentially offering lower initial costs but increased uncertainty, suitable for borrowers willing to take risk for potential savings. Choosing between fixed and floating interest depends on your tolerance for interest rate variability and your financial goals regarding predictability versus flexibility.

Related Important Terms

Inverse Floating Rate Loan

Inverse floating rate loans feature interest rates that move inversely to a benchmark rate, providing borrowers with lower payments when market rates rise. These loans offer unique risk management benefits compared to fixed interest loans, which maintain constant rates regardless of market fluctuations.

Step-up Fixed Rate

Step-up fixed rate loans start with a lower fixed interest rate that increases at predetermined intervals, offering predictable payment schedules while accommodating future interest rate rises. This hybrid structure blends the certainty of fixed interest with flexibility compared to traditional fixed or floating interest loans in loan agreements.

Hybrid Interest Structure

A hybrid interest structure combines fixed and floating interest rates, offering borrowers initial payment stability with potential cost savings from subsequent rate adjustments tied to market benchmarks like LIBOR or SOFR. This approach mitigates risks associated with interest rate volatility while providing flexibility to benefit from declining rates during the loan term.

Teaser Rate Loan

A teaser rate loan features a fixed interest rate initially set below the prevailing market rate to attract borrowers, switching to a floating interest rate after the promotional period ends, which can lead to higher payments based on market fluctuations. Borrowers should carefully compare the initial benefits of lower fixed interest with the potential risks of increased costs under the subsequent floating interest rate to make informed loan agreement decisions.

Reset Period (for Floating Interest)

The reset period in floating interest loans determines how often the interest rate is adjusted based on market benchmarks, typically ranging from monthly to quarterly intervals. A shorter reset period can lead to more frequent rate fluctuations, impacting the overall loan cost, while a longer reset period provides rate stability but may delay responsiveness to market changes.

Interest Rate Collar

An Interest Rate Collar in loan agreements sets a floor and cap on floating interest rates, protecting borrowers from rising rates while allowing some benefit if rates fall. This mechanism balances the risk of variable interest fluctuations, offering more predictable loan costs compared to purely fixed or floating interest rate options.

Base Rate Linked Loan

Base rate linked loans combine a fixed margin with a fluctuating base interest rate, causing repayments to vary in alignment with market rate movements. Borrowers benefit from potential rate decreases tied to the base rate, while facing increased costs if the base rate rises, contrasting with fixed interest loans where payment amounts remain constant regardless of market fluctuations.

Fixed-to-Float Switch Option

The Fixed-to-Float switch option in loan agreements allows borrowers to start with a fixed interest rate, providing payment stability, then transition to a floating interest rate to benefit from potential market rate declines, optimizing loan cost management. This hybrid structure combines predictable budgeting with flexibility, helping to hedge against interest rate volatility while capitalizing on favorable economic conditions.

Negative Basis Loan

Negative basis loans often involve floating interest rates that can decrease below the reference rate, leading to a situation where the lender pays the borrower interest, complicating traditional loan valuation. Fixed interest loans provide predictable repayment amounts, but negative basis loan structures require careful risk assessment due to potential negative yield scenarios impacting both parties.

Reference Rate Transmission

Fixed interest loans maintain a constant rate throughout the agreement, providing predictable payments but no benefit from decreasing market rates. Floating interest loans adjust according to a reference rate, such as LIBOR or EURIBOR, allowing borrowers to benefit when these benchmark rates decline but exposing them to potential rate increases.

Fixed Interest vs Floating Interest for loan agreements. Infographic

moneydiff.com

moneydiff.com