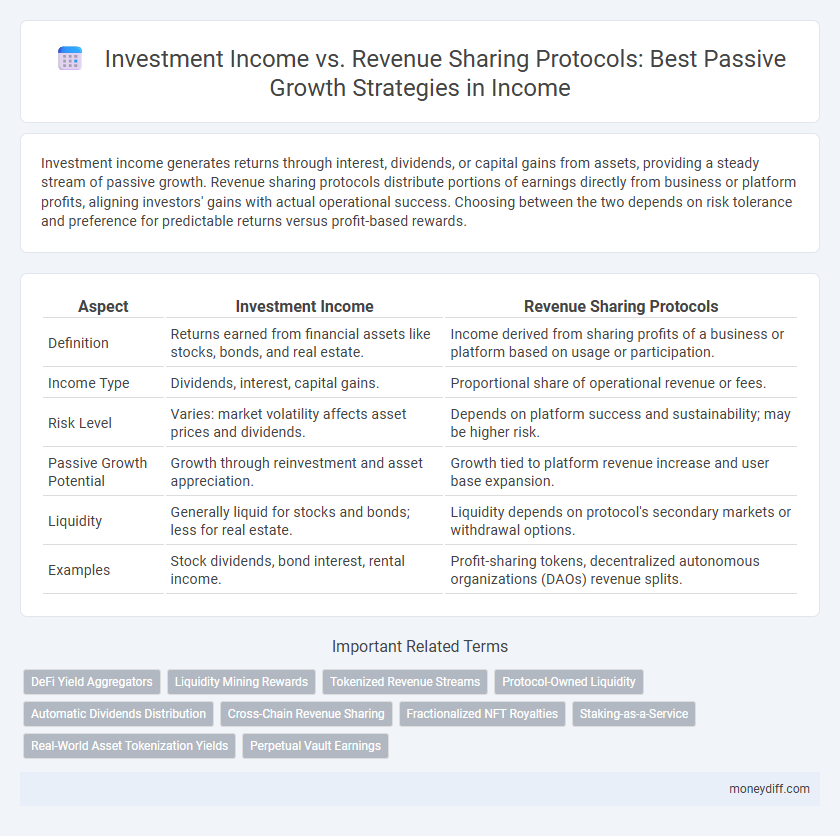

Investment income generates returns through interest, dividends, or capital gains from assets, providing a steady stream of passive growth. Revenue sharing protocols distribute portions of earnings directly from business or platform profits, aligning investors' gains with actual operational success. Choosing between the two depends on risk tolerance and preference for predictable returns versus profit-based rewards.

Table of Comparison

| Aspect | Investment Income | Revenue Sharing Protocols |

|---|---|---|

| Definition | Returns earned from financial assets like stocks, bonds, and real estate. | Income derived from sharing profits of a business or platform based on usage or participation. |

| Income Type | Dividends, interest, capital gains. | Proportional share of operational revenue or fees. |

| Risk Level | Varies: market volatility affects asset prices and dividends. | Depends on platform success and sustainability; may be higher risk. |

| Passive Growth Potential | Growth through reinvestment and asset appreciation. | Growth tied to platform revenue increase and user base expansion. |

| Liquidity | Generally liquid for stocks and bonds; less for real estate. | Liquidity depends on protocol's secondary markets or withdrawal options. |

| Examples | Stock dividends, bond interest, rental income. | Profit-sharing tokens, decentralized autonomous organizations (DAOs) revenue splits. |

Understanding Investment Income: Key Concepts

Investment income includes dividends, interest, and capital gains generated from assets like stocks, bonds, and real estate. Revenue sharing protocols distribute a portion of a project's income to token holders, enabling passive growth through decentralized finance (DeFi) mechanisms. Understanding these concepts helps investors evaluate risk, return potential, and the benefits of diversified passive income streams.

Revenue Sharing Protocols: An Overview

Revenue sharing protocols distribute a portion of platform-generated revenue directly to token holders, enabling passive income without active management. These protocols leverage decentralized finance (DeFi) ecosystems to automate and transparently allocate earnings based on user participation or stake. By aligning incentives between developers and investors, revenue sharing protocols offer a scalable method for passive growth compared to traditional investment income streams.

Comparing Income Streams: Investment vs. Revenue Sharing

Investment income generates consistent returns through asset appreciation, dividends, or interest, offering predictable passive growth with relatively lower risk. Revenue sharing protocols distribute a portion of business earnings directly to participants, creating variable income tied to operational performance and market demand. Evaluating these income streams involves balancing stability against potential high-yield fluctuations inherent in revenue sharing models.

Risk Factors in Investment Income and Revenue Sharing

Investment income carries inherent risks such as market volatility, interest rate fluctuations, and credit risk that can affect the stability of returns. Revenue sharing protocols, while offering a fixed percentage of business earnings, face operational risks like inconsistent revenue streams and dependence on company performance. Assessing risk factors in both models is essential for optimizing passive growth strategies aligned with individual risk tolerance and investment goals.

Passive Growth Potential: Which Model Wins?

Investment income often provides higher passive growth potential due to diversified asset appreciation and compounding returns, making it ideal for long-term wealth accumulation. Revenue sharing protocols, while offering consistent cash flow and reduced risk exposure, typically yield modest growth linked to the operational success of a specific platform. Investors seeking maximum passive growth should prioritize investment income models that leverage market dynamics over the fixed proportions common in revenue sharing agreements.

Accessibility and Barriers to Entry

Investment income typically requires substantial initial capital, creating higher barriers to entry for average investors seeking passive growth. Revenue sharing protocols often offer more accessible options by enabling smaller investments and reducing complexity through automated distribution systems. This democratization allows broader participation and diversifies potential income streams in the passive income landscape.

Fees, Taxes, and Profitability Considerations

Investment income from traditional assets typically incurs management fees and capital gains taxes, impacting net profitability, whereas revenue sharing protocols often involve lower fees but may have uncertain tax treatment depending on jurisdiction. Passive growth through revenue sharing can increase profitability by aligning incentives between platform participants, yet the variability in revenue streams requires careful assessment of tax obligations and fee structures. Evaluating profitability necessitates comparing the effective fee rates and tax implications of both methods to optimize after-tax returns in passive income strategies.

Automation and Hands-Off Earning Strategies

Investment income from automated platforms allows for hands-off growth by leveraging algorithms that optimize returns without active management. Revenue sharing protocols distribute earnings from decentralized networks, enabling passive income through smart contracts with minimal intervention. Both methods harness automation to maximize efficiency and scale passive earnings in digital finance ecosystems.

Real-World Examples and Case Studies

Investment income from stocks and bonds offers predictable returns and is well-documented through case studies such as the steady dividend growth of the S&P 500 companies. Revenue sharing protocols, particularly in decentralized finance (DeFi), demonstrate passive growth through real-world examples like Uniswap and PancakeSwap, which distribute fees among liquidity providers. Comparing these, studies reveal that while investment income offers stability, revenue sharing protocols can yield higher but more volatile returns, emphasizing the importance of diversification.

Choosing the Best Passive Growth Path for Your Goals

Investment income typically comes from interest, dividends, and capital gains generated by assets, offering predictable returns aligned with market performance. Revenue sharing protocols distribute a portion of business earnings to participants, providing potentially higher but more variable income tied to operational success. Selecting the best passive growth path depends on risk tolerance, desired income stability, and long-term financial objectives, where investment income suits conservative goals and revenue sharing appeals to those seeking higher, albeit fluctuating, returns.

Related Important Terms

DeFi Yield Aggregators

Investment income from DeFi yield aggregators maximizes returns by automatically reallocating assets across high-yield protocols, enhancing capital efficiency and compounding potential. Revenue sharing protocols distribute a portion of platform fees or earnings to token holders, providing steady passive income streams aligned with the platform's overall growth and user activity.

Liquidity Mining Rewards

Investment income from liquidity mining rewards generates passive growth by providing users with token-based incentives for contributing assets to decentralized finance (DeFi) protocols. Revenue sharing protocols distribute a portion of platform earnings to liquidity providers, creating a steady income stream while incentivizing long-term participation and enhancing overall investment returns.

Tokenized Revenue Streams

Investment income from tokenized revenue streams offers direct exposure to asset-generated cash flows, while revenue sharing protocols distribute earnings proportionally among token holders, enabling scalable passive growth through decentralized finance mechanisms. Understanding the distinctions between these models helps optimize portfolio diversification and maximize returns in blockchain-based income opportunities.

Protocol-Owned Liquidity

Investment income generated through protocol-owned liquidity ensures sustainable passive growth by maintaining control over assets within the ecosystem, enhancing long-term value capture. Revenue sharing protocols distribute earnings to participants but often depend on external liquidity, potentially limiting consistent income streams compared to protocol-owned liquidity models.

Automatic Dividends Distribution

Investment income generated through automatic dividends distribution provides a consistent and hands-free approach to passive growth, leveraging revenue sharing protocols that allocate profits directly to investors' accounts. This method maximizes efficiency by ensuring real-time, proportional payouts based on the token holdings within decentralized finance platforms, optimizing compound income potential without ongoing active management.

Cross-Chain Revenue Sharing

Cross-chain revenue sharing protocols enable investors to earn passive income by distributing revenue generated from multiple blockchain networks, maximizing diversification and reducing risk compared to traditional single-chain investment models. These protocols leverage smart contracts to automate profit distribution, ensuring transparent and efficient returns that enhance long-term investment income across decentralized finance ecosystems.

Fractionalized NFT Royalties

Investment income from fractionalized NFT royalties generates passive growth by enabling multiple stakeholders to earn ongoing revenue streams from digital asset appreciation and sales. Revenue sharing protocols distribute earnings transparently among fractional owners, maximizing income potential through decentralized smart contract mechanisms without active management.

Staking-as-a-Service

Investment income from traditional assets generates returns through dividends and interest, while revenue sharing protocols in Staking-as-a-Service platforms distribute transaction fees and rewards earned from blockchain validation. Staking-as-a-Service enables passive growth by allowing users to earn consistent staking rewards without managing nodes, optimizing income streams via decentralized finance mechanisms.

Real-World Asset Tokenization Yields

Investment income from real-world asset tokenization yields often surpasses traditional revenue sharing protocols by providing direct ownership and fractionalized returns from tangible assets like real estate or infrastructure. Tokenized assets enable passive growth through transparent, blockchain-based distributions, minimizing intermediaries and increasing yield efficiency.

Perpetual Vault Earnings

Perpetual Vault Earnings generate steady investment income by allowing users to lock assets in decentralized protocols that yield compounded returns, outperforming traditional revenue sharing protocols which distribute variable and often less predictable income streams. By leveraging smart contracts, Perpetual Vaults optimize passive growth through automated reinvestment and reduced withdrawal fees, maximizing long-term profitability.

Investment income vs Revenue sharing protocols for passive growth. Infographic

moneydiff.com

moneydiff.com