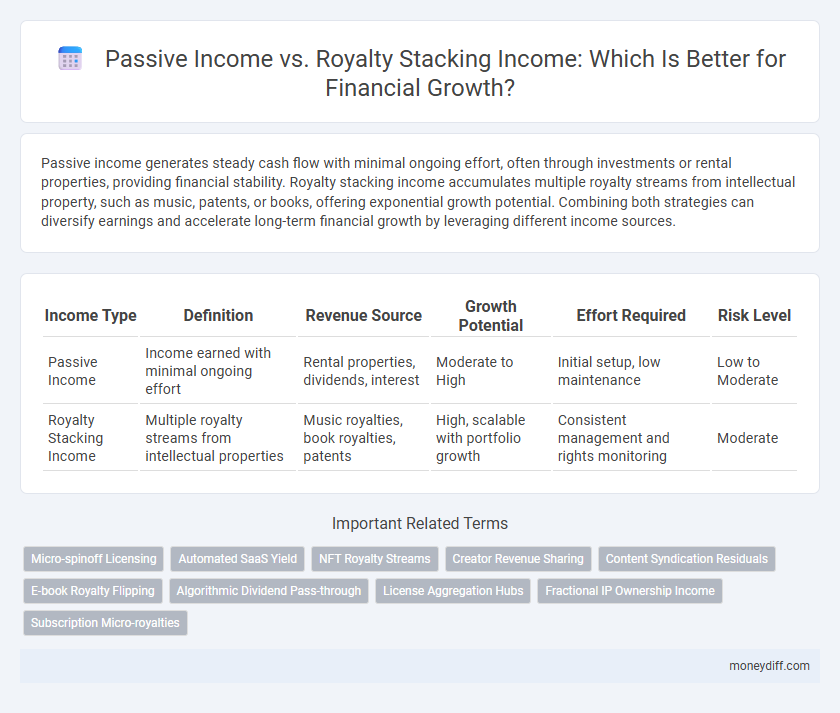

Passive income generates steady cash flow with minimal ongoing effort, often through investments or rental properties, providing financial stability. Royalty stacking income accumulates multiple royalty streams from intellectual property, such as music, patents, or books, offering exponential growth potential. Combining both strategies can diversify earnings and accelerate long-term financial growth by leveraging different income sources.

Table of Comparison

| Income Type | Definition | Revenue Source | Growth Potential | Effort Required | Risk Level |

|---|---|---|---|---|---|

| Passive Income | Income earned with minimal ongoing effort | Rental properties, dividends, interest | Moderate to High | Initial setup, low maintenance | Low to Moderate |

| Royalty Stacking Income | Multiple royalty streams from intellectual properties | Music royalties, book royalties, patents | High, scalable with portfolio growth | Consistent management and rights monitoring | Moderate |

Introduction to Passive Income and Royalty Stacking

Passive income generates revenue through investments or assets that require minimal active involvement, providing steady cash flow over time. Royalty stacking income arises from multiple royalty agreements, leveraging intellectual property rights across various platforms to maximize earnings. Combining both strategies enhances financial growth by diversifying income streams and increasing long-term wealth potential.

Defining Passive Income Streams

Passive income streams refer to earnings generated with minimal active involvement, such as rental income, dividends, or affiliate marketing revenue. Royalty stacking income specifically involves receiving multiple royalties from intellectual property rights, including music, books, or patents. Both income types contribute to financial growth by leveraging assets to produce continuous cash flow without ongoing direct labor.

Understanding Royalty Stacking Income

Royalty stacking income involves earning multiple streams of royalties from various intellectual properties such as books, music, patents, or digital content, maximizing financial growth potential through diversified revenue sources. Unlike traditional passive income that often relies on rental properties or investments, royalty stacking leverages intellectual assets to generate a continuous and scalable income flow. Understanding royalty stacking income is crucial for investors seeking sustainable long-term wealth by capitalizing on the rights and royalties associated with creative or patented works.

Key Differences Between Passive Income and Royalty Stacking

Passive income generates earnings through investments or businesses requiring minimal active involvement, such as rental properties or dividend stocks. Royalty stacking income arises from multiple royalty agreements, often in industries like music or publishing, where creators earn continuous payments based on usage or sales. The key difference lies in passive income's broad sources versus royalty stacking's concentrated reliance on intellectual property rights and long-term contractual revenue streams.

Advantages of Building Passive Income

Building passive income offers financial growth by creating multiple revenue streams that require minimal ongoing effort, allowing for sustained wealth accumulation over time. Unlike royalty stacking income, which depends on intellectual property or creative works, passive income can stem from diverse sources like investments, rental properties, or automated businesses. This diversification reduces risk and provides greater stability in long-term financial planning.

Benefits of Royalty Stacking for Income Diversification

Royalty stacking income provides a strategic advantage for income diversification by aggregating multiple royalty streams from various intellectual properties, thereby reducing dependency on a single source. This method enhances financial growth through consistent, scalable revenue inflows tied to creative or patented assets. Compared to traditional passive income avenues, royalty stacking offers higher resilience against market fluctuations and strengthens overall portfolio stability.

Income Stability: Passive vs. Royalty Stacking

Income stability from passive income streams often depends on consistent cash flow sources like dividends, rental properties, or automated businesses, which provide predictable returns over time. Royalty stacking income, generated from multiple intellectual property rights such as patents, trademarks, and copyrights, can offer higher financial growth but may fluctuate based on market demand and licensing agreements. Diversifying between passive income and royalty stacking enhances income stability by balancing steady earnings with variable royalty payments tied to creative or technological assets.

Financial Growth Potential: Passive vs. Royalty Stacking

Passive income streams such as rental properties or dividend investments offer steady, predictable cash flow that supports consistent financial growth. Royalty stacking income, derived from multiple intellectual property rights or creative works, can exponentially increase earnings by leveraging diverse revenue sources. Combining these income streams enhances financial growth potential by balancing stability with scalable, high-margin returns.

Strategies for Combining Both Income Types

Combining passive income and royalty stacking income enhances financial growth by diversifying revenue streams and maximizing earnings through multiple channels. Strategies include investing in intellectual property rights while simultaneously building automated businesses or rental properties to generate steady cash flow. Leveraging digital platforms and rights management tools ensures efficient monitoring and optimization of both income types for sustained wealth accumulation.

Choosing the Right Approach for Your Financial Goals

Passive income streams such as rental properties or dividend investments offer steady financial growth with lower active involvement, while royalty stacking income leverages intellectual property rights from multiple sources to maximize earnings. Analyzing your risk tolerance, initial investment capacity, and long-term financial objectives is crucial to selecting between these approaches. Optimizing for consistent cash flow versus scalable earnings will determine the ideal strategy to accelerate wealth accumulation and achieve sustainable financial independence.

Related Important Terms

Micro-spinoff Licensing

Micro-spinoff licensing generates royalty stacking income by allowing multiple licensees to pay royalties for the use of intellectual property, creating a scalable passive income stream. This strategy enhances financial growth by leveraging existing assets to secure diversified and continuous revenue without requiring active day-to-day management.

Automated SaaS Yield

Automated SaaS yield generates passive income through subscription fees that scale efficiently with minimal ongoing effort, offering consistent and predictable cash flow. Royalty stacking income accumulates from multiple licensing agreements, providing diversified revenue streams but often requiring active management and negotiation.

NFT Royalty Streams

NFT royalty streams generate ongoing passive income by earning a percentage from secondary sales of digital assets, offering scalable financial growth compared to traditional royalty stacking income, which relies on pre-negotiated fixed rates. Leveraging blockchain technology ensures transparent, automatic royalty distributions, maximizing long-term revenue potential for NFT creators and investors.

Creator Revenue Sharing

Creator revenue sharing models enhance passive income by leveraging royalty stacking, enabling content creators to earn multiple revenue streams from diverse platforms and intellectual property rights. This strategy maximizes financial growth by continuously generating royalties from various sources such as digital sales, licensing, and performance rights, ensuring scalable and sustainable income over time.

Content Syndication Residuals

Passive income from content syndication residuals offers consistent financial growth by leveraging existing digital assets without continuous active involvement. Royalty stacking income enhances this growth by accumulating multiple streams from various syndication agreements, maximizing revenue potential through diversified licensing and rights management.

E-book Royalty Flipping

E-book Royalty Flipping generates scalable royalty stacking income by acquiring low-earning digital assets and optimizing marketing strategies to boost passive income streams exponentially. This method leverages long-term equity in digital content, outperforming traditional passive income sources by continuously multiplying earnings through strategic portfolio diversification.

Algorithmic Dividend Pass-through

Algorithmic Dividend Pass-through enhances passive income by automating the distribution of earnings from multiple royalty streams, increasing efficiency and compounding financial growth without active involvement. This approach leverages royalty stacking income through algorithm-driven allocation, maximizing returns and diversifying income sources for long-term wealth accumulation.

License Aggregation Hubs

License Aggregation Hubs streamline royalty stacking income by consolidating multiple licensing contracts, enabling creators to maximize passive income through efficient rights management and diversified revenue streams. This innovative structure enhances financial growth by leveraging aggregated royalties, reducing administrative overhead, and increasing long-term cash flow stability.

Fractional IP Ownership Income

Fractional IP ownership income enables investors to earn passive income through shared rights to intellectual property assets, providing steady royalty stacking that amplifies financial growth by combining multiple revenue streams. Leveraging fractional shares in patents, trademarks, or copyrights diversifies income sources while maximizing long-term wealth accumulation through scalable royalty payments.

Subscription Micro-royalties

Subscription micro-royalties generate scalable passive income by leveraging continuous, small payments from a broad customer base, providing steady cash flow without active involvement. Compared to traditional royalty stacking income, subscription models optimize financial growth through predictable, recurring revenue streams and reduced dependency on fluctuating lump-sum payments.

Passive income vs Royalty stacking income for financial growth. Infographic

moneydiff.com

moneydiff.com