Traditional employment offers a stable and predictable income with benefits like health insurance and retirement plans, ensuring financial security for many workers. The gig economy provides flexible earning opportunities through freelance or short-term jobs but often lacks consistent income and employee protections. Choosing between the two depends on individual priorities for stability versus flexibility in income streams.

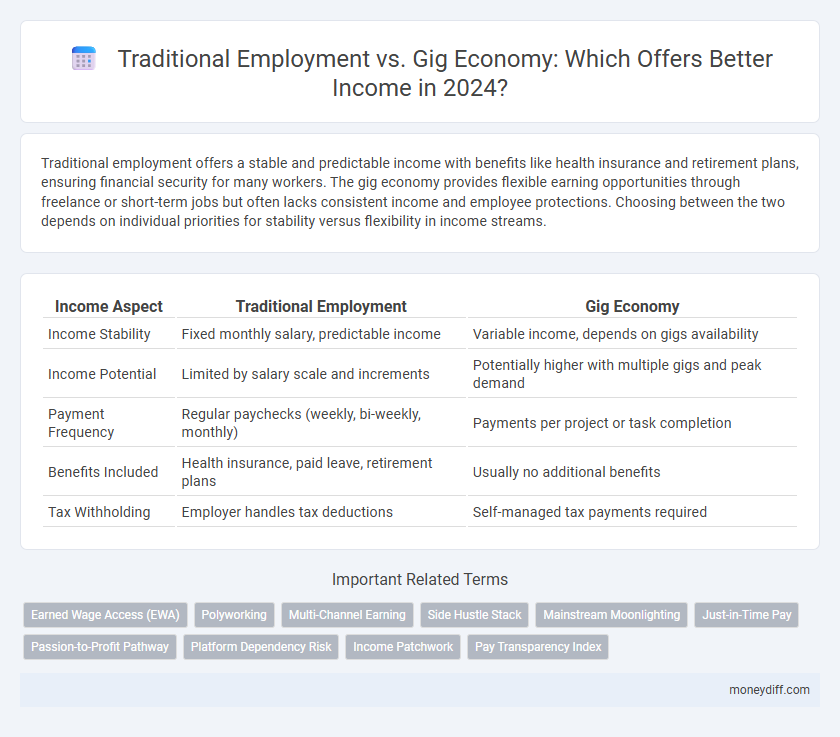

Table of Comparison

| Income Aspect | Traditional Employment | Gig Economy |

|---|---|---|

| Income Stability | Fixed monthly salary, predictable income | Variable income, depends on gigs availability |

| Income Potential | Limited by salary scale and increments | Potentially higher with multiple gigs and peak demand |

| Payment Frequency | Regular paychecks (weekly, bi-weekly, monthly) | Payments per project or task completion |

| Benefits Included | Health insurance, paid leave, retirement plans | Usually no additional benefits |

| Tax Withholding | Employer handles tax deductions | Self-managed tax payments required |

Understanding Traditional Employment and the Gig Economy

Traditional employment offers consistent income through fixed salaries, employee benefits, and tax withholdings, providing financial stability and predictability. The gig economy generates income via freelance, contract, or temporary jobs with flexible hours but variable earnings, requiring self-management of taxes and benefits. Understanding these income patterns helps individuals make informed decisions based on their financial goals and risk tolerance.

Income Stability: Secure Paychecks vs. Fluctuating Earnings

Traditional employment offers income stability through fixed monthly salaries and predictable paychecks, ensuring consistent financial planning and budgeting. In contrast, the gig economy presents fluctuating earnings dependent on project availability, market demand, and hours worked, which can lead to irregular cash flow and financial uncertainty. Workers in traditional jobs benefit from steady income streams, while gig workers must manage variable income with strategic financial reserves.

Benefits and Perks: Traditional Jobs Compared to Gig Work

Traditional employment offers consistent benefits such as health insurance, retirement plans, and paid leave, providing financial stability and long-term security. In contrast, gig economy workers typically face irregular income streams and lack employer-sponsored perks, relying on flexibility and multiple income sources. The disparity in benefits highlights the trade-off between predictability in traditional jobs and autonomy in gig work.

Flexibility and Work-Life Balance in Income Generation

Traditional employment offers stable income with fixed schedules, providing predictable work-life balance but limited flexibility. The gig economy enables flexible working hours and varied projects, enhancing personal time management and income diversification, though with potential income instability. Flexibility in gig work allows individuals to tailor their income generation to lifestyle needs, supporting improved work-life balance for many workers.

Earning Potential: Limits and Opportunities in Both Models

Traditional employment offers stable income with predictable salary ranges and benefits, but often limits earning potential through fixed pay scales and slow wage growth. The gig economy provides flexible income opportunities where earnings vary widely based on skills, demand, and hours worked, allowing some workers to exceed traditional salary limits. However, gig work lacks guaranteed income and benefits, making financial stability less certain compared to conventional jobs.

Job Security: Long-Term Careers vs. Short-Term Gigs

Traditional employment offers greater job security with stable, long-term career paths providing consistent income, benefits, and retirement plans. The gig economy emphasizes flexibility but often lacks guarantees of steady work or long-term financial stability, leading to fluctuating income streams. Workers in gig roles face unpredictable earning potential, whereas traditional jobs typically ensure a reliable monthly salary and opportunities for career advancement.

Taxes, Withholding, and Financial Planning

Traditional employment offers automatic tax withholding and employer-managed payroll taxes, simplifying tax compliance and financial planning. In contrast, gig economy workers face self-employment taxes and must proactively manage quarterly estimated tax payments, increasing the need for disciplined financial planning. Understanding these differences is crucial for optimizing tax obligations and ensuring steady cash flow in diverse income models.

Building Wealth: Savings and Investment Strategies

Traditional employment offers stable income streams, enabling consistent savings and long-term investment plans such as employer-sponsored retirement accounts and stock options. The gig economy provides flexible earning opportunities, encouraging diverse investment approaches including short-term asset diversification and digital financial platforms. Combining steady salary with strategic gig income can maximize wealth-building potential through disciplined savings and dynamic investment strategies.

Financial Risks: Unemployment, Injury, and the Lack of Safety Nets

Traditional employment typically offers stable income with benefits such as unemployment insurance, workers' compensation, and access to healthcare, providing a financial safety net during injury or job loss. In contrast, gig economy workers face higher financial risks due to irregular income, absence of employer-provided benefits, and limited legal protections against unemployment or workplace injury. These vulnerabilities increase economic uncertainty and demand greater personal financial planning for those relying on gig work as their primary income source.

Choosing the Right Income Path for Your Financial Goals

Traditional employment offers stable income with predictable paychecks, often including benefits like health insurance and retirement plans, appealing to those seeking financial security. The gig economy provides flexible earning opportunities and diverse income streams, suited for individuals valuing autonomy and aiming to supplement or replace traditional income. Evaluating your financial goals, risk tolerance, and lifestyle preferences is essential when choosing between consistent wages and variable gig income sources.

Related Important Terms

Earned Wage Access (EWA)

Traditional employment offers steady income with predictable pay cycles, while the gig economy provides variable earnings but often lacks financial stability; Earned Wage Access (EWA) solutions bridge this gap by allowing workers in both sectors to access earned wages before payday, enhancing cash flow and reducing financial stress. EWA platforms play a crucial role in improving income liquidity for gig workers and employees alike, supporting timely access to funds without the need for high-interest loans or advances.

Polyworking

Polyworking, involving multiple income streams from both traditional employment and gig economy roles, enhances financial stability by diversifying earnings and reducing reliance on a single source. This approach leverages the steady paycheck and benefits of traditional jobs alongside the flexibility and potential high returns of gig work, optimizing overall income potential.

Multi-Channel Earning

Traditional employment offers stable, predictable income through fixed salaries and benefits, while the gig economy enables multi-channel earning by leveraging flexible freelance projects, ride-sharing, and online platforms. Diversifying income streams in the gig economy enhances financial resilience and maximizes earning potential beyond a single source.

Side Hustle Stack

Traditional employment offers stable income with predictable paychecks and benefits, while the gig economy enables flexible earning opportunities through platforms like Side Hustle Stack that aggregate diverse freelance and part-time jobs. Users can maximize income by leveraging Side Hustle Stack's curated listings to supplement or replace conventional wages, adapting to market demand and personal schedules.

Mainstream Moonlighting

Mainstream moonlighting in traditional employment offers steady supplemental income through part-time roles or freelancing, enhancing financial stability without sacrificing primary job security. The gig economy provides flexible income opportunities with varying pay rates and irregular hours, allowing individuals to monetize skills on platforms like Uber, Fiverr, and TaskRabbit.

Just-in-Time Pay

Traditional employment offers fixed salaries and predictable pay schedules, ensuring financial stability but limiting income flexibility. Gig economy platforms leverage Just-in-Time pay systems, providing immediate earnings that enhance cash flow but may lead to inconsistent income streams.

Passion-to-Profit Pathway

Traditional employment offers steady income with predictable benefits, appealing to those valuing financial security, while the gig economy provides flexible earning opportunities ideal for transforming personal passions into profit through diverse, project-based work. The passion-to-profit pathway thrives in gig roles by enabling individuals to monetize unique skills and interests without the constraints of conventional 9-to-5 jobs.

Platform Dependency Risk

Traditional employment offers stable income streams with consistent paychecks and benefits, minimizing platform dependency risk. Gig economy workers face high platform dependency, as income relies heavily on algorithmic visibility and platform policies, creating income volatility and uncertainty.

Income Patchwork

Income patchwork reflects the growing trend of workers combining traditional employment with gig economy opportunities to create diversified revenue streams. This hybrid approach enhances financial stability by leveraging steady salaries alongside flexible, task-based earnings from platforms like Uber, Airbnb, and freelance marketplaces.

Pay Transparency Index

The Pay Transparency Index reveals that traditional employment typically offers more predictable income streams with clear salary bands and benefits, whereas the gig economy provides variable earnings dependent on project volume and client demand. Workers in the gig economy often face income instability but benefit from flexible schedules, contrasting with the structured pay scales observed in traditional roles.

Traditional employment vs Gig economy for Income. Infographic

moneydiff.com

moneydiff.com