Wage income provides a steady and predictable cash flow essential for meeting daily expenses and financial obligations. Micro-investing income, generated through small-scale investments, offers potential for long-term wealth accumulation by leveraging compound growth and market opportunities. Diversifying income streams by combining wage earnings with micro-investing can enhance personal finance growth and build financial resilience.

Table of Comparison

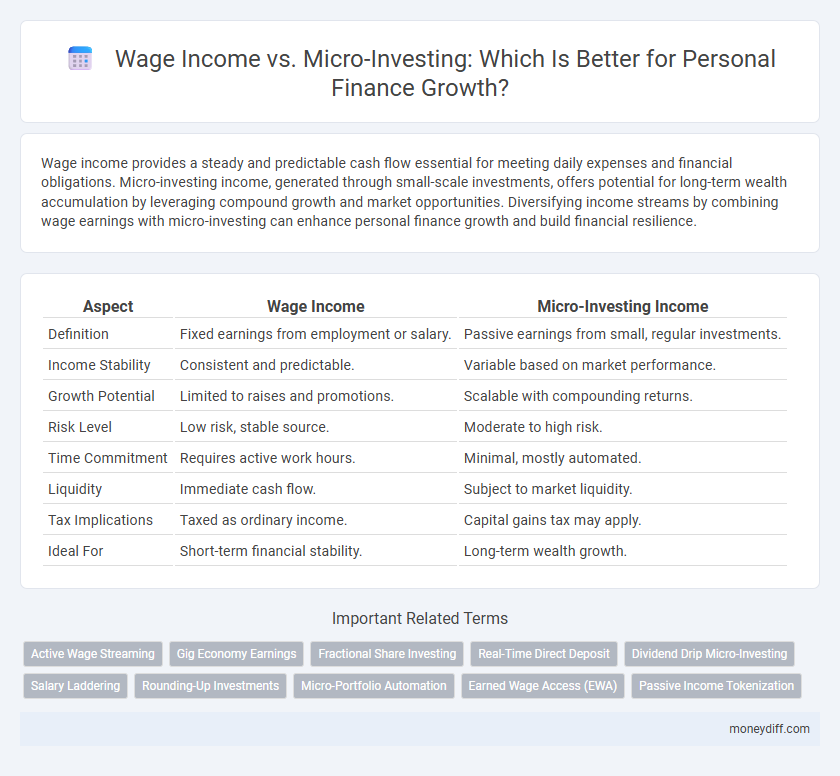

| Aspect | Wage Income | Micro-Investing Income |

|---|---|---|

| Definition | Fixed earnings from employment or salary. | Passive earnings from small, regular investments. |

| Income Stability | Consistent and predictable. | Variable based on market performance. |

| Growth Potential | Limited to raises and promotions. | Scalable with compounding returns. |

| Risk Level | Low risk, stable source. | Moderate to high risk. |

| Time Commitment | Requires active work hours. | Minimal, mostly automated. |

| Liquidity | Immediate cash flow. | Subject to market liquidity. |

| Tax Implications | Taxed as ordinary income. | Capital gains tax may apply. |

| Ideal For | Short-term financial stability. | Long-term wealth growth. |

Understanding Wage Income vs Micro-Investing Income

Wage income provides a stable, predictable cash flow earned through employment, crucial for daily expenses and financial security. Micro-investing income emerges from small, regular investments that generate passive returns, contributing to long-term wealth accumulation. Understanding the balance between these income types helps optimize personal finance growth by combining consistent earnings with the potential for compound interest and portfolio diversification.

Core Differences Between Active Earnings and Passive Gains

Wage income is earned through active labor, reflecting direct compensation for time and skills, whereas micro-investing income generates returns passively by leveraging small, regular investments in diversified portfolios. Active earnings from wages provide predictable, steady cash flow tied to employment, while passive gains from micro-investing fluctuate based on market performance and compound growth. Understanding these core differences is crucial for optimizing personal finance growth by balancing immediate cash needs against long-term wealth accumulation.

Stability and Predictability: Wages Compared to Investment Returns

Wage income provides consistent and predictable cash flow, as salaries are typically fixed and paid regularly, offering financial stability essential for budgeting and essential expenses. Micro-investing income, while potentially boosting personal finance growth, tends to be variable and less predictable due to market fluctuations and investment performance volatility. Prioritizing wage income for foundational expenses and using micro-investing income as a supplementary growth strategy balances stability with potential higher returns.

Time Commitment: Earning a Paycheck vs Building an Investment Portfolio

Wage income provides a consistent paycheck through active work hours, requiring a fixed time commitment directly tied to employment. Micro-investing income, however, demands periodic attention and initial effort to build and monitor a diversified investment portfolio, allowing money to grow passively over time. Balancing wage earnings with strategic micro-investing enhances long-term financial growth by leveraging both immediate cash flow and compounding returns.

Risk Factors: Job Security vs Market Volatility

Wage income provides relatively stable cash flow due to steady employment, but carries risks associated with job security and potential layoffs. Micro-investing income offers potential for higher returns through diversified portfolios but exposes individuals to market volatility and economic fluctuations. Balancing these income sources requires assessing risk tolerance and financial goals to optimize personal finance growth.

Growth Potential: Limits of Wages vs Compounding in Micro-Investing

Wage income provides a stable but capped earning potential tied to hours worked and salary scales, often limiting long-term wealth accumulation. Micro-investing leverages the power of compounding returns, enabling even small contributions to grow exponentially over time, significantly boosting personal finance growth. The compounding effect in micro-investing can surpass wage growth, highlighting its superior potential for building sustained wealth.

Barriers to Entry: Employment Requirements vs Micro-Investing Accessibility

Wage income often requires formal employment, which involves barriers like educational qualifications, experience, and job market competition, limiting accessibility for many individuals. Micro-investing platforms lower these barriers by allowing users to start investing with minimal capital and no specialized knowledge, democratizing access to wealth-building opportunities. This increased accessibility supports personal finance growth by enabling consistent contributions and compounding returns from a broader segment of the population.

Diversification Strategies: Combining Wages with Micro-Investments

Combining wage income with micro-investing income enhances personal finance growth by diversifying income streams and reducing dependency on a single source. Wage income provides stability and consistent cash flow, while micro-investing offers opportunities for incremental wealth accumulation through small, frequent investments in stocks, ETFs, or cryptocurrencies. This diversification strategy balances risk and return, promoting long-term financial resilience and compounding gains over time.

Impact on Long-Term Personal Finance Goals

Wage income provides a stable and predictable cash flow essential for covering daily expenses and building an emergency fund. Micro-investing income, while typically smaller and less consistent, offers the potential for compound growth and diversification, accelerating wealth accumulation over time. Combining steady wages with disciplined micro-investing can significantly enhance long-term personal finance goals such as retirement savings and financial independence.

Choosing the Right Balance for Sustainable Wealth Building

Wage income provides a stable and predictable cash flow essential for meeting daily expenses, while micro-investing income offers potential for long-term growth through small, regular contributions to diversified portfolios. Balancing steady wage income with disciplined micro-investing strategies can create a sustainable wealth-building model by leveraging consistent earnings and compounding investment returns. Prioritizing this dual approach enhances financial resilience, diversifies income streams, and accelerates personal finance growth over time.

Related Important Terms

Active Wage Streaming

Active wage streaming through consistent employment provides a reliable source of income essential for covering daily expenses and building a financial foundation, while micro-investing income offers supplemental growth potential by leveraging small-scale, recurring investments that compound over time. Balancing steady wage income with strategic micro-investing enhances personal finance growth by combining stability with incremental wealth accumulation.

Gig Economy Earnings

Wage income provides a steady cash flow essential for covering daily expenses, while micro-investing income from gig economy earnings offers dynamic growth potential by leveraging small, consistent investments into diversified portfolios. Balancing traditional wage income with gig-based micro-investing strategies can accelerate personal finance growth and enhance long-term wealth accumulation.

Fractional Share Investing

Wage income provides a steady cash flow essential for day-to-day expenses, while micro-investing income, particularly through fractional share investing, enables individuals to diversify portfolios with minimal capital and compound wealth over time. Fractional share investing lowers barriers to entry, allowing personal finance growth by accessing high-value stocks and reinvesting dividends to maximize long-term returns.

Real-Time Direct Deposit

Wage income provides a steady cash flow essential for daily expenses, while micro-investing income, enhanced by real-time direct deposit, offers immediate access to returns for reinvestment and compounding growth. Real-time direct deposit bridges the gap between earning and investing, accelerating personal finance growth by ensuring funds are available instantly for strategic financial decisions.

Dividend Drip Micro-Investing

Wage income offers steady cash flow, while dividend DRIP micro-investing leverages compound growth by automatically reinvesting earnings to boost long-term portfolio value. This strategy enhances personal finance growth by generating passive income streams and maximizing returns through continuous dividend accumulation.

Salary Laddering

Wage income provides a stable cash flow essential for meeting daily expenses, while micro-investing income offers incremental growth by leveraging small, consistent investments that compound over time. Salary laddering enhances personal finance growth by systematically increasing wage income, which can then be partially directed into micro-investing to accelerate wealth accumulation and financial security.

Rounding-Up Investments

Rounding-up investments allow wage earners to automatically invest spare change from everyday purchases, gradually building micro-investing income without impacting their primary wage income. This strategy enhances personal finance growth by leveraging small, consistent contributions that compound over time, providing a low-risk supplement to traditional wage earnings.

Micro-Portfolio Automation

Micro-portfolio automation enhances personal finance growth by consistently reinvesting wage income into diversified micro-investments, maximizing compound returns with minimal manual intervention. This systematic approach reduces market timing risks and leverages fractional shares, making wealth accumulation more accessible and efficient compared to relying solely on traditional wage income.

Earned Wage Access (EWA)

Wage income provides a consistent cash flow essential for meeting daily expenses, while micro-investing income leverages small, regular contributions to grow personal wealth over time. Earned Wage Access (EWA) enhances financial flexibility by allowing employees to access earned wages before payday, reducing reliance on high-interest loans and supporting more strategic micro-investing decisions for long-term financial growth.

Passive Income Tokenization

Wage income provides a steady cash flow but often lacks scalability, whereas micro-investing income through passive income tokenization enables fractional ownership in diverse assets, generating continuous, scalable earnings. Tokenized assets on blockchain platforms facilitate seamless liquidity and transparency, optimizing personal finance growth with minimal active management.

Wage income vs Micro-investing income for personal finance growth. Infographic

moneydiff.com

moneydiff.com