Fixed income provides a reliable and predictable cash flow, ensuring financial stability through regular payments such as salaries or pensions. Variable income, while potentially higher, fluctuates based on performance, sales, or commissions, leading to periods of uncertainty. Prioritizing fixed income streams enhances income stability, reducing stress and enabling more precise budgeting.

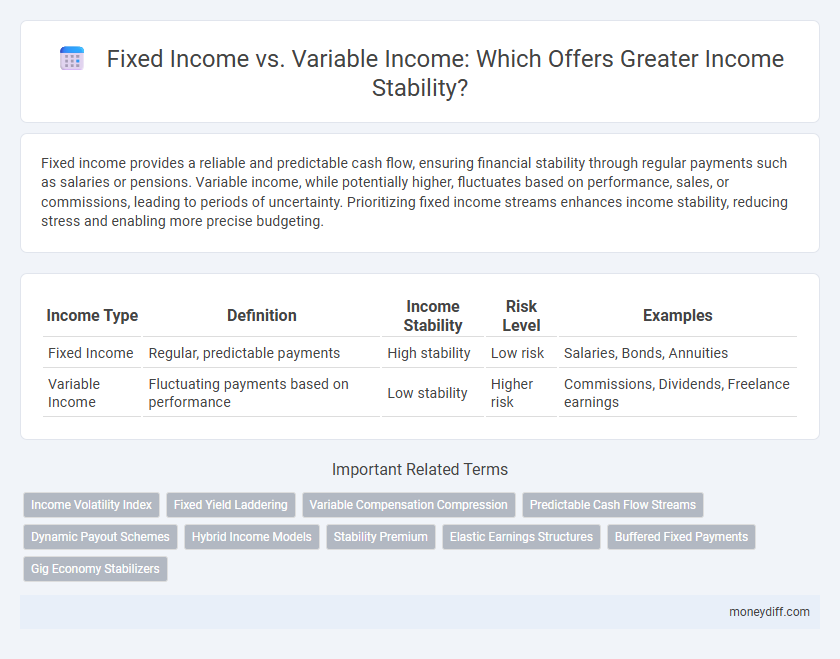

Table of Comparison

| Income Type | Definition | Income Stability | Risk Level | Examples |

|---|---|---|---|---|

| Fixed Income | Regular, predictable payments | High stability | Low risk | Salaries, Bonds, Annuities |

| Variable Income | Fluctuating payments based on performance | Low stability | Higher risk | Commissions, Dividends, Freelance earnings |

Understanding Fixed Income: Definition and Sources

Fixed income refers to earnings received at regular intervals and a predetermined amount, providing predictable cash flow essential for financial stability. Common sources include government and corporate bonds, certificates of deposit (CDs), and fixed annuities, which offer investors steady returns regardless of market fluctuations. This income type is favored for risk-averse individuals seeking consistent payment streams to support budgeting and long-term planning.

What Is Variable Income? Key Characteristics

Variable income refers to earnings that fluctuate based on performance, sales, or market conditions, such as commissions, bonuses, or investment returns. Key characteristics include unpredictability, potential for higher rewards, and dependence on external factors impacting cash flow. This contrasts with fixed income, which provides consistent, stable payments regardless of fluctuations.

Comparing Income Stability: Fixed vs Variable

Fixed income provides a predictable and stable cash flow, making it ideal for financial planning and risk-averse individuals. Variable income fluctuates based on performance or market conditions, offering higher potential returns but with greater uncertainty. Stability favors fixed income, while variable income suits those willing to embrace volatility for growth opportunities.

Pros and Cons of Fixed Income Streams

Fixed income streams provide consistent and predictable earnings, which enhances financial stability and aids in budgeting. They typically involve lower risk due to fixed interest payments, but may offer limited growth potential and can be negatively impacted by inflation. Dependence on fixed income can reduce flexibility in responding to changing market conditions or unexpected expenses.

Advantages and Disadvantages of Variable Income

Variable income offers flexibility and the potential for higher earnings during favorable economic conditions by linking payments to performance or sales outcomes. However, its unpredictability can lead to financial instability, making budgeting and long-term financial planning challenging for individuals relying solely on this income type. The fluctuating nature of variable income requires robust risk management strategies to ensure cash flow stability and avoid income shortfalls.

Impact of Income Type on Financial Planning

Fixed income provides predictable cash flow, enabling more accurate budgeting and long-term financial planning by reducing uncertainty. Variable income introduces fluctuations that require flexible financial strategies, including larger emergency funds and adaptive expense management. Understanding the impact of income type is essential for aligning investment choices and risk tolerance with personal financial goals.

Risk Management Strategies for Variable Incomes

Fixed income provides consistent earnings through predetermined payments, ensuring financial stability and predictable cash flow. Risk management strategies for variable incomes include diversifying income sources, maintaining an emergency fund, and leveraging insurance products to mitigate income volatility. Employing budgeting techniques and investing in low-risk assets further stabilizes financial health despite fluctuations in earnings.

Budgeting Techniques for Fixed vs Variable Income

Budgeting techniques for fixed income emphasize consistent expense tracking and allocating set amounts for bills, savings, and discretionary spending to ensure financial stability. Variable income budgeting requires creating a flexible plan that prioritizes essential expenses first, saving a higher percentage during peak income periods, and maintaining an emergency fund for income fluctuations. Utilizing zero-based budgeting and the 50/30/20 rule can help both fixed and variable income earners manage cash flow effectively and avoid overspending.

Choosing the Right Income Type for Your Goals

Fixed income provides consistent, predictable earnings ideal for individuals seeking financial stability and reliable cash flow, often favored in retirement planning or budgeting. Variable income, influenced by market performance or business outcomes, offers growth potential but carries higher risk and income fluctuations suitable for those with higher risk tolerance and long-term financial goals. Selecting the right income type depends on personal financial objectives, risk appetite, and the need for income predictability versus growth opportunities.

Enhancing Income Stability: Tips and Best Practices

Fixed income sources, such as salaries, pensions, or annuities, provide predictable cash flow essential for budgeting and financial planning, reducing income volatility. Incorporating variable income streams like bonuses, commissions, or freelance earnings can diversify revenue but requires strategic management to offset unpredictability. To enhance income stability, prioritize building an emergency fund, automate savings, and regularly assess income sources to balance fixed and variable earnings effectively.

Related Important Terms

Income Volatility Index

The Income Volatility Index measures fluctuations in earnings, highlighting that fixed income sources such as salaries or bonds provide greater stability compared to variable income from commissions or freelance work. Lower volatility in fixed income reduces financial risk, ensuring consistent cash flow and better budgeting capabilities.

Fixed Yield Laddering

Fixed yield laddering in fixed income investments enhances income stability by spreading maturities across multiple dates, reducing reinvestment risk and ensuring consistent cash flow. This strategy contrasts with variable income sources, which fluctuate and may lead to unpredictable earnings over time.

Variable Compensation Compression

Variable income, subject to market fluctuations and performance metrics, often leads to variable compensation compression where high performers face diminished incremental earnings, undermining motivation and income stability. Fixed income offers consistent earnings, providing financial predictability and mitigating the adverse effects of variable compensation compression on overall income security.

Predictable Cash Flow Streams

Fixed income provides predictable cash flow streams through regular, contractual payments that enhance income stability, minimizing financial uncertainty. Variable income fluctuates based on market conditions or performance, introducing risk and less predictable cash flow, which can impact overall financial planning.

Dynamic Payout Schemes

Fixed income provides predictable cash flow with consistent payments, ensuring income stability through structured schedules. Variable income with dynamic payout schemes adjusts payments based on performance or market conditions, offering potential growth while introducing volatility and less predictable cash flows.

Hybrid Income Models

Hybrid income models blend fixed income's predictability with variable income's growth potential, offering enhanced income stability and flexibility. By balancing guaranteed earnings with performance-based rewards, these models mitigate risks associated with purely fixed or variable income streams.

Stability Premium

Fixed income provides a stability premium by offering predictable and consistent cash flows, reducing financial uncertainty and risk for investors. Variable income, while potentially yielding higher returns, lacks this stability premium due to its dependence on fluctuating market conditions, leading to increased income volatility.

Elastic Earnings Structures

Fixed income provides predictable cash flow with consistent payments, ensuring financial stability and easier budgeting, while variable income, driven by elastic earnings structures, fluctuates based on performance metrics or market conditions, offering potential for higher returns but increased financial volatility. Understanding the balance between fixed and variable income streams is crucial for managing risk and maintaining income stability in uncertain economic environments.

Buffered Fixed Payments

Buffered fixed payments in fixed income provide consistent and predictable cash flow, reducing financial volatility compared to variable income streams that fluctuate with market conditions. This stability is essential for budgeting and long-term financial planning, ensuring reliable income even during economic downturns.

Gig Economy Stabilizers

Fixed income provides consistent earnings crucial for financial stability, while variable income fluctuates based on work availability and market demand, posing planning challenges. Gig economy stabilizers such as diversified freelance projects and income-smoothing platforms help mitigate income variability by offering supplemental, predictable revenue streams.

Fixed Income vs Variable Income for income stability. Infographic

moneydiff.com

moneydiff.com