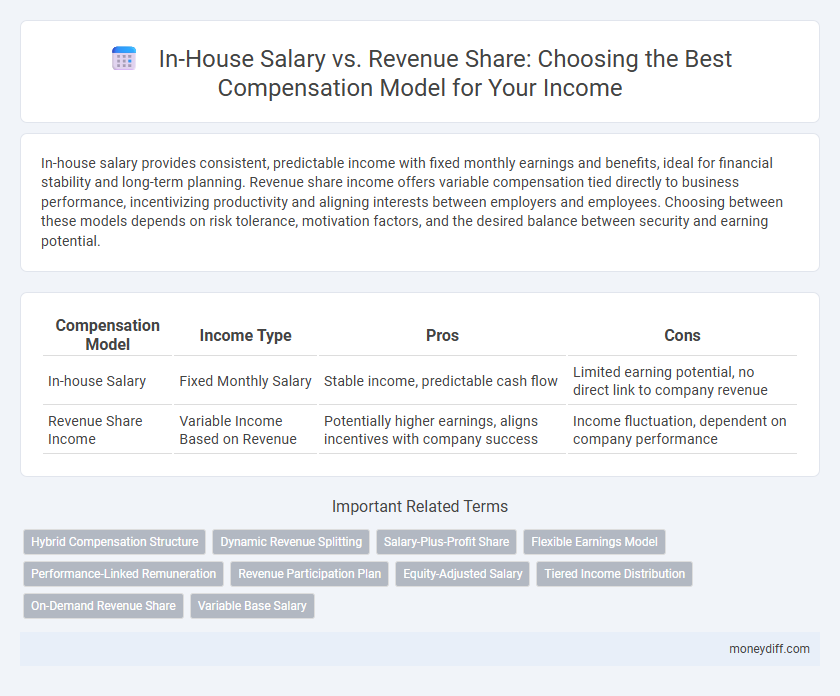

In-house salary provides consistent, predictable income with fixed monthly earnings and benefits, ideal for financial stability and long-term planning. Revenue share income offers variable compensation tied directly to business performance, incentivizing productivity and aligning interests between employers and employees. Choosing between these models depends on risk tolerance, motivation factors, and the desired balance between security and earning potential.

Table of Comparison

| Compensation Model | Income Type | Pros | Cons |

|---|---|---|---|

| In-house Salary | Fixed Monthly Salary | Stable income, predictable cash flow | Limited earning potential, no direct link to company revenue |

| Revenue Share Income | Variable Income Based on Revenue | Potentially higher earnings, aligns incentives with company success | Income fluctuation, dependent on company performance |

Understanding In-House Salary Compensation

In-house salary compensation offers fixed, predictable income, providing financial stability regardless of business performance. This model typically includes benefits such as health insurance, retirement plans, and paid leave, enhancing overall employee security. Understanding in-house salary compensation is crucial for evaluating risk tolerance and long-term financial planning compared to variable revenue share income.

What Is Revenue Share Income?

Revenue share income is a compensation model where individuals earn a percentage of the revenue generated from their work or sales rather than receiving a fixed salary. This model aligns incentives by directly linking earnings to business performance, promoting motivation and productivity. Unlike in-house salary structures, revenue share income can fluctuate based on company success and individual contribution.

Key Differences Between Salary and Revenue Share

In-house salary provides a fixed, predictable income regardless of company performance, ensuring financial stability for employees. Revenue share income fluctuates based on business profits, directly tying compensation to the company's success and incentivizing productivity. Key differences include risk exposure, income variability, and alignment of employee interests with business growth.

Pros and Cons of In-House Salary Models

In-house salary models provide employees with stable, predictable income and often include benefits such as health insurance and retirement plans, enhancing financial security and job satisfaction. However, fixed salaries may limit earning potential compared to revenue share models, which offer incentives aligned with individual or company performance. Additionally, in-house salaries can increase fixed costs for employers, reducing financial flexibility during economic fluctuations.

Advantages and Disadvantages of Revenue Share Income

Revenue share income offers the advantage of aligning compensation with business performance, providing potential for higher earnings during profitable periods and incentivizing employee productivity. However, it introduces income variability and financial uncertainty, making budgeting and personal financial planning more challenging compared to fixed in-house salaries. This compensation model may also cause disparities among employees and reduce guaranteed income stability, impacting overall job security.

Job Security: Fixed Salary vs Variable Income

Fixed in-house salaries provide employees with consistent job security by ensuring predictable monthly income regardless of company performance, while revenue share income introduces variability closely tied to business success, creating potential income fluctuations. Employees relying on revenue share face financial uncertainty but may benefit from higher earnings during profitable periods, contrasting with the steadiness of fixed compensation. The choice between these models affects risk tolerance and financial planning, with fixed salaries emphasizing stability and revenue sharing rewarding performance alignment.

Which Offers More Earning Potential?

In-house salary provides a consistent, predictable income with benefits, ideal for financial stability, while revenue share income offers a variable earning potential linked directly to business performance or sales success, often resulting in higher earnings during peak periods. Revenue sharing incentivizes productivity and alignment with company growth, potentially surpassing fixed salaries for high performers in dynamic markets. Choosing between the two depends on risk tolerance and income preference, with revenue share models favored in entrepreneurial or sales-driven roles for maximizing earnings.

Impact on Motivation and Performance

In-house salary provides employees with consistent financial stability, fostering a sense of security that can enhance focus and steady performance. Revenue share income directly ties compensation to individual or team results, often boosting motivation by aligning financial rewards with achieved outcomes. Choosing between these models significantly impacts motivation, with salary favoring reliability and revenue share encouraging proactive performance and entrepreneurial drive.

Tax Implications: Salary vs Revenue Share

In-house salary typically faces standard payroll tax deductions including income tax, Social Security, and Medicare, resulting in predictable tax liabilities for employees and employers. Revenue share income often classifies as self-employment income, subjecting recipients to self-employment taxes and requiring quarterly estimated tax payments, which can complicate tax planning. Understanding these distinctions is crucial for optimizing net income and ensuring compliance with IRS regulations in compensation models.

Choosing the Right Compensation Model for Your Career

Selecting between in-house salary and revenue share income depends on your career goals, risk tolerance, and financial stability. In-house salary provides predictable, stable income and benefits, ideal for professionals seeking security and structured growth. Revenue share income offers performance-based earnings that can exceed fixed salaries but requires entrepreneurial mindset and acceptance of income variability.

Related Important Terms

Hybrid Compensation Structure

A hybrid compensation structure combines a fixed in-house salary with revenue share income, providing employees with financial stability and performance-driven incentives. This model aligns individual motivation with company profitability, enhancing retention and encouraging higher productivity through balanced risk and reward.

Dynamic Revenue Splitting

Dynamic revenue splitting optimizes compensation by aligning in-house salaries with fluctuating revenue shares, ensuring fair income distribution based on actual business performance. This model enhances motivation and transparency by adjusting earnings proportionally to individual or team contributions reflected in real-time revenue metrics.

Salary-Plus-Profit Share

Salary-plus-profit share compensation combines a fixed base salary with a percentage of company profits, offering financial stability alongside performance incentives. This hybrid model aligns employee motivation with organizational success, balancing predictable income with potential earnings growth.

Flexible Earnings Model

A flexible earnings model combines in-house salary stability with revenue share income growth potential, offering employees a balanced compensation structure that aligns personal performance with company profitability. This model incentivizes productivity and innovation while maintaining financial security through fixed salary components.

Performance-Linked Remuneration

Performance-linked remuneration models balance in-house salary with revenue share income to directly align employee compensation with company profitability and individual contribution metrics. This hybrid approach enhances motivation, driving higher productivity by rewarding measurable outcomes rather than fixed pay alone.

Revenue Participation Plan

Revenue Participation Plans align employee compensation directly with company performance by distributing a percentage of revenue, incentivizing productivity and long-term commitment. This model contrasts with fixed in-house salaries, offering scalable income potential tied to the organization's financial success, fostering a performance-driven culture.

Equity-Adjusted Salary

Equity-adjusted salary provides a balanced compensation model by combining a stable in-house salary with potential revenue share income, aligning employee incentives with company performance and long-term growth. This approach mitigates financial risk for employees while offering upside potential through equity stakes tied to revenue milestones.

Tiered Income Distribution

Tiered income distribution in compensation models allocates in-house salary as a fixed baseline, while revenue share income scales based on performance metrics, incentivizing higher productivity and aligning employee rewards with company profitability. This hybrid approach balances financial stability with growth potential, driving motivation through progressively increasing earnings tied to individual or team-generated revenue tiers.

On-Demand Revenue Share

On-demand revenue share income offers flexible, performance-based compensation that directly aligns earnings with generated sales, providing scalable potential compared to fixed in-house salaries. This model benefits professionals seeking income variability tied to real-time business outcomes rather than predetermined paychecks.

Variable Base Salary

In-house salary with a variable base provides a predictable income supplemented by performance-linked bonuses, ensuring stability while incentivizing productivity. Revenue share income aligns compensation directly with business performance, offering higher earning potential but less income predictability compared to fixed-variable salary models.

In-house Salary vs Revenue Share Income for compensation model. Infographic

moneydiff.com

moneydiff.com