Balancing salary income and passion income is essential for effective money management, as salary income provides financial stability while passion income offers growth potential and personal fulfillment. Prioritizing budgeting and saving from salary income ensures consistent cash flow, whereas reinvesting passion income can fuel entrepreneurial ventures or creative projects. Diversifying income streams enhances financial security and supports both short-term needs and long-term goals.

Table of Comparison

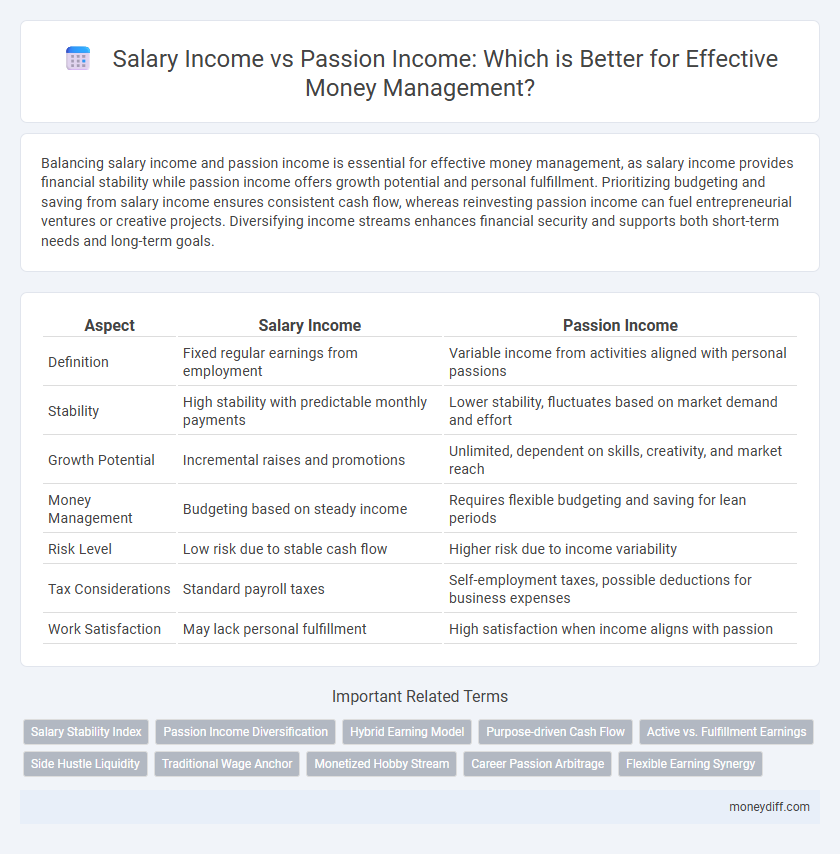

| Aspect | Salary Income | Passion Income |

|---|---|---|

| Definition | Fixed regular earnings from employment | Variable income from activities aligned with personal passions |

| Stability | High stability with predictable monthly payments | Lower stability, fluctuates based on market demand and effort |

| Growth Potential | Incremental raises and promotions | Unlimited, dependent on skills, creativity, and market reach |

| Money Management | Budgeting based on steady income | Requires flexible budgeting and saving for lean periods |

| Risk Level | Low risk due to stable cash flow | Higher risk due to income variability |

| Tax Considerations | Standard payroll taxes | Self-employment taxes, possible deductions for business expenses |

| Work Satisfaction | May lack personal fulfillment | High satisfaction when income aligns with passion |

Defining Salary Income and Passion Income

Salary income refers to the fixed, regular earnings received from employment, typically paid as a monthly or biweekly wage. Passion income stems from monetizing personal interests or hobbies, such as freelance work, creative projects, or entrepreneurial ventures. Understanding the distinct characteristics of salary income and passion income aids in effective money management by balancing financial stability and personal fulfillment.

Key Differences Between Salary and Passion Income

Salary income provides a consistent and predictable cash flow, often linked to job stability and fixed working hours, while passion income tends to be variable, driven by personal interests and entrepreneurial efforts. Salary income typically benefits from structured benefits such as health insurance and retirement plans, whereas passion income may require more proactive financial planning due to its irregularity. Managing money effectively necessitates balancing the reliability of salary income with the potential growth and fulfillment derived from passion income.

Financial Stability: Salary vs Passion Earnings

Salary income provides consistent financial stability through regular paychecks and predictable budgeting, essential for covering fixed expenses and building emergency savings. Passion income, often variable and project-based, can supplement salary earnings but requires careful money management to balance cash flow fluctuations. Diversifying income streams by combining salary stability with passion-driven earnings enhances overall financial resilience and long-term wealth growth.

Managing Budgets with Regular vs Irregular Incomes

Managing budgets with salary income involves predictable monthly cash flow, enabling structured expense planning and consistent savings strategies. Passion income, often irregular and variable, demands flexible budgeting techniques such as tracking fluctuating earnings, prioritizing essential expenses, and maintaining emergency funds. Effective money management balances stability from salary income with adaptability required for passion income to ensure financial security.

Building Wealth: Which Income Source Wins?

Salary income provides consistent cash flow and financial stability ideal for systematic saving and investing, forming a reliable foundation for building wealth. Passion income, while often variable, can offer exponential growth potential and greater satisfaction, which may lead to innovative opportunities and higher long-term returns. Balancing both income sources strategically maximizes wealth accumulation by combining steady earnings with scalable entrepreneurial ventures.

Risk Management in Salary and Passion-Driven Careers

Salary income offers consistent cash flow with lower financial risk, making it easier to plan budgets and manage expenses compared to passion-driven income, which often fluctuates unpredictably. Risk management in salary-based careers involves prioritizing emergency savings and stable benefits, while those relying on passion income must aggressively diversify income streams and maintain higher liquidity to buffer against income variability. Balancing these approaches helps optimize financial stability and resilience regardless of whether the primary income is salaried or passion-derived.

Diversifying Income Streams for Better Money Management

Diversifying income streams by balancing salary income with passion income enhances financial stability and reduces dependence on a single source. Salary income provides consistent cash flow and security, while passion income offers opportunities for growth and fulfillment, contributing to long-term wealth building. Effective money management involves strategically allocating earnings from both types to optimize savings, investments, and spending.

Tax Implications: Salary Income vs Passion Income

Salary income typically faces standard withholding taxes, employer contributions, and predictable tax brackets, simplifying tax management. Passion income, often derived from freelancing or entrepreneurial ventures, can involve variable tax rates, self-employment taxes, and potential deductions but requires meticulous record-keeping. Understanding these tax implications is crucial for optimizing income tax strategy and maximizing after-tax earnings.

Long-Term Financial Planning with Different Income Types

Salary income provides consistent cash flow essential for stable budgeting and meeting fixed expenses in long-term financial planning. Passion income, often variable and riskier, can supplement savings and investments, enhancing wealth growth when managed prudently alongside salary income. Balancing both income types promotes diversified revenue streams, reducing financial vulnerability and supporting sustained economic security.

Choosing the Right Path for Your Money Goals

Salary income provides consistent cash flow essential for meeting fixed expenses and building financial stability, while passion income can offer higher rewards but with greater variability and risk. Prioritizing salary income helps establish a reliable foundation for budgeting and saving, enabling more strategic investment in passion projects that align with long-term money goals. Balancing both income types allows for diversified revenue streams, maximizing financial growth and personal fulfillment in money management.

Related Important Terms

Salary Stability Index

Salary income provides a consistent Salary Stability Index, ensuring predictable cash flow crucial for budgeting and financial planning, while passion income often fluctuates, posing challenges for long-term money management. Prioritizing salary stability helps maintain financial security and supports disciplined saving strategies despite the potential variable returns from passion-driven ventures.

Passion Income Diversification

Passion income diversification enhances financial stability by creating multiple revenue streams beyond traditional salary income, reducing dependency on a single source. This approach leverages unique skills and interests to generate consistent cash flow while promoting personal fulfillment and long-term wealth growth.

Hybrid Earning Model

Salary income provides financial stability and predictable cash flow essential for budgeting, while passion income fosters creativity and personal fulfillment with variable earnings that can complement the base salary. A hybrid earning model combines these sources to enhance financial resilience and diversify income streams, balancing security with growth potential.

Purpose-driven Cash Flow

Salary income provides consistent cash flow essential for financial stability, while passion income offers purpose-driven earnings that enhance personal fulfillment and motivate long-term wealth creation. Balancing both income types optimizes money management by securing reliable funds and fueling passion projects that generate meaningful financial growth.

Active vs. Fulfillment Earnings

Salary income provides consistent active earnings essential for financial stability, while passion income generates fulfillment earnings that enhance personal satisfaction and long-term motivation. Balancing salary income and passion income supports effective money management by combining reliable cash flow with meaningful engagement.

Side Hustle Liquidity

Salary income provides consistent cash flow essential for fixed expenses, while passion income from side hustles enhances liquidity by generating flexible, supplemental funds for savings or investments. Balancing reliable salary earnings with the variable earnings of passion-driven side hustles optimizes overall money management and financial stability.

Traditional Wage Anchor

Traditional Wage Anchor prioritizes salary income as a stable financial foundation, providing predictable cash flow and supporting disciplined budgeting strategies. Passion income offers variable earnings but lacks the reliability needed for consistent money management compared to fixed wages.

Monetized Hobby Stream

Salary income provides consistent financial stability, while passion income from a monetized hobby stream offers potential for exponential growth and personal fulfillment. Effective money management involves diversifying these income sources to balance security with creative earnings.

Career Passion Arbitrage

Salary income provides consistent financial stability, while passion income leverages personal interests to create supplementary revenue streams. Career passion arbitrage maximizes money management by strategically balancing reliable wages with profitable passion projects, enhancing overall income diversification and growth potential.

Flexible Earning Synergy

Salary income provides consistent financial stability while passion income offers opportunities for creative fulfillment and growth, creating a flexible earning synergy that enhances overall money management. Balancing these two income streams allows individuals to optimize cash flow, diversify income sources, and maintain financial resilience in dynamic economic conditions.

Salary Income vs Passion Income for money management. Infographic

moneydiff.com

moneydiff.com