Commission income is earned directly from sales generated through personal efforts or referrals, offering more predictable cash flow for money management. Affiliate marketing income relies on promoting third-party products, often resulting in variable earnings based on traffic and conversions, which requires careful budgeting to manage fluctuations. Understanding the difference helps in allocating resources effectively and planning for financial stability.

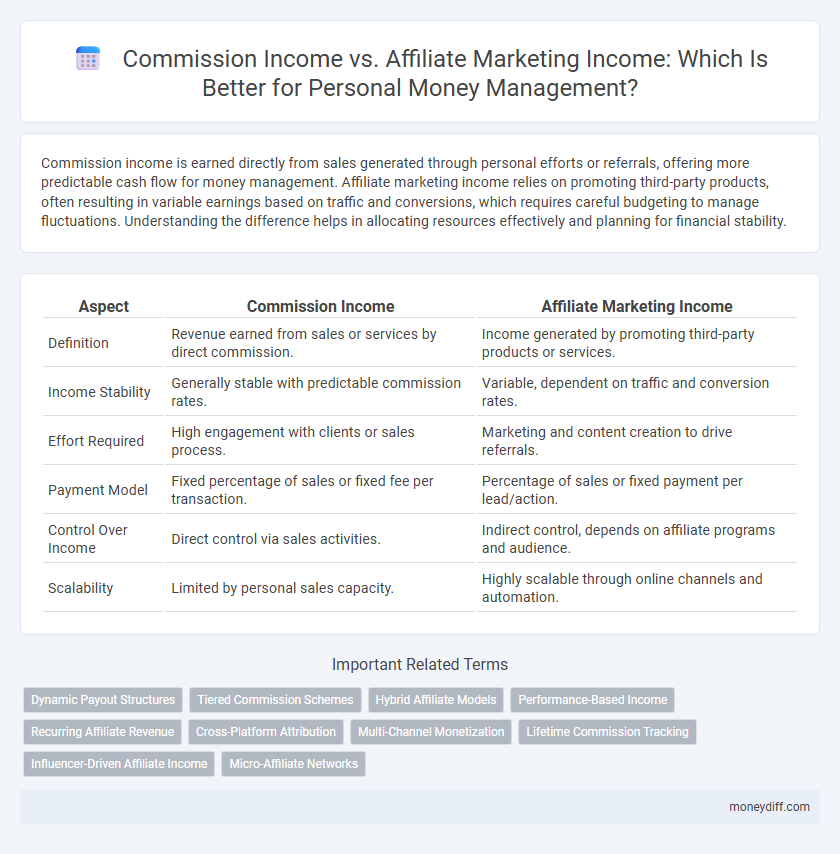

Table of Comparison

| Aspect | Commission Income | Affiliate Marketing Income |

|---|---|---|

| Definition | Revenue earned from sales or services by direct commission. | Income generated by promoting third-party products or services. |

| Income Stability | Generally stable with predictable commission rates. | Variable, dependent on traffic and conversion rates. |

| Effort Required | High engagement with clients or sales process. | Marketing and content creation to drive referrals. |

| Payment Model | Fixed percentage of sales or fixed fee per transaction. | Percentage of sales or fixed payment per lead/action. |

| Control Over Income | Direct control via sales activities. | Indirect control, depends on affiliate programs and audience. |

| Scalability | Limited by personal sales capacity. | Highly scalable through online channels and automation. |

Introduction to Commission Income vs Affiliate Marketing Income

Commission income is earned from direct sales or services where a percentage of the transaction value is paid to the individual or entity as compensation. Affiliate marketing income arises from promoting third-party products or services, earning a commission for each referral or sale generated through unique affiliate links. Understanding the nuances between commission income and affiliate marketing income is crucial for effective money management and accurate financial tracking.

Defining Commission Income and Affiliate Marketing Income

Commission income is the revenue earned by individuals or businesses from sales transactions where a percentage of the sale price is paid as a fee for facilitating the sale. Affiliate marketing income is generated through promoting products or services online, receiving a commission when referred customers complete specific actions such as making a purchase. Both income types are performance-based earnings, but commission income often involves direct sales activities, while affiliate marketing income relies on digital marketing and referral tracking systems.

Key Differences Between Commission and Affiliate Income

Commission income is earned directly from sales generated through personalized efforts or sales transactions, often involving a fixed percentage or fee per sale. Affiliate marketing income is derived from promoting products or services through affiliate links, earning a commission only when referred users complete specific actions, such as purchases or sign-ups. The key difference lies in commission income being tied to direct sales activities, while affiliate marketing income depends on referral-based performance metrics and broader digital marketing strategies.

Earning Potential: Commission vs Affiliate Marketing

Commission income typically offers higher earning potential per transaction because it is directly tied to sales performance and can include escalating rates or bonuses. Affiliate marketing income, while often lower on a per-sale basis, generates steady passive revenue streams through volume and recurring commissions. Effective money management strategies should consider the variability of commission income and the consistency of affiliate marketing payouts to optimize overall income stability.

Initial Investment and Setup Costs

Commission income typically requires lower initial investment and minimal setup costs, as it often depends on existing sales activities or referrals. Affiliate marketing income demands a moderate initial investment in building platforms, creating content, and marketing efforts to drive traffic effectively. Understanding these cost structures helps optimize budget allocation for scalable and sustainable income streams.

Passive vs Active Income Streams

Commission income generates revenue through active transactions, requiring ongoing effort to secure sales or leads, making it a more active income stream. Affiliate marketing income often operates passively, earning commissions from content-driven referrals without constant direct involvement once established. Efficient money management involves balancing these income types to ensure steady cash flow and long-term financial growth.

Managing Cash Flow for Commission and Affiliate Revenue

Commission income and affiliate marketing income both contribute significantly to cash flow management by providing diverse revenue streams with variable payout schedules. Effective money management involves tracking payment cycles, reconciling delayed commissions, and forecasting income fluctuations to maintain liquidity. Leveraging financial tools to monitor affiliate performance and commission reports ensures timely adjustments in budgeting and expense planning for sustained cash flow stability.

Tax Implications and Reporting for Each Income Type

Commission income is generally reported as ordinary income on tax returns and requires issuing Form 1099-NEC for payments over $600, with expenses deducted as business costs. Affiliate marketing income, although also taxable as ordinary income, often involves tracking multiple small payments and may require careful record-keeping of promotional expenses for accurate deductions. Effective money management includes distinguishing these income types to ensure compliance with IRS reporting requirements and optimize tax liability through appropriate documentation and expense allocation.

Risk Factors and Income Stability Comparison

Commission income from direct sales offers greater control and typically provides more consistent earnings, though it depends heavily on individual performance and client retention. Affiliate marketing income tends to be more variable due to fluctuating web traffic and conversion rates, introducing higher risk and less predictability in cash flow. Effective money management requires balancing these income streams by assessing market volatility, payout structures, and contract terms to maintain financial stability.

Choosing the Right Income Stream for Your Financial Goals

Commission income typically involves earning a percentage of sales directly from product or service transactions, offering more control and predictable cash flow. Affiliate marketing income depends on driving traffic and conversions through referral links, often providing scalable and passive revenue opportunities. Evaluating your business model, risk tolerance, and financial goals will help determine whether commission or affiliate marketing income aligns best with your money management strategy.

Related Important Terms

Dynamic Payout Structures

Commission income typically involves a fixed percentage of sales generated, offering predictable revenue streams, while affiliate marketing income uses dynamic payout structures that adjust based on performance metrics like clicks, conversions, or tiered incentives, enhancing money management flexibility. Understanding these differences allows businesses to optimize cash flow and tailor financial strategies to fluctuating income patterns driven by varying commission rates and affiliate marketing models.

Tiered Commission Schemes

Tiered commission schemes in commission income structures provide escalating payout percentages based on sales volume, optimizing revenue potential for sales-driven roles, while affiliate marketing income often relies on fixed or tiered rates determined by referral performance, offering scalable passive earnings. Understanding the nuances of tier thresholds and payout multipliers is critical for effective money management and maximizing financial returns in both income types.

Hybrid Affiliate Models

Hybrid affiliate models combine commission income and affiliate marketing income by merging direct sales commissions with performance-based affiliate rewards, optimizing revenue streams for money management. This approach enhances financial tracking accuracy and diversifies income through integrated payout structures, improving cash flow stability and scalability.

Performance-Based Income

Commission income arises from direct sales transactions where payment is tied to the volume or value of products sold, offering precise performance tracking for money management. Affiliate marketing income is earned through referral links or advertising, with earnings based on clicks or conversions, requiring careful monitoring to optimize return on investment within performance-based income strategies.

Recurring Affiliate Revenue

Commission income refers to earnings from direct sales transactions, often one-time payments, while affiliate marketing income typically generates recurring affiliate revenue through ongoing customer referrals and subscription renewals, providing more stable cash flow for effective money management. Prioritizing recurring affiliate revenue enables predictable income streams, enhancing budgeting accuracy and long-term financial planning.

Cross-Platform Attribution

Commission income, earned through direct sales or leads tracked via unique codes, offers clearer cross-platform attribution compared to affiliate marketing income, which often relies on multiple touchpoints and cookie-based tracking that can obscure precise revenue sources. Accurate cross-platform attribution enhances money management by enabling businesses to allocate budgets effectively based on verified commission income streams rather than estimated affiliate marketing returns.

Multi-Channel Monetization

Commission income typically stems from direct sales or services rendered, providing predictable cash flow, while affiliate marketing income relies on referral-based commissions across multiple platforms, enhancing revenue diversification. Effective money management in multi-channel monetization involves tracking these income streams separately to optimize tax strategies and reinvestment opportunities.

Lifetime Commission Tracking

Commission income often provides more stable revenue streams due to lifetime commission tracking, enabling ongoing earnings from client transactions over time. Affiliate marketing income varies widely and typically lacks lifetime tracking, making it less reliable for consistent money management and long-term financial planning.

Influencer-Driven Affiliate Income

Commission income typically arises from direct sales or services rendered, while influencer-driven affiliate marketing income depends on promoting third-party products, generating earnings through tracked referrals and conversions. Effective money management for influencer-driven affiliate income involves tracking performance metrics, optimizing marketing channels, and managing fluctuating cash flow due to campaign-based commissions.

Micro-Affiliate Networks

Commission income from direct sales often provides predictable cash flow and higher payout rates, while affiliate marketing income through micro-affiliate networks offers diversified revenue streams with lower entry barriers and real-time performance tracking. Effective money management in micro-affiliate networks requires tracking commission structures, monitoring conversion rates, and optimizing campaigns for maximum ROI.

Commission Income vs Affiliate Marketing Income for money management. Infographic

moneydiff.com

moneydiff.com