Dividends provide a reliable income stream from traditional equity investments, often supported by established companies with a history of consistent payouts. DeFi staking rewards offer potentially higher returns by locking cryptocurrencies in decentralized finance protocols, but come with increased risks such as smart contract vulnerabilities and market volatility. Investors must balance the stability of dividends against the growth potential and risks inherent in DeFi staking to optimize their overall income strategy.

Table of Comparison

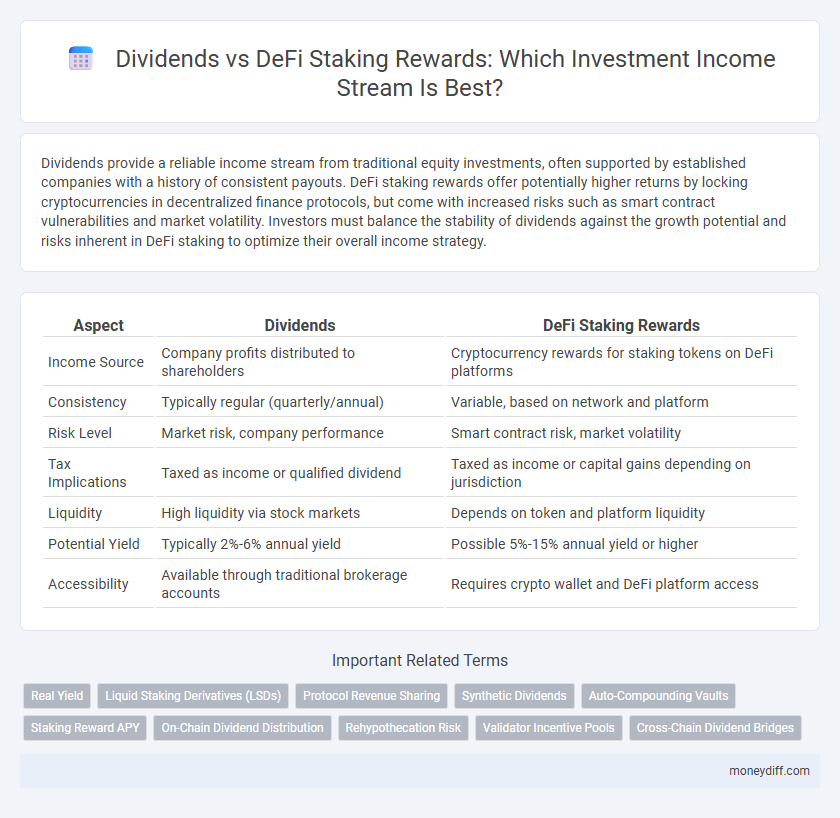

| Aspect | Dividends | DeFi Staking Rewards |

|---|---|---|

| Income Source | Company profits distributed to shareholders | Cryptocurrency rewards for staking tokens on DeFi platforms |

| Consistency | Typically regular (quarterly/annual) | Variable, based on network and platform |

| Risk Level | Market risk, company performance | Smart contract risk, market volatility |

| Tax Implications | Taxed as income or qualified dividend | Taxed as income or capital gains depending on jurisdiction |

| Liquidity | High liquidity via stock markets | Depends on token and platform liquidity |

| Potential Yield | Typically 2%-6% annual yield | Possible 5%-15% annual yield or higher |

| Accessibility | Available through traditional brokerage accounts | Requires crypto wallet and DeFi platform access |

Understanding Dividends and DeFi Staking Rewards

Dividends represent a traditional form of income generated from equity investments, where shareholders receive periodic payments derived from a company's profits, often reflecting the stability and profitability of established firms. In contrast, DeFi staking rewards emerge from decentralized finance protocols, providing income by locking up cryptocurrencies to support network operations, with returns influenced by protocol incentives and market volatility. Understanding the distinctions between dividends and DeFi staking rewards involves evaluating risk profiles, income predictability, and the underlying mechanisms of centralized versus decentralized financial systems.

How Dividends Generate Passive Income

Dividends generate passive income by distributing a portion of a company's earnings directly to shareholders, providing a steady cash flow without selling assets. This income is often taxable but offers predictable returns based on the company's profitability and dividend policy. Compared to DeFi staking rewards, dividends benefit from established regulatory frameworks and historical performance data, enhancing income reliability for long-term investors.

Exploring Income Potential with DeFi Staking Rewards

DeFi staking rewards offer a promising income potential by enabling investors to earn passive income through decentralized finance protocols, often with higher yields compared to traditional dividends from stocks. Unlike dividends, which depend on corporate profits and can be variable or suspended, DeFi staking rewards are generated by participating in blockchain network validation or liquidity provision, providing a more consistent and transparent income stream. Exploring these mechanisms reveals opportunities to diversify investment income sources while leveraging the growth of decentralized financial ecosystems.

Risk Comparison: Dividends vs DeFi Staking

Dividends provide a relatively stable income from well-established companies with regulatory oversight, reducing risk compared to DeFi staking rewards, which are subject to smart contract vulnerabilities and market volatility. Dividend income benefits from historical performance data and formal disclosure requirements, whereas DeFi staking carries risks such as impermanent loss and platform insolvency. Investors prioritizing consistent, lower-risk returns may prefer dividends, while those seeking higher yields accept DeFi staking's elevated risk profile.

Accessibility: Traditional Markets vs Decentralized Finance

Dividends from traditional markets often require brokerage accounts and are subject to market hours and regulatory constraints, limiting accessibility for some investors. DeFi staking rewards are accessible 24/7 through decentralized platforms, enabling anyone with a digital wallet to earn income without intermediaries. This continuous availability and lower entry barriers make DeFi staking more inclusive compared to conventional dividend investments.

Tax Implications: Dividends and DeFi Staking Earnings

Dividends are typically taxed as ordinary income or qualified dividends, depending on holding period and account type, with rates ranging from 0% to 37% in the U.S., while DeFi staking rewards are often treated as ordinary income at the fair market value upon receipt. The IRS considers DeFi staking earnings as taxable events at the time rewards are received, necessitating meticulous record-keeping for cost basis and future capital gains reporting. Taxpayers must also be aware of potential complications such as double taxation on dividends and the complexity of tracking DeFi transactions for accurate tax filing.

Liquidity and Flexibility of Income Streams

Dividends from traditional stocks provide predictable income with relatively stable liquidity, as shares can be sold on established exchanges at any time. DeFi staking rewards offer potentially higher returns but come with varied lock-up periods and network risks, impacting the immediate accessibility of funds. Investors seeking flexibility often balance these streams, leveraging dividends for steady cash flow and DeFi staking for enhanced yield opportunities.

Historical Returns: Stock Dividends vs DeFi Staking

Historical returns from stock dividends typically average 2-4% annually, reflecting steady income from established companies with proven track records. In contrast, DeFi staking rewards have demonstrated higher yields, often ranging from 5-15% or more, but carry greater volatility and regulatory uncertainty. Investors should weigh the consistent cash flow of traditional dividends against the potentially higher, yet riskier, returns of DeFi staking income.

Security Considerations in Dividends and DeFi Staking

Dividends from established companies offer a stable income source secured by regulatory oversight and corporate governance, reducing counterparty risk for investors. DeFi staking rewards provide higher yield potential but carry significant security vulnerabilities such as smart contract bugs, hacking risks, and lack of regulatory protection. Investors must weigh the reliability and legal protections of traditional dividends against the innovative but riskier nature of decentralized finance staking mechanisms.

Choosing the Best Income Strategy for Your Portfolio

Dividends provide a steady, regulated income stream often favored for their predictability and tax advantages, while DeFi staking rewards offer potentially higher yields with increased risk and market volatility. Evaluating factors such as risk tolerance, liquidity needs, and portfolio diversification is essential when choosing between dividends and DeFi staking for investment income. Combining both strategies can optimize income potential by balancing stable returns with exposure to innovative blockchain-based opportunities.

Related Important Terms

Real Yield

Dividends provide shareholders with a share of company profits, offering a relatively stable and predictable income stream based on corporate earnings and market performance. DeFi staking rewards generate real yield by locking cryptocurrency assets in decentralized protocols, earning returns from transaction fees and network incentives, often resulting in higher income volatility but potential for greater yield compared to traditional dividends.

Liquid Staking Derivatives (LSDs)

Dividends provide traditional income through earnings distribution from stocks, whereas DeFi staking rewards, particularly with Liquid Staking Derivatives (LSDs), offer passive income by earning staking yields while maintaining liquidity and enabling secondary market trading. LSDs enhance income strategies by combining staking benefits with asset fungibility, optimizing returns compared to static dividend payouts.

Protocol Revenue Sharing

Dividends provide income through earnings distributed by traditional corporations, while DeFi staking rewards offer returns derived from protocol revenue sharing within blockchain networks. Protocol revenue sharing in DeFi enables investors to earn a portion of fees generated by decentralized applications, often resulting in higher yields compared to conventional dividends.

Synthetic Dividends

Synthetic dividends generated through DeFi staking rewards offer investors a decentralized alternative to traditional dividend income by enabling yield generation on crypto assets without owning underlying shares. These rewards often provide higher APRs compared to classic stock dividends, leveraging blockchain protocols to automate income distribution while minimizing counterparty risk.

Auto-Compounding Vaults

Dividends from traditional stocks provide passive income with predictable payouts, while DeFi staking rewards, especially through auto-compounding vaults, offer higher yield potential by automatically reinvesting rewards to maximize returns. Auto-compounding vaults optimize income generation by leveraging continuous compounding effects, outperforming static dividend income in volatile cryptocurrency markets.

Staking Reward APY

Staking rewards in DeFi often offer higher APYs compared to traditional dividend yields, sometimes exceeding 10-20% annually due to protocol incentives and liquidity rewards. While dividends provide predictable income from established companies, DeFi staking rewards leverage blockchain mechanisms to generate potentially higher, but more volatile, returns on investment.

On-Chain Dividend Distribution

On-chain dividend distribution leverages blockchain technology to transparently and securely automate the payout of dividends directly to shareholders' wallets, eliminating intermediaries and reducing settlement times. Unlike traditional dividends, DeFi staking rewards provide income through liquidity provision and token staking, generating yield from decentralized protocols rather than corporate profits.

Rehypothecation Risk

Dividend income from traditional stocks carries lower rehypothecation risk compared to DeFi staking rewards, as DeFi protocols may reuse staked assets multiple times, increasing counterparty vulnerability. Investors seeking consistent income should weigh the rehypothecation risk inherent in decentralized finance against the relatively safer dividend payouts regulated by established financial institutions.

Validator Incentive Pools

Dividends provide steady income through corporate profit distribution, while DeFi staking rewards from Validator Incentive Pools generate income by securing blockchain networks and validating transactions, often yielding higher returns but with increased risk. Validator Incentive Pools aggregate staking power, optimizing reward distribution and enhancing income potential compared to traditional dividends.

Cross-Chain Dividend Bridges

Cross-chain dividend bridges enable seamless distribution of dividend income across multiple blockchain networks, enhancing accessibility and liquidity for investors compared to traditional DeFi staking rewards that are typically confined to single-chain ecosystems. By leveraging interoperability protocols, these bridges facilitate real-time dividend payments and diversified income streams, optimizing portfolio yield in decentralized finance environments.

Dividends vs DeFi staking rewards for income from investments. Infographic

moneydiff.com

moneydiff.com