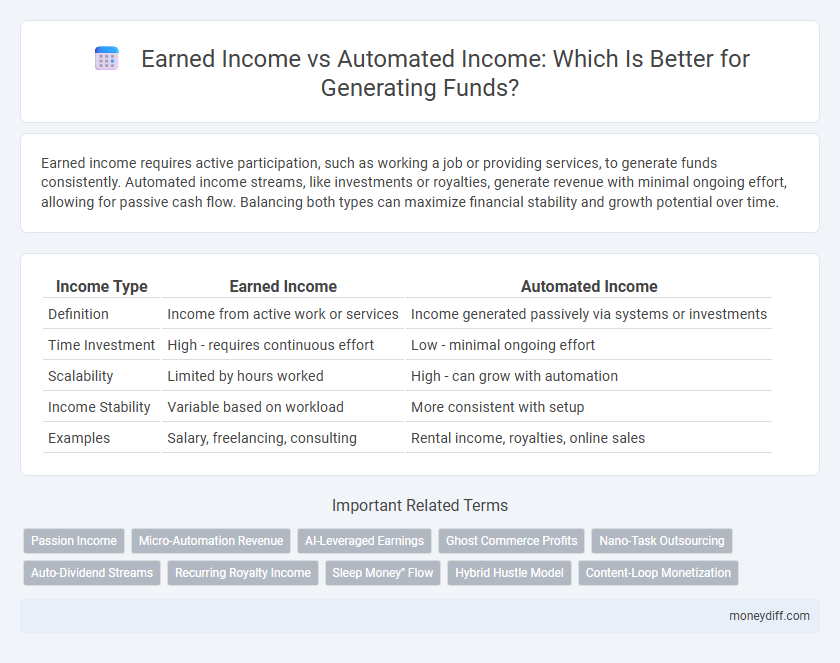

Earned income requires active participation, such as working a job or providing services, to generate funds consistently. Automated income streams, like investments or royalties, generate revenue with minimal ongoing effort, allowing for passive cash flow. Balancing both types can maximize financial stability and growth potential over time.

Table of Comparison

| Income Type | Earned Income | Automated Income |

|---|---|---|

| Definition | Income from active work or services | Income generated passively via systems or investments |

| Time Investment | High - requires continuous effort | Low - minimal ongoing effort |

| Scalability | Limited by hours worked | High - can grow with automation |

| Income Stability | Variable based on workload | More consistent with setup |

| Examples | Salary, freelancing, consulting | Rental income, royalties, online sales |

Understanding Earned Income: Definition and Examples

Earned income refers to the money individuals receive through active work, including salaries, wages, tips, and commissions. This type of income requires continuous effort or time investment and is the primary source of funds for most people. Examples of earned income include a full-time job salary, freelance consulting fees, and earnings from part-time work.

What Is Automated Income? Overview and Key Features

Automated income refers to earnings generated with minimal ongoing effort through systems such as investments, affiliate marketing, or digital products that operate independently. Key features include scalability, passive cash flow, and reduced time commitment compared to earned income, which requires active labor or services. This income model leverages automation tools and technologies to generate sustainable funds, making it ideal for long-term financial growth.

Comparing Earned Income and Automated Income

Earned income requires active work such as salaries, wages, or freelance payments, directly linking time to money earned. Automated income, generated through systems like investments, royalties, or digital products, creates passive revenue streams with minimal ongoing effort. Comparing both highlights earned income's dependence on continuous labor, while automated income offers scalability and financial freedom.

Benefits of Focusing on Earned Income Streams

Focusing on earned income streams provides direct control over cash flow through active work, leading to more predictable and immediate financial returns. Earned income often enhances skills, professional growth, and networking opportunities that can increase future earning potential. Consistent effort in earned income sources builds a stable foundation for financial security before diversifying into automated income models.

Advantages of Building Automated Income Sources

Building automated income sources offers the advantage of generating consistent revenue with minimal ongoing effort, allowing individuals to scale their earnings beyond the constraints of earned income tied directly to time. Automated income streams such as investments, royalties, and online businesses provide financial flexibility and passive growth potential. This approach also reduces reliance on active work, enhancing long-term financial stability and wealth accumulation.

Common Types of Earned Income Opportunities

Common types of earned income opportunities include salaried employment, freelancing, and contract work, where individuals trade time and skills for wages. These sources often require active participation and direct effort to generate funds. In contrast, automated income involves investments, royalties, or online businesses that produce revenue with minimal ongoing involvement.

Popular Automated Income Ideas for Beginners

Popular automated income ideas for beginners include affiliate marketing, creating and selling digital products, and dropshipping through e-commerce platforms. These methods allow individuals to generate revenue with minimal ongoing effort by leveraging online tools and automation software. Automated income streams provide scalable opportunities that complement traditional earned income sources by creating passive cash flow.

Risks and Challenges of Both Income Models

Earned income relies heavily on consistent effort and time investment, making it vulnerable to job loss, burnout, and limited scalability. Automated income streams, while offering passive earnings, face risks such as initial setup costs, technical failures, and market volatility. Both income models require strategic management to mitigate uncertainties and ensure sustainable financial growth.

Transitioning From Earned to Automated Income

Transitioning from earned income, generated through active work like salaries or freelance tasks, to automated income streams involves leveraging investments, digital products, or passive business models that generate funds with minimal ongoing effort. Automated income sources such as rental properties, dividend-paying stocks, or online courses enable consistent cash flow independent of daily labor. Focusing on scalable, passive income systems increases financial freedom and reduces reliance on traditional earned income.

Choosing the Right Income Strategy for Your Financial Goals

Evaluating earned income versus automated income is crucial for aligning with your financial goals; earned income offers stability through active work, while automated income generates funds passively through investments or online systems. Prioritize automated income streams like dividend stocks, rental properties, or digital products for scalable financial growth and long-term wealth accumulation. Combining both income types optimizes cash flow and financial security, ensuring a balanced approach to meeting short-term needs and achieving future financial independence.

Related Important Terms

Passion Income

Passion income, a subset of earned income, arises from actively engaging in work aligned with personal interests, providing both financial rewards and intrinsic satisfaction. Automated income, generated through systems like investments or online businesses, offers passive revenue streams but often lacks the fulfillment linked to passion-driven efforts.

Micro-Automation Revenue

Micro-automation revenue leverages small-scale automated processes to generate consistent passive income streams, reducing reliance on active earned income that requires continuous effort and time. This model enhances financial scalability by enabling cash flow generation through automated digital platforms, minimizing manual labor and maximizing efficiency.

AI-Leveraged Earnings

Earned income relies on active participation through work or services, while automated income, enhanced by AI technologies, generates funds passively by leveraging algorithms for continuous revenue streams. AI-leveraged earnings optimize investment portfolios, automate marketing, and manage digital assets, significantly increasing efficiency and profitability in income generation.

Ghost Commerce Profits

Earned income relies on active work and time investment, while automated income, such as Ghost Commerce Profits, generates funds passively through streamlined e-commerce systems and automated sales funnels. Ghost Commerce Profits maximizes revenue by utilizing AI-driven marketing strategies and automated order fulfillment, reducing manual effort and increasing scalability.

Nano-Task Outsourcing

Earned income from nano-task outsourcing relies on actively completing small, delegated tasks, generating immediate cash flow but requiring continuous effort and time investment. Automated income leverages technology and systems to scale nano-task workflows, enabling passive revenue streams with minimal ongoing input while maximizing efficiency and profit potential.

Auto-Dividend Streams

Earned income relies on active work and time investment, while automated income, particularly auto-dividend streams, generates consistent cash flow through reinvested dividends from dividend-paying stocks. Auto-dividend streams offer passive wealth growth by compounding returns without ongoing effort, making them a strategic choice for long-term financial independence.

Recurring Royalty Income

Earned income requires active work and time investment, whereas automated income from recurring royalty payments generates a steady cash flow with minimal ongoing effort. Recurring royalty income leverages intellectual property like books, music, or patents to provide consistent, passive financial returns over time.

Sleep Money" Flow

Earned income requires continuous active effort, limiting cash flow to hours worked, while automated income generates funds passively, enabling consistent "sleep money" flow without ongoing labor. Leveraging automated streams such as investments, royalties, or online businesses creates financial stability and scalable earnings during non-working hours.

Hybrid Hustle Model

The Hybrid Hustle Model combines earned income from active work with automated income streams like investments or digital sales to maximize financial growth and stability. This approach leverages the steady cash flow from earned income while building passive revenue channels for long-term wealth generation.

Content-Loop Monetization

Earned income relies on active participation, such as freelancing or consulting, where time directly correlates with earnings, while automated income through Content-Loop Monetization leverages digital assets like blogs, videos, or courses to generate continuous revenue without constant intervention. This model amplifies earnings by repeatedly engaging audiences with optimized content that drives affiliate sales, subscriptions, or ad revenue through algorithm-driven cycles.

Earned income vs Automated income for generating funds. Infographic

moneydiff.com

moneydiff.com