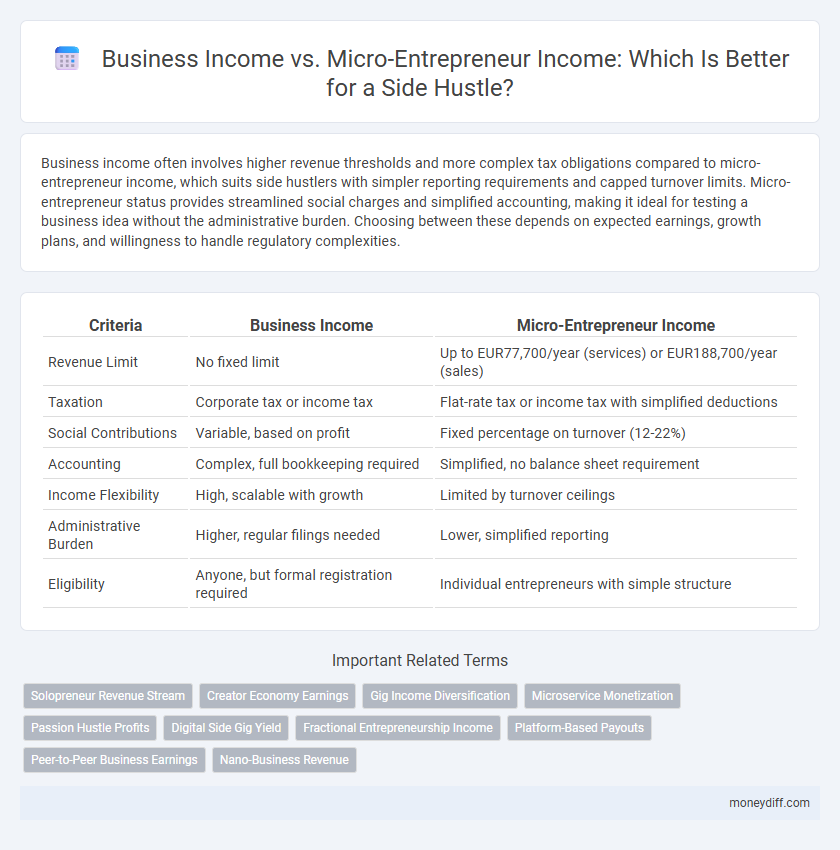

Business income often involves higher revenue thresholds and more complex tax obligations compared to micro-entrepreneur income, which suits side hustlers with simpler reporting requirements and capped turnover limits. Micro-entrepreneur status provides streamlined social charges and simplified accounting, making it ideal for testing a business idea without the administrative burden. Choosing between these depends on expected earnings, growth plans, and willingness to handle regulatory complexities.

Table of Comparison

| Criteria | Business Income | Micro-Entrepreneur Income |

|---|---|---|

| Revenue Limit | No fixed limit | Up to EUR77,700/year (services) or EUR188,700/year (sales) |

| Taxation | Corporate tax or income tax | Flat-rate tax or income tax with simplified deductions |

| Social Contributions | Variable, based on profit | Fixed percentage on turnover (12-22%) |

| Accounting | Complex, full bookkeeping required | Simplified, no balance sheet requirement |

| Income Flexibility | High, scalable with growth | Limited by turnover ceilings |

| Administrative Burden | Higher, regular filings needed | Lower, simplified reporting |

| Eligibility | Anyone, but formal registration required | Individual entrepreneurs with simple structure |

Defining Business Income vs. Micro-Entrepreneur Income

Business income refers to the total revenue generated from commercial activities conducted by a registered company, encompassing profits, sales, and operational earnings. Micro-entrepreneur income specifically relates to earnings from small-scale, often informal, self-employed ventures that typically have simplified tax and regulatory requirements. Understanding the distinction aids in optimizing tax strategies and compliance for side hustle ventures.

Key Income Sources: Established Business vs. Side Hustle

Established business income primarily derives from diverse revenue streams such as product sales, service contracts, and recurring client relationships, resulting in more stable and scalable earnings. Micro-entrepreneur income for side hustles often relies on gig work, freelance projects, or small-scale online sales, leading to variable and less predictable cash flow. Understanding these distinctions is crucial for tax planning, cash management, and growth strategy development.

Initial Investment and Revenue Potential

Business income often requires a higher initial investment, including costs for inventory, equipment, and marketing, which can limit accessibility for side hustlers. Micro-entrepreneur income typically involves minimal upfront expenses, making it an attractive option for individuals seeking to start a side hustle with low financial risk. Revenue potential in traditional business income can be significantly higher due to scalability, whereas micro-entrepreneur income tends to be more modest but stable, reflecting limited operational scope.

Scalability of Earnings: Business vs. Micro-Entrepreneur

Business income offers greater scalability due to access to larger markets, potential for diverse revenue streams, and the ability to reinvest profits into growth initiatives. Micro-entrepreneur income typically remains limited by smaller customer bases and simpler operational structures, restricting long-term earning potential. Leveraging business income strategies can significantly enhance side hustle scalability compared to micro-entrepreneur models.

Risk and Income Stability

Business income generally offers higher earning potential but comes with greater financial risk and income instability due to market fluctuations and operational costs. Micro-entrepreneur income tends to provide more predictable cash flow with lower risk, ideal for side hustles focused on steady supplemental earnings. This stability often results from simplified tax structures and limited liability, reducing exposure to significant financial losses.

Tax Implications and Financial Planning

Business income from a registered entity typically incurs higher tax rates but allows for more comprehensive deductions and expense tracking, enhancing long-term financial planning. Micro-entrepreneur income, often subject to simplified tax regimes with fixed rates or thresholds, offers ease of compliance but may limit deductions, affecting net profitability. Careful comparison of tax obligations, potential deductions, and projected earnings is essential for optimizing side hustle profitability and tax efficiency.

Time Commitment Versus Income Output

Business income from a side hustle often requires significant time commitment but can yield higher revenue and scalability through strategic investments and customer acquisition. Micro-entrepreneur income typically involves limited hours with more flexible schedules, offering steady, though generally smaller, financial returns. Evaluating the balance between hours invested and income generated is crucial for maximizing profitability and sustainable growth in either revenue model.

Diversifying Income Streams: Strategies and Benefits

Diversifying income streams by combining business income with micro-entrepreneur income enhances financial stability and growth opportunities. Business income offers scalability and higher revenue potential, while micro-entrepreneur income provides flexibility and reduces dependence on a single source. Leveraging both streams maximizes cash flow, mitigates risks, and supports sustainable side hustle success.

Managing Business vs. Side Hustle Cash Flow

Business income typically involves higher revenue streams, requiring detailed cash flow management, including tracking expenses, invoicing, and budgeting for taxes. Micro-entrepreneur income from a side hustle often has simpler cash flow dynamics, emphasizing quick income turnover and minimal overhead costs. Efficiently managing cash flow in both scenarios ensures sustainability, with business owners needing more formal accounting tools and side hustlers benefiting from streamlined financial tracking methods.

Long-Term Financial Growth: Which Income Stream Wins?

Business income typically offers greater potential for long-term financial growth due to scalability, higher revenue generation, and asset-building opportunities. Micro-entrepreneur income, while often more flexible and easier to start, usually results in limited growth and smaller profit margins over time. Prioritizing business income as a side hustle can lead to sustained wealth accumulation and greater financial stability in the long run.

Related Important Terms

Solopreneur Revenue Stream

Business income for solopreneurs typically involves higher revenue potential through diverse services or products, requiring comprehensive accounting and tax reporting. Micro-entrepreneur income, ideal for side hustles, offers simplified tax obligations and lower administrative costs but is limited by annual revenue thresholds and fewer deductible expenses.

Creator Economy Earnings

Business income from a registered company often offers higher revenue potential and tax deductions compared to micro-entrepreneur income, which is limited by simplified tax regimes and turnover caps. In the Creator Economy, scaling earnings through business structures enables access to partnerships, sponsorships, and diversified revenue streams beyond the restrictions faced by micro-entrepreneurs.

Gig Income Diversification

Business income from a registered company typically offers higher revenue potential and tax benefits compared to micro-entrepreneur income, which suits freelancers and side hustlers with lower overhead and simplified tax reporting. Diversifying gig income through both structures allows maximizing earnings while optimizing tax liabilities and legal protections for varying income scales.

Microservice Monetization

Micro-entrepreneur income from side hustles often benefits from simplified tax regimes and lower administrative costs compared to traditional business income, maximizing profitability in microservice monetization. Leveraging platforms that facilitate microtransactions enables micro-entrepreneurs to scale revenue streams efficiently without the complexity of full business operations.

Passion Hustle Profits

Business income from a side hustle typically involves higher revenue potential and more complex tax obligations compared to micro-entrepreneur income, which benefits from simplified accounting and lower social charges. Passion Hustle Profits thrive when micro-entrepreneurs leverage streamlined structures to maximize earnings while maintaining flexibility and minimal regulatory burden.

Digital Side Gig Yield

Business income from a digital side gig typically generates higher revenue due to scalability and access to broader markets, while micro-entrepreneur income is often limited by small-scale operations and local customer bases. Optimizing digital side hustles through strategic marketing and diverse online platforms significantly increases yield compared to traditional micro-entrepreneur income streams.

Fractional Entrepreneurship Income

Fractional entrepreneurship income from micro-entrepreneur activities often yields flexible, tax-advantaged earnings compared to traditional business income, which may involve higher operational costs and regulatory compliance. Leveraging micro-entrepreneur status for side hustles maximizes profit retention while minimizing administrative burdens, making it an efficient income stream for fractional business owners.

Platform-Based Payouts

Platform-based payouts for business income typically involve higher transaction volumes and structured payment schedules, reflecting established operations with invoicing and tax reporting. In contrast, micro-entrepreneur income from side hustles on platforms is often characterized by smaller, more frequent payments, simplified tax obligations, and direct-to-user disbursements, enhancing flexibility but requiring careful income tracking.

Peer-to-Peer Business Earnings

Peer-to-peer business earnings generated through a side hustle often differ in tax treatment and reporting requirements compared to traditional business income, with micro-entrepreneurs benefiting from simplified accounting and lower tax rates. Understanding the distinctions between business income and micro-entrepreneur income is crucial for maximizing profitability and compliance in peer-to-peer platforms.

Nano-Business Revenue

Nano-business revenue typically falls under micro-entrepreneur income, offering simpler tax structures and lower compliance costs compared to traditional business income from larger enterprises. Micro-entrepreneurs benefit from streamlined reporting and reduced social contributions, making this model ideal for side hustles aiming to maximize net earnings while maintaining manageable administrative burdens.

Business income vs Micro-entrepreneur income for side hustle. Infographic

moneydiff.com

moneydiff.com