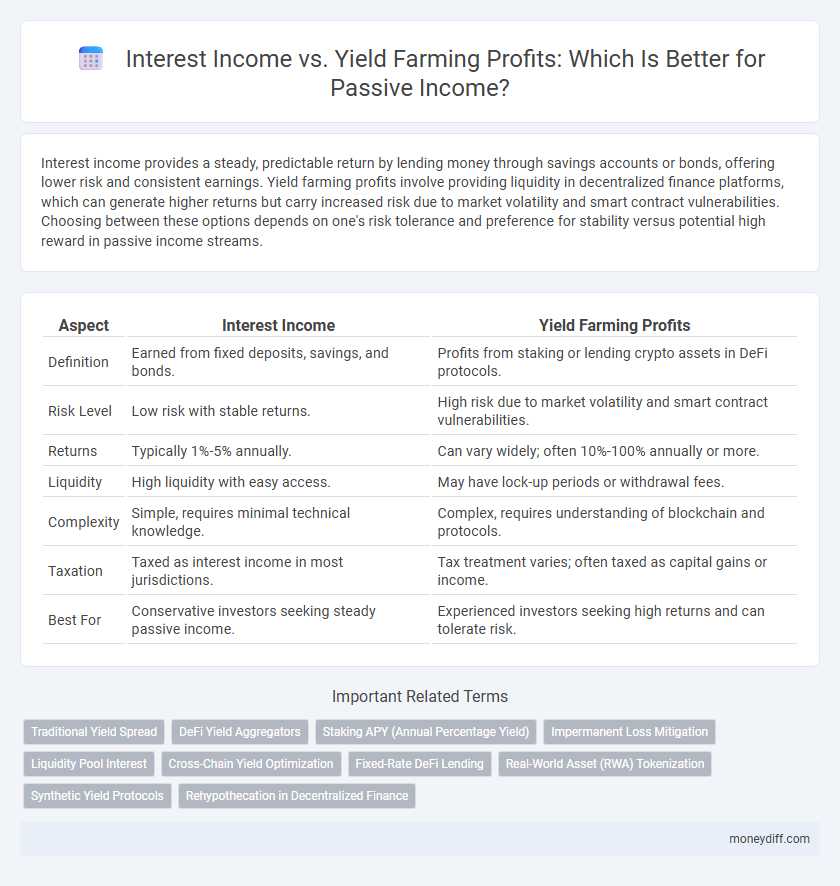

Interest income provides a steady, predictable return by lending money through savings accounts or bonds, offering lower risk and consistent earnings. Yield farming profits involve providing liquidity in decentralized finance platforms, which can generate higher returns but carry increased risk due to market volatility and smart contract vulnerabilities. Choosing between these options depends on one's risk tolerance and preference for stability versus potential high reward in passive income streams.

Table of Comparison

| Aspect | Interest Income | Yield Farming Profits |

|---|---|---|

| Definition | Earned from fixed deposits, savings, and bonds. | Profits from staking or lending crypto assets in DeFi protocols. |

| Risk Level | Low risk with stable returns. | High risk due to market volatility and smart contract vulnerabilities. |

| Returns | Typically 1%-5% annually. | Can vary widely; often 10%-100% annually or more. |

| Liquidity | High liquidity with easy access. | May have lock-up periods or withdrawal fees. |

| Complexity | Simple, requires minimal technical knowledge. | Complex, requires understanding of blockchain and protocols. |

| Taxation | Taxed as interest income in most jurisdictions. | Tax treatment varies; often taxed as capital gains or income. |

| Best For | Conservative investors seeking steady passive income. | Experienced investors seeking high returns and can tolerate risk. |

Understanding Interest Income: Traditional Passive Earnings

Interest income is generated by lending money or depositing funds in financial institutions, earning a fixed or variable rate over time. This traditional passive income relies on lower risk and predictable returns, often seen in savings accounts, bonds, or certificates of deposit. Unlike yield farming profits, interest income is generally more stable and less dependent on market volatility, making it a favored choice for conservative investors.

Yield Farming Explained: Modern Passive Income in DeFi

Yield farming in decentralized finance (DeFi) offers higher potential returns compared to traditional interest income by leveraging liquidity provision, staking, and token incentives. Unlike fixed interest from savings accounts, yield farming profits fluctuate based on platform liquidity, token value, and network activity, presenting both greater risk and reward. This dynamic form of passive income capitalizes on blockchain protocols to generate rewards through automated market making and governance participation.

Key Differences Between Interest Income and Yield Farming Profits

Interest income is generated from lending money through traditional financial instruments like savings accounts, bonds, or peer-to-peer lending, providing predictable and relatively low-risk returns. Yield farming profits arise from decentralized finance protocols where users lock cryptocurrencies in liquidity pools, earning rewards that vary dramatically based on market conditions and protocol incentives. Key differences include risk exposure, with interest income being more stable and yield farming profits highly volatile, and complexity, as yield farming often requires active management and understanding of blockchain mechanisms.

Risk Factors: Comparing Safety in Interest Income vs. Yield Farming

Interest income from traditional savings accounts or bonds offers lower risk due to regulatory protections and stable returns, making it a safer option for passive income. Yield farming profits, while potentially higher, involve significant risks such as smart contract vulnerabilities, market volatility, and impermanent loss in decentralized finance protocols. Evaluating risk tolerance and security mechanisms is crucial when choosing between the predictable safety of interest income and the high-reward but volatile nature of yield farming.

Return on Investment: Interest Rates vs. Yield Farming APYs

Interest income typically offers stable returns with interest rates ranging from 1% to 5% annually depending on the financial instrument, providing low-risk passive income. Yield farming profits, often expressed as APYs, can reach upwards of 20% or higher, leveraging decentralized finance protocols but are subject to significant volatility and impermanent loss. Comparing ROI, interest income provides consistent but modest gains, while yield farming offers higher potential returns accompanied by elevated risk and complexity.

Accessibility and Barriers to Entry: Banks vs. Decentralized Finance

Interest income from traditional banks is accessible through regulated savings accounts and certificates of deposit, offering low barriers to entry with minimal requirements and insured deposits. Yield farming profits in decentralized finance (DeFi) demand a higher level of technical knowledge, cryptocurrency wallets, and understanding of smart contracts, presenting significant barriers for average investors. DeFi platforms provide potentially higher returns but expose users to risks like smart contract vulnerabilities and market volatility, contrasting with the stable yet lower yields and regulatory protections of bank interest income.

Tax Implications for Interest Income and Yield Farming

Interest income is typically taxed as ordinary income at federal and state levels, often reported on Form 1099-INT. Yield farming profits, considered taxable events, may be categorized as capital gains or ordinary income depending on holding periods and specific transactions, requiring detailed tracking of cryptocurrency trades. Taxpayers need to account for differing regulations and reporting requirements, as failure to accurately report yield farming profits can result in IRS penalties or audits.

Liquidity Concerns: Withdrawing Funds from Both Methods

Interest income from traditional savings accounts offers high liquidity, allowing immediate fund withdrawals without penalties, whereas yield farming profits often require locking assets for a specific period, leading to potential withdrawal delays. Yield farming involves smart contract constraints and network congestion, which can further impact the timely access to funds compared to the instant availability in interest-bearing accounts. Investors must weigh the trade-off between liquidity and higher returns when choosing between these passive income methods.

Diversification Strategies: Combining Interest Income and Yield Farming

Diversifying passive income streams by combining traditional interest income from savings accounts or bonds with yield farming profits in decentralized finance enhances overall returns while mitigating risk exposure. Interest income provides stable and predictable cash flow, while yield farming leverages liquidity provision and staking rewards to capitalize on higher, albeit variable, yields. Integrating both strategies optimizes portfolio performance by balancing conservative income with high-growth opportunities in the crypto ecosystem.

Future Trends: Evolving Opportunities in Passive Income Streams

Interest income from traditional savings accounts offers stable and predictable returns, while yield farming profits in decentralized finance present higher potential gains accompanied by increased risk. Emerging trends indicate that advancements in blockchain technology and DeFi protocols will diversify passive income opportunities, enabling more personalized and automated yield optimization strategies. Future passive income streams are expected to blend conventional finance reliability with innovative crypto-based mechanisms, creating dynamic financial ecosystems.

Related Important Terms

Traditional Yield Spread

Interest income from traditional yield spread banking involves earning profits by borrowing short-term funds at lower interest rates and lending them at higher rates, providing stable passive income with predictable returns. Yield farming profits, while potentially higher, come from decentralized finance (DeFi) platforms with variable APYs and increased risk, making interest income a more reliable choice for conservative passive income strategies.

DeFi Yield Aggregators

Interest income from traditional savings accounts offers predictable, low-risk returns, whereas yield farming profits through DeFi yield aggregators can generate significantly higher passive income by leveraging blockchain protocols and liquidity pools. However, yield farming involves greater volatility and smart contract risks, making DeFi yield aggregators ideal for investors seeking optimized returns within decentralized finance ecosystems.

Staking APY (Annual Percentage Yield)

Interest income from traditional savings accounts typically offers low APY rates, often below 1%, while yield farming profits through staking can provide significantly higher APYs, sometimes exceeding 20%, depending on the platform and liquidity pool. Staking APY reflects the annualized return on locked assets within decentralized finance protocols, making it a more dynamic and potentially lucrative option for passive income compared to conventional interest income.

Impermanent Loss Mitigation

Interest income from traditional savings accounts offers steady returns with minimal risk, while yield farming profits can be significantly higher but expose investors to impermanent loss due to volatile token pairs. Employing impermanent loss mitigation strategies such as liquidity pool diversification and automated market maker optimization enhances yield farming profitability and stabilizes passive income streams.

Liquidity Pool Interest

Liquidity pool interest generates income by providing assets to decentralized finance (DeFi) protocols, earning fees from transaction volumes and reward tokens, while yield farming profits often involve higher risk strategies with variable returns based on token price fluctuations. Interest income from liquidity pools tends to offer more stable, predictable passive income by leveraging constant asset availability within the pools.

Cross-Chain Yield Optimization

Cross-chain yield optimization enhances passive income by leveraging multiple blockchain protocols to maximize interest income and yield farming profits through diversified asset allocation and automated arbitrage strategies. This approach increases return on investment by efficiently capturing higher compounding interest rates across DeFi platforms while mitigating risks associated with single-chain exposure.

Fixed-Rate DeFi Lending

Fixed-rate DeFi lending offers predictable interest income by locking funds at a set rate, providing stability compared to the variable, often higher but riskier yield farming profits. Interest income from fixed-rate lending attracts passive investors seeking consistent returns without exposure to volatile DeFi yield optimization strategies.

Real-World Asset (RWA) Tokenization

Interest income from traditional savings offers predictable, low-risk returns, whereas yield farming profits in blockchain ecosystems, especially via Real-World Asset (RWA) tokenization, provide higher potential yields by leveraging digitized physical assets such as real estate and commodities. RWA tokenization enhances passive income by enabling fractional ownership, liquidity, and diversified exposure to tangible assets, bridging traditional finance with decentralized finance (DeFi) yield opportunities.

Synthetic Yield Protocols

Interest income generated from traditional savings accounts or bonds provides a steady but relatively low return, whereas yield farming profits, especially through Synthetic Yield Protocols, offer higher passive income by leveraging decentralized finance (DeFi) smart contracts to synthetically replicate yield-bearing assets. Synthetic Yield Protocols optimize capital efficiency and risk management by mimicking real-world financial instruments, enabling users to earn amplified returns through collateralized debt positions and synthetic asset creation.

Rehypothecation in Decentralized Finance

Interest income derives from lending assets or deposits with predictable returns, while yield farming profits stem from providing liquidity and staking tokens in decentralized finance protocols. Rehypothecation in DeFi enables platforms to reuse collateral across multiple loans, amplifying yield farming returns but also increasing systemic risk exposure.

Interest income vs Yield farming profits for passive income. Infographic

moneydiff.com

moneydiff.com